If you’ve taken action based on my articles over the past year, you’re likely seeing significant gains. REITs have experienced an impressive average surge of 40%, with many of our Top Picks soaring by 50-100% within just one year. If you’ve benefited from our free research, I have a small favor to ask: consider exploring our newsletter, High Yield Landlord. Here, we provide our most in-depth and high-quality research. We invest $100,000 annually in research, sharing the insights with you for a fraction of the cost. Our strategy has garnered over 500 five-star reviews from satisfied members.

Don’t miss the opportunity to join our community of real estate investors. You can gain immediate access to our Top Picks for 2025, completely risk-free for the first two weeks, meaning you have everything to gain and nothing to lose.

Additionally, we’re offering a limited-time $100 discount on your first year of subscription if you choose to stay with us for the long term.

The Fed recently surprised many by cutting interest rates not by the expected 25 basis points, but by a significant 50 basis points. They also signaled their intention to continue lowering rates further in the coming months.

We have long predicted that this would happen and we are pleased to see it finally play out. It is this prediction that gave us the confidence to aggressively accumulate REITs over the past two years while they were heavily discounted.

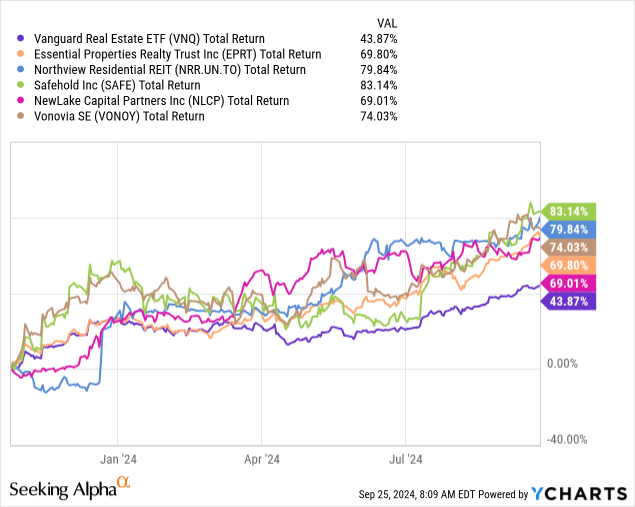

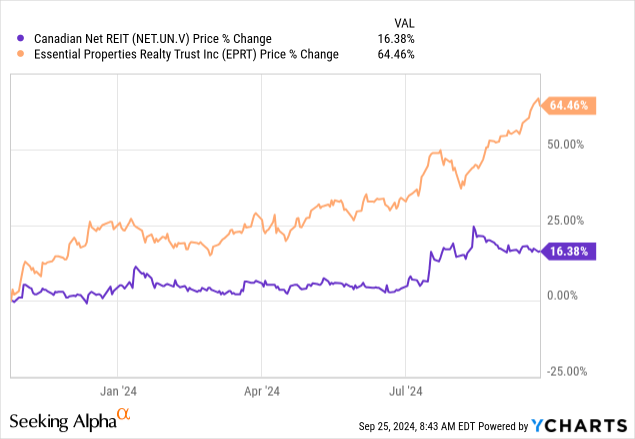

Now our patience is finally paying off as REITs have surged by 40% off their lows and some of our biggest holdings are up far more than that:

On one hand, I am happy these gains...

But on the other hand, I also know that this will make it harder for us to identify new opportunities going forward.

A year ago, you could have bought almost any REIT and earned strong returns because they were so cheap. As an example, we invested heavily in blue-chip investment grade rated REITs like Camden Property Trust (CPT) because those REITs rarely come for sale.

But the easy money has now been earned and it is time for REIT investors to become more selective.

Many of those large and popular REITs are slowly approaching fair value, but there are still plenty of opportunities among smaller and lesser-known REITs, particularly in more complex situations with more leverage, portfolio transformations, and in foreign markets.

With that in mind, we are today buying another 1,500 shares of Canadian Net REIT (NET.UN:CA), making it our largest Canadian REIT holding.

