Discussion

This is a lite version of the market review I send to Haggerston BioHealth Marketplace subscribers every week. To discover more about the service and sign up please follow this link.

We cover biotech, healthcare, and Pharma in depth with several deep dive notes published every week, and access to thousands of written pieces of analysis, modelling and forecasting for all larger companies.

Most importantly, we guide readers towards breaking investment opportunities, market moving trends, and advise on how to build a balanced portfolio.

Discover all this and more at Haggerston BioHealth, and sign up today for 25% off all annual subscriptions - you pay just $25 per month.

Thanks for reading I hope you enjoy this week's analysis!

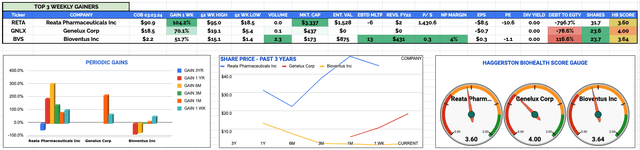

3 Best Performing BioHealth Stocks Week Ending Friday 3rd Mar 2023

Biotech, Pharma, Healthcare overall sector best performing stocks Mon 27th Feb - Fri 3rd Mar 2023 KPIs: Source: HB Live Analytics (message me for a link)

Reata Pharmaceuticals Inc (RETA)

Weekly Gain: 104% to $90.9

Current Price & Time: $88.5 (Market Close 6th March)

Market Cap: $3.24bn

Share Count: 36.6m

Discussion: I made Reata a Stock to Watch back in Week 127 (week commencing 31st October) when the company's shares traded at $33 - shares have risen in value by >165% since. I wrote at the time:

Omaveloxolone now has a PDUFA date of Feb 28th, 2023, after the FDA triggered a 3-month extension from November.

Omaveloxolone is indicated to treat Freidreich's Ataxia ("FA"), an inherited disorder caused by a genetic defect - according to Johns Hopkins:

Symptoms often begin in late childhood and can include trouble walking, fatigue, changes in sensation, and slowed speech. These tend to get worse over time. Heart disease, skeletal problems, and diabetes can also occur.

There are ~5k patients in the US diagnosed with the disease and no approved therapies. Reata already has a sales team in place in preparation for commercial launch.

Last week, Reata was able to announce that omaveloxone 50mg capsules are approved for commercial sale in the US by the FDA, under the brand name SKYCLARYS, in patients >16 years old, causing the share price to skyrocket. It is the first drug approval in Reata's 21-year history, after its drug Bardoxolone - indicated for Alport Syndrome, which can lead to Chronic Kidney Disease - was rejected last year by the FDA after an advisory panel voted 13-0 against approval.

The approval was granted based on data from a single study - named MOXIE Part 2 - which a press release stated:

Patients with genetically confirmed Friedreich’s ataxia and baseline modified Friedreich’s Ataxia Rating Scale (“mFARS”) scores between 20 and 80 were randomized 1:1 to receive placebo or 150 mg of SKYCLARYS daily. The primary endpoint was change from baseline in mFARS score compared to placebo at Week 48 in the Full Analysis Population of patients without severe pes cavus (n=82). Treatment with SKYCLARYS resulted in statistically significant lower mFARS scores (less impairment) relative to placebo at Week 48.

The data was originally rejected by the FDA back in 2020, with the agency asking for another pivotal to be conducted, but Reata was able to supply further data from a post hoc Propensity-Matched Analysis in which "mFARS scores were observed in patients treated with SKYCLARYS after 3 years relative to the matched set of untreated patients from the FA-COMS natural history study."

Some analysts have forecast SKYCLARYS to achieve sales of ~$400m by 2030, although others have suggested the drug could become a blockbuster (>$1bn per annum) selling drug. The lost price has been quoted as $370k annually.

Reata expects to have commercial product ready to launch by Q223, and the company has reported a cash position of $387.5m in a presentation covering the approval, which is expected to last to the end of next year. Reata will discover if the drug will be approved in Europe likely this year, having submitted its marketing application in the final quarter of 2022.

With the uncertainty over peak sales, and a pipeline composed of Bardoxolone and one other asset, RTA 901, in development for Diabetic Peripheral Neuropathic Pain, it is difficult to judge what range Reata shares are likely to trade within going forward. Based on a peak sales opportunity of $1bn, there is certainly room for upside although the FDA has requested more post-approval studies and I would preach caution as the company attempts to penetrate an unknown market.

