William Dudley, President and CEO of the Federal Reserve Bank of New York and vice chairman of the FOMC, gave a speech on Friday which strongly supports a continuation of the "QE II" trade (long stock indexes and dollar weakness).

Here are some key points with my highlights:

"In recent quarters the pace of growth has been disappointing even relative to our modest expectations at the start of the year. After rising at about a 3.25 percent annual rate during the second half of 2009, there has been a progressive slowing—to a 2.75 percent annual rate during the first half of the year and, very likely, to an even slower rate in the third quarter."

"Currently, my assessment is that both the current levels of unemployment and inflation and the timeframe over which they are likely to return to levels consistent with our mandate are unacceptable. In addition, the longer this situation prevails and the U.S. economy is stuck with the current level of slack and disinflationary pressure, the greater the likelihood that a further shock could push us still further from our dual mandate objectives and closer to outright deflation."

"We have tools that can provide additional stimulus at costs that do not appear to be prohibitive. Thus, I conclude that further action is likely to be warranted unless the economic outlook evolves in a way that makes me more confident that we will see better outcomes for both employment and inflation before too long."

Since Mr. Bernanke’s speech at Jackson Hole on August 27 (which was released at 10:00 a.m. ET that day), the S&P 500 index has gained over 9.5%. Meanwhile, the dollar has fallen by 1076 pips (8.5%) against the euro, 858 pips (9.7%) on the Australian dollar and by 291 pips (1.8%) to Sterling.

Speculation on additional QE II at or before the November 2-3 meeting increased after the Institute for Supply Management reported on Friday that "while the headline number shows relative strength this month (September) as the PMI reading of 54.4 percent is still quite positive, the overall picture is less encouraging." The ISM now believes that "weaker growth is the expectation for the fourth quarter."

Also of note was that the employment componet fell to 56.5 last month from August's robust 60.4.

Trading FX

Traders should be aware of how currencies moved from March 18, 2009, the day the FOMC last announced it would increase the amount of assets held by purchasing an additional $750 billion of agency mortgage-backed securities and $100 billion of agency debt. Also that day, the Fed announced it would purchase up to $300 billion of longer-term Treasury securities over the next six months.

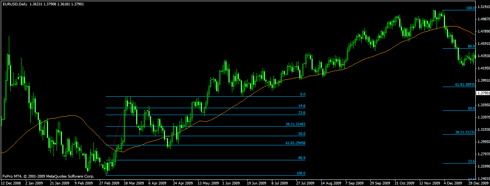

The euro, after hitting a peak of 1.3640 on March 23, retraced just over 61.8% (in pips) of the upswing which began on March 4 before eventually reaching 1.5140 on December 3, when the first rumblings regarding the European Sovereign Debt Crisis began to be heard.

However, Australia's dollar suffered no such pull back as it rode the momentum all the way to November 16.

Disclosure: Long AUD/USD, AUD/JPY