It has been noted here on many occasions previously that future historians will have a field day when assessing economic activity during the last few decades. Nowhere will the puzzlement be more profound than when they turn to the measure of home ownership costs in the government's inflation statistics - owners' equivalent rent.

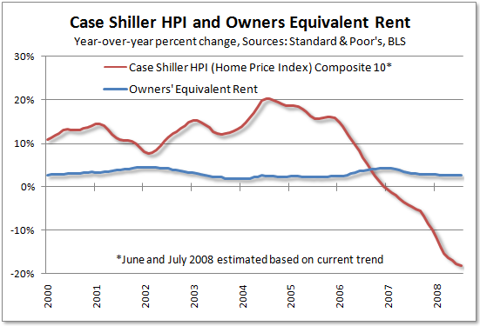

As shown above, there is nothing "equivalent" about the price of housing and how home ownership costs are represented in the consumer price index.

For those not familiar with the history, it can be summarized as follows:

In 1983, after an era of soaring inflation and the biggest housing boom and bust since World War II, estimated rental costs were substituted for such sensible measures like mortgage payments, taxes, and insurance in the "official" government measure of inflation.

Since then, the rising cost of home ownership has been barely noticeable in the cost of living (at least the way the government measures it), much to the benefit of the pencil pushers in Washington who are rewarded with lower cost increases for payments indexed to consumer prices - little things like social security.

None of this mattered much until after the internet bubble went bust and the Greenspan Fed started looking for a new bubble to inflate. Fast forward to today and it's clear to see how distorted the reporting of consumer prices became in the new decade.

Substituting the Case-Shiller Home Price Index for owners' equivalent rent shows the following divergent measures of inflation, where the "pedal to the metal" one or two percent short-term rates from 2002 to early-2005 look, ahem, "inappropriate" at best.

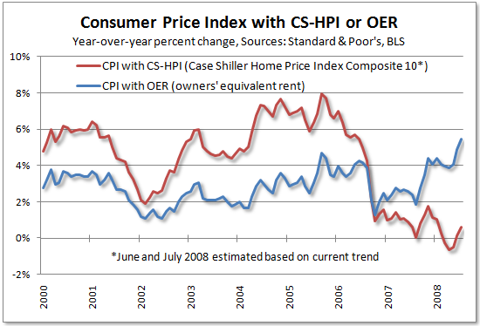

Even more surprising, when factoring in today's plunging home prices, the annual rate of inflation, reported at a 17-year high of 5.7 percent yesterday, recently dipped into negative territory and currently stands at less than one percent.

But it gets even better...

Since much of headline inflation comes from food and energy, stripping those out of the most recent inflation data and substituting the Case-Shiller Home Price Index for owners' equivalent rent shows core inflation, economists' favored measure of inflation, now at about minus 4 percent.

Since OER accounts for almost one-third of core inflation, it has a much bigger impact than for overall inflation as shown clearly above - both at the height of the housing bubble in 2004-2005 and now as the housing bubble has gone bust in 2007-2008.

When including soaring home prices instead of the tumbling cost of rent in 2003 (back when anyone and everyone was buying houses with no money down, bidding home prices skyward while pulling the rug out from under the rental market), core inflation would have measured more than four percent, not the one percent reading that is now characterized as the "2003 deflation scare" among dismal scientists.

The historians will not be kind when they pass judgment on current day economists.

Notes:

1. The charts above use a simple substitution of the Case-Shiller Home Price Index for owners' equivalent rent and are not intended to duplicate the pre-1983 measure of home ownership costs calculated by the Bureau of Labor Statistics.

2. The first chart above was featured in Kevin Phillips' recent book Bad Money (highly recommended reading) as discussed here previously.