An E-Commerce Giant

When you mention Alibaba (BABA) to investors, the first thought that comes to mind would be a Chinese e-commerce giant. However, looking deep into the various businesses that Alibaba operates or owns, one will notice that Alibaba is not only a pure commerce company. Even within its widely popular commerce business, there are many interesting sub-segments such as delivery services, physical and new retail.

Business Segments

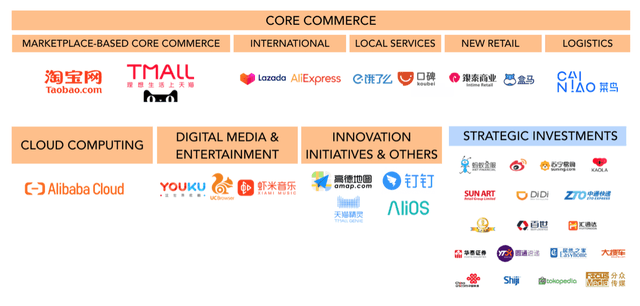

Alibaba has four main business segments as well as a portfolio of investments as depicted in the table below:

Source: Alibaba 2019 Investors Presentation and author's own edits

Source: Alibaba 2019 Investors Presentation and author's own edits

As can be seen, the most widely known China-based e-commerce business of Alibaba is only one small part of the company's entire ecosystem. While the Chinese e-commerce business still generates the bulk of revenues, a number of the company's other operations are seeing rapid growth and in the long run, this could help Alibaba reduce its reliance on e-commerce growth.

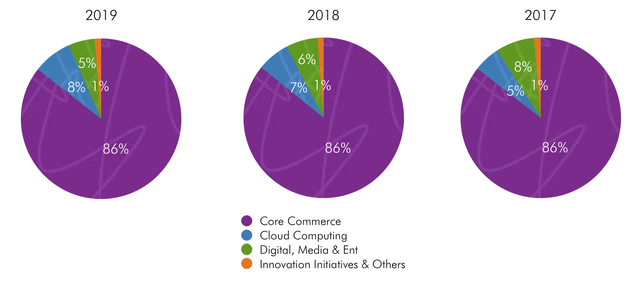

Revenue/Income Breakdown By Business

The diagram below depicts the breakdown of Alibaba's revenues in the past three years.

Source: Alibaba 10K and author's own edits

Source: Alibaba 10K and author's own edits

Core commerce has been Alibaba's main driver of revenue in the past three years while cloud computing is the fastest growing segment, although this may not be so evident from this chart as the core commerce business has also been growing at an astronomical pace.

In terms of net income, 100% of Alibaba's net income is from the core commerce business as currently, its other three segments are all still unprofitable.

Analysis of Each Business Segment

Core Commerce: China Based Marketplaces

Alibaba has three main e-commerce platforms in China: Alibaba, Taobao, Tmall.

1. Alibaba (B2B)

- A Business to Business, B2B trading platform which connects manufacturers from various countries with international buyers

- Income is generated from advertisements and paid services that merchants can subscribe to such as paying for higher product exposure and unlimited product listings

2. Taobao (C2C, B2C)

- A Business to Consumer / Consumer to Consumer focused platform which enables small businesses and individuals to open online stores

- Merchants can join Taobao for free and the platform doesn't charge transaction fees, which helped it gain massive traction in China in its early years

- Income is generated by advertising and services that merchants can pay for to boost their product exposure and sales

- According to rankings from Alexa.com , Taobao is the 9th most visited website in the world

3. Tmall (B2C)

- Launched in 2008, Tmall is a Business to Consumer platform focused on connecting larger companies and multinational brands like Apple with consumers. This is unlike Taobao which is more focused on small merchants and individuals

- Tmall was an important driver of Alibaba's e-commerce growth as it offered a variety of branded products targeted at China's growing middle class. It also gave consumers the confidence that the goods bought were genuine and authentic

- Income is generated by charging merchants a deposit, an annual fee, and a commission fee on transactions

- Tmall also provides analytic tools to merchants which show important information such as number of visitors, page views, and customer ratings, which help companies alter their business strategies

- According to rankings from Alexa.com, Tmall is the 3rd most visited website in the world

