SYDNEY, July 07, 2025 (GLOBE NEWSWIRE) -- IREN Limited (IREN) (NASDAQ: IREN) (together with its subsidiaries, “IREN” or “the Company”), today published its monthly update for June 2025.

June Highlights

- Record monthly revenue and hardware profit3

- 50 EH/s mid-year target achieved

- AI Cloud expanded with ~2.4k Blackwell GPUs

- $550m convertible notes offering oversubscribed

- US domestic issuer status transition complete

- Customer and financing workstreams progressing across AI verticals

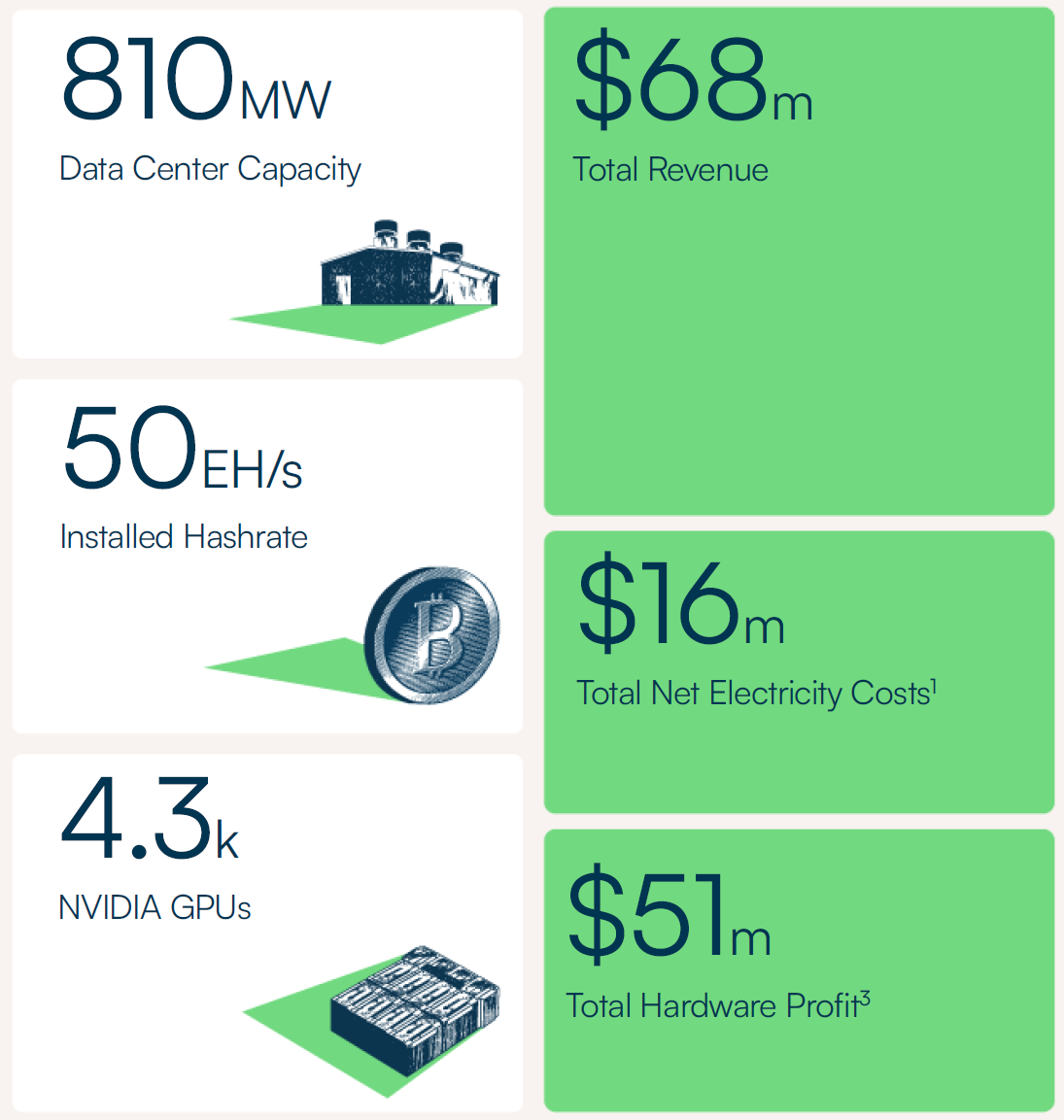

| Key Metrics | Jun 25 | May 25 | |

| Bitcoin Mining | |||

| Average operating hashrate | 41.1 EH/s | 38.4 EH/s | |

| Bitcoin mined4 | 620 BTC | 627 BTC | |

| Revenue per Bitcoin mined | $105,730 | $103,345 | |

| Net electricity cost per Bitcoin mined2 | ($26,259) | ($27,033) | |

| Revenue | $65.5m | $64.7m | |

| Net electricity costs1 | ($16.3m) | ($16.9m) | |

| Hardware profit3 | $49.2m | $47.8m | |

| Hardware profit margin5 | 75% | 74% | |

| AI Cloud Services | |||

| Revenue | $2.2m | $2.2m | |

| Net electricity costs1 | ($0.03m) | ($0.03m) | |

| Hardware profit3 | $2.1m | $2.1m | |

| Hardware profit margin5 | 98% | 98% | |

Management Commentary

“The past month has marked several significant milestones for IREN. We delivered another month of record revenues, executed an oversubscribed convertible note offering, reached our self-mining target of 50 EH/s, transitioned to U.S. domestic issuer status, and more than doubled our AI Cloud business with the procurement of next-generation NVIDIA Blackwell GPUs,” said Daniel Roberts, Co-Founder and Co-CEO.

“With nearly 3GW of grid-connected power and deep infrastructure expertise, we’re uniquely positioned to deliver flexible solutions across the AI stack, including powered shells, build-to-suit facilities, turnkey colocation, and fully managed cloud services. IREN is at the forefront of two transformative technologies, Bitcoin and AI, owning and operating the compute infrastructure that powers both.”

