There are several reasons why stocks have significantly rallied in recent months:

Better than expected positive vaccine news

Election results (for now, no blue sweep so higher corporate taxes are delayed for the time being)

Investors underexposed to stocks

Tons of liquidity in the capital markets system (M1 velocity sharply rising, fiscal stimulus, and rock bottom interest rates)

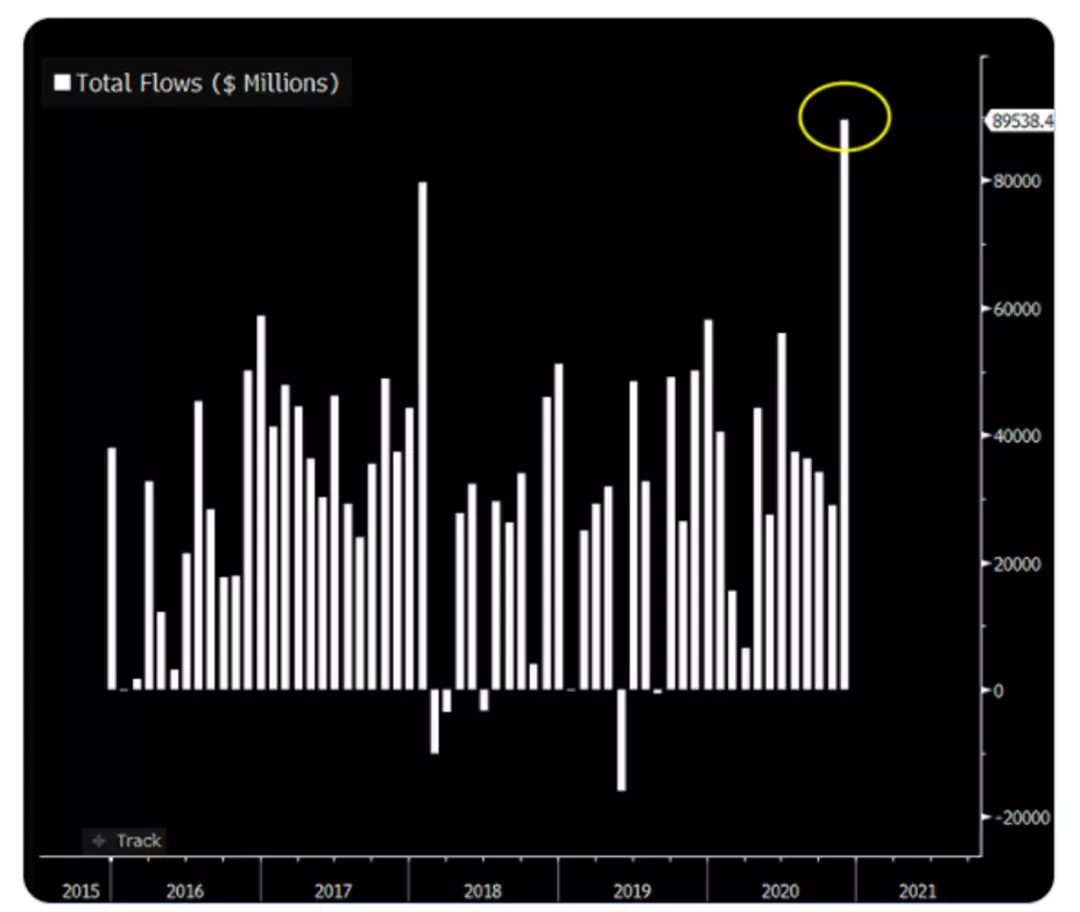

Approximately, $90 bln has gone into ETFs in the month of November (see Bloomberg chart below). Last week alone saw $27 bln into US equity ETFs. These are big numbers.

Source: Bloomberg chart via Eric Balchunas on Twitter. Link here.

We mentioned above a number of reasons for why stocks have been rallying. We cannot help to think that a near 50% rally in the S&P 500 Index since the March 2020 lows brings an added layer of comfort.

There is a large rotation in the marketplace where investors are buying stocks that are sensitive to the re-opening of the US economy. These cohorts would include value-oriented stocks, (energy, banks, hospitality industry, travel, leisure, etc.), small-caps, and mid-caps. Momentum, low volatility, and growth stocks have relatively suffered.

Astoria’s view is that if provided liquidity remains abundant, earnings continue to beat expectations, and vaccines are deployed as indicated, investors will continue to rotate into more attractively priced assets (or at least they should in our opinion).

By the way, value’s recent outperformance is not unusual as it historically has outperformed during the period around a recession. Astoria was interviewed on CNBC TV back in June where we spoke positively about the US economy and why we were constructive on more cyclical-oriented stocks (click here).

The title of our June Investment Committee report was “Increasing the Cyclicality of our Portfolios,” so we are not jumping on the bandwagon all of a sudden (click here). Strategically, an easy way to increase the cyclicality of one’s portfolio would be to go overweight small-caps, mid-caps, and international equities. Call us to discuss this aspect in more detail.

Lastly, we have broadened our range of services to our clients. We now offer a range of Thematic Equity stock portfolios, ESG ETF models, as well as a portfolio construction dashboard which demonstrates our portfolio risk, performance attribution, factor tilts, various macro-economic indicators, and more (click here).

Best, Astoria Portfolio Advisors

For full disclosure, please refer to our website: https://www.astoriaadvisors.com/disclaimer