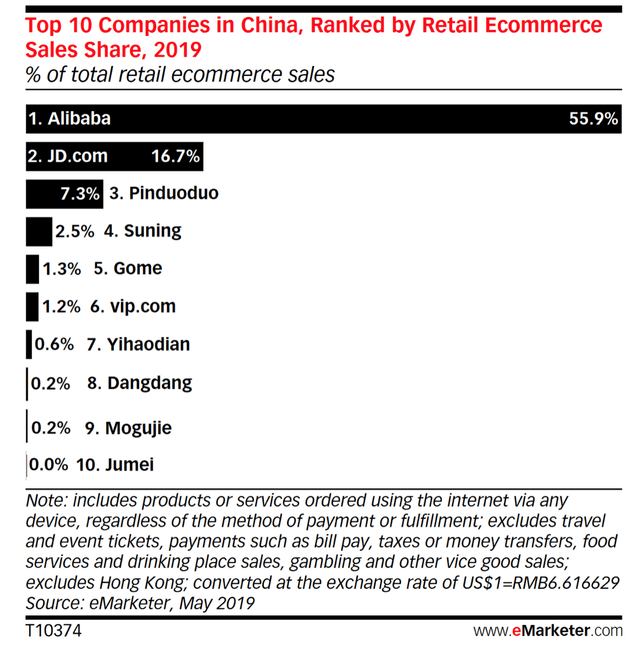

Despite the emergence of new e-commerce players in China such as JD.com (JD) and Pinduoduo (PDD), Alibaba remains the top e-commerce site in China with over 50% of the market share.

Source: eMarketer.com

Source: eMarketer.com

Core Commerce: International

Alibaba’s exposure into the e-commerce marketplace worldwide is mainly via the following sites: Aliexpress, Lazada, Tokopedia (Equity Stake).

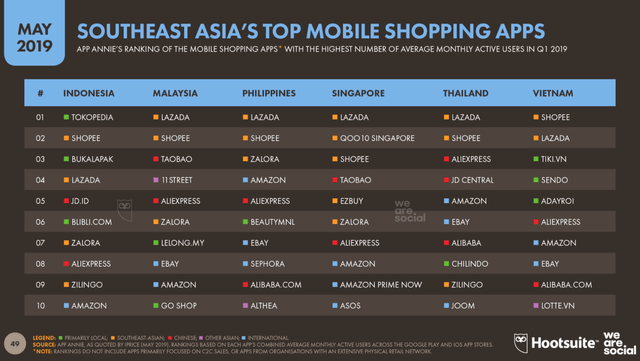

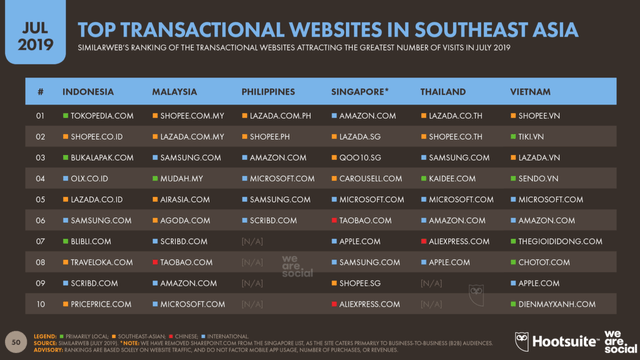

Alibaba's international market is mainly targeted at South East Asia as they believe that the region is in a similar state as China was 10-20 years ago which allowed e-commerce to boom.

Alibaba's crown jewel in its international portfolio is Lazada, which essentially operates in a duopoly in South East Asia together with Shopee. The only exception is in Indonesia where Tokopedia is the market leader. Fortunately, Alibaba also owns an equity stake (~25%) in Tokopedia, which likely explains Lazada's lower rankings in Indonesia.

Source: datareportal.com

Core Commerce: Local Services

The two main local services provided by Alibaba are: ele.me and Koubei.

ele.me (饿了么) is a food delivery company while Koubei operates an internet and mobile phone platform providing life information and services such as restaurant guide.

According to daxueconsulting.com, "ele.me is China's largest food delivery giant with a 53.4% market share and 260 MAUs as of 2019. Its closest competitor, Tencent-backed Meituan has 40% of the market share. However, Meituan offers more non-food delivery services such as flowers and office supplies."

