The Elliott Wave Principle has a history of controversy. It was discovered by R.N. Elliott in the mid-1930s. Its contrarian nature seems to befuddle not only fundamental analysts but technical analysts as well. To understand it you must first turn everything you already think you know about markets upside down. To learn it well enough to become comfortable can take a very long time... years, in fact.

Most people either can't learn it, won't put in the time, or because of some internal prejudice, won't even try. That Elliott Wave Theory (EWT) renders Fama's Efficient Market Hypothesis incredible is reason enough for many to dismiss it. Fundamental analysts, especially, want to believe the market is all-knowing, all-seeing. Others dismiss it simply because they can't make immediate sense of it. But, for those that put in the time to study and learn it, the theory is invaluable and an unparalleled tool for predicting market behavior.

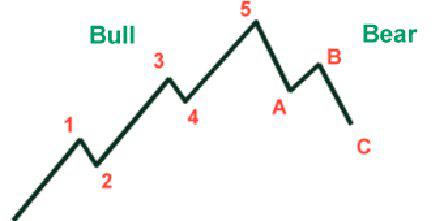

The basic construct of an Elliott Wave is the idealized 8 wave structure to the right. Five impulsive waves up, three corrective waves down to complete the cycle. While the general concept is simple, learning the myriad wave types and patterns is anything but simple.

The basic construct of an Elliott Wave is the idealized 8 wave structure to the right. Five impulsive waves up, three corrective waves down to complete the cycle. While the general concept is simple, learning the myriad wave types and patterns is anything but simple.

A good place to begin is my

Charles Dow's Dow Theory was almost certainly the inspiration for Elliott's discovery of his wave principle. But where Dow painted in broad strokes, Elliott identified, in incredible detail, consistent patterns that identify each phase of the bull and bear markets. It became obvious to him that the market fluctuated in cycles he called "waves". A bull market is comprised of five waves, three motive or "impulse" waves (1, 3, and 5), and two corrective waves (2 and 4). Bear market corrections are comprised of three waves. Impulse waves are down in a bear market and corrective waves are up, opposite of bull markets. The A and C waves are impulse waves with a B wave correction in between. The above figure illustrates the idealized 8 waves that make up one complete Elliott Wave market cycle.

The attending social psychology is what makes the Elliott Wave Principle so powerful. It is also what makes it so misunderstood. The herding mentality of humans is endogenous, i.e., sub-conscious, and therefore counter intuitive without training. No doubt many of the comments I will receive about this article will reflect vehement criticisms and attempts to discredit the theory through observations of exogenous causality. That is fine. Controversy is fun when handled with respect. Just don't expect me to mount a counter defense. Read the information on my Global Deflation News website and make up your own mind if you're on the fence.

I write this article motivated by the observation that, according to my EWT analysis, a major market reversal is imminent (perhaps days, weeks at the most). My website offers weekly charting updates for the S&P 500 and the Dow Jones Industrials. I don't track the markets daily like dedicated Elliott Wave websites, once a week is enough to inform. If you want to short-term trade based on EWT there are better sites to use.

The rest of the week I look at global events through social, economic and political eyes. It is apparent to me that the world is in the throes of deflation. That is the lens through which I observe and report. There are plenty of websites that are equally convinced that inflation is the enemy at the door. It shouldn't be long before the Inflation vs. Deflation debate is resolved and the markets start to deteriorate across the board. As early as this week we could see the first significant signs that a major trend change has gotten underway, a trend of downward collapse that will eventually prove catastrophic for those that remain in denial for too long.

Sannleikur Komist

Editor, Global Deflation News