Technical Commentary

Bitcoin Mining

- Record monthly revenues – driven by higher Bitcoin prices that more than offset the decline in Bitcoin production due to the shorter month

- Maintaining strong and resilient margins – underpinned by best-in-class efficiency (15 J/TH), low net electricity costs and energy market intelligence & algorithms (3.0c/kWh Childress net electricity cost in June)1

- 50 EH/s installed – reached target self-mining capacity by month end, with further expansion paused to prioritize continued build-out of AI verticals ($827m illustrative annualized hardware profit at 50 EH/s)6

AI Cloud Services

- Hopper GPUs near full utilization – supporting diverse customer mix on contract terms ranging from on-demand to 3 years, including through white-labelled compute with leading US AI cloud providers (generating annualized run-rate revenue of $28 million)7

- Blackwell GPUs procured– 1.3k B200s & 1.1k B300s to be installed at Prince George over the coming months, lifting total fleet to 4.3k NVIDIA GPUs and unlocking next-gen training and inference at scale

AI Data Centers

- Customer workstreams progressing – continued engagement across a range of structures such as powered shells, build-to-suit and turnkey colocation across our portfolio, including Childress and Sweetwater

- Procurement ongoing – continuing to secure long-lead equipment to enable rapid expansion of liquid cooled capacity at Childress beyond the initial 50MW Horizon 1 deployment

Events

- BTC '25 | Building Data Centers With Bitcoin Mining & AI In Mind

Replay available here

- Q3 FY25 Results Webcast

Replay available here

- RAISE Summit

Paris, July 8-9, 2025

- Canaccord Annual Growth Conference

Boston, August 12-13, 2025

Kent Draper, CCO, presenting at BTC Vegas (May 2025)

