CNN's Fear and Greed Index may show a "neutral" rating of 51 amongst traders, but it goes unsaid that investors and fund managers alike are worried about the Federal Reserve hiking interest rates on their bonds by the summer of this year. Such a proposition is very dangerous in these times, and nobody really knows what will happen if such a monetary policy is enacted.

Much of the uncertainty stems from the fact that inflation rates are still around or below two percent. During the height of holiday shopping, the month of December, the consumer price index fell 0.4%. It just goes to show how much businesses were cutting costs to get consumers to buy gifts at their places. Now, some of this can be attributed to the falling price of oil and other energy minerals as the sectors' performance is down 7%, easily the worst of the twelve stock sectors.

Even as unemployment stands at 5.7% as 257,000 jobs were added in January this year, U.S investors still have to be affected by what is occurring in Greece and the rest of Europe which is essentially standing in recession. Russia continues to cause trouble up north in Ukraine and anything can happen there, while the Middle East and much of Africa also remains in economic, political, and wartime turmoil.

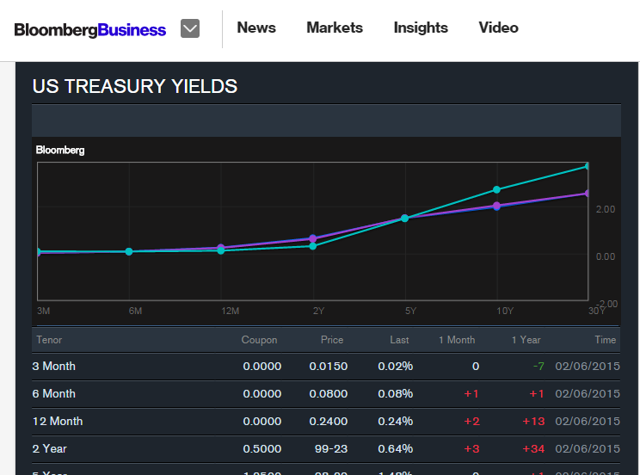

Given current fragile economic conditions for the middle class and college students (student loan debt collectively has never been higher), a short term interest rate hike short term federal funds rate of anything more than one-percent could be very dangerous. After all, the Fed, according to the Wallstreet Journal, only plans to hike short term rates this summer. Currently, a 30 year treasury bill has just a 2.42% return according to the U.S Treasury's Resource Center. A one year bill is just 0.2%.

One financial principle that works nine out of ten times on predicting a recession is a chart of all the possible Treasury note yields graphed on a line. When that line is moved through time, an interesting pattern shows up. Almost every recession occurs right after that curve is inverted. An inverted or flat curve can mean recession. Of course, what causes an inverted or flat curve is when 6 month and 1 year treasury bills have the same yield as a 20 or 30 year Treasury bill.

Now nobody knows how much the Fed intends to raise the short term rates, and if they raise the long term rates as well, but once that happens all the other rates should go up too. Credit cards, adjustable mortgages, student loan interest, you name it, all will go up. Couple that with an oil market should recover by June or July, and hikes of the minimum wage in major cities like Seattle, and there's a good bet that inflation will be well above the 2% threshold. Last year, the reported inflation rate was just 0.8%.

Another factor to consider is the $VIX. Remember that mini-correction in mid-October? The S&P 500 dropped 150 points from mid-September, coinciding with fantastic volatility not seen since Christmas Eve, 2012. That's how much the $VIX jumped. Back in early December, the $VIX was at it again with a second jump that was a bit smaller, but still higher than any jump since Christmas eve, 2012. Since then, the $VIX has stayed around 17.5, while pre-October $VIX averaged around 13.0.

mid-September, coinciding with fantastic volatility not seen since Christmas Eve, 2012. That's how much the $VIX jumped. Back in early December, the $VIX was at it again with a second jump that was a bit smaller, but still higher than any jump since Christmas eve, 2012. Since then, the $VIX has stayed around 17.5, while pre-October $VIX averaged around 13.0.

Consistency still lacks in the market to this day and the spread of many securities remain all over the place. And until the uncertainty and the bi polar disorder Wallstreet is experiencing quiets down, a hike of short term rates will raise costs to do business, which will make earnings season a very scary time, and from there, who knows what else might happen.