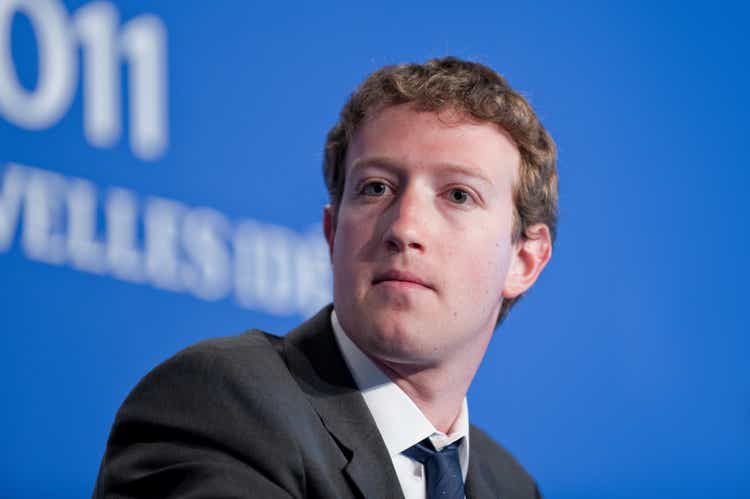

Meta: Mark Zuckerberg's Aggressive AI Push Sets High, Yet Achievable Expectations

Summary

- Meta's aggressive AI hiring spree signals strength, not weakness, as Zuckerberg enters 'Founder Mode' to build a world-class AI team and capabilities.

- AI offers Meta opportunities to strengthen its core ad business, enable new ventures like WhatsApp Business, and defend against competitive threats from rivals like OpenAI and Google.

- Meta's Q1 results show robust revenue growth and margin expansion, with heavy AI investments expected to yield long-term, lucrative returns, despite near-term capex pressure.

- While no longer a bargain, Meta's innovation, execution, and AI leadership justify an attractive 'Buy' rating, with potential for further multiple expansion and outperformance.

Analyst’s Disclosure:I/we have a beneficial long position in the shares of META either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.