Executive Summary

With a Ponzi, Collapse is Assured

The tragically beautiful essence and defining characteristic of a Ponzi scheme is that it can keep growing so long as money keeps flowing in and will necessarily collapse when the money stops.

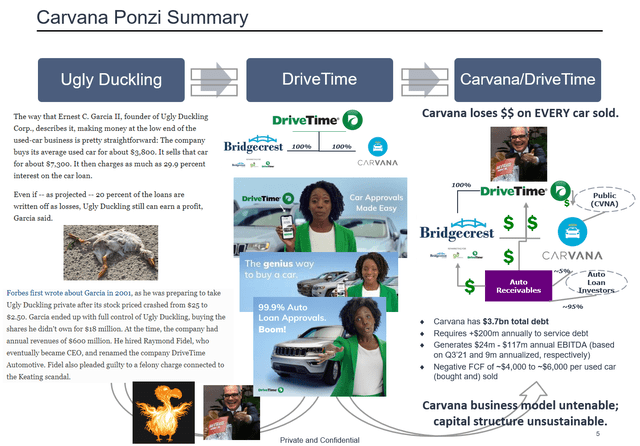

In a Ponzi scheme, a con artist (Ernie Garcia II in the case of Carvana) offers an investment that promises very high returns to his victims. The returns are said to originate from a business or a secret idea run by the con artist. In reality, the business does not exist or the idea does not work. With little or no legitimate earnings, Ponzi schemes require a constant flow of new money to survive. When it becomes hard to recruit new investors, or when large numbers of existing investors cash out, these schemes tend to collapse. As a result, most investors end up losing all or much of the money they invested. In some cases, the operator of the scheme may simply disappear with the money. (Source)

On November 4th, 2021, Carvana reported third quarter results. In doing so, Carvana started the clock on the Final Countdown toward the inevitable collapse of an epic Ponzi scheme and Pump and Dump.

Carvana Reported Terrible Results. The Truth is Much Worse.

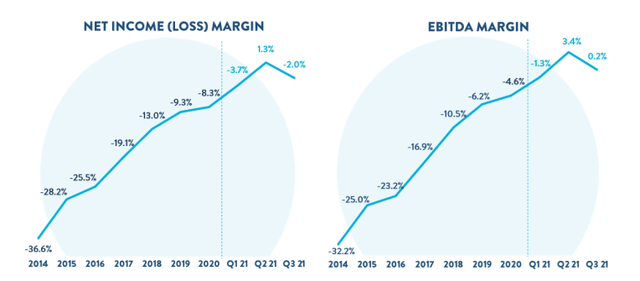

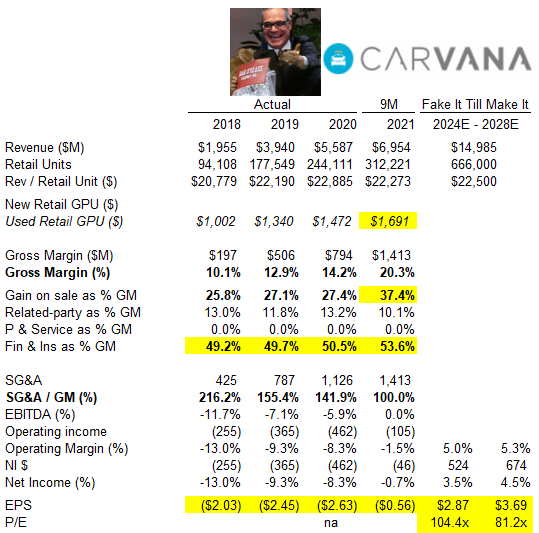

As depicted below, Carvana has lost money in each of the last seven years. Said differently: with the exception of Q2'21, Carvana has lost money on each and every used car they have ever sold.

Carvana was supposed to be scaling toward superior profitability and a large Total Addressable Market. It's true that there is a large market of used cars to be sold. However, Carvana will never capture it because:

1) Carvana achieved peak profitability in Q2'21, as demonstrated above (with Q4'21 guidance being down further from Q3'21); and

2) Carvana has "Economic Earnings" (i.e. real earnings) that are materially lower than the overstated "Net Income" and "EBITDA" that is presented above.

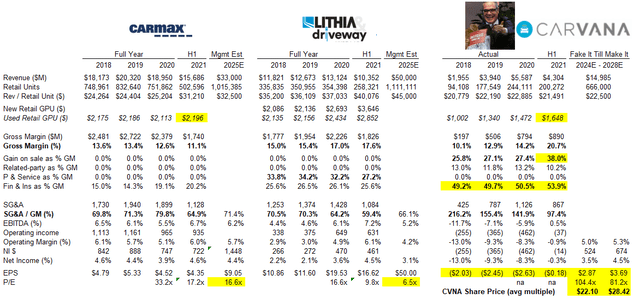

Here is a financial snapshot of Carvana, including the last three years of actual "audited" financials, the first nine months of 2021 (unaudited), and illustrative future headline results, should Carvana ever manage to achieve $15bn annual sales (2.6x 2020 sales) and peer-leading profitability metrics.

