- Citi analyst Emmanuel Korchman raises Empire State Realty Trust (NYSE:ESRT) to Neutral from Sell as much of the bad news is already baked into the REIT's shares.

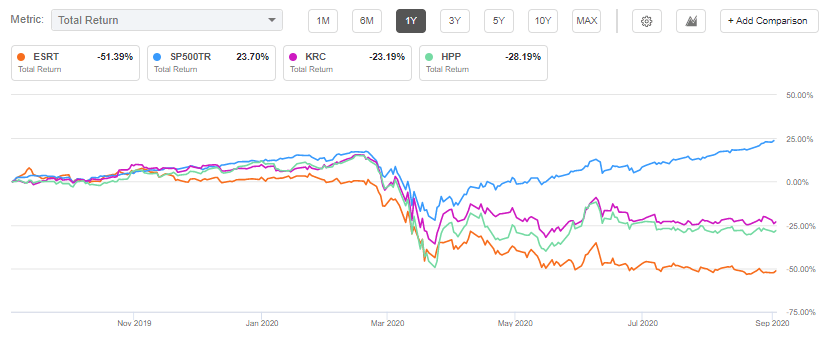

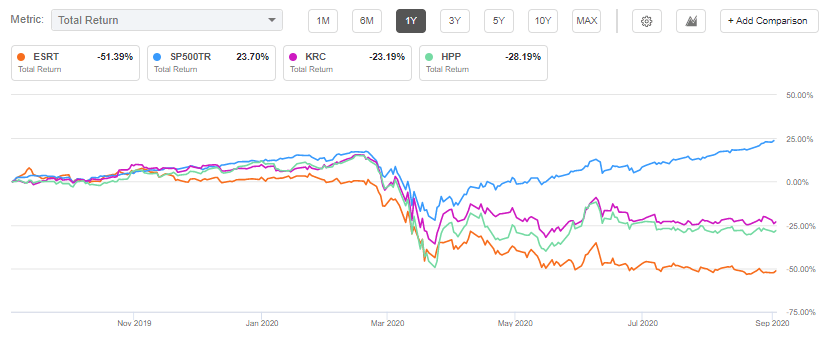

- ESRT has dropped 52% YTD vs. its office peers' 28% decline.

- The biggest risk to ESRT's cash flows remains the recovery of business at the Empire State Building's observation deck, where capacity is currently limited and attendance trends weak, Korchman wrote.

- Questions about the health of the NYC office market, retail, small tenant exposure, observatory income, collection trends, G&P spending, and buybacks weigh on ESRT if things don't improve, he wrote.

- Remains underweight on all NYC-focused office REITs.

- The analyst is more optimistic about West Coast REITs Kilroy Realty (NYSE:KRC) and Hudson Pacific Properties (NYSE:HPP) as tech and medial are likely to support demand an "supply still in better shape."

- Korchman diverges from the Bearish Quant view on ESRT; and comes in line with the average Wall Street analyst rating of Neutral.

-

See ESRT's total return vs. KRC, HPP and the S&P 500 over the past year: