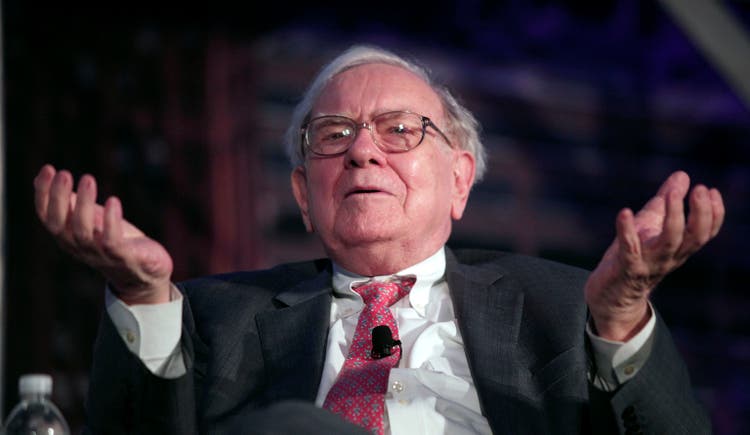

Can Berkshire Hathaway Still Be Great Without Warren Buffett?

Summary

- Warren Buffett will step down as CEO of Berkshire Hathaway at the end of the year, continuing as Board Chair and coming to his office every day.

- Buffett has prepared well for his departure, has a successor well vetted, and good portfolio actions, leaving Berkshire well positioned to avoid trouble with a market downturn.

- Berkshire's core businesses should continue to do well with low risk, but the real question is whether Berkshire can still be "great" without Buffett. In one area it probably cannot.

- Buffett is an investment giant, able to make huge decisions to buy or sell no one else could make. He attributes Berkshire's success to just eight or nine lifetime decisions.

- The looming question of what to do with $350 billion in cash would probably best be served by huge buybacks at a price accretive to shareholder value.

Analyst’s Disclosure:I/we have a beneficial long position in the shares of BRK.B either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.