This article was written by

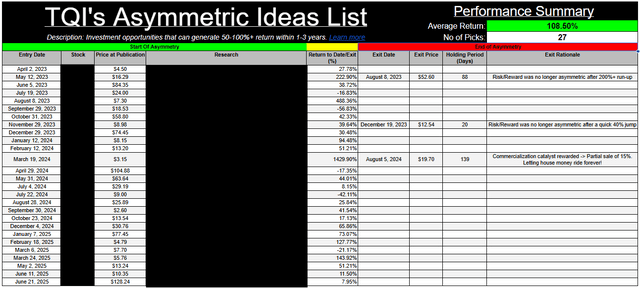

"We're in an asset bubble, and TQI can help you navigate it profitably"

I am Ahan Vashi, a seasoned investor with professional background in equity research, private equity, and software engineering. I currently serve as the Chief Financial Engineer at The Quantamental Investor, a community pursuing financial freedom through bold, active investing with proactive risk management.

TQI was established in July 2022 with a singular mission to make investing simple, fun, and profitable for all investors. In alignment with this mission, we publish premium equity research reports on Seeking Alpha - research library - performance tracker. However, there's a lot more on offer within our investing group - features include highly-concentrated, risk-optimized model portfolios that meet investor needs across different stages of the investor lifecycle, access to proprietary software tools, and group chats. Learn more

In addition to our work on Seeking Alpha, we publish best-in-class investing tidbits and research insights at TQI Tidbits [free newsletter], Twitter, and LinkedIn. Follow for more investing content.

Analyst’s Disclosure:I/we have a beneficial long position in the shares of HIMS, NVO either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.