Genelux Corp (GNLX)

Weekly Gain: 70% to $18.5

Current Price & Time: $29.63 (Market Close 6th March)

Market Cap: $700m

Share Count: 23.6m

Discussion: Genelux also featured amongst the Top 3 Gainers in last week's market review - covering week commencing 20th Feb - its stock price continued to climb throughout last week and has reached a high of $30 this week.

Last week I discussed the company as follows:

Westlake Village, California based Genelux completed its Initial Public Offering ("IPO") on January 25th 2023, raising $15m by listing 2.5m shares at a price of $6. The company says it is:

developing a pipeline of next-generation oncolytic viral immunotherapies for patients suffering from aggressive and/or difficult-to-treat solid tumor types. The Company's most advanced product candidate, Olvi-Vec (olvimulogene nanivacirepvec), is a proprietary, modified strain of the vaccinia virus, a stable DNA virus with a large engineering capacity.

The core of Genelux's discovery and development efforts revolves around the Company's proprietary CHOICE™ platform from which the Company has developed an extensive library of isolated and engineered oncolytic vaccinia virus immunotherapeutic product candidates, including Olvi-Vec.

Olvi-Vec has completed a Phase 1/2 study in patients with platinum resistant/refractory ovarian cancer ("PRROC"), and according to Genelux' IPO prospectus:

data from this trial suggests systemic anti-tumor responses to monotherapy and documented clinical responses to subsequent chemotherapy. Furthermore, no dose-limiting toxicity (DLT) or maximum tolerated dose ("MTD") were reached.

Apparently, another Phase 1 study of the drug completed in 2014 showed that:

Olvi-Vec may have utility against a variety of cancers, particularly those diagnosed with lung diseases, including non-small-cell lung cancer (NSCLC)

Genelux has formally submitted its protocol for its Phase 3 registration clinical trial of Olvi-Vec in approximately 186 patients with PRROC to the FDA - which happened in January 2022, and has also licensed the drug to Chinese Pharma Newsoara which is completing Phase 1 studies in China.

Finally, the company holds an IND for its V2ACT Immunotherapy, which is in a Phase 1/2a trial for the treatment of newly diagnosed surgically-resectable pancreatic cancer.

Although I cautioned against backing companies post IPO, as valuations often come crashing down during periods without significant data catalysts, both the Ovarian cancer market has high unmet need. Although the 5-year survival rate for Stage 1 Ovarian cancer is ~93%, overall 5-year survival rates drop to ~50% when all types of the disease are taken together.

Together with NewSoara, Genelux' Chinese partner, a Phase 2 study in non-small cell lung cancer ("NSCLC") is planned to take place in the US, and there is also a program dedicated to treating heme and solid cancers in animals, in partnership with Elias Animal Health. As I concluded last week:

The recent buying activity is intriguing and may merit further due diligence - in one form or another, Genelux has been a going concern since being founded in 2001 by an academic team from Loma Linda University.

Bioventus Inc (BVS)

Weekly Gain: 52% to $2.2

Current Price & Time: $2.45 (Market Close 6th March)

Market Cap: $190.5m

Share Count: 77.7m

Discussion: When I last covered Bioventus back in Week 137 (week commencing Jan 9th) the company was amongst the Top 3 Weekly Fallers.

Orthopedic developer Bioventus IPO'd in February last year, raising ~$125m at a price of ~$17. The company is a former spinout of Smith & Nephew (SNN) offering medtech and biologic products focused on healing broken bones and relieving joint pain.

Durham, North Carolina based Bioventus' share price value had been in steady decline since its IPO< but in Week 129 (week commencing 14th Nov 2021), in response to underwhelming Q322 results, shares took a significant nose-dive.

The company made net sales of $137.1m, which were up 26% year-on-year (7.3% organically) and earned net income of $3.2m, compared to a $2.3m loss in the prior year. CEO Ken Reali commented:

Though we experienced some temporary reimbursement related volatility, we drove above-market growth, demonstrating the success of our ongoing integrations and the strength of our diversified portfolio.

Bioventus revealed it had a cash position of $34.4m, and debt obligations of $424m, which sounds alarming given the company is barely profitable. FY22 guidance is for net sales of $527m - $532m, and non-GAAP earnings per share ("EPS") of $0.2 - $0.25.