Unlike any other auto retailer in the world, Carvana relies on "Finance & Insurance" for +50% of gross margin. That is the biggest red flag in financial statement analysis since a 31-yr old Bethany McLean asked "How exactly does Enron make its money?"

The single biggest contributor to Carvana "gross profit" is something called "gain on loan sales". As shown above, 27% to 37% or $1,500 to $1,700 per $22,000 used car is coming from these gains on loan sales that appear as a non-cash (or non-economic) item on Carvana's Cash Flow Statement.

Confused Yet?

If you're finding this a bit confusing, don't be discouraged. You're not alone. Con artists and fraudsters often use complexity to deceive.

The below clip describes securitized mortgage bonds, which is the exact same structure as the securitization trusts that Carvana uses to finance its auto loans. Carvana provides financing on 75% to 80% of all the cars they sell.

Instead of mortgages on houses, Carvana securitizes auto loans. Subprime loans like this prospectus and this summary, which charge ~20% on loans to car buyers generate the majority of the gains. The gains primarily occur when Carvana "sells" the very bottom tranches of subprime auto loans.

A huge future problem is that Carvana is not exactly selling the loans. All the way at the back of Carvana's financial statements is this table:

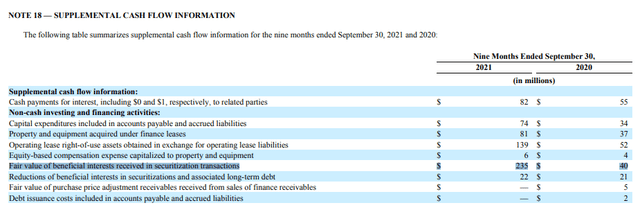

The line "Fair value of beneficial interests received in securitization transactions" is a red flag. Carvana "sells" the bottom tranches of subprime auto loan securitizations to undisclosed purchasers AND retains part of the bottom tranches, which are the primary source of the gains on loan sales.

In 2021, Carvana has retained an amount equal to $235m (or ~45% of the gain on loan sale) recognized.

If you were wondering why the gain on loan sales spiked from 26%-27% to 38% of "gross profit" in 2021, it's because record high used auto prices and unprecedented government stimulus created an environment where there are nil or even negative losses on subprime auto loans. Unprecedented.

However, used car prices will normalize, stimulus checks have stopped and those auto default and loss rates are already rising...

Carvana is a worse fraud than Enron, which also used accounting shenanigans to fabricate "profits". Carvana uses similar accounting shenanigans and can't even feign profitability.

Carvana is also worse than Countrywide Financial, which was less precariously capitalized than Carvana and generated real earnings before it collapsed.

Carvana is Already Operationally Bankrupt

The most important financial metric of any company is Free Cash Flow ("FCF") per share. Just ask Jeff Bezos at Amazon.com.

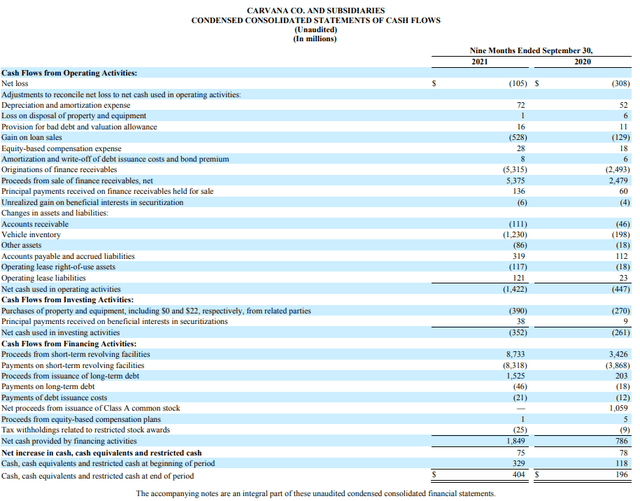

Below is Carvana's Cash Flow Statement for 2021 YTD. A simple measure of FCF is Operating Cash Flow ($1,422m) less capital expenditures ($390m) or FCF of negative ($1,812m). Carvana experienced a cash outflow of ($10.49) per share or ($5,804) for each of the 312,221 used vehicle units sold.

Carvana did grow units by 82% year-over-year (from 171,939 units) but in 2020, Carvana only experienced a cash outflow of ($4,170) per used vehicle.

The faster Carvana grows, the more money ($1,634 per used vehicle unit) goes out the door...

