Today the euro made a 21-month low and traders/investors are curious as to how to position themselves, and what their competitors are doing. However, large institutions dominate foreign exchange (FX) trading, and the traders there get to see the flow of orders coming in and can take notice of which way clients are leaning. Are the weak hands buying? Is the smart money selling out? Since this market is primarily traded over the counter most of this information is available to only a privileged few.

But, there is still a small sliver of the financial markets where a snapshot of how various players are positioned is revealed. The information is released each Friday by the CFTC in its "Commitment of Traders" (COT) report. The data represents positions as of the previous Tuesday. The publicly traded FX futures market is much smaller than the over the counter FX market but information about what actors are doing, with a delay in timing, is available. The following is a table of the actors reported:

| CFTC Description | Dealer | Asset Mgr | Lev Money | Non Report |

| Trader Vernacular | Banks | Asset Managers | Hedge Funds | Small Speculators |

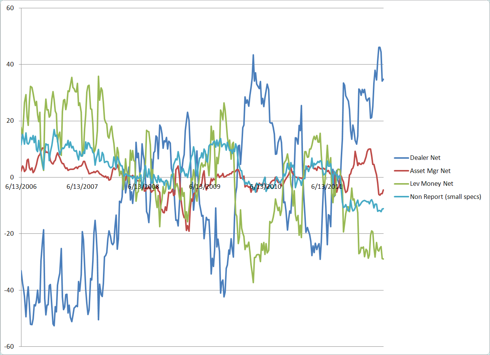

The CFTC reports how much in each category is long, short or spreading in the futures market. For my analysis I took the net percentage reported. I find this more meaningful than saying, "X is net long 10,000 contracts," since the open interest of futures contracts changes over time. As an example, if dealers were 25% long and 10% short, then I would report the net being at + 15%. Here is a chart showing how the various players positioned themselves over the last six years, through May 15, 2012.

One can see that dealers are very much net long. However, dealers (banks) also trade the cash OTC FX market and