In order to maintain its competitiveness, Alibaba has combined ele.me and Koubei to strengthen offline services and compete with Meituan in the booming offline-to-offline (O2O) market. The O2O market is one where "apps link smartphone users with bricks-and-mortar businesses to provide food delivery and other offerings." (source)

Separately, ele.me is also expanding to include ordering groceries, booking hotels, paying bills and renting bikes etc...

Core Commerce: New Retail

New Retail is Alibaba’s way of complementing online and offline shopping experiences. It seeks to combine its online marketplaces as well as technology with traditional brick and mortar shops and malls to provide a “new” retail experience for consumers. This allows the online and offline world to work together seamlessly.

New Retail represents the convergence of online and offline retail by leveraging digitalised operating systems, in-store technology, supply chain systems, consumer insights and mobile ecosystem to provide a seamless shopping experience for consumers -- adapted from Alibaba's 2020 Annual Report

Alibaba’s venture into new retail is spearheaded by two chains: Intime Retail Group and Hema.

1. Intime Retail Group

Intime is one of the largest department-store chains in China, with over 60 stores in more than 30 cities. Many new retail technologies are being piloted and adapted in these malls. For example, stores are fitted with virtual shelves (large interactive touchscreen panels) which displays the catalogue containing all of a shop's products and their sizes. After trying out the item in the physical store, shoppers can find the product on the virtual shelf, scan a barcode with the Tmall app and have it delivered.

2. Hema

Hema is Alibaba’s designed from scratch grocery stall which is powered by a smartphone. Using the Hema app, shoppers can scan the barcode next to the product of interest and this will provide them with information such as ingredient mix for the product and country of origin (see picture below). Once shopping is done, checkout is done via Alipay. Hence the entire shopping experience can be completed with just a smartphone. Hema also provides other services such as fresh grocery delivery and a restaurant which can cook fresh seafood on the spot.

By leveraging on technology, the Hema app also tracks past purchases and browsing habits, allowing it to make highly personalised recommendations to the shopper in future visits

Source: chengdu-expat.com

Source: chengdu-expat.com

Hema represents the future of grocery shopping as it combines both online and offline tools to improve the shopping experience and efficiency.

While the concept of new retail is very novel and exciting, it is still a relatively new concept and not everyone believes in it yet. Jack Ma says that the transition will take 12 years, we are currently four years in.

Core Commerce: Cainiao Logistics Service

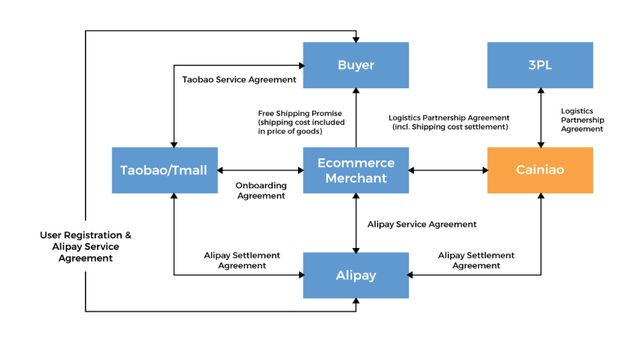

Cainiao, Alibaba’s logistics arm, was founded in 2013 to create a logistics data platform and global fulfilment network that links a network of delivery partners, warehouses and merchants to make package deliveries faster and more efficient.

The decentralised nature of this platform means that Alibaba does not directly hire delivery staff or deliver any merchandise, but rather, it connects delivery companies with it via a data powered system. By leveraging cloud and data technologies, Cainiao is able to provide real-time information to logistics partners such as route planning information and order volume forecasts to improve the efficiency of delivery.

