Introduction

So it appears that on SA blogs will soon be going the way of the dodo bird. Or the dinosaurs. With that in mind, thanks to everyone who has read or commented. This was 80% written when I found this out - I tend to add bits and pieces through the month - so I'll put it up.

This is my real-world portfolio I will use to retire on at the end of 2021. The bulk is in a taxable account but I began a Roth in 2017 which is a small portion. As of now I have 27 stocks. The complete list is at the bottom of this post.

Probably the best - but quite long - overview of my investing goals for my taxable account and how I go about selecting companies is this post: Doing the "Deep Dive" for My Next Potential Stock Purchase.

The purpose of my Taxable Account is primarily to provide me with dividend income to fund my retirement. I plan to completely fund my retirement from this account.

My Roth - and my T-IRA once I set it up in spring, 2022 - is a total return account though I still lean toward companies that pay dividends.

I have quite a few Retirement Planning Posts. This one has the most detail about how I plan to actually pay myself not to work. Retirement Planning IX.

Here's a quick numbers summary:

|

Trades Made and Dividends Received

The Trades:

11/1/21 - Sold Gilead (GILD) at $65.45, this closed my GILD position

11/1/21 - Bought Philip Morris (PM) at $93.65

11/2/21 - Sold Pinnacle West (PNW) at $65.42, this closed my PNW position

11/2/21 - Bought OGE Energy (OGE) at $34.70

11/10/21 - Sold Pfizer (PFE) at $48.91

11/10/21 - Bought Restaurant Brands International (QSR) at $57.67, this opened a new position

11/10/21 - Bought PayPal (PYPL) at $202.85, this opened a new position

11/22/21 - Sold AT&T (T) at $24.14

11/22/21 - Bought Altria (MO) at $43.72

11/22/21 - Bought AbbVie (ABBV) at $115.69

The Dividends:

11/1/21 - Bristol-Meyers Squibb (BMY)

11/1/21 - CVS Health (CVS)

11/1/21 - AT&T (T)

11/1/21 - Verizon (VZ), increase from $.6275 to $.64 per share

11/11/21 - Apple (AAPL)

11/12/21 - General Dynamics (GD)

11/15/21 - AbbVie (ABBV)

11/15/21 - A.O. Smith (AOS), increase from $.26 to $.28 per share

11/26/21 - Starbucks (SBUX)

11/26/21 - Williams-Sonoma (WSM), increase from $.59 to $.71 per share

The Trades:

The first two trades were in my Taxable Account and finished off my retirement prep moves (for now), completing what I started in October. I do have a T "tweaking" move as I'll mention further on.

GILD/PM: For GILD, as I have discussed previously, after owning it for over 4 years I have decided not to wait any longer. I initially bought it as a good company going through a rough patch expecting that it would resume increasing revenues at some point. Four years later and revenues have not increased, debt has, and the latest dividend increase was markedly lower than previously. Can it still turn around? Of course. Even with the increased debt it's not in any sort of trouble. The company has made some acquisitions and maybe one or more will pay off. But it was time for me to move on. PM was not cheap but not overpriced either and had gone through a recent dip of about 7%.

PNW/OGE: PNW was my last onesie - a company I only had one buy of. In addition it is struggling, largely due to a rate issue and Arizona announcing a surprise rate cut which is still being argued about in meetings. I'd have likely been selling even without the rate problem. All other things being equal OGE would probably not have been my number one choice. However I like it fairly well and it was my only remaining utility other than NextEra Energy (NEE). I decided I want to own at least one other ute. It was also a onesie but with the buy I nearly doubled my amount. It's now at about a 1/8 full position, the smallest size holding in my taxable account.

PFE/QSR/PYPL: The PFE transaction was in my Roth and was another "growthification" move. I still own a pile in my Taxable Account and have no plans to do anything there. I won't spend much time on PYPL. My reason was simple. It's going through post-COVID weakness which involves growing revenues by 15% and guiding for 18% revenue increase in 2022 rather than what the street looked for (not sure what that was, evidently more) in the last ER, hence the price drop. It just announced that next year Venmo will be allowed for use with Amazon purchases which to me is a nice growth opportunity. And it gave me the chance to use the word "hence" in a post.

QSR is more interesting. As its company name indicates, Restaurant Brands International deals with restaurants, primarily Burger King, Popeyes and what I consider its shining star, Tim Hortons. It had issues going through COVID as most companies in that sort of business did and it is going through issues now with labor and supply chain disruption which, again, many of its competitors are also facing. Despite this, revenues have returned to pre-COVID levels.

I would not buy this company in my Taxable Account where dividend safety is critically important. Its debt levels are too high. Its payout ratio, while not flashing red, is certainly a bright yellow. And its 5-year DGR is a big fooler as its last two hikes have been small. But despite COVID, it has hiked. And it is paying down debt though again, slowly.

For my Roth I saw this as a chance to get a company I've looked at and liked for a while at a very nice price. Management seems solid and I think it has navigated the massive COVID surprise quite well. It may be a couple of years before it really gets rolling again and while I doubt it happens, a dividend freeze or even cut is possible. In the Roth this dividend treatment is far less critical than in the Taxable Account. It is also my first dividend-paying Canadian company. A bit unexpected - I really thought that would be a bank.

T/ABBV/MO: I've been talking about selling more T from my Taxable Account for a while. On 11/20, as the wash sale period from my 10/19 T buy was coming to an end, I gave this some deeper thought.

