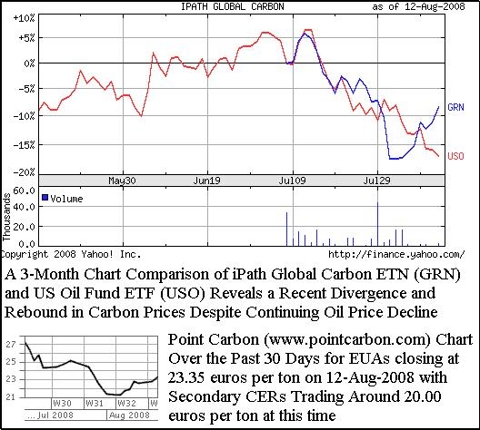

click to enlarge

Carbon prices are rebounding and diverging from an overall decline in commodities and oil on Tuesday as London-based Camco International [London: CAO] recorded a $2.6 million (US Dollar) profit on the sale of 151,288 tons of carbon credits on the spot market. The CERs were sold to an undisclosed buyer outside of the European Union for an average price of just over 19 euros per ton versus an average acquisition price of just 7.5 euros per ton. With Certified Emissions Reductions (CERs) currently trading around 19.75 euros per ton on Tuesday, Camco's portfolio of carbon credits is worth over $1.2 billion [USD] at current market prices -- including over 150 projects which are expected to generate 151 million CERs by 2012 (of which 41.8 million will go directly to Camco).

EcoloCap Solutions [pdf file] [OTCBB: ECOS] is a US-traded stock that I own based on its carbon credit hedge fund business model; whereby the Company generates CERs in emerging and frontier markets such as Vietnam at a below-market cost and then sells them at higher spot market prices in developed countries such as the US. EcoloCap is focusing its initial efforts in Vietnam and China (which account for over half of all earned carbon credits followed by India at around 10%) through an extensive network of contacts in Eastern Asia -- leveraging upon its technical expertise in the implementation of clean energy projects and experience in obtaining United Nations certification for these projects. EcoloCap currently has a total of seven signed renewable energy projects which will generate an estimated $39 million in revenues (versus a market cap of just $21.5 million) and $15 million in cumulative cash flow through 2012, in addition to tradable carbon credits.

As a pioneer in North America and a pure-play on the