Leading Macau’s Non-Gaming Diversification Through Mice, Entertainment And Sporting Events

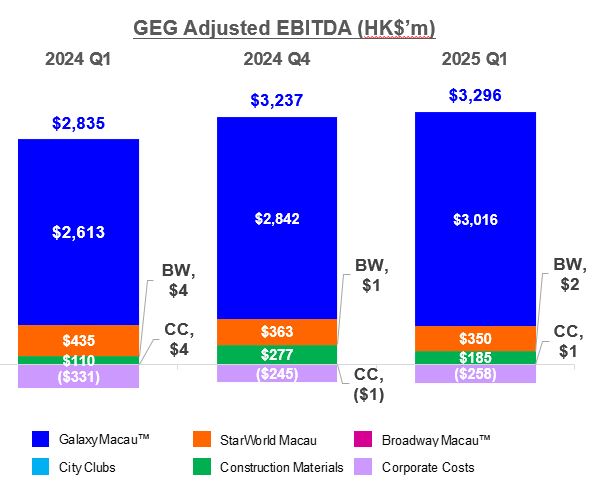

Q1 2025 Group Adjusted EBITDA Of $3.3 Billion,

Up 16% Year-on-Year, Up 2% Quarter-on-Quarter

Soft Launched Capella At Galaxy Macau in May

A Final Dividend Of $0.50 Per Share Payable June 2025

HONG KONG, May 08, 2025 (GLOBE NEWSWIRE) -- Galaxy Entertainment Group (“GEG”, “Company” or the “Group”) (HKEx stock code: 27) today reported results for the three-month period ended 31 March 2025. (All amounts are expressed in Hong Kong dollars unless otherwise stated)

Mr. Francis Lui, Chairman of GEG said,

“Today I am pleased to report solid results for GEG in Q1 2025. During the quarter we continued to drive every segment of the business in particular the premium mass through our unparalleled products and service, ongoing property enhancements, diverse entertainment shows and events, as well as the full implementation of smart tables, among others.

In Q1 2025 the Group reported Net Revenue of $11.2 billion, up 6% year-on-year and down 1% quarter-on-quarter. Adjusted EBITDA was $3.3 billion, up 16% year-on-year and up 2% quarter-on-quarter. We were satisfied with our casinos’ performance over the Chinese New Year and in particular the post Chinese New Year which experienced a longer tail than previously. During March we made a few adjustments to Galaxy Macau™’s main gaming floor adding new electronic games which was partially disruptive for the month.

Despite geo-political turbulence and continued economic slowdown, overall Macau market was still resilient with Q1 2025 Gross Gaming Revenue (“GGR”) of $56.0 billion, up marginally year over year and quarter over quarter, recovering to 76% of 2019 level.

Macau’s Chief Executive Mr. Sam Hou Fai delivered his first Policy Address last month, reiterating that Macau will continue to implement the plan for the development of a diversified economy, to promote the ‘1+4’ diversified industries and accelerate the development of the Hengqin Deep Co-operation Zone. The Government will also guide the concessionaires to make their non-gaming investments effective and to put more resources into supporting development projects in Macau and Hengqin. As always, GEG will support the Government’s policies and the goal to develop Macau into the World Centre of Tourism and Leisure.

The Group’s balance sheet remains healthy and liquid, with cash and liquid investments increasing to $33.0 billion. The net position was $29.0 billion after deducting debt of $4.0 billion. This financial strength allows us to fund our development pipeline, explore overseas opportunities and return capital to shareholders via dividends. The GEG Board previously recommended a final dividend of $0.50 per share payable in June 2025. This demonstrates our continued confidence in the longer-term outlook for Macau in general and in GEG specifically.

We continue to leverage our competitive advantage of our extensive non-gaming amenities including: our retail, food & beverage, multiple hotels brands, Grand Resort Deck, MICE facilities and Galaxy Arena. Entertainment shows and events continued to play a key role in driving new and repeat customers to Macau. In the first quarter alone, we hosted a number of significant events at the Galaxy International Convention Center (“GICC”) and Galaxy Arena such as 2025 TF Family New Year Concert, Jeff Chang World Tour Concert, for K-pop we had BIGBANG’s lead singer Taeyang 2025 Macao solo Tour and BLACKPINK’s member JISOO solo Asia Fan Tour, as well as the world-renowned Italian tenor Andrea Bocelli’s Concert, among others. During the first quarter we experienced a 64% year-on-year increase in Galaxy Macau™’s foot traffic which we believe was driven largely by our diverse non-gaming amenities and entertainment offering.

