- Financial earnings will dominate the current week as the sector tries to break out of its malaise that made it an underperformer throughout the summer’s recovery rally.

JPMorgan Chase (NYSE:JPM) and Citigroup (NYSE:C) will report results ahead of the bell Tuesday. Goldman Sachs (NYSE:GS), Bank of America (NYSE:BAC), Wells Fargo (NYSE:WFC) and U.S. Bancorp (NYSE:USB) will weigh in on Wednesday premarket. Morgan Stanley (NYSE:MS) and Charles Schwab (NYSE:SCHW) report earnings Thursday and BNY Mellon (NYSE:BK) and State Street (NYSE:STT) issue numbers Friday.

Trading revenue and credit loss estimates, which will give an indication of the pace of the economic recovery, will be in focus.

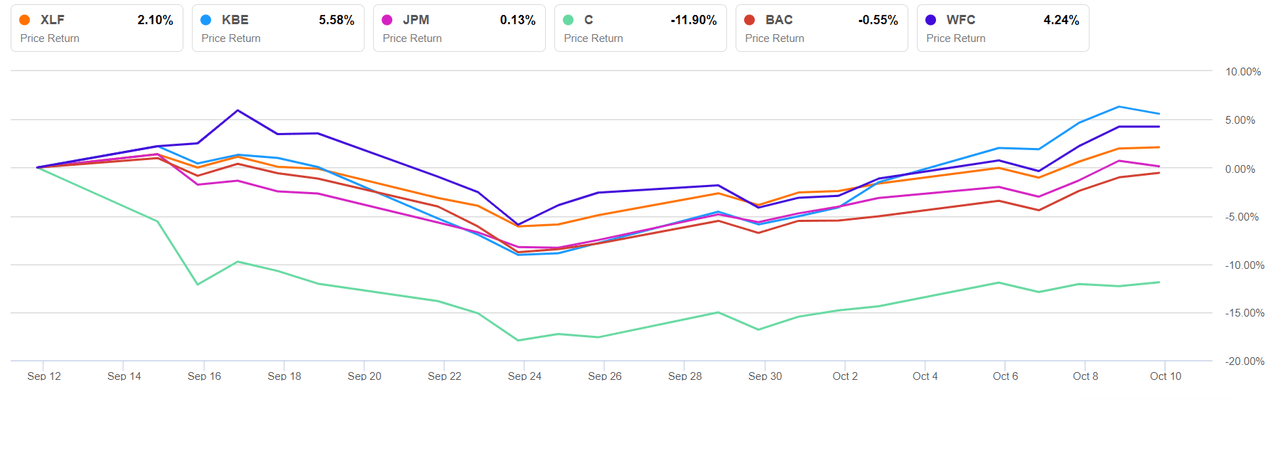

The SPDR Financial Sector ETF (NYSEARCA:XLF) had a comparatively good run last week amid all the volatility caused by stimulus optimism and pessimism, rising 3.8%. All but three components finished the week in the green, with SVB Financial (NASDAQ:SIVB), State Street and Invesco (NYSE:IVZ) in the lead.

M&A speculation also helped financial stocks as Morgan Stanley followed up its acquisitions of E*Trade by snapping up Eaton Vance (NYSE:EV).

