After crossing the $1 billion mark for the first time in 2006, the voice-recognition market has grown exponentially in the last few years. The global industry stood at $38.4 billion in 2010 which equates to an annual growth of more than 100 percent. Within the industry, Nuance Communications (NUAN), a pioneer company, was able to capture a large chunk of this historic growth. Over the years, the company was able to register an annual growth rate of 23.5 percent in its revenue due to the increased adoption of technology by the healthcare and consumer segment.

The company is working for Apple's Siri and Samsung's S-Voice and has been tipped to be one of the fastest growing companies in the coming years. It is this high potential for growth that has attracted the attention of the highly regarded equity investor, Carl Icahn. Recently, Icahn has shifted from being a passive investor in the company to being an active investor and increased his stake to 16.9 percent. The occurrence of these recent events and the high potential for growth in the company brought my attention to Nuance, and in this article, I will analyze whether the company offers an attractive investment opportunity.

A History of High Growth

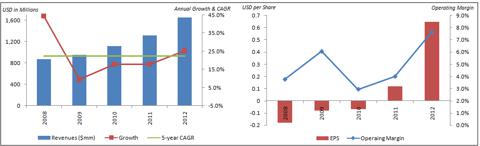

Nuance expanded its technology portfolio and enhanced its product offerings through various acquisitions. This has enabled the company to grow its revenues at an exponential pace over the last few years. Since 2008, the company's revenues have grown at a 5 year CAGR of 22.4 percent and its earnings per share has improved significantly from a net loss of $0.18 per share in 2008 to net earnings of $0.65 per share in 2012.

Source: Company Financial Statements

In the last five years, 2008 was the most fruitful year for the company in terms of revenue growth. Revenues grew by more than 44 percent due to the 5 acquisitions undertaken by Nuance during the year. Overall, the company has conducted more than 25 acquisitions since September 2008, with the largest number of acquisitions being made in the current fiscal year.

