Let's talk PIMCO Total Return

PIMCO Total Return seeks maximum total return, consistent with preservation of capital and prudent investment management. The fund normally invests at least 65% of its total asset in a diversified portfolio of Fixed Income Instruments of varying maturities, which may be represented by forwards or derivatives such as options, futures contracts, or swap agreements. It invests primarily in investment-grade debt securities, but may invest up to 10% of its total assets in high yield securities rated B or higher, if unrated, determined by PIMCO to be of comparable quality. To understand how PIMCO achieves its written investment objective we have to understand what's inside Total Return Fund and I would like to first focus on the Mutual Funds' holding before moving forward and discussing its smaller brother, BOND:

- Cash & cash Equivalents 49.37%

- Fin Fut Euro$ Cme 06/15//15 +12.56%

- Irs Usd 3mls/1.50000s 03/18/15-16 Cme +12.47%

- Fin Fut Euro$ Cme 12/14/15 +8.55%

- European Monetary Union Euro -6.20%

- Cash & cash equivalents +5%

- PIMCO Funds +3.88%

- Canadian Dollar -3.17%

- Fin Fu Us 10yr Cbt 06/19/13 +3.16%

- Fin Fut Euro$ Cme 3/14/16 +2.49%

- Fin Fut Euro% Cme 9/14/15 +2.34%

- Us Treasury Note 1.625% +2.28%

Well to be quite honest Gross didn't pick up his phone to discuss his underlying holdings with me and the above captured Morningstar Top Holdings snapshot is not much of a help for either most investors or investing professionals. While Morningstar considers some of the holdings bonds, PIMCO considers them cash. We also see a negative cash position that usually represents short selling - short sale being an investment that profits when prices fall. Another huge amount of the underlying top holdings represent currency futures, interest rate swaps and several other derivatives. Such a portfolio, as described, would usually be similar to a leveraged hedge fund portfolio. However, PIMCO's total return fund is no such investment and uses derivative instruments for many years and mainly to mitigate risks and generating returns. Bill Gross uses a mix of macroeconomic forecasting and bottom-up analysis to determine interest rate, yield curve, currency, country, sector, and issue-level decisions. I know that the word derivative concerns a lot of investors, but blaming the recent underperformance on PIMCO's use of Derivatives is like blaming cameras for pornography - it would just be unfair. If Derivatives are used correctly they do not add significant risk to a portfolio, but can actually lower the overall volatility.

And here is how it works for PIMCO:

A derivative is a security whose price is dependent upon or derived from one or more underlying assets. The derivative itself is merely a contract between two or more parties. Its value is determined by fluctuations in the underlying asset. PIMCO has been using a variety of derivatives such as deployed treasury, money market, and index futures, interest rate swaps, currency forwards, options, credit default swaps and total return swaps mainly to manage risk, capitalize on market inefficiencies and improve performance. As of my understanding, most of PIMCO's derivatives are used to handle the fund's interest rate exposure and making bets on different sectors of the bond market. Primarily most of the derivatives are meant to hedge the fund's individual bond holdings and their duration. Interest rate swap holdings allow total return to pay out a fixed rate to another investor, or counterparty, and receive an adjusting rate in exchange. When entering an interest rate swap agreement the fixed rate receiver will "win" when interest rates stay or fall below the upon initiation agreed fixed rate, while the fixed rate payer will "win" when interest rates rise above the upon initiation agreed fixed rate. This being said, PIMCO will generate additional returns in a rising interest rate market and efficiently lowers its interest rate exposure and therefore duration risk. Interest rate swap can act as a proxy of bank risk and are based off LIBOR. They provide an efficient means to adjust duration and sector exposure in a portfolio (Derivatives and Alternative Investments, CFA Program Volume 6, Pearson).

Secondarily PIMCO uses derivatives to enhance the fund's overall performance/risk profile by buying credit-default swaps as insurance on some of the fund's corporate-bond holdings. Some people's ears might spike up hearing about credit default swaps, since they nearly brought down AIG and can add significant risk to an investor's portfolio - but think about the camera I mentioned earlier! By buying credit default swaps an investor buys insurance for the default event of some of their holdings or counterparty and PIMCO can significantly lower its credit risk exposure. However, in the meantime PIMCO has also participated in selling credit default swaps - a way of betting that the borrower will pay on time. Overall the usage of credit default swaps can give PIMCO more flexibility in managing the fund's overall credit risk exposure, since a credit default swap does not require a physical buy in or sell out of the actual bond. The third derivative I would like to mention are so called Eurodollar Futures. Eurodollar Futures have nothing to do with the Euro, more likely they are an efficient way of speculating on the direction of short-term interest rates. When entering into a eurodollar contract as the seller, someone bets on rising interest rates and will generate positive returns when interest rates go up, vice versa.

