Introduction

I am 59 and will retire December 31, 2021. I first opened my accounts to trade individual stocks on March 8, 2017. Prior to that my investments were mainly in real estate, particularly farm land.

I have three accounts that will contribute to my retirement. These are:

Taxable account - This is primarily for dividend income. I do own some weak and non-dividend payers and plan to sell these as I need to in order to supplement dividends and saved cash. No new money is being deposited into it and dividends are taken as cash to build before I retire.

Roth - This is a total return account. I expect to never have to touch it. Beyond a final $7k contribution to it in 2022, growth for it will come from IRA conversions, if I do those.

403b - I will convert this to an IRA, likely in April or May 2022. I'll be 59.5 in February but I may as well do the whole thing at once after I receive my final employer contribution next spring. It will also be a total return account. I do not expect to need to touch it until RMD time, right now in 2034. I may use it for Roth conversions but this will be a year-to-year decision.

Current Status Toward Goal:

Achieved. I am able to fund my retirement from my taxable account alone. Alphabet (GOOGL) and Apple (AAPL) make up about 18% of that account and don't contribute much in dividend income. So I'll sell them, supplemented with saved cash, to make up for my dividend income shortfall. With this strategy I easily have enough funds to cover my needs and spend at a higher level than I ever have in my life. Using long-term capital gains rather than IRA withdrawals appears to be more advantageous when it comes to taxes.

I may find as time goes on that IRA withdrawals for living expenses will make more sense than my initial tax calculations indicate, but for now the only money I plan to take out of the IRA will be for annual Roth conversions.

Here are my previous quarterly portfolio updates.

- 2018 Portfolio Review

- Third Quarter, 2019

- 2019 Portfolio Review

- First Quarter, 2020

- Second Quarter, 2020

- Third Quarter, 2020

- 2020 Portfolio Review

- First Quarter 2021

- Second Quarter 2021

Portfolio Update

Most of my moves were in my Roth to change it from primarily a dividend-producer to a total return account. I made one more trim of AT&T (T) in August in response to its recent announced plans to cut the dividend next year but other than this everything took place in the Roth.

Positions closed:

New Positions:

I bought Amazon (AMZN) on October 1 but that's the fourth quarter.

My monthly reviews have more details on individual transactions.