We think that it is the single best investment opportunity in the net lease sector today and that's because it has mostly missed out on the recent rally, causing its equity to become deeply undervalued relative to that of its US peers:

| Canadian Net REIT (NET.UN:CA) | Essential Properties Realty Trust (EPRT) | |

| FFO Multiple | 8.5x | 18x |

This valuation differential is massive and unjustified based on the fundamentals of the company. As a reminder, Canadian Net REIT owns very desirable assets leased mostly to investment grade rated tenants and it has historically grown the fastest of any net lease REITs that we know of.

Moreover, rate cuts are expected to be even more aggressive in Canada and therefore, smaller more heavily leveraged REITs like Canadian Net REIT should be surging in value right now.

But we have often seen this happen with Canadian REITs. They are often slower to respond to macro changes than US REITs, which are more actively traded by investors.

This delay in market reaction is a great opportunity for more sophisticated REIT investors, allowing us to buy more shares at just 8.5x FFO. We expect about 50% upside as it eventually recovers and while we wait, we earn a 6.5% dividend, paid monthly and we expect the REIT to create an additional ~5% of value each year.

I just recently had the chance to ask questions to the company's CEO, Kevin Henley, and below I share the main takeaways.

In case you are new to this REIT, we recommend that you first read our investment thesis by clicking here.

Interview Takeaways:

- Canadian Net REIT is not just the only net lease REIT in Canada, but it is the only institutional investor in its market niche, and this is a major advantage because it faces little competition for new acquisitions and can find deals with very attractive cap rates and lease terms.

- The reason why US net lease REITs are not coming to Canada is because it is very hard to acquire larger portfolios in Canada. The market is highly fragmented and small acquisitions would not move the needle for them given their larger size. However, despite being the largest dedicated owner of such properties in Canada, Canadian Net REIT is still very small, owning just 93 properties compared to 15,000+ in the case of Realty Income. Their CEO explains that "they are essentially feeding on crumbs of giants and slowly building a very high quality portfolio." These crumbs move the needle for them, but not for the giants.

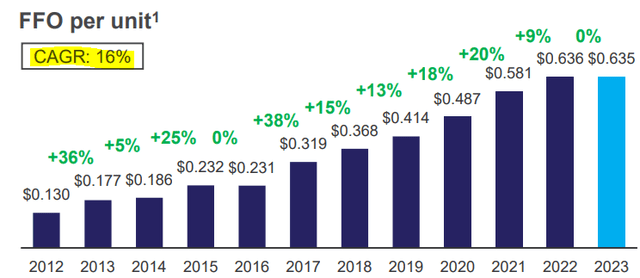

- Therefore, they are in the sweet spot right now. Their unique market focus allows them to close highly accretive deals and because they are still small in size, these deals should result in above-average growth for many years to come. Historically, this approach has been extremely rewarding and they they are still in their early growth phase.

- Their CEO makes it very clear to me that the focus is on growing FFO on a per share basis and they don't care about top line growth. They seem to be very well aligned with shareholders. This is well-reflected in their management cost, which is lower as a percentage of total assets than many of their larger US peers, and it is also reflected in their superior track record and the high insider ownership of the management.

- Something unique about Canadian Net REIT is also that it has a very low payout ratio at 56% and they gradually amortize their debt with retained cash flow.

Closing Note

How many net lease REITs do you know that have historically managed to grow their FFO per share by 16% annually, and yet, trade at only 8.5x FFO?

I don't know any other.

As interest rates now return to lower levels and their growth accelerates, I expect their FFO multiple to also expand, resulting in significant upside from here.

They have a unique strategy that's very rewarding and we think that the company is still in its early growth stage.

We are happy to get the chance to buy more shares at a discounted price before the market realizes this.

What Else Are We Buying?

We are currently sharing all our Top Picks with members of High Yield Landlord, and you can get access to them for free with our 2-week free trial! We are so confident in what we offer that we allow you to join us and decide within your free trial whether this service is something for you or not.

You have everything to gain and nothing to lose. You won't be charged a penny if you cancel during your free trial.