Project Update

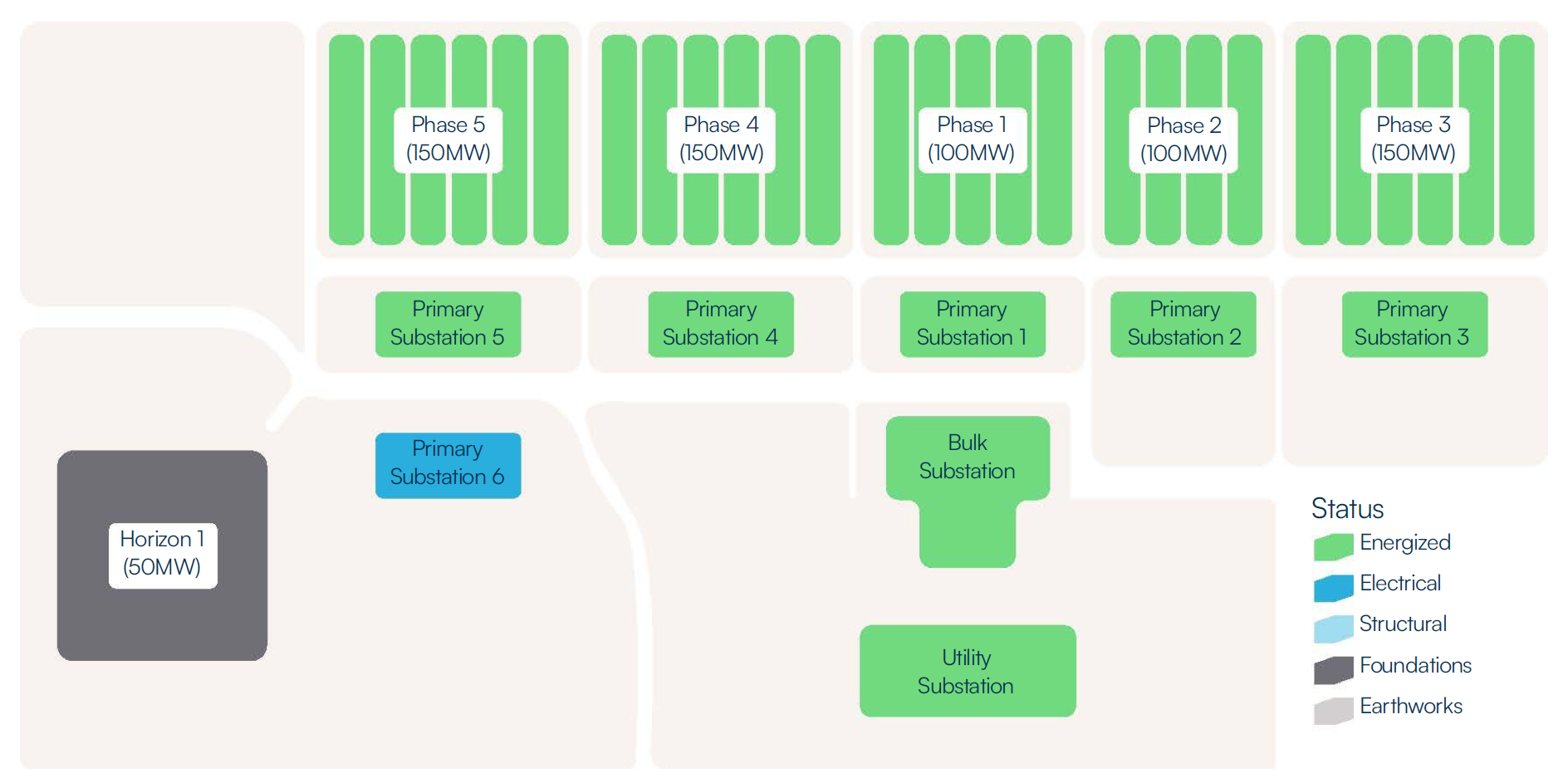

Childress Phases 5 & 4 (June 2025)

Horizon 1 Concrete Pour (June 2025)