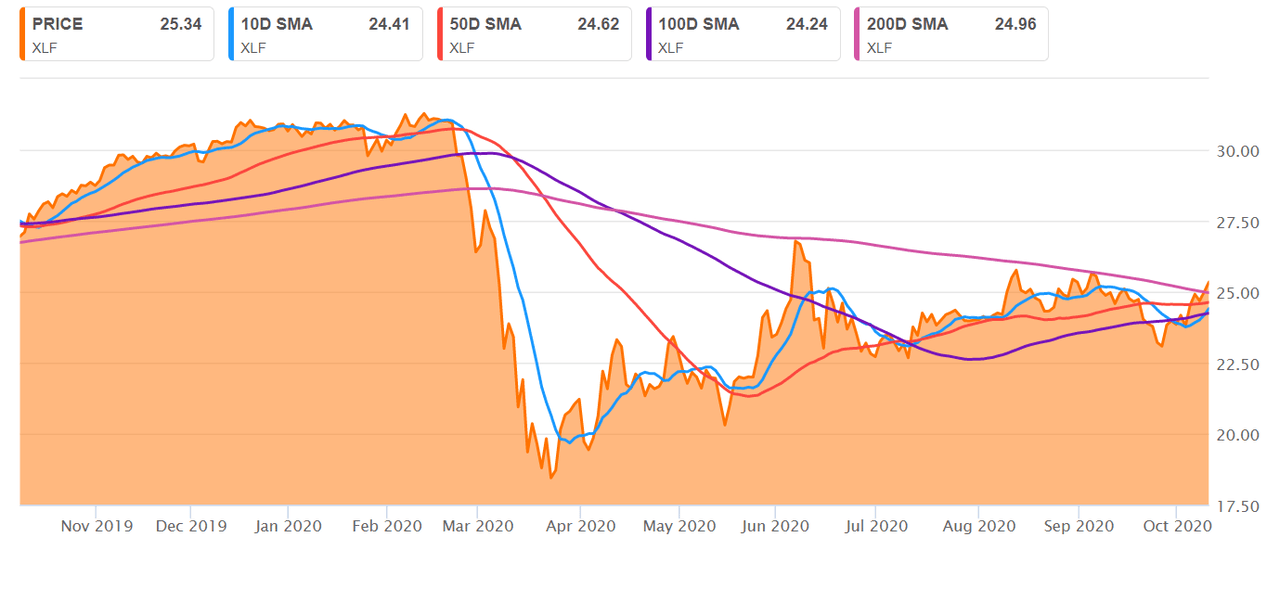

While financials looked like they could be gaining some traction this week, XLF is up just 8% in the past six months and down 18% year to date.

But it crossed an important technical level last week.

XLF crossed above its 200-day simple moving average of $25.95 for the first time since late February. It currently sits at $25.23, but still close to its 50-day SMA of $24.61 and a 100-day SMA of $24.22.

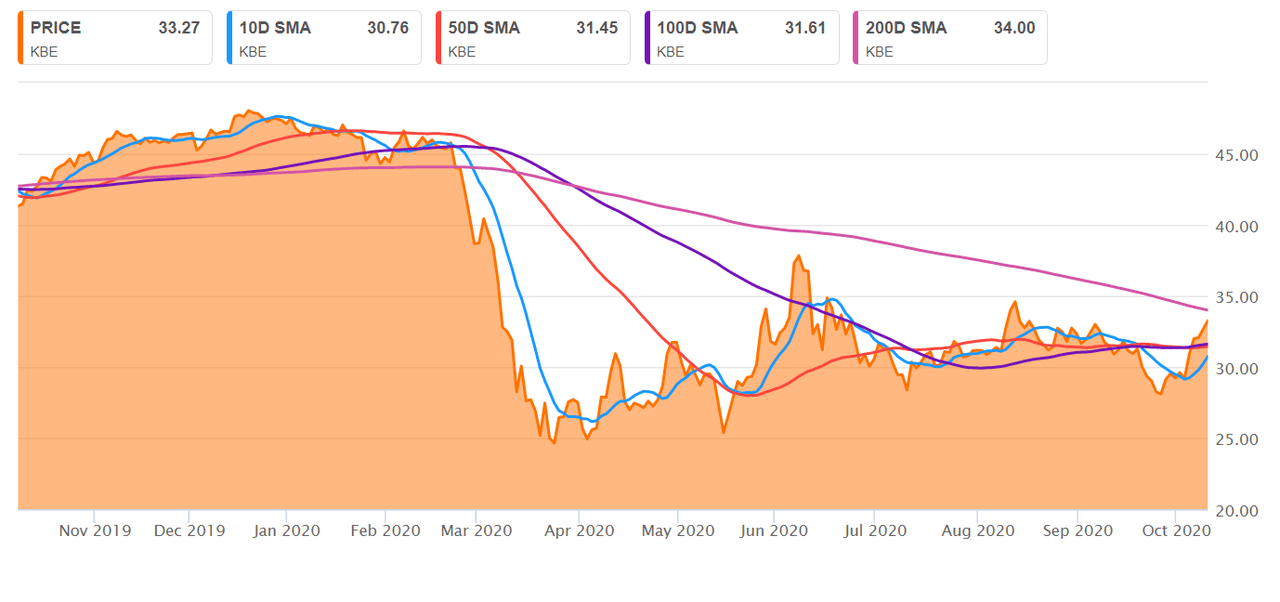

Digging down into banks specifically, the SPDR S&P Bank ETF (NYSEARCA:KBE) climbed 7.2% last week. It’s up more than 6% in the past six months, but down 31% year to date.

At $32.75, KBE is 3.5% below its 200-day SMA of $33.92.

"Bank stocks have lagged sharply and are trending well below long term averages, despite high capital levels, due to concerns about a double dip or slow recovery,” JPMorgan said this week. “We expect bank stocks to outperform near term given valuations and earnings expectations”.

“Money center banks have recently lagged due to concerns about greater pressure on net interest income – strong markets-related revenues should offset some, such as at Citi.”

“Based on Dealogic data and commentary at a recent financials conference, we are raising our 3Q20E investment banking revenue estimate to up 4% Y/Y from down 30% Y/Y prior (our assumption was that a lot of activity had been pulled forward into 2Q20) and raising our equities and FICC trading to up 7.5% Y/Y from our prior estimate of up 2.5% Y/Y," Oppenheimer said.