Martin Marietta Materials (NYSE:MLM) is the second biggest producer of construction aggregates in the USA and has been severely hit by the abrupt downturn of the US construction market because of the Great Recession. However as the economy continues to grow and the construction market recovers, the company is bound to see its sales and profits more than double over the next years. Fortunately the company is trading close to its fair value and any significant correction could provide a good entry point for long-term investors.

Business Overview

Producing and selling construction aggregates is a simple business. The company extracts the materials through drilling and blasting rock, then loads and hauls it using excavators and trucks, and finally process it by crushing and screening it. Construction aggregates are used primarily for construction of highways and other infrastructure projects, in certain green initiatives, including flue gas desulphurization, and in the domestic commercial and residential construction industries. Martin Marietta has a network of approximately 300 quarries, distribution yards and plants with presence in 28 states, Canada, the Bahamas and the Caribbean Islands.

Competitive Advantages

The main difficulty in the aggregates business is getting a quarry permit. Despite the usefulness of its products, an aggregate materials quarry is usually an undesired facility in most residential areas due to the noise and dust pollution it creates and the impact it has on the local landscape. However it is this not-in-my-backyard mentality that provides the foundation of Martin Marietta's almost impenetrable competitive position.

Once a quarry is established in an area, it's almost impossible for a competitor to get a permit for a second one leaving the first-comer with a small local monopoly. And it is a well protected and isolated monopoly because it is usually highly uneconomical to transport aggregates over big distances because they are so cheap that transportation costs at some point become higher than the product's price. So unless there's an efficient water or rail transportation option, every quarry is the undisputed low-cost provider within a 45 minutes (approximately) truck driving range.

Due to the simple production process and the monopolies it enjoys in most of its facilities, Martin Marietta can easily adjust that scale of its production according to demand and thus exert some pricing power over its customers which keeps the company free cash flow positive even in tough economic times.

Market Concerns & Growth Drivers

The market's concerns about Martin Marietta are about the uncertainty around the recovery of the construction market and the infrastructure budget and spending of the Federal Government and the States.

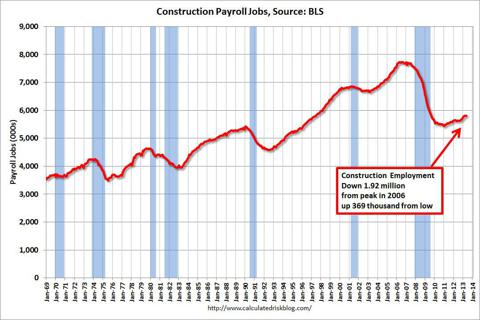

Mr. Bill McBride has an excellent post at his blog "Calculated Risk" where he sums up the opinions of the major bank analysts about the construction industry. All of them are using construction jobs as a proxy for the health of the construction industry and they come to the conclusion that the industry has bottomed and is on its way to full recovery.

(Source: www.calculatedriskblog.com)

(Source: www.calculatedriskblog.com)

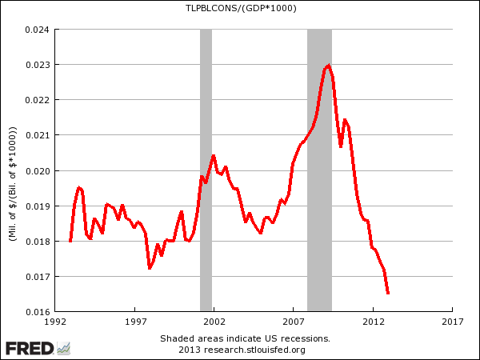

The bad news however, is that Martin Marietta's revenue is more closely tied to public infrastructure spending which is in a 20-year low in relation to GDP mostly due to budget tightening at the state level.

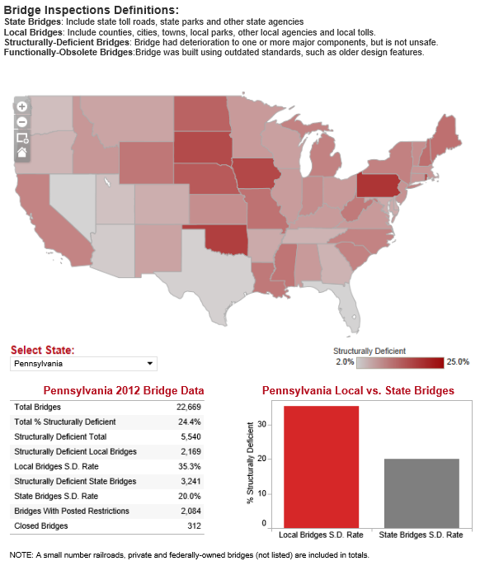

Nevertheless, since the country's roads and bridges infrastructure keeps deteriorating, the states and the Federal Government will sooner or later be forced to increase their spending for public infrastructure. And given the state of the country's roads and bridges are, this spending will probably come sooner than later.

(Source: www.governing.com

(Source: www.governing.com

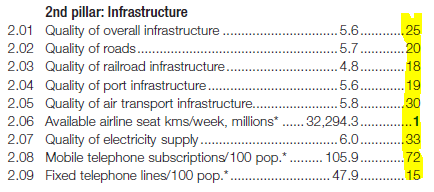

(US world infrastructure rankings according to the Global Competitiveness Report 2012-2013 by the World Economic Forum)

(US world infrastructure rankings according to the Global Competitiveness Report 2012-2013 by the World Economic Forum)

Balance Sheet and valuation

Martin Marietta's balance sheet is in very good shape given that the company's industry is just emerging from the bottom of its business cycle. The company's debt is around two-thirds of the company's equity, which is pretty low in my opinion given the business environment and the fact that Martin Marietta is in a capital intensive business.

Since we can't know at what pace infrastructure spending will increase, it would be prudent to value Martin Marietta using its average earnings to smooth out the cyclical fluctuations of its industry. In the previous decade, the company earned an average $3.18 per share. However, given the massive rebuilding that the US must do for its roads and bridges and the higher cost of energy that allows Marietta to charge higher prices (because truck transportation is more expensive than it was in the previous decade), I expect the company to earn at least twice that amount on average over the next decade or so.

That means that an investor who buys Marietta's stock at its current $100 price can expect to "earn back" at least 60% of his investment over the next decade, while he will still own Marietta's assets which are worth around $45 per share, according to Marietta's failed acquisition attempt for its major competitor Vulcan Materials (VMC).

Marietta had priced its rival at $10 million per facility, and using a similar approach, Marietta's facilities should worth around $2 billion net of debt or $45/share. As a result, the company should be worth to the rational investor no more than $105 per share; $60 for the expected earnings over the next decade plus $45 for the company's assets.

Conclusion

While Martin Marietta is a company with an excellent business model and a lot of growth potential going forward, the lack of catalysts that would unlock the company's value makes me cautious enough to avoid buying the stock at its current price. I believe that a heavy 20% to 30% discount from its $105 fair value would be a good entry point for investors with a long-term holding period in mind.

Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.