How does the whole thing blow up?

First of all Bill Gross bested 96% of his peers over the past 10 years and hasn't given us a single reason to leave him. The fund's derivative positions however have a significant influence on the fund's overall performance and every now and then even a mastermind blows up by placing a wrong bet. Leverage can overexpose an investor to certain risks, but PIMCO's track record and management efficiency does not leave me with any concerns right now that Bill Gross doesn't know what he is doing. Let's face the truth, Wall Street will always invent a product that can blow up and leave some investors with significant losses, I do however believe that derivatives if used wisely can add significant value to a fund's portfolio, such as my camera can shoot beautiful pictures.

So if derivatives do not concern me, what concerns me about PIMCO Total Return?

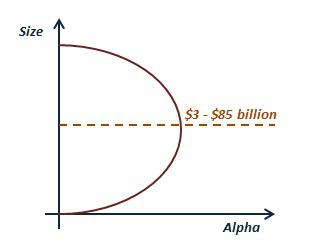

Size - size means ownership constraints, which result into a fund that might beta morph into an index. With a fund size of nearly $300 billion it is not easy for Bill Gross to operate as efficient as it might be for some smaller competitors like Ridgeworth, BlackRock, Prudential and so on. In economics, the Laffer Curve is a representation of the relationship between possible rates of taxation and the resulting levels of government revenue. It illustrates the concept of taxable income elasticity, where taxable income will change in response to changes in the rate of taxation. It postulates that no tax revenue will be raised at the extreme rates of 0% and 100% and that there must be at least one rate where tax revenue would be a non-zero maximum. By changing the x and y axis of the Laffer Curve we arrive with an entirely new Curve that illustrates the concept of return elasticity, where alpha generating will change in response to changes in strategy size.

First of all, a firm's size does not matter; it is the firm's strategy size that matters. This means that a smaller strategy can go out in the market and generate alpha all day long with their intermediate-term bond strategy being the largest asset management firm in the world. For PIMCO's Total Return strategy to generate alpha in any given position it takes a much larger investment than most of its Peer group members. In easy words, you just can't buy enough cheap bonds to find alpha opportunities and will therefore be pressured into other available, but more expensive issues such as government bonds. On the other hand a firm that is too small will also face issues of finding and generating alpha opportunities. The fixed income market is way more competitive than the equity market. An investor has to understand that fixed income trading is not performed as equity trading and that you actually have to pick up the phone to buy a bond. If your strategy size, and therefore investment stake is too small, it will be too insignificant to allow for attractive pricing.

Scared of derivatives and size? Have a look at the ETF:

Compared to its bigger brother PIMCO Total Return Mutual Fund, BOND, trades at a size of "only" $4.41 billion. Since cost matters when it comes to investment decisions the ETF also seems very attractive at an expense ratio of 0.55% compared to PTTAX PIMCO Total Return A share trading at an expense of 0.85% for retail investors. Looking at performance the ETF has significantly outperformed its bigger brother in up and downtrend markets which has been achieved through more effective management due to its significantly smaller size (Curve introduced above). While Total Return mutual fund can and currently uses a great amount of derivatives, BOND ETF gained exemptive relief before the SEC lifted the moratorium on derivatives for actively managed ETFs. However, I do believe that the derivatives introduced and used by PIMCO play an essential role in Total Returns strategy and that investing in either the mutual fund or the ETF should not be based solely on the discussion on whether derivatives do harm or benefit an investor. I also would like to refer to my previous article "The risk of passive bond investing" for educational purposes. I highly recommend to thoroughly analyze each investment before making an investment decision.

As much as I believe in my theory, Bill Gross has proven me wrong by generating alpha and alpha and alpha time over time. I do not believe that PIMCO will blow up due its use of derivatives or will end up being an index tracker. I do however believe that PIMCO's Total Return Strategy will underperform its smaller competitors.

*Newly created actively managed ETFs are allowed to implement derivatives into the ETFs' structure.

Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.