My original plan was to use the T sales to fulfill two purposes; 1) Complete my $3k in tax loss sales for my 2021 taxes and 2) Give me the $7k I'll use for my 2022 Roth contribution.

On the 20th I thought a bit more about that. Selling enough T to reach the tax loss target will take away about 1% of my Taxable Account dividend income, based on what T pays today. I don't need the Roth money - as far as I can tell - forever. Do I like what tax-advantaged accounts can do for total return? You bet. But I need the Taxable Account to live. Maintaining dividend income in it is a higher need

So I split the sale proceeds between MO and ABBV. I still lost a little dividend income, about .25%. If I'd gone T for MO I'd have lost a tiny amount which would be made up with another 5% MO dividend increase next year. But I like ABBV so much more and it's still trading attractively that I went in that direction.

On the plus side, this one trade raised my projected annual dividend growth rate (based on 5-yr DGRs) from 8.60% to 8.85%. That was pretty nice.

I have until 4/15/23 to make my Roth contribution. I expect to do that but can't say how right now. I could toss in $500/mo - I have 16 months. Or I could use outside money as I have a little income from my partnerships. Or something else - maybe someone pays a special dividend. It'll get done but probably not in January.

It's important to note that for me, T has been a failed investment so far and it's hard for me to see how I'll ever be able to say anything different. I bought it using two premises:

- It would continue paying a hefty, slowly growing dividend going forward

- I was buying (started at under $36 in fall, 2017) at very attractive prices, partially brought on by TWX acquisition debt fears.

Today, the dividend will be cut and the share price has dropped by something like 30% though I have bought cheaper going along, suspect I'm down 10-15%.

It's nice that the IRS lets me take a consolation prize with tax losses but let's face it; my T investment has fallen flat on its face.

To look at it another way:

I bought T pre-TWX acquisition trading at $36 paying a $2/share dividend.

Sometime next summer T will spin off the TWX. I'll be left with a company trading at $18-20 per share with a $1.20-$1.30/share dividend along with shares of a non-dividend company I don't really want. In the harsh light of day, this is not good. At least I'm not alone.

The above involves me going out on a limb and predicting that share price will not double between now and next June. For some reason, that limb feels pretty stable. I still own a decent amount, about 40% of a full position so if a miracle does happen . . .

The Dividends:

Dividends were down from both August and last November. I never like to see this but there's a pretty simple reason - further sales of T. I also sold a lot of the dividend-payers from my Roth and replaced them with growth.

On the plus side, I received three dividend increases. For VZ and AOS, these were roughly as expected. Good.

WSM was a bonanza. It raised from $.53 to $.59 with the May payment. Two quarters later, this latest raise means a 34% one-year increase and brings its five-year DGR to 13.92%. There were several factors raising my Taxable Account "organic" dividend growth rate to nearly 9%. A big one was owning less T with its frozen dividend (before it cuts). But the WSM impact was significant too. For the month my projected forward dividend income growth rate increased from 8.65% to 8.99% in my taxable account, from 7.82% to 9.18% in my Roth.

I am looking forward to banking dividend increases from Microsoft (MSFT) and Lockheed-Martin (LMT) in December.

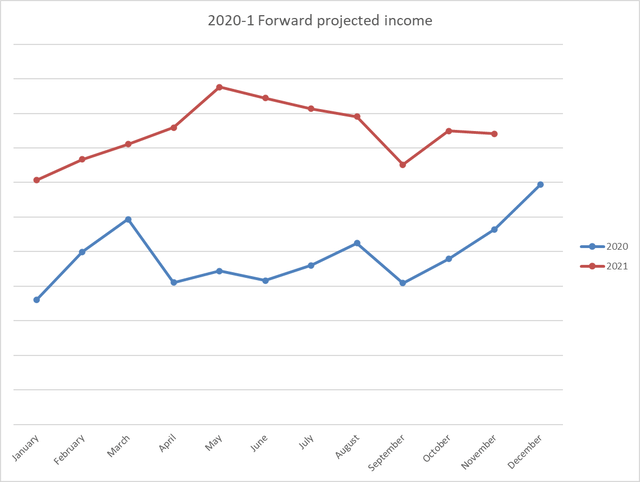

Chart of the Month:

I can't recall if I've shared this chart before or not. It's my 12-month forward dividend progression since I started tracking this two years ago. Most, maybe all of the decline since May is from the Roth changes - doing away with REITs and BDCs and selling other dividend payers for growth. I've just started tracking the Roth separately from the taxable account.

Plans Going Forward

For the time being I have no planned trades in the Taxable Account though I could always get sick of looking at T. In the Roth, MO is on the sell list but at over $50 - maybe. Even at that price it will yield over 7% and that sort of guaranteed return is nothing to sneeze at. I'm not sure about Bristol-Myers Squibb (BMY). And I will add $7k to it at some point and spend that.

I hope you are all enjoying the Holiday Season. For me this also means a retirement tour which has not been too painful so far.

It's unfortunate that with blogs evidently shutting down I won't be able to relate my dividend harvesting/funding retirement strategy with everyone. I also had this idea of posting a couple of weeks before the IRA rollover and asking for buy suggestions. I can do that in chat but it would have been fun to do it here. But this is the way of the world - change.

Happy investing everyone!

I am long: AAPL, ABBV, ADM, AMZN, AOS, BBY, BMY, CHWY, CVS, GD, GOOGL, ITW, LMT, LYB, MO, MSFT, MSM, MU, NEE, OGE, PFE, PM, PYPL, QSR, SBUX, T, UNH, VZ, WHR, WSM.