Cloud Computing

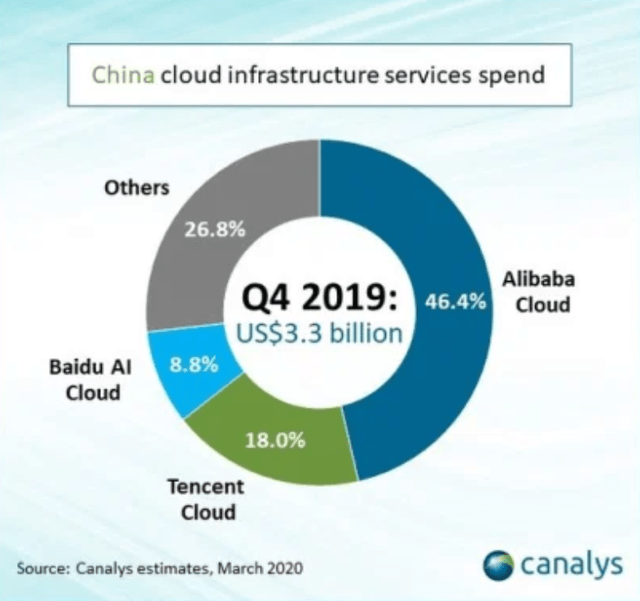

Alibaba Cloud, also known as Aliyun (阿里云) provides cloud computing services to online businesses and Alibaba's own e-commerce ecosystem. It is the largest cloud computing company in China and operates in 21 data center regions and 63 availability zones around the globe.

Alibaba Cloud provides a wide range of services including storage, database, networking, security, elastic computing, analytics, artificial intelligence, hybrid cloud, developer services and IoT.

Alibaba Cloud is the leader in cloud services in China with over 45% of the market share (see figure below). It is also ranked No 1 public cloud-service provider in Asia Pacific and No 3 in the world by Gartner.

Digital Media & Entertainment

Alibaba’s Digital Media & Entertainment segment is an extension to capture consumption beyond the company’s core commerce business.

This segment was likely established to expand Alibaba’s ecosystem against China’s two other tech giants, Baidu and Tencent. The digital media & entertainment business provides a wide variety or services in the entertainment industry. The following are the main services provided:

1. Long Form Video Platform in China -- Youku

- Alibaba acquired Youku in 2016. Youku licenses TV shows and produces original content for variety shows, films and drama series

- Its main revenue stream comes from subscription and advertising

- There is huge competition in the streaming industry where Youku ranks 3rd, behind Baidu-backed iQiyi (IQ) and Tencent Video

- While Youku is aiming to reduce its licensing expenditure by producing its own content, Youku will likely remain profit draining for a long while as they compete with rivals to gain market share

2. Film Production -- Alibaba Pictures Group/ Tao Piao Piao

- Alibaba bought a controlling 60% stake in a film making company ChinaVision Media in 2014 and renamed it to Alibaba Pictures Group.

- According to Alibaba Pictures Group, the company "covers content production, promotion and distribution, intellectual property licensing and integrated management, cinema ticketing management and data services for the entertainment industry"

- Within Alibaba Pictures is Tao Piao Piao, one of China’s largest movie ticketing App. Tao Piao Piao has rapidly expanded its user base, accounting for "more than 30% of film ticketing sales in China" according to a WalkTheChat analysis.

3. Online Ticketing Platform -- Damai

- Alibaba completely acquired live events ticketing App, Damai in 2017.

- According to walkthechat.com, "Damai is the largest live events ticketing App in China with 70% market share. Tickets sold using the Damai platform includes concerts tickets, sports tickets and theatre tickets"

- With no major competitors, Damai could benefit from the growth in the live events market industry of China which currently lags in size compared to that of the US market -- USD 7 vs 29 billion in 2017 (source).

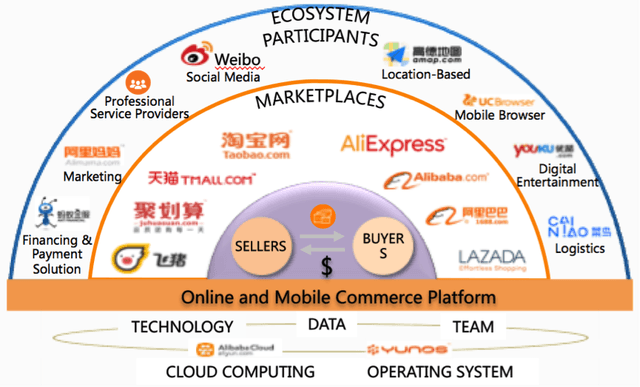

Creating An Ecosystem

Starting out as an e-commerce platform connecting sellers with buyers, Alibaba has grown into a conglomerate that operates businesses in almost every aspect of the internet. It provides a wide range of services, ranging from financing to video streaming and ride hailing. This extensive network of products and investments has been ingrained into the everyday lives of Chinese. For example:

