About three months ago, we were discussing a French industrial company for potential inclusion in our Global strategy. For the purposes of this, who the company is doesn't matter, just that, like many businesses, it is primarily dependent on revenues from domestic and nearby markets. We brought up the election, went through the primary candidates and their positions on a few key details that would impact the business, but looked at it like any other foreign election.

Then we came to last week, and as Sunday's election drew closer, it was obvious it was not like most other foreign elections. With 11 candidates running, there appeared to be a real risk that far right and far left candidates, each of whom espouses anti-EU views, would gain enough votes to knock out centrist candidate Emmanuelle Macron and potentially begin the path to a "Frexit." Macron eventually received enough votes to take the largest share of the first round of voting and make it to the runoff, and the market let a sigh of relief. The next morning, the best-known French stock market index, the CAC 40, was up over 4% and the Euro ran 1.3% versus the dollar. These reactions make sense, as further risk to the EU seemed in the rear-view mirror as most other French parties have rallied behind him instead of the far-right National Front.

However, even the Russell 2000 Index, a small cap index made up of American companies, was up strongly on the news. If things had gone the other way, the Index would likely have reacted similarly to the Brexit vote, or worse. We've spent a lot of time talking about the benefits of owning small cap stocks for their greater domestic exposure. But in a global economy, one needs to be aware that domestic exposure still reflects global exposure. American companies buy overseas, sell overseas, and partner with foreign companies. It's not easy, but investors have to take a global view.

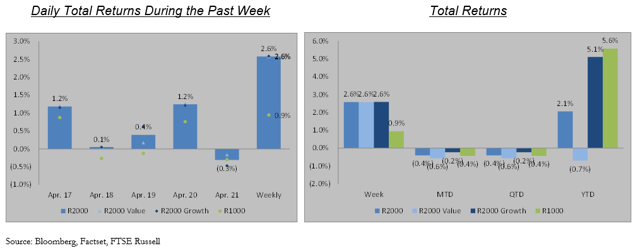

The small cap market, as defined by the Russell 2000 Index, was up 2.6% overall during the week. With large cap earnings season starting (it will be some time until most small cap firms report), the market was focused on positive read-throughs to small cap firms, as well as potential policy advancement on health care and tax reform. Oil commodity prices were weak, as US production growth is likely to be strong. With small-cap running, risk-on trades such as Financials (+3.9%), Consumer Discretionary (+3.7%), and Industrials (+3.7%) were the strongest performers. Energy (-5.3%) and Health Care (-3.0%) were weaker. In total, small cap significantly outperformed large cap, with the Russell 2000 Index beating the Russell 1000 Index by around 165bps. Relative performance was focused primarily on a capitalization basis, as among small caps, the Russell 2000 Growth Index was in line with the Russell 2000 Value Index.

The information, statements, views, and opinions included in this publication are based on sources (both internal and external sources) considered to be reliable, but no representation or warranty, express or implied, is made as to their accuracy, completeness or correctness. Such information, statements, views and opinions are expressed as of the date of publication, are subject to change without further notice and do not constitute a solicitation for the purchase or sale of any investment referenced in the publication.