Michael H

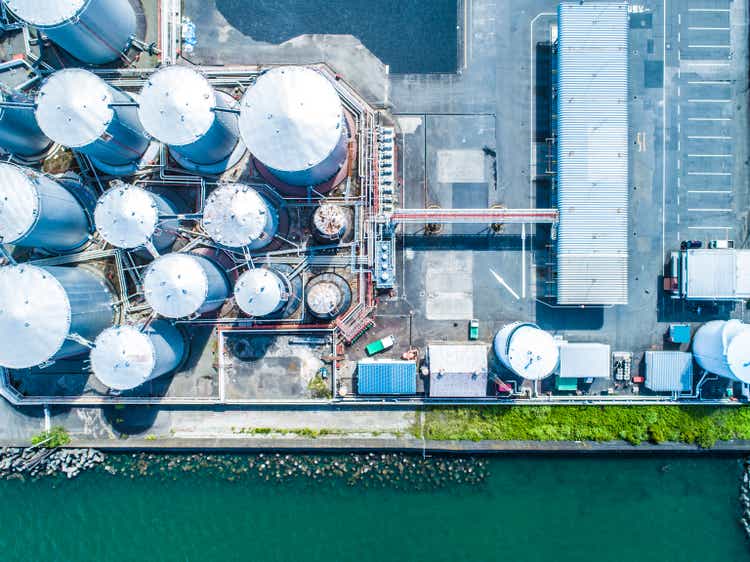

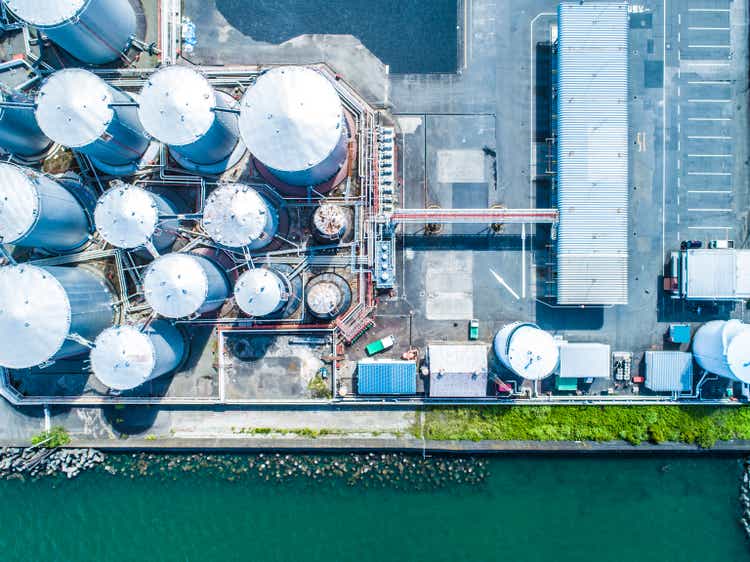

Moving closer towards the worst-case scenario

The bombing of Iranian nuclear facilities by the US over the weekend increased supply risks significantly for the oil and LNG market. The big question now is how Iran

Michael H

The bombing of Iranian nuclear facilities by the US over the weekend increased supply risks significantly for the oil and LNG market. The big question now is how Iran