Last week Bioventus clawed back some of its lost valuation - although admittedly not a lot - after announcing a settlement with former shareholders of CartiHeal, an Israeli privately held firm that it acquired in July 2022. CartiHeal is a surgical implant maker whose Agili-C cartilage repair implant earned FDA approval last March. According to Seeking Alpha:

- The agreement gives Bioventus (BVS) an option to eliminate $350M of deferred purchase price obligations plus accrued interest as part of its obligations under an amended acquisition agreement.

- Per the terms, the company gets 30 days to evaluate options to fund the remaining obligations in the amended acquisition agreement to keep CartiHeal.

- In exchange, Bioventus (BVS) agreed to pay CartiHeal shareholders $10M in cash and $150K in non-refundable expense reimbursement payment.

This settlement apparently frees Bioventus from any future claims made by CartiHeal, potentially ending a protracted saga that stretches back to last April, when Bioventus bid for, and then withdrew its offer for Cartiheal.

The acquisitions of Bioness, Misonix and CartiHeal have enabled Bioventus to grow revenues from $275m in 2016, to a forecast $555m in 2022, and target a $17bn total addressable market ("TAM"), according to an investor presentation.

Bioventus' Q422 earnings results - when they finally become available, apparently on March 23rd, ought to provide a strong price catalyst, although it is hard to say if that will be to the upside or downside. With the Cartiheal acquisition potentially tied up with no further issues, there is a chance for the company to begin delivering on promises such as deleveraging from 6.4, to 4.4x EBITDA, and target the continuation of ~9% annual growth. The non-opioid market is attractive and potentially lucrative, although companies such as Pacira Biosciences (PCRX) and Heron Therapeutics (HRTX) have struggled.

I will continue to keep a close eye on Bioventus however and hope to cover the FY22 results in detail when they finally arrive.

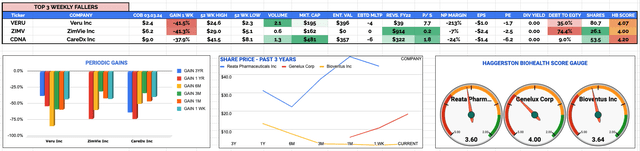

3 Worst Performing BioHealth Stocks Week Ending Friday 3rd Mar 2023

Biotech, Pharma, Healthcare overall sector worst performing stocks 27th Feb - 3rd Mar 2023 KPIs: Source: HB Live Analytics (message me for a link)

Veru Inc (VERU)

Weekly Loss: -42% to $2.4

Current Price & Time: $2.44 (Market Close 6th March)

Market Cap: $196.4m

Share Count: 80.66m

Discussion: I covered Veru and the FDA's rejection of its COVID therapy Sabizabulin in some detail in a deep dive note released yesterday.

Veru conducted a Phase 3 study of its cancer drug Sabizabulin, in COVID, that showed patients receiving Sabizabulin achieved a 22.4% absolute reduction in deaths vs placebo, and an 81.2% relative reduction in deaths vs placebo.

On the face of it these results suggest an Emergency Use Authorisation ("EUA") ought to have been granted by the FDA, given the paucity of treatment options for hospitalised COVID patients. Digging into the trial data, however, the FDA raised several objections around the way the trial was carried out and convened an Advisory Committee to discuss the matter.

The main objection was arguably the fact that the placebo arm in the Phase 3 study had an unusually high death rate compared to other studies. Veru conducted its study at >50 different sites and 6 different countries and its placebo arm death rate was >45%, far higher than in comparable studies.

In Bulgaria for example, 3 of 6 patients in the placebo arm died who might reasonably have been expected to recover, whilst no patients in the Sabizabulin arm died. Questions were also raised about whether patients may have known whether they were taking Sabizabulin or placebo (due to a difference in colour of the medicines used), and why there is no supporting evidence that a drug with Sabizabulin's mechanism of action ("MoA") could be an effective therapy against COVID.

I have covered Veru in several previous notes warning about the issues (having initially been bullish on the stock), and ultimately the FDA AdComm voted 8-5 against approval and the FDA denied it.

Veru could still secure approval for Sabiz in Europe and other territories, and it has a Phase 3 stage breast cancer drug, Enobosarm but this drug was evaluated in other cancers at VERU CEO Mitchell Steiner's former company GTx, and failed to impress.