The table from Note 18 disclosed that Carvana put an additional $74m capital expenditures through the balance sheet (accounts payable and accrued liab).

Properly adjusting for the above, the economic FCF is lower by $74m. Carvana has FCF of negative ($1,886m); negative ($10.92) per share; negative ($6,041) per used retail unit sold in the first nine months of 2021.

More importantly, Carvana's presented Net Income and EBITDA is overstated by an amount roughly equal to the $235m retained from securitizations.

Removing the non-cash, non-economic amount means that Carvana's Economic Earnings are negative. In the best operating environment for auto retailing ever, when Autonation, Carmax, Lithia, and Asbury are all reporting record results, Carvana can't make money. Seriously!?

Recall that this is the precise definition of a Ponzi scheme: Carvana requires a constant flow of new money to survive and the business idea doesn't work as promised...

A Ponzi Collapses When The Money Stops.

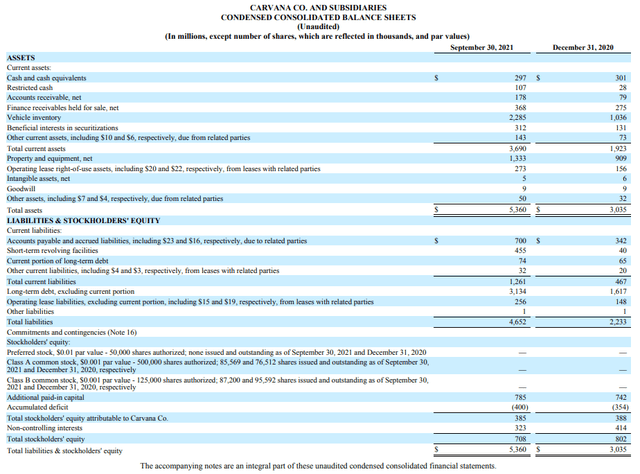

Carvana's Balance Sheet below is as bad as the Cash Flow Statement.

Carvana had Total stockholders' equity of $708m at September 30, 2021, down from $802m at December 31, 2021. We know that Carvana didn't raise equity in 2021 and will never return cash to shareholders, so we know that Carvana income was negative by about $100m for the first nine months of 2021.

As outlined, the Economic Net Income and Economic EBITDA is overstated by an amount equal to approximately $235m. Properly adjusted, Carvana had economic earnings of negative ($300m) in 2021 YTD.

Carvana has approximately $3,000m ($3bn) of net long-term debt. To avoid default, Carvana has to pay almost $200m per year in interest to bondholders.

How can Carvana pay its cash interest (let alone principal) when Carvana loses money on every single used car they sell? The losses are structural and Carvana loses even more as it continues to grow!?

As shown in the financial statements above, Carvana is months away from bankruptcy.

Carvana Will Go Bankrupt Two Ways: Gradually, then Suddenly.

While the Final Countdown has officially commenced, the path is not preordained. Carvana currently has two options:

1) The End of 'Move Fast and Break Things'

The first thing to do when you realize you're in a hole is to stop digging. If Carvana loses money on every used car it sells, then the simplest solution is to sell less cars.

Carvana was always an uneconomic loan originator masquerading as a disruptive auto retailer for the purpose of insider enrichment (Google fraud). They did a pretty good job hyping a false and misleading "disruptor" narrative. Just look at all that Ivy League and entrepreneurial / tech-focused pedigree!!

One thing that everyone knows about Silicon Valley is that failure happens. Sometimes, like in the case of WeWork, a $47bn company becomes a $10bn company in a month and goes from insane uneconomic growth mode to living within its means.

One thing that everyone knows about Silicon Valley is that failure happens. Sometimes, like in the case of WeWork, a $47bn company becomes a $10bn company in a month and goes from insane uneconomic growth mode to living within its means.

Carvana has an opportunity to rein in the growth, drastically reduce units sold (and cash burn) to try and find an economic business model around current sales volumes.

Carvana shares would likely experience an immediate 50% - 80% decline, but with a clean slate, refocused business and updated disclosures, perhaps Carvana could raise new capital with more realistic economic growth expectations.

The above would be the most sensible strategy, but it is not without risk or financial hardship. A share price collapse could eliminate Carvana's ability to raise new capital and cause the SEC (and Department of Justice?) to intensify their ongoing investigations. There is a risk that Carvana doesn't survive them taking their foot off the gas...which leads to Option #2.

2) Carvana could double down on their fraud.

Fraud only exists in hindsight. So long as Carvana can maintain a relatively high share price and continue to materially deceive investors, they can try to raise new equity capital. This is a very high-risk strategy.

Carvana last raised equity during the depths of the COVID-19 crisis. In early 2020, as COVID-19 spread across the globe and lockdown measures were enacted, the capital markets seized up. Carvana's share price dropped from $110 to $29 in a month.