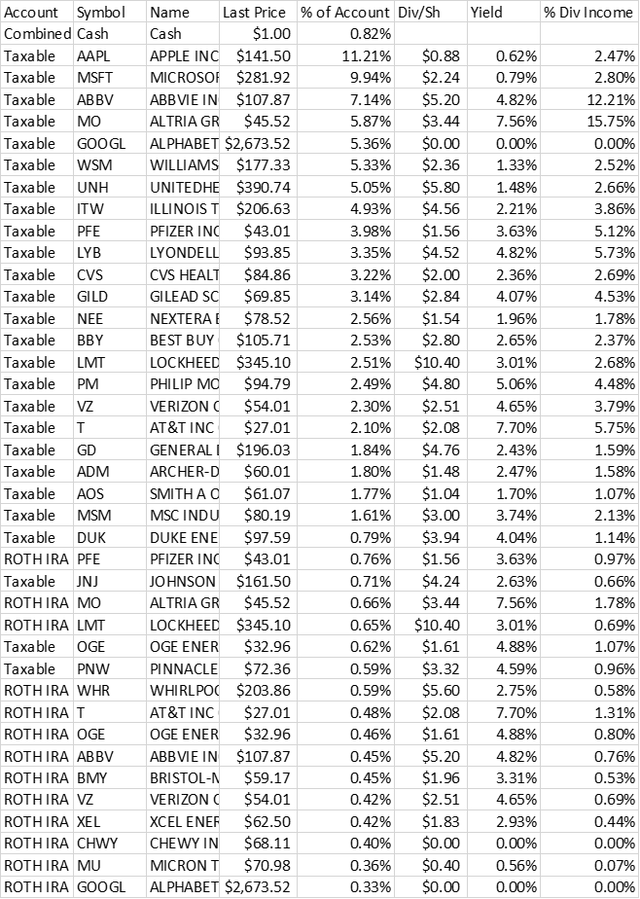

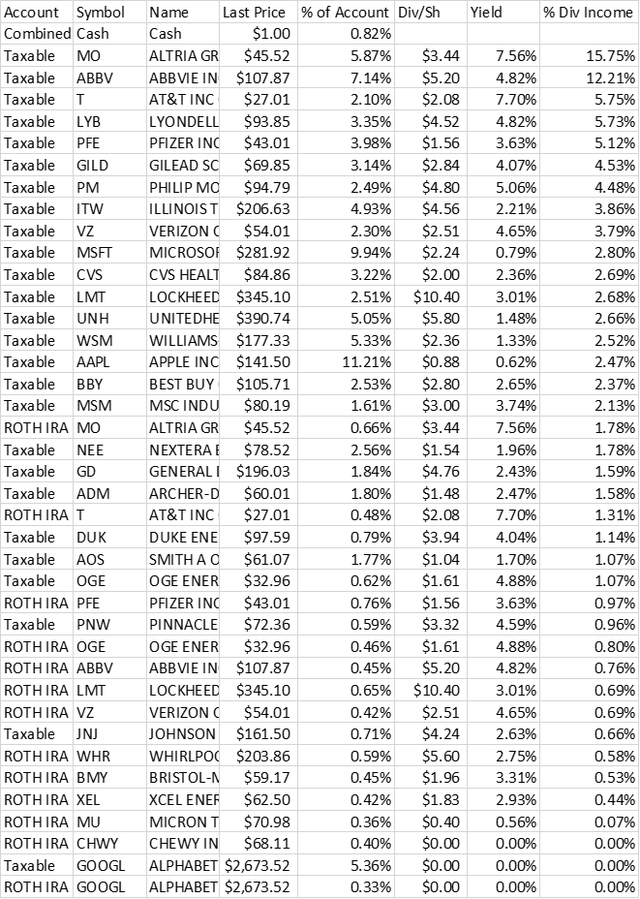

These are my two standard charts. The first lists my portfolio based on account value. The second by each stock's contribution to my dividend income.

Numbers are as of market close on September 30, 2021. Dividends do not reflect announced raises or cuts but the last payout.

Portfolio, ranked by Position Size:

Portfolio, ranked by Dividend Income Contribution:

I'm not worried about the amount any of these make up of my account but I don't consider the amount of income generated in my taxable account by either Altria (MO) or AbbVie (ABBV) ideal. I'd like to see 10% as the maximum from any single company. Both have pretty high 5-yr DGRs too so it's not like I can expect them to decline relative to everything else. I'm going to live with it. I have a large safety margin. But if I didn't I might be looking at ways to address this.

The cash balance is above what I have had since late 2018 when I spent what came in from my last property sale. So far not spending it has been easier than I thought, discipline I guess though the elevated market doesn't hurt. I do miss buying a dividend-payer whenever I have $1k but not so much that I've had to resort to meditation or going to a SBA (stock buyers anonymous) meeting or anything. That balance should be a little over 2% by next April when I'll be able to use it to offset GOOGL and AAPL sales to live on.

And while not part of my accounts, I have not been adding new money since June either so my bank account is building. Not as quickly as from accumulated dividends but with retirement on the horizon, cash and the flexibility helps. All according to plan. Sort of waiting for something to screw it up, it seems a bit too smooth so far.

Taxable Account by yield and dividend growth.

I thought it would be interesting to see which of my stocks are low, medium, and high yielders and have low, medium, and high 5-year dividend growth.

My categories are:

Yield; High - 4% & above, Medium - 2-3.99%, Low - below 2%.

Dividend Growth; High - 10% & above, Medium - 4%-9.99%, Low - below 4%

Yield

| Category | Stocks | % of Account | % of Dividends |

| High, 4% & above | ABBV, DUK, GILD, LYB, MO, OGE, PM, PNW, T, VZ | 30.36% | 60.62% |

| Medium, 2-3.99% | ADM, BBY, CVS, GD, ITW, JNJ, LMT, PFE | 24.71% | 24.82% |

| Low, < 2% | AAPL, AOS, GOOGL, MSFT, NEE, UNH, WSM | 44.06% | 14.56% |

Dividend Growth

| Category | Stocks | % of Account | % of Dividends |

| High, 10% & above | ABBV, AOS, BBY, GD, ITW, MSM, UNH | 29.30% | 30.27% |

| Medium, 4-9.99% | AAPL, ADM, GILD, JNJ, LMT, LYB, MO, MSFT, OGE, PFE, PNW, WSM | 52.44% | 50.20% |

| Low, < 4% | CVS, DUK, GOOGL, PM, T, VZ | 17.39% | 19.53% |

There really should be two more dividend growth categories to reflect how I view stocks, with divisions at 6% and 8%. There's a big difference between 4.1% and 9.9% but for the purposes of this post I'm going this way.

I don't know if there's much here that I'd call "actionable." If there were no tax implications - remember, these two tables are for my taxable account alone - I might be looking at converting lower yielders to higher so I could completely fund my retirement from my dividends. But I will have to pay taxes; moot point.

The other item is that I have been able to roughly track the S&P the last 4 years and that is because of those lower-yielding companies. I bought most of them before I became locked into dividend investing and I call this a happy accident. I think each of them is an excellent company. Some are what I call best in their respective businesses - UNH, NEE, MSFT.