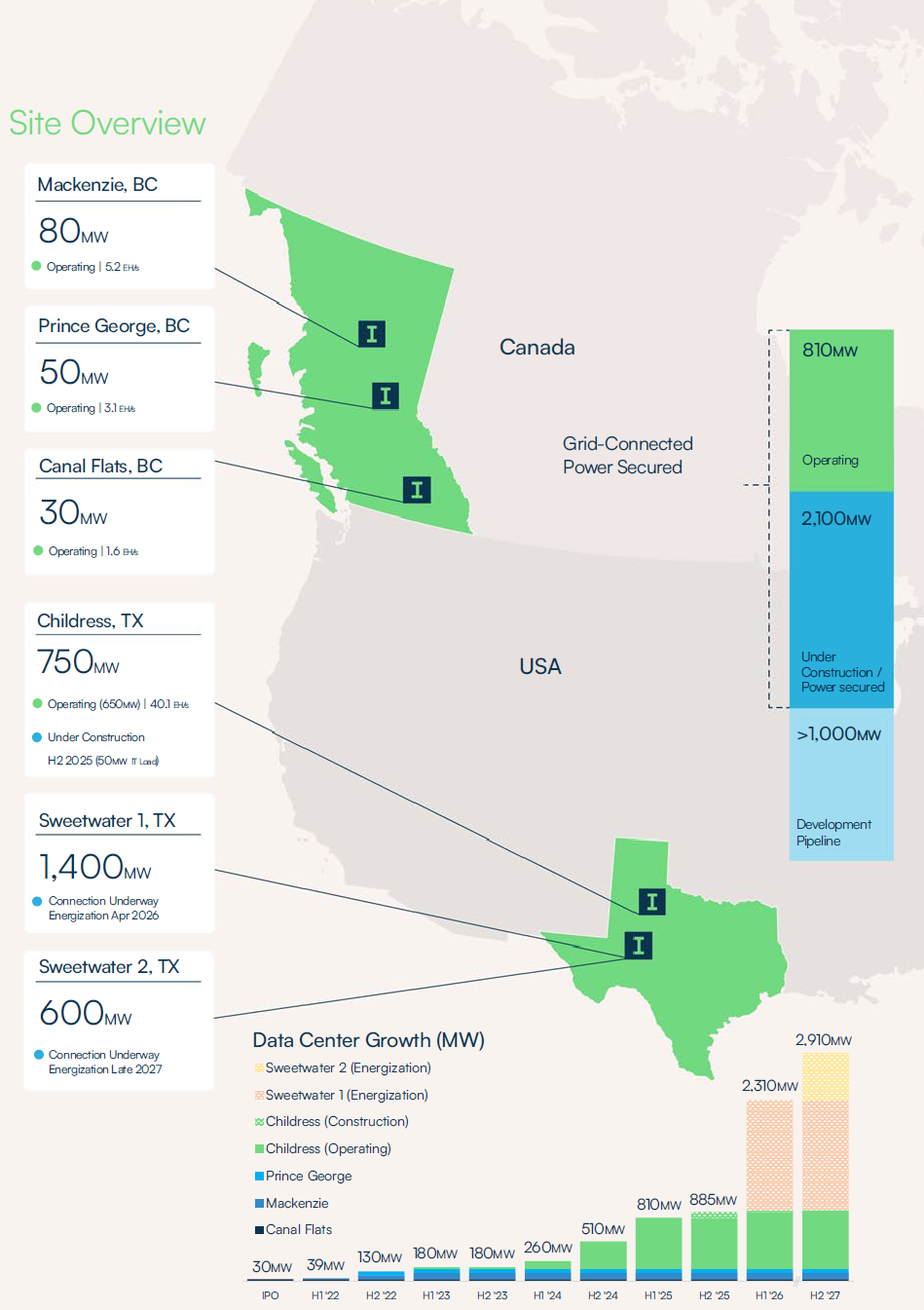

Childress (750MW)

- 650MW total operating data centers, with Phase 5 (150MW) now complete

- Horizon 1 (up to 50MW IT load) on track for Q4 2025 delivery, with foundations underway and long lead equipment continuing to arrive in line with initial expectations

- Planning and site works underway for Horizon 2 and beyond

Sweetwater 1 (1.4GW)

- General site-works continuing and substation civil works complete

- Targeting energization April 2026

Sweetwater 2 (600MW)

- Design work complete for a direct fiber loop connecting Sweetwater 1 & 2

- Procurement of long lead high voltage equipment underway

- Targeting energization late 2027

Childress Project Status

Site Overview

Assumptions and Notes

- Total net electricity costs are presented on a net basis and calculated as GAAP electricity charges, demand response program revenue and demand response fees. Figures are based on current internal estimates and exclude Renewable Energy Certificate (“REC”) purchases.

- Net electricity costs per Bitcoin mined is calculated as Net electricity costs for Bitcoin mining divided by Bitcoin mined.

- Hardware profit is calculated as revenue less net electricity costs. Hardware profit is a non-GAAP financial measure and is provided in addition to, and not as a substitute for, measures of financial performance prepared in accordance with GAAP. Refer to the Forward-Looking Statements disclaimer.

- Bitcoin and Bitcoin mined in this investor update are presented in accordance with our revenue recognition policy which is determined on a Bitcoin received basis (post deduction of mining pool fees).

- Hardware profit margin for Bitcoin Mining and AI Cloud Services is calculated as revenue less net electricity costs, divided by revenue (for each respective revenue stream) and excludes all other costs.

- Illustrative Annualized Hardware Profit = illustrative annualized mining revenue less assumed net electricity costs. Source: CoinWarz Bitcoin Mining Calculator. Illustrative calculations and inputs assume hardware operates at 100% uptime, 3.5c/kWh net electricity costs, 3.125 BTC block reward, 0.1 BTC transaction fees, 0.16% pool fees, 765MW power consumption, $105k Bitcoin price, 50 EH/s operating hashrate and 837 EH/s network hashrate. Illustrative Annualized Hardware Profit is for illustrative purposes only and should not be considered projections of IREN’s operating performance. Inputs are based on assumptions, including historical information, which are likely to be different in the future and users should input their own assumptions. There is no assurance that any illustrative outputs will be achieved within the timeframes presented or at all, or that mining hardware will operate at 100% uptime. The above should be read strictly in conjunction with the forward-looking statements disclaimer in this press release.

- AI Cloud Services annualized run-rate revenue for utilized GPUs as of June 30, 2025.

Reconciliation of Non-GAAP metrics

| Units | Jun 25 | May 25 | |

| Electricity charges | $’m | (17.5) | (17.1) |

| Add/(deduct) the following: | |||

| Demand response program revenue | $’m | 1.2 | 0.2 |

| Demand response program fees | $’m | (0.1) | (0.0) |

| Total net electricity costs1 |