- Taobao and Tmall are used for online shopping

- Intime and Hema are physical shopping alternatives

- Post-shopping checkout is efficiently done using Alipay

- Weibo is used for socialising and checking on news updates

- Tao Piao Piao is used to book movie tickets

- Those who prefer staying at home can watch shows using Youku

Source: Alibaba company presentations

The Benefits This Connectedness Brings

1. Control over the entire commerce business

Due to its ecosystem surrounding the core commerce business, Alibaba is now able to control the entire supply chain in its commerce business.

- Tmall and Taobao is used to connect buyers and sellers

- Ant Financial is used for payments and quick financing for sellers

- Cainiao is a data-logistics platform that facilitates the delivery of goods from seller to buyer

- Physical shops like Intime and Hema are connected to Tmall and Alipay

Source: ecommerceIQ

2. Collaborations between different business segments

With its extensive ecosystem, Alibaba is able to engage techniques such as cross promotions to draw users from one of its apps to the other.

- During the 2017 Chinese New Year, Tao Piao Piao, Taobao and Alipay had cross-promotion campaigns, offering free tickets to new Taobao App installs. Special discounts also apply when the consumer checked out with Alipay

- Cross promotions also occured with Youku and Tmall -- Trial Youku membership was offered with Tmall promotion, while cash rebates were given on Tmall with Youku subscriptions

Another way Alibaba leverages its ecosystem is in the production of films. For example, the movie "Eternal Love (三生三世十里桃花)" was produced by Alibaba Pictures and promoted on Tao Piao Piao. Following the success of the movie, over RMB300 million worth of merchandise was sold on Tmall.

Therefore, the interconnectedness and complementary nature of the businesses in Alibaba's ecosystem has allowed the company to create new forms of revenue stream and keep consumers "stuck" within their products and services.

A Network Effect

Alibaba's extensive ecosystem of complementary businesses has helped the company develop a competitive advantage through its network effect.

With more services offered by Alibaba, consumers are likely to spend more time using Alibaba offerings. As the number of users (and hours spent) on Alibaba platforms increases, more merchants would want to list their products on Alibaba e-commerce platforms or utilise this large consumer base for advertisements. This generates more revenue for Alibaba which it can use to further expand its network of operations and provide even more services to consumers. With an increase in users and hours spent on their platforms, Alibaba can also further monetise time spent on their platforms using methods such as subscriptions (Youku) and cross-promotions.

This is a benefit that Alibaba's main competitors do not have as they do not have that many well developed businesses in multiple markets.

More Than An E-Commerce Platform

After a deep dive into Alibaba's businesses, we learn that investing in Alibaba is not just a pure play on China and South East Asia's e-commerce growth. While e-commerce is still Alibaba's main income generator, the company's other ventures such as cloud computing and local services are rapidly growing and have a dominant position in their respective markets.

In the long run, Alibaba should be able to reap the benefits of multiple income sources from different businesses. Therefore, investing into Alibaba is akin to buying an e-commerce company, plus Netflix, plus DoorDash, plus FedEx and so on...

Given Alibaba's track record on innovation, I believe that this company has a long road ahead in terms of growth and could even be worth more than its American counterparts Amazon and eBay.

Management

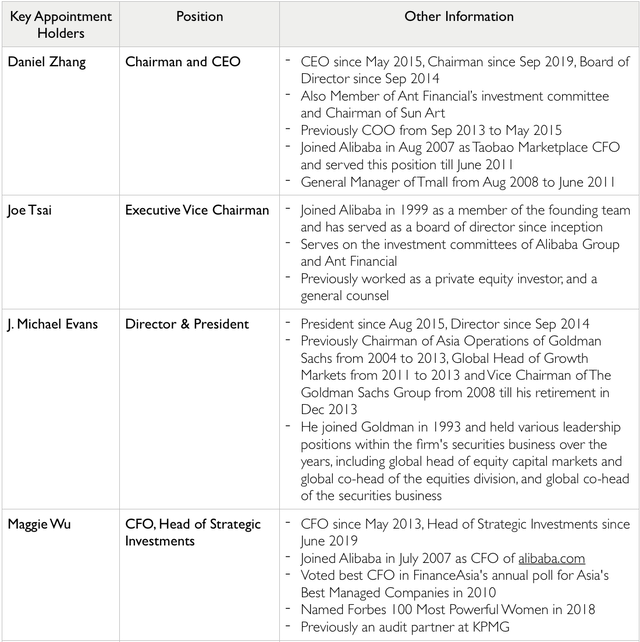

We now turn over to Alibaba's management. The figure below shows some of the key figures in the company as well as some brief background of the individuals.