The dividend growth chart is a bit surprising as it runs against conventional wisdom. We - or me anyway - tend to think of high yielders as being low dividend growth companies. This doesn't have to be the case. ABBV has grown its dividend very aggressively and even MO has had robust hikes recently though the last two have been tepid. The three growth categories must have roughly equal yields as the dividends paid for each is about the same as the amount held. I wasn't expecting that.

A scattershot graph would be a nice way to illustrate this but I tried once and with 30 or so stocks it's too busy to be useful when I included the company names.

So these tables fit more as "knowing your portfolio characteristics" items than anything I might do something with. It's also an example of one of the benefits of blogging. They took a little time - not a ton but I had to do Excel sorts and simple formulas - to put together. I wouldn't have done it if I weren't blogging.

Sector Weights:

I don't do much with these but I know some people do. I have an idea of where I sit and sometimes it helps me understand why I may be over- or under-performing the market. But I don't use them to choose a company in one sector over another - unless everything else between companies is a dead heat.

These were pulled from a Fidelity screen on October 3. I never remember to do this until I start putting the post together but doubt the day of trading changed things much.

- Health Care - 25%

- Information Technology - 22%

- Industrial - 13%

- Communications Services - 11%

- Consumer Staples - 11%

- Consumer Discretionary - 9%

- Utilities - 5%

- Materials - 3%

This didn't change much from June. At the end of the second quarter I had 1% each in energy and financials which the sales of XOM and the two BDCs took care of. Nothing else changed by more than a percent.

Second Quarter Performance

Here are some quick numbers.

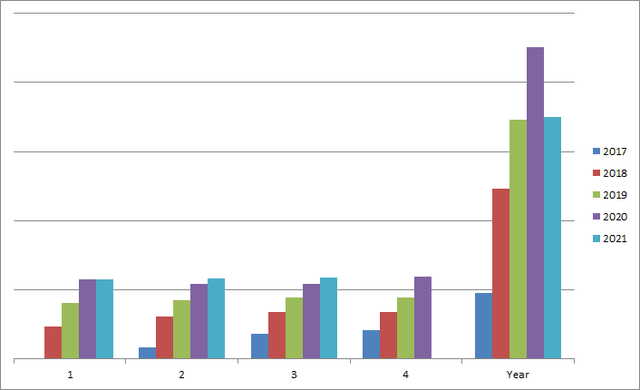

- Dividend increase over second quarter, 2021: .75%

- Dividend increase over third quarter, 2020: 7.55%

- Third Quarter change in value: -.03%

- Current portfolio yield: 2.85%

- Increase in projected 12 month dividend income from June 30, 2021: .16%

- Internal/organic 12-month forward DGR comparison: 6/30/21 - 8.77%; 9/30/21 - 9.08%

I finally divided my taxable account and Roth for performance tracking purposes after posting my September portfolio review. But I have nothing to compare those separate accounts to from June. So the above is still for combined numbers. In the future I'll have separate figures for them.

The flat value over three months isn't great but not the main goal so I'll live with it. I suspect the S&P was up a little over the same period - I think I underperformed for the most part. But I don't really know.

The .16% projected forward dividend growth would be something I wouldn't be happy with if it were for my taxable account alone. But with my selling so many companies paying 7% and above from my Roth, well, it still bothers me but it bothers me because I was lazy and hadn't started tracking my accounts separately before July 1. This is fixed now.

Honestly, I was surprised to see an increase at all. Those Roth stocks were small positions but big payers. I liked seeing the DGR go up. That growth rate is 9.30% for my taxable account alone.

This is the second quarter in a row where my dividends were up between seven and eight percent over the previous year. The combination of this number and the fact that right now I'm selling most of the high yielders that are in my Roth tells me I won't make my 10% YoY goal. But back when I set it I was retiring in 2022, not this year, and would continue to use dividends to buy more companies and toss a little outside cash in. So underperforming this goal doesn't bother me.

Portfolio Dividend Income by Quarter:

Summary

I don't do a pile of analysis in these quarterlies - they're more to show a snapshot of where my portfolio is so I can look at these over time and have an idea if what I'm doing is working. Analysis is deeper in my monthly updates and, these days, my retirement posts.

This was the first full quarter where I transitioned from the accumulation phase. I'm not in the harvest phase yet. Call it harvest preparation. But by no longer reinvesting dividends or adding new money, income growth will be slower.

I'm tempted to look into using the cash that's accumulating for options but I'll need to study more first. The idea for the cash is safety. Maybe options are too risky though from an initial look some types seem pretty secure. But I have my emergency fund as a backup - does screwing up options count as an emergency? guess this is up to me - so using what will grow to be about $30k to generate a little extra income may be worth doing. Right now it's just sitting there. If I get comfortable with it, this may be a way to reduce the amount of GOOGL and AAPL I'll need to sell once I retire.

Happy investing everyone!