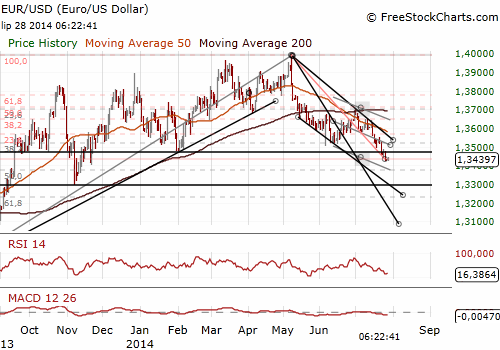

EUR/USD

The market is calm today and there is a "wait and see" mood ahead of some important macroeconomic events scheduled for this week. The market is clearly short on the EUR/USD but today's moves are not significant. We expect, however, another drop of the rate later this week.

What are the main events this week?

The BEA will publish its advance estimate of GDP growth for the second quarter of 2014 on Wednesday. After contracting an annualized 2.9% in the first quarter, we forecast US real GDP to rise an annualized 3.1% in 2Q14. Our estimate is higher by 0.1 pp. than consensus expectation. In line with our estimates the most important growth driver in 2Q14 was consumer spending and business fixed investment. On the other hand, we see negative contribution from net exports to the growth, as imports rose faster than exports.

The GDP reading will be followed by the release of the FOMC statement on the same day. We do not expect major news from the Fed mainly due to slow wage growth. The Fed will almost certainly reiterate that accommodative policy is still needed and trim its monthly bond buying by another USD 10 bn.

This Thursday sees the release of eurozone flash HICP, with expectations that we will see a repeat of June's 0.5% reading. However, we expect headline inflation to slow by 0.1 pp. to 0.4% yoy in July, mainly due to deceleration in energy prices (resulting from base effects). We see core inflation to stabilize at 0.8%. The ECB Vice President Constancio said over the weekend that new measures would not be introduced until the effectiveness of the June measures have been assessed. HICP readings from Germany and Spain both due on Wednesday will provide an indication of the reading on Thursday. Lower than expected inflation data will support the bearishness on the EUR and bullishness on carry trades as it will strengthen the view that ECB rates will maintain its accommodative policy for longer.

A strong manufacturing ISM and another solid nonfarm payroll reading are expected on Friday. We expect that nonfarm payrolls increased 220,000, below market consensus of 235,000 and vs. 288,000 a month earlier. The unemployment rate likely stayed at an unchanged 6.1%. Our forecast for the manufacturing ISM amounts to 56.6 (market consensus at 56.0). Regional manufacturing indicators have improved significantly across the board and what is important we had higher readings of key sub-indexes of new orders and production.

Short-term outlook: bearish

Medium-term outlook: mixed

Long-term outlook: mixed

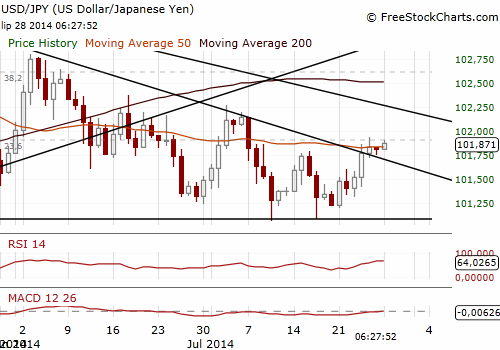

USD/JPY, EUR/JPY

The trade on USD/JPY was calm today due to Singapore holiday. The nearest resistance level is pre 102.00 and then technical resistance in the form of 100/200 dma just above 102.00, while the support is 21 dma at 101.60. Tighter EU sanctions on Russia may put a downward pressure on USD/JPY. The EU discussed options to curb Russian access to capital markets, arms and energy technology.

EUR/JPY rose slightly today vs. Friday's close. EUR/JPY bears are aiming for the 2014 low at 136.25 (February). A break and close below at the end of this week will weaken the cross further towards 135.39 - 38.2% retrace of the 118.47-145.67 gains. Our trading idea for this week is to get short on EUR/JPY.

We encourage you to subscribe to our Forex and Macroeconomic Service to read the full version of our analysis right away.

Thank you for reading.