Worawith Ounpeng

By Eric Leininger

At a Glance

- U.S. Treasury yields have surged to their highest levels since 2007, with fiscal concerns and burgeoning deficits exerting pressure

- The market is experiencing heightened volatility amid rising deficits, ongoing tariff uncertainties, and the potential impact of increased borrowing costs on consumer spending

Is the recent surge in U.S. Treasury yields a signal that the bond market is beginning to price in fiscal concerns? Treasury yields are breaking key technical levels, with 30-year yields exceeding 5% – a level not seen since 2007. Real rates and breakeven inflation rates are also climbing, and the U.S. dollar is weakening against the euro. Could these be indicative signs that bond vigilantes may be reasserting their influence?

Facing a Fiscal Reality Check

On May 16, 2025, credit agency Moody's downgraded the U.S. sovereign credit rating, citing a staggering national debt of $36 trillion. Just a few days later, on May 21, a $16 billion Treasury sale saw weak demand, leading to a downturn in the stock market. The next day, May 22, 30-year U.S. Treasury yields climbed above 5%, nearing their highest levels since 2007, following the passage of a multi-trillion-dollar tax bill in the lower house of Congress.

The Congressional Budget Office (CBO) projects that the proposed budget bill could add $3.8 trillion to deficits over the next decade, while the Committee for a Responsible Federal Budget estimates the total impact could reach $5.1 trillion if all provisions are extended.

The U.S. holds $29 trillion in marketable debt. It's estimated that interest rate sensitivity is roughly $15 billion per basis point. Therefore, a 100-basis point increase in interest rates could add approximately $1.5 trillion to cumulative interest costs* over a decade.

Using the CBO's lower deficit projections and their 2034 GDP forecast of $41.4 trillion, the 2034 deficit could rise from $3.3 trillion to about $4.8 trillion, pushing the deficit-to-GDP ratio from 8% to around 11.6%.

Historical Context and Current Trends

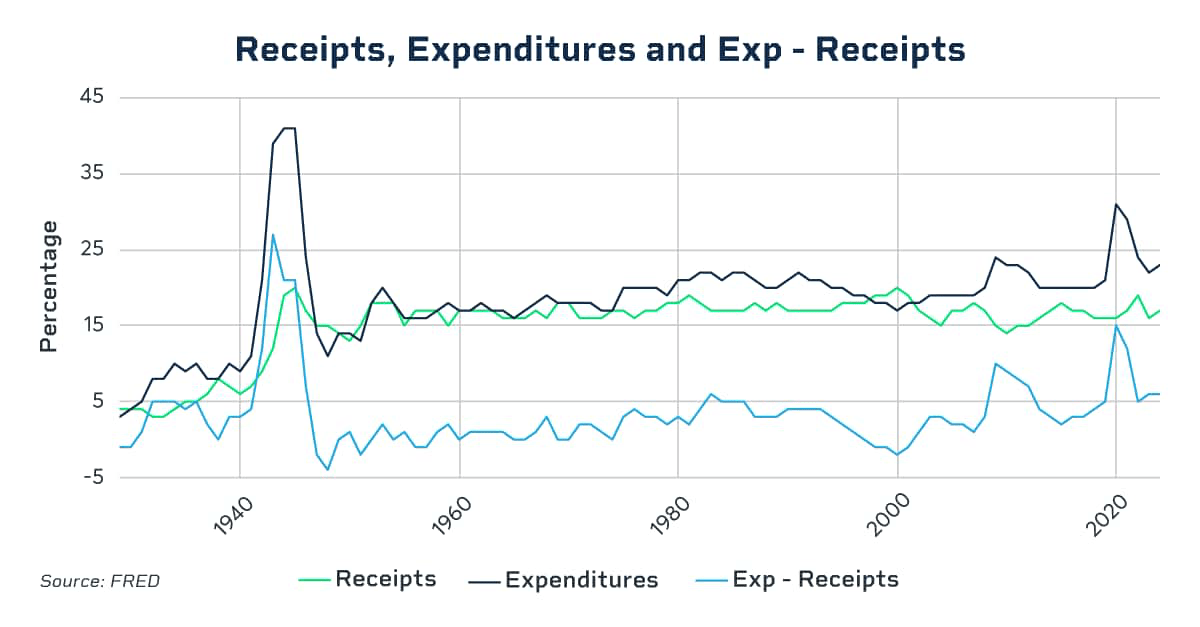

Between 1970 and 2010, the U.S. averaged a relatively modest 2.5% deficit-to-GDP ratio. However, since 2011, this has surged to 6%. Currently, U.S. revenues stand at around 17% of GDP, while expenditures exceed 23%, resulting in structurally high deficits.

Treasury yields are rising as the U.S. economy faces growing uncertainty and expectations of slower growth. This uncertainty is largely fueled by trade tariffs, despite some having been temporarily paused since April.

Additionally, the Federal Reserve continues to navigate persistently high inflation, which remains above its 2% target. Historically, high inflation paired with increased federal debt has led to higher borrowing costs. For example, in the 1970s, when inflation spiked and federal debt rose due to tax cuts and defense spending, Fed Chair Paul Volcker raised interest rates sharply, pushing 10-year bond yields to over 15% in 1981. This historical context demonstrates how significant debt and fiscal expansion can drive up borrowing costs.

More recently, during and after the COVID-19 pandemic, increased fiscal spending contributed to 10-year Treasury yields climbing above 4.5-5% in 2024-25.

The combination of mounting deficits, trade tariff uncertainties and the potential effects of higher borrowing costs on consumer spending is likely to keep market volatility elevated.

*The DV01 calculation is based on the Treasury-reported average maturity of 71 months (5.92 years), with an assumed effective duration of 90%, or 5.33 years. Using the formula DV01 = (Duration × Notional) / 10,000, we apply this to $29 trillion in marketable debt: (5.33 × $29T) / 10,000 = $15.44B per basis point. 100 bps × $15.44B = $1.544T. U.S. Department of the Treasury. “Monthly Statement of the Public Debt of the United States.” Bureau of the Fiscal Service, April 2025.

All examples in this report are hypothetical interpretations of situations and are used for explanation purposes only. The views in this report reflect solely those of the author and not necessarily those of CME Group or its affiliated institutions. This report and the information herein should not be considered investment advice or the results of actual market experience.

Editor's Note: The summary bullets for this article were chosen by Seeking Alpha editors.