There are plenty of problems in the world, and doubtless climate change - or whatever the currently voguish phrase for it all is - certainly is one of them. But it's low on my list." - P. J. O'Rourke

Believe it or not, fourth quarter earnings results are still coming across the wire. Given the current state of hysteria around Covid-19 and tumbling markets, it is easy to see why so many of these postings are getting little shrift from investors at the moment. Today, we check back in on small biopharma that just delivered another quarter of explosive revenue growth that was mostly overlooked thanks to the current conniptions in the markets.

Company Overview:

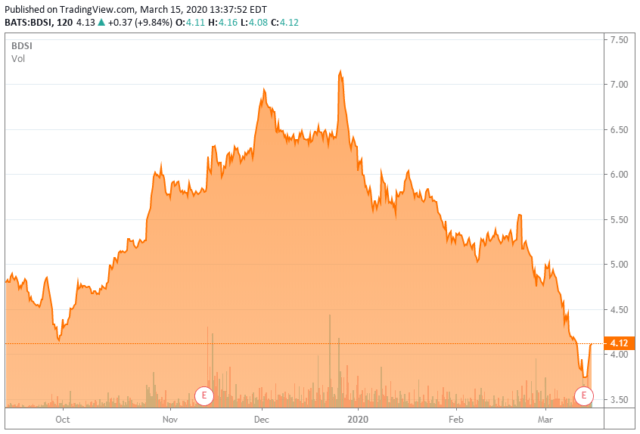

BioDelivery Sciences (BDSI) pain management focused 'Tier 3' biopharma based in North Carolina. The company's main product is BELBUCA targeting pain relieve and has a relatively low risk for developing dependence. This product has been the beneficiary of the increasing focus on the opioid crisis in the United States and the need to find less addictive pain management solutions. The stock currently trades just over $4.00 a share and has an approximate $400 million market capitalization.

Fourth Quarter Results:

Revenue for the fourth quarter came in at $31.6 million, up 75% from a year ago. Sales growth was driven by BELBUCA which posted revenues of $28.3 million, up 78% on a year-over-year basis. For FY2019, BioDelivery had $111.4 million in overall sales, just over double FY2018's levels.

EBITDA in Q4 was $4.1 million compared to $3.5 million in the third quarter of 2019 and a negative $3 million in the fourth quarter of 2018. Operating cash flow turned positive in Q4, which was a significant milestone for the company.

Analyst Commentary & Balance Sheet:

H.C. Wainwright reissued their Buy rating and $7 price target on BDSI right after quarterly results were posted. So far in 2020, Cantor Fitzgerald has maintained its Buy rating with $8.00 price target and Willaim Blair also reiterated their Buy rating sans price target. On January 9th, Piper Sandler initiated BioDelivery as a new Outperform with a $9 price target as well as the following commentary.

We believe that visibility into aggressive volume/sales growth for top-seller Belbuca, BDSI’s buccal film form of buprenorphine for chronic pain, is high, translating into transformative longer-term EBITDA growth. The product is hitting its stride following some fits and starts early in its commercial life. We believe that this is a function of strong execution on the payer front (chronic pain being a heavily contracted category) and the opioid crisis reaching a lamentable crescendo of sorts, driving more cautious prescribing behavior by physicians."

The company ended FY2019 with just under $65 million in cash and marketable securities on the balance sheet.

Verdict:

The company has done a very solid job in ramping up growth in BELBUCA since re-acquiring the right to this compound from marketing partner Endo International (ENDP) when the latter dissolved its pain management business at the end of 2018.

BioDelivery produced positive cash flow in Q4 which as I said earlier is an important milestone. The first quarter could see some minor impacts from the coronavirus but growth should continued at a solid pace in FY2020. Extrapolating fourth quarter operating cash flow, gives you an approximate forward operating cash flow yield in the low teens. With a solid balance sheet, BDSI makes a good buy-write candidate using either the September or December $5 call strikes would be how I would add to BioDelivery at the moment as any new money I am putting into the market is being done via covered calls. I expect BELBUCA's solid ramp out to continue in 2020, although like most of the market, the new few weeks and months will likely be bumpy. However, the stock has come down from $7.00 a share late last year and its long term risk/reward profile seems very attractive here.

The average IQ in America is - and this can be proven mathematically - average." - P. J. O'Rourke

Live Chat on The Biotech Forum has been dominated by myriad buy-write and straight equity opportunities over the past several weeks during the huge spike in market volatility. To take a free tour of our thriving community, just initiate your two-week no obligation free trial into The Biotech Forum by clicking HERE.

Live Chat on The Biotech Forum has been dominated by myriad buy-write and straight equity opportunities over the past several weeks during the huge spike in market volatility. To take a free tour of our thriving community, just initiate your two-week no obligation free trial into The Biotech Forum by clicking HERE.

Thank You & Happy Hunting

Thank You & Happy Hunting

Bret Jensen

Founder, The Biotech Forum, The Busted IPO Forum & The Insiders Forum