As described, the essence of a Ponzi scheme is that it can grow so long as cash comes in, but will necessarily collapse as soon as that stops. Without new equity or debt capital, Carvana was collapsing. In order to prevent that, insiders led a capital raise, followed by another equity raise a month later.

Bankruptcy was averted and Carvana was back to Ponzi growth mode. Since May 2020, Carvana has required increasing amounts of capital (the more they grow the more money they lose) but has relied exclusively on debt markets to fund the growth.

Now, Carvana can't turn to the debt markets for solvency and covenant-related reasons. They could pursue a high-risk strategy of raising equity.

The reason that raising equity would be considered high-risk is that new issue bonds are sold to financially sophisticated institutional investors that are capable of dissecting the financial statements and understand the risks. Their bonds are governed by an indenture agreement that serves to protect them. When Carvana files for bankruptcy, the bond investors have the financial wherewithal to hire lawyers and negotiate a recovery based on the vehicle inventory, receivables, vending machines, etc.

The reason that raising equity would be considered high-risk is that new issue bonds are sold to financially sophisticated institutional investors that are capable of dissecting the financial statements and understand the risks. Their bonds are governed by an indenture agreement that serves to protect them. When Carvana files for bankruptcy, the bond investors have the financial wherewithal to hire lawyers and negotiate a recovery based on the vehicle inventory, receivables, vending machines, etc.

Issuing new equity requires full, true and plain disclosure which is something that Carvana's financial statements lack. As well, Carvana's directors owe a duty of care (fiduciary duty) to equity holders that is not extended to bond holders. When Carvana files for bankruptcy, certain insiders, directors or affiliates could face criminal charges that include prison sentences.

As a previously convicted felon, Ernie Garcia II could likely go to prison for his involvement, should Carvana be exposed as a Ponzi scheme. Even worse, his son, Ernie Garcia III, might face a similar sentencing.

It seems inconceivable to pursue a path as ruinous as something that Cersei Lannister would choose...but anything is possible...

Three Most Important Words in Investing: "Maybe I'm Wrong"

Perhaps you have read this far and remain amused but skeptical. That is your right and the above is just one opinion (even if it has been formed after hundreds of hours of research and analysis over the course of many months).

Perhaps Carvana can keep the Ponzi going longer. Perhaps they can turn an insider enrichment scheme into a real business.

Let's illustrate what that would look like: assuming Carvana can raise $2bn to $3bn of equity (because they can't raise any more debt) and can continue to fund uneconomic growth until it magically becomes economic, the implied price target for the equity (share price) is 1/10 of the current share price.

Investors should expect to lose +90% of their money from current levels.

As per the above table of comparable companies with superior business models and robust economics that are not fabricated and deceiving, Carvana shares would be expected to decline to $20 to $30.

At $20 to $30 per share, the implied equity (enterprise) valuation of Carvana would be $3.65bn ($6.65bn) to $5.5 ($8.5bn). Not too shabby for a company that currently loses money on each and every used vehicle sold...

But it could be financially ruinous for those deceived who may currently own the equity at a valuation of $300 per share or a total capitalization of $51.9bn ($54.9bn).

Financial Collapse is a Process Not an Event

For a refresher on what happens when a financial collapse begins, it's worth watching the below clip (The Big Short). Obviously, the great financial / mortgage crises was significantly bigger than a small Ponzi like Carvana.

However, in much the same way, the Carvana fraud has been propped up by Wall Street banks, the firm that audits both Carvana and ParentCo (DriveTime), and others that know better (like Jim Cramer and CNBC).

These parties will try to keep the share price high long enough for key insiders and funds to get out before the inevitable collapse. The motto of Wall Street is CAVEAT EMPTOR (BUYER BEWARE).

Conclusion

In recent months, efforts have been made to: warn investors directly; alert the U.S. Securities and Exchange Commission (which oversees issuers and is tasked with preventing or prosecuting frauds like Carvana); notify the Financial Industry Regulatory Authority (which regulates brokerage firms); call out bulge bracket firms as well as the auditors of Carvana and its ParentCo, DriveTime; and provide information to media outlets to educate as well as stop their platforms from being manipulated by a fraudulent issuer that is deceiving potential investors for insider enrichment.

If you've read this far and are still looking for more information, the following reference articles may be of interest:

1) Wall St. Journal: Carvana’s Success Rides on Used-Car Loans;

2) Wall St. Journal: CEO’s Father Gets a $3.6 Billion Stock Windfall at Carvana;

3) SeekingAlpha: Carvana is a Ponzi Scheme; and

4) SeekingAlpha: Carvana is a Pump and Dump Scheme.

We genuinely tried our best. Now, economic gravity will do the rest. The Final Countdown has commenced...