GTx proved a disastrous investment and a similar management team is in place at Veru, who have faced accusations that its Phase 3 Sabiz COVID trial cherry picked healthy patients for the Sabiz arm of the study. The company which was once valued >$1.2bn now has a valuation of ~$200m, and with cash running out, is best avoided, unless you are an experienced volatility trader, in my view.

ZimVie Inc (ZIMV)

Weekly Loss: -41% to $6.2

Current Price & Time: $6 (Market Close 6th March)

Market Cap: $157.7m

Share Count: 26.2m

Discussion: Zimvie is a wholly owned subsidiary of Zimmer Bionet Holdings (ZBH) that was spun off into a separate, publicly traded company in mid-February 2021. The company refers to itself as "a global life sciences leader in the dental and spine markets".

I profiled ZimVie in Week 96 (week commencing March 28th 2022) suggesting that its market opportunities - the ~$8bn tooth replacement market, and ~$12bn spine surgery market (estimates are taken from ZimVie's 2023 JP Morgan Healthcare conference presentation) and its leading position in markets such as cervical disc replacement and vertebral body tethering, plus the ongoing backing of its parent company - set the company up for success.

Alas, ZimVie's share price has fallen by 74% in the past 12 months, and shares hit a new low last week after the company released Q422 and FY22 earnings. The Westminster, Colorado based company recorded $909.5m of third party net sales, and a net loss of $63.9m, for EPS of $(2.45), although on an adjusted basis, EPS is quoted as $1.84.

Vafa Jamali, President and Chief Executive Officer of ZimVie, commented:

Our team has been diligently focused on accelerating independence from our prior parent, and despite a difficult macroenvironment, we launched several innovative products and drove significant operational progress in our first year as a company.

The market clearly disagrees - total net sales fell year-on-year, although operating loss declined, from $(95m) in the prior year. The company reported current assets of $537m, versus $536m in FY21. Current liabilities have increased from $185m in FY21, to $217m, and total liabilities have increased to $883m thanks to the appearance on the balance sheet of $532m of "non-current portion of debt".

FY23 guidance is for $825 - $850m of net sales, and adjusted EPS of $0.3 - $0.5, so the company appears to be moving backwards, not forwards. This often seems to happen with spin-offs, which become saddled with debt and falling product sales - after all, would the parent company have discarded these businesses if they had forecast future success?

The JP Morgan presentation speaks about margin expansion and cash flow generation, and in fairness to Zimvie, the current market cap valuation does seem unusually low based on forward sales of >$800m and a narrow profit, on an adjusted basis, at least.

I believe there may be a case to be made for Zimvie shares being undervalued - despite its debt, it strikes me as unlikely the company could go bankrupt and the transition to an independent company remains ongoing therefore judgement should perhaps be suspended.

I hope to cover the company and its prospects for the remainder of 2023 in more detail in a deep dive note going forward.

CareDx Inc (CDNA)

Weekly Loss: -38% to $9

Current Price & Time: $10.7 (Market Close 6th March)

Market Cap: $571.6m

Share Count: 53.7m

Discussion: When I last covered CareDX back in Week 78 (week commencing Nov 3rd 2021) the company was amongst the Top 5 Weekly Fallers, but still enjoyed a market cap valuation of $2.65bn!

CareDX is a biotech focused on better outcomes through personalised transplant surveillance, and it was a holding for Cathie Wood's ARK Genomic, which was one of the most hyped - and best performing - investment funds at the time.

As we now know, the torrid biotech bear market of 2022 damaged Wood's credibility and belief in transformative biotech companies such as CareDX. Back in Week 78 I commented:

CareDx' focus is the transplant ecosystem, and its mantra is to "improve long-term outcomes by providing innovative solutions throughout the entire transplant patient journey."

The company offers its AlloSure and AlloMap services for kidney and heart transplants, has reimbursement in place for its products, and targets a ~$12bn market, according to management.

The company has grown via acquisitions and partnerships with the likes of gene-sequencing giant Illumina (ILMN), VeraCyte (VCYT), and Stanford University, and now claims to be the leading partner across US transplant centres.

Not that much has changed - in its latest corporate presentation the company reports revenue of $82.4m for Q422 - up 4% annually, and a net loss of $18.3m. Guidance for 2023 is for $328 - $338m of revenues, although this is dependent on there being "no change in reimbursement on paid tests of ~$2,500.