GEG is well positioned to continue capitalizing on this trend of increased entertainment in Macau with Macau’s largest indoor coliseum - Galaxy Arena. In April we hosted ITTF World Cup Macao 2025, one of the world’s most prestigious table tennis events, which received overwhelming demand. Just the past weekend we successfully hosted the Wakin Chau World Tour. Later in May we will be having J-hope, a member of the globally acclaimed K-pop group BTS, who is set to bring his first solo world tour to Galaxy Arena. Additionally, in June we will host BIGBANG leader G-Dragon’s first concert tour in eight years and the highly anticipated Jacky Cheung 60+ Concert Tour, as well as the Extraordinary General Assemblies and Conference of the Fédération Internationale de l’Automobile which is co-organized by Automobile General Association Macao-China and GEG, marking the first time of this world class annual event in Asia.

We will continue to make enhancements to our resorts including adding new F&B and retail offerings at Galaxy Macau™. At StarWorld Macau we are evaluating a range of major upgrades, that includes the main gaming floor, the lobby arrival experience and increasing the F&B options. StarWorld Macau now hosts one of the largest scale Live Table Games (“LTG”) terminals in Macau.

In the recently announced Michelin Guide Hong Kong Macau 2025 List, four of our restaurants collectively earned five Michelin stars, with Sushi Kissho by Miyakawa, which is founded by celebrated Michelin three-starred Chef Masaaki Miyakawa, winning one star in its first year of operation. Additionally in the Forbes Travel Guide 2025 List, Galaxy Macau™ proved its unrivalled position as an integrated resort with the most Five-Star hotels under one roof of any luxury resort company worldwide for the third consecutive year. Galaxy Macau™ was also named Best Integrated Resort in the Asia Pacific region for the second time by Inside Asian Gaming.

On the development front, the ultra-luxury Capella at Galaxy Macau, the 10th hotel brand in GEG’s portfolio, soft launched in May and we anticipate to have the property fully opened over the next few months. Capella at Galaxy Macau is an all-suite gilded residence, located within Asia’s most luxurious and award-winning resort. Showcasing new standards of bespoke, accentuated luxury, Capella at Galaxy Macau sets the scene for the most discerning of guests to forge authentic connections with Macau – a global entertainment hub with a rich history of culture, UNESCO-world heritage gastronomy and a gateway to the vibrant Greater Bay Area. We also continue to progress with the construction of Phase 4, which has a strong focus on non-gaming, primarily targeting entertainment and family facilities, and also includes a casino.

Meanwhile we continue to evaluate development opportunities in the Greater Bay Area and overseas markets on a case by case basis, including Thailand.

Recently the Macau’s Chief Executive indicated that with the slowing global economy and the potential impact of the recently announced tariffs that in the shorter term it may be difficult to achieve the overall GGR target for 2025. We acknowledge that there are shorter term challenges but remain confident in the longer-term outlook for Macau.

Finally, I would like to thank all our team members who deliver ‘World Class, Asian Heart’ service each and every day and contribute to the success of the Group.”

| Q1 2025 RESULT HIGHLIGHTS GEG: Well Positioned for Future Growth

|

Macau Market Overview

Based on DICJ reporting, Macau’s GGR for Q1 2025 was $56.0 billion, up 1% year-on-year and up 0.4% quarter-on-quarter, representing 76% of 2019 level.

In Q1 2025, visitor arrivals to Macau were 9.9 million, up 11% year-on-year and up 9% quarter-on-quarter, recovering to 95% of 2019. Mainland visitor arrivals to Macau grew at a faster rate of 15% year-on-year to 7.2 million, with Individual Visit Scheme (“IVS”) visitors of 4.0 million, up 16% year-on-year. Among the Mainland visitors, approximately 0.4 million travelled under the one-trip-per-week visa and approximately 0.1 million under the multiple-entry visa which were implemented at the start of 2025. In addition, visitations from the nine Pearl River Delta cities in the Greater Bay Area increased by 19% year-on-year to 3.6 million. International visitor arrivals to Macau increased by 17% year-on-year to approximately 0.7 million. GEG has continued to work with Macao Government Tourism Office (“MGTO”) to actively promote Macau as a tourism destination. We have opened offices in Tokyo, Seoul and Bangkok.

Group Financial Results

In Q1 2025, the Group posted Net Revenue of $11.2 billion, up 6% year-on-year and down 1% quarter-on-quarter. Group Adjusted EBITDA was $3.3 billion, up 16% year-on-year and up 2% quarter-on-quarter. Latest twelve months Adjusted EBITDA of $12.6 billion, up 16% year-on-year and up 4% quarter-on-quarter.

In Q1 2025, GEG played lucky in its gaming operation which increased its Adjusted EBITDA by approximately $330 million. Normalized Adjusted EBITDA was $3.0 billion, up 7% year-on-year and down 9% quarter-on-quarter.

Summary table of GEG Q1 2025 Adjusted EBITDA and adjustments:

| in HK |