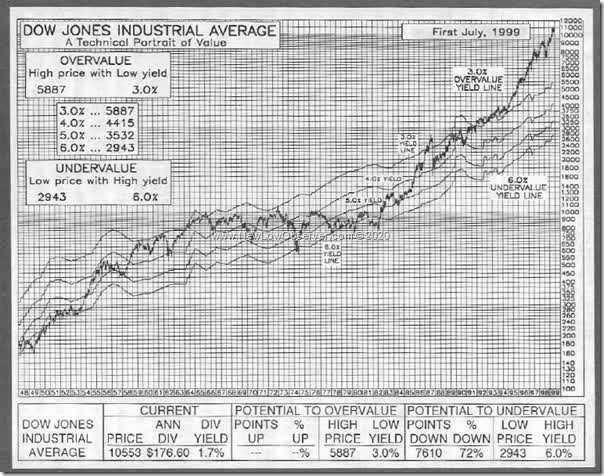

In a July 1999 issue of Investment Quality Trends published by Geraldine Weiss, it was observed that a dynamic shift in the history of the Dow Jones Industrial Average (DIA) may have been in the process. Weiss said the following:

“For more than 100 years, the benchmarks of value for the Dow Jones Industrial Average have been 3.0% at Overvalue and 6.0% at Undervalue. Now, the venerable D.J.I.A. has climbed so extremely high, it’s dividend yield has dropped to 1.5%…the lowest in history. The situation intrigues us and causes us to wonder if the Dow is establishing a new profile of value between dividend yield extremes of 1.5% at Overvalued (where stocks should be sold) and 3.0% at the former Overvalued level (where stocks can be bought). Throughout history, there has been a 100% differential between the high and low dividend yields at historical extremes. The D.J.I.A. now is 100% above its historic benchmark of Overvalue.

“If in fact the profile of value has changed from the Dow Jones Industrial Average (time will tell), then it is reasonable to assume that some blue chip stocks which also have climbed far beyond their historic levels of Overvalue, may be experiencing a similar fundamental change in their profiles of value. We saw the other side of the coin in 1982, when interest rates rose to unprecedented levels and some interest rate sensitive stocks established extremes of high yield at Undervalue. (Weiss, Geraldine. Should Some Overvalued Stocks Be Re-Evaluated? Investment Quality Trends. Mid-July 1999. page 12.).”

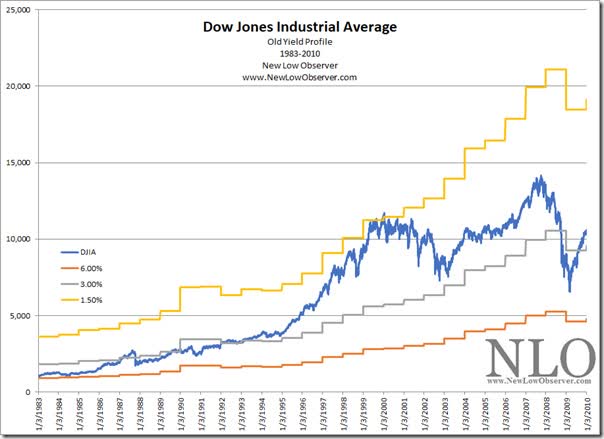

1983-2010

Our updated dividend yield profile for the Dow Jones Industrial Average since Weiss’ 1999 observation is below:

We’ve included the old high yield of 6% and old low yield of 3% with the new 1.50% overvalued level for contrast.

We’ve included the old high yield of 6% and old low yield of 3% with the new 1.50% overvalued level for contrast.

Because the March 2009 low fell short of the 6% dividend yield on the Dow Jones Industrial Average, many market analysts were not willing to accept the fact that the market would turn to the upside. They waited and waited with the view that the rebound was a Fed induced rise rather than a fundamentals and values based increase. Those same analyst were forces to wait out the most hated bull market in history, claiming a crash was coming for over 10 years.