Analysts have been speculating that, according to Seeking Alpha:

a new billing and coding document published by the Centers for Medicare and Medicaid Services (CMS) “appeared clearly negative” for the organ transplant test maker.

Analysts at Craig Hullum commented:

the worst-case scenario just occurred for CareDx in a decision we have been worried about since Medicare's CAC meeting last November. The policy appears to: 1) eliminate HeartCare reimbursement and make KidneyCare reimbursement a non-starter, and 2) dramatically weakens reimbursement for kidney transplant testing when used in the surveillance setting. Surveillance testing is defined as a test used when no biopsy is considered, or no center-specific surveillance biopsy protocol is in place."

Brisbane, California based CareDX has issued a statement commenting on the changes:

it is now our understanding that MolDX does not plan to modify the foundational LCD but instead issued this Billing Article revision for clarification purposes

The company has provided a detailed response to the matter in a press release: 3 important points the company makes are:

- Notably, reimbursement is not necessarily limited to centers that have surveillance biopsy protocols.

- In heart transplantation, both AlloSure Heart and AlloMap Heart can now be billed individually to Medicare, whereas in the past AlloSure Heart could only be billed with AlloMap Heart. This change will now enable AlloSure Heart to be reimbursed independently.

- In the Billing Article revision, two billed tests in a single patient encounter will not be covered. MolDX has indicated that this coverage would be considered with additional data supporting this use. This provides a path for multimodality with sufficient data.

In 2021, iRhythm Pharmaceuticals (IRTC) faced major cuts to its reimbursement coverage, its stock price falling from >$250, to just $45, before staging a recovery after the cuts were not nearly as substantial as feared. I tipped iRhythm in September 2021 and the stock price has risen >90% since.

Should the CareDX predicament not be as severe as analysts fear, it's possible that the stock could stage a major comeback, but more due diligence is certainly required - I hope to cover the situation in more detail in an upcoming deep dive note.

Top 3 BioHealth Stocks To Watch Week Commencing Mon 6th Mar 2023

Top 3 Stocks to Watch Week Commencing 6th March 2023 - investment theses underlying CNS drug developers.

GH Research PLC (GHRS)

Weekly Gain / Loss: +9.6% to $10.5

Current Price & Time: $10.9 (Market Close 6th March)

Market Cap: $568m

Share Count: 52m

Discussion: GH Research is seeking "ultra rapid, durable remissions in depression" according to a mission statement opening a recent investor presentation. The Dublin, Ireland based company raised $160m through its June 2021 IPO, issuing 10m ordinary shares at a price of $16 per share.

Shares may have slipped in value by >50% since then, although by biotech bear market / new biotech IPO standards, that is not nearly as disastrous as some companies, and so far this year, shares have added a modest 7% in value.

The company's lead product is Mebufotenin (5-Methoxy-N,N-Dimethyltryptamine, 5-MeO-DMT), which is a naturally occurring psychoactive substance from the tryptamine class. The drug is in a Phase 2b study in patients with treatment resistant depression, a Phase 2a in Bipolar Disorder, and a Phase 2a in postpartum depression.

The thesis is that patients with depression have their treatment options restricted to slow acting agents only, and consequently, remission rates in e.g. TRD are >15%. The psychoactive effects of Mebufotenin are conversely ultra-rapid and have a short duration, with a high propensity to induce "peak experiences". GH is focused on a single visit initial treatment, with no structured psychotherapy, and is targeting use of Mebufotenin as a convenient and infrequent retreatment.

A Phase 1 study has been negotiated with no serious adverse effects noted, although at the higher doses flashbacks, hallucinations, headaches and other adverse events did occur. In the Phase 2, a primary efficacy endpoint was met, with 7 of 8 patients (87.5%) experiencing a MADRS (commonly used depressive scale) remission at day 7.

All of this research is encouraging however there are significant hurdles to overcome. First of all the competition - in its annual report for 2021, GH notes its competitors as follows:

Axsome Therapeutics, Beckley Psytech, COMPASS Pathways, Cybin, Entheon, Mindmed, Perception Neuroscience, Praxis Precision Medicines, Relmada Therapeutics, Sage Therapeutics, Small Pharma and Viridia Life Sciences.