Source: Author's compilations from Alibaba's website

Source: Author's compilations from Alibaba's website

CEO: Daniel Zhang

Following founder Jack Ma's stepping down as CEO and Chairman in 2015 and 2019 respectively, Daniel Zhang now holds the highest positions in the company. At just 48 years old, Zhang will likely helm these appointments for a fairly long time. Therefore it is important to analyse how Zhang may lead and direct the company.

Zhang has been with Alibaba since 2007 and has taken various leadership positions during this timeframe. Some of his notable achievements / successes include:

- Being a key architect of the 11/11 Singles Day shopping event as he personally lobbied the online marketplaces’ merchants to participate in the first Singles’ Day in 2009

- Building Tmall from a regional to global B2C platform when he was General Manager of Tmall

- Being at the forefront of Alibaba’s drive to become a mobile-first business

- Fortune Businessperson of the Year 2019, Rank 16

Some of his characteristics and working style include:

1. Soft Spoken but Tough

Unlike Jack Ma who is flashy and outspoken, Zhang is more soft spoken, but tough when needed. In a McKinsey interview, Zhang admitted that while he speaks softly, he always makes tough decisions because “… the most important thing [for a leader] is to lead the whole team forward. They need direction, and they need clear guidance. Leaders have to make the tough decisions, even if it may not be the perfect decision."

2. Strong Believer in Innovation and Change

Zhang always emphasises innovation and technology to make impossible ideas possible. He always tries to learn from young people, particularly those born after 1990, 1995 as he believes that learning about their lifestyle and preferences helps give him a lot of new ideas and inspires innovation

I believe every business has a life cycle. You have to be innovative and create new businesses with new technology, with a new model. Then that can make our entire business sustainable. We always say that we want to build a sustainable, long-term business. But most of it is not evergreen. I strongly believe that if we don’t kill our existing business, someone else will. So I’d rather see our new business kill our existing business. -- Zhang in a 2018 interview

3. Values Self-Reflection

Zhang conducts a self evaluation for himself every year, where he looks at how many new businesses he incubates, and secondly, how many new people he finds. This self reflection also reinforces his emphasis of constantly finding new businesses and the importance of finding “people with very strong leadership skills and high potential”

How Likely Will Daniel Zhang Succeed?

Daniel Zhang is well equipped to take on the top job in Alibaba as he has had hands-on experience running various subsidiaries of the company since 2007 and has served as CEO since 2015.

Considering Zhang's vast experience in running the company's operations and his success in pushing out new, innovative products, I believe that he will be able to continue pushing for innovation and growth within the company.

His analytical mind is unparalleled, he holds dear our mission and vision, he embraces responsibility with passion, and he has the guts to innovate and test creative business models” -- Jack Ma on Daniel Zhang in a 2018 interview

Overall Evaluation on Management

Alibaba's management team is well experienced, with many of the current leaders having been with the company for over 10 years while working up the ranks. Importantly, the management has a long term outlook and is innovation-driven. This is testament in Alibaba’s track record where they have always been in the forefront of innovation, from e-commerce to new retail. An emphasis on innovation and trend setting is important for succeeding in this competitive digital industry.

Conclusion on Alibaba's Fundamentals

Alibaba is an exceptionally well-runned company with a strong business model, good business strategy and experienced management. The company has very strong fundamentals which will help it grow and expand in the coming years.

In my opinion, Alibaba is a great business to own as it has a strong core business which still has room to grow, as well as complementary businesses in not year mature markets. This means that Alibaba is a "growth" stock despite its current size (market cap of 600-700m USD) and it can capitalise on its free cash flow and strong ecosystem to fuel future growth. Hence at a reasonable price, I would be interested in adding more Alibaba into my portfolio.