Perhaps the even greater challenge is the fact that the FDA - and Drug Enforcement Agency ("DEA") - categorises drugs like Mebufotenin as a schedule 1 drug, which means they:

by definition have the highest potential for abuse, have no currently accepted medical use in treatment in the United States and lack accepted safety for use under medical supervision.

In order to bring its lead product candidate to market, and its other 2 products, an IV version of Mebufotenin, and a nasally administered one (the lead candidate is administered via a third party device) GH would need the agencies to reschedule the drug to the less severe Category 2,3,4, or 5. As GH notes:

Rescheduling is dependent on FDA approval and an FDA recommendation to the DEA as to the appropriate schedule. The DEA must conduct notice and comment rulemaking to reschedule a substance. Such action is subject to public comment and potential requests for administrative hearing on any such action. In addition, each state or jurisdiction must also take appropriate administrative or legislative action to reschedule based on federal action.

Alongside Compass Pathways (my note here) GH is part of a vanguard of companies seeking to prove psychedelic drugs can genuinely improve depressive conditions and convince the FDA to change its stance. Frankly, if investing in GH, shareholders will have to be patient because the FDA / DEA show few signs of changing their stance at the present time, and it could be years before this impasse is resolved.

Nevertheless there are some notable upcoming catalysts, such as the completion of a Phase 1 study of the IV administered version, and Investigational New Drug submission for an aerosol delivery version (once an "IND" is secured in-human studies can begin).

GH retains $251.7m of cash - sufficient to fund operations into 2026 management says. This is an intriguing buy and hold opportunity for those who believe psychedelics genuinely have something to contribute to the treatment of depression - and there is plenty of evidence to suggest that it can.

Cerevel Therapeutics Holdings Inc (CERE)

Weekly Gain / Loss: +9.6% to $27.8

Current Price & Time: $27.6 (Market Close 6th March)

Market Cap: $4.33bn

Share Count: 156.7m

Discussion: Cerevel is a company I covered in a bearish post back in July 2022, when shares traded at $29 and the market cap was ~$4.4bn. There has not been much movement to the upside or downside since.

Cerevel's high valuation reflects the fact that the Cambridge, Massachusetts based company - which IPO'd in July 2020, after a merger with Arya Sciences Acquisition Corp II - a Special Purpose Acquisition Company ("SPAC") - is backed by the likes of Bain Capital, Perceptive Advisors, Fidelity and RA Capital, whilst Cerevel itself raised $150m in a private round, and is a drug developer focused on diseases of the Central Nervous System ("CNS"), which was spun out of the Pharma giant Pfizer's (PFE) neuroscience division.

As I wrote last July:

The lead assets handed over to Cerevel by Pfizer include Emraclidine - an M4-selective positive allosteric modulator ("PAM") in development for schizophrenia as a once-daily medication without the need for titration, Darigabat - an α2/3/5-selective GABAA receptor PAM currently under development for anxiety and epilepsy - and Tavapadon - a D1/D5 partial agonist currently in Phase 3 trials for the treatment of Parkinson's disease.

In a presentation to accompany Q422 and FY22 earnings, Cerevel reveals the following updates:

Emraclidine • Two robust Phase 2 EMPOWER trials in schizophrenia on track for data in 1H 2024 • Announced positive ABPM data in 4Q • Dosed first patients in elderly healthy volunteer trial to support development in ADP in 4Q

Darigabat • Phase 2 proof-of-concept REALIZE trial in epilepsy ongoing • Phase 2 trial in panic disorder expected to initiate 2Q 2023

Tavapadon • Three Phase 3 TEMPO trials in Parkinson’s with data expected beginning mid-year 2024

Seven mid-to-late stage readouts expected in 2024

The company also reports a substantial cash position of $950m, and encouragingly, its management team have worked on drugs such as the atypical antipsychotic Abilify, and cancer therapeutics Kyprolis, and Blincyto, helping to guide them through the FDA approval process.

Emraclidine's Phase 1b study in Schizophrenia yielded clinically meaningful improvements in PANSS (a scale used to assess depression) total score and although the wait for Phase 2 data will stretch in 2024, the company says it is "Prioritizing key registration-enabling activities" such as longer term safety studies, and there may be an opportunity to move into Alzheimer's Disease psychosis.

Darigabat has entered a Phase 2 study intended to "establish proof of concept (POC) and tolerability profile in focal epilepsy and support development in additional epilepsy indications", and early data compares the drug favourably with Benzidiazepines. Tavapadon is the "only D1/D5 selective partial agonist in development for Parkinson’s disease" management believes.

Schizophrenia is a 20m patient, $7bn market growing at a CAGR of 3.5%, according to Cerevel, and Emraclidine may be able to compete against Karuna Therapeutics KARXT, pegged for nearly $7bn in peak sales in an expanding market - the 2 drugs have a similar MoA.

In epilepsy, Darigabat takes on the likes of Valium (lorazepam) Ativan (clorazepate) Tranxene (alprazolam) and Xanax, in a market which is crowded but lacks a genuinely effective therapy.

In my July note I advised that multiple data readouts would be upcoming but it seems they have either not arrived or have failed to move Cerevel's share price. Most of the key data readouts now seem to be promised for 2024. With its substantial cash funding runway and promise of its drugs it appears Cerevel can afford to bide its time however, and a small position in this company may deliver gains when the push for pivotal trials and approvals begins - likely next year. The high valuation still troubles me slightly, however.

Supernus Pharmaceuticals Inc (SUPN)

Weekly Gain / Loss: +4.7% to $39.8

Current Price & Time: $38.4 (Market Close 6th March)

Market Cap: $2.1bn

Share Count: 54m

Discussion: Supernus is a stock I own and it has delivered a 25% gain across the past 12 months, although it is down 8% across the past 5 years.

According to the company's Q322 10Q submission:

Our diverse neuroscience portfolio includes approved treatments for epilepsy, migraine, attention-deficit hyperactivity disorder (ADHD), hypomobility in Parkinson’s Disease (PD), cervical dystonia, chronic sialorrhea, dyskinesia in PD patients receiving levodopa-based therapy, and drug-induced extrapyramidal reactions in adult patients.

The Company is developing a broad range of novel CNS product candidates including new potential treatments for hypomobility in PD, epilepsy, depression, and other CNS disorders.

The company earned $649m in product sales in FY22, with leading contributions from epilepsy therapy Trokendi - $261m, partial onset seizures treatment Oxtellar - $115.4m sales, and ADHD therapy Qelbree - $61.3m sales.

Whilst the former 2 drug's sales declined year-on-year, Qelbree sales were up 228% annually. Another lead seller, Apokyn, indicated for hypomobility, saw sales decline 30% year-on-year.

Overall however total product sales increased 6% year-on-year, and for the full year ended December 31, 2022, net earnings (GAAP) and diluted earnings per share (GAAP) were $60.7 million and $1.04, respectively, as compared to $53.4 million, or $0.98 per diluted share, in the same period in 2021.

Supernus has guided for FY23 revenues of $580 - $620m, and an operating loss of $(50m) - $(25m) - not especially encouraging, although as President and CEO Jack Khattar explained:

“In 2022, we continued to execute on our long-term growth strategy focusing on successfully transitioning from our legacy and mature products to our growth products, and finished the year with record revenues of $667.2 million, up 15% from the prior year.

Based on this successful transition and with a solid foundation, we are confident that our growth drivers will allow us to offset the impact coming from loss of exclusivity for Trokendi XR and position us well to drive strong revenue and non-GAAP operating income growth in 2024 and beyond.”

Supernus is confident that patients will continue to switch to Qelbree in the 90m prescription per annum ADHD market, and the drug has been forecast for peak revenues of ~$400m per annum, which if achieved, ought to help Supernus grow its business and valuation, despite patent expiries on older products. Gocovri in Parkinson's Disease is another strong growth prospect - acquired from Adamas for $400m, there is potential for label expansion opportunities here.

Supernus appears to have an enviable pipeline also, led by SPN-830, a "Non‐invasive dopaminergic stimulation therapy for continuous treatment of ON-OFF episodes in Parkinson's Disease ("PD"), and SPN-820, a "first-in-class selective brain mTORC1 activator" indicated for Treatment Resistant Depression.

Supernus has a nice blend of commercial and pipeline opportunities, and still feels a little undervalued with a market cap of just over $2bn, based on Qelbree's peak sales expectation, the promise of Gocovri, and the pipeline. A policy of "evolution not revolution" seems to suit Supernus, a company that tends to fly under the radar but which has been successful nonetheless.

The market clearly has faith in the company and its products as there have not been a major sell-off after so-so FY22 earnings and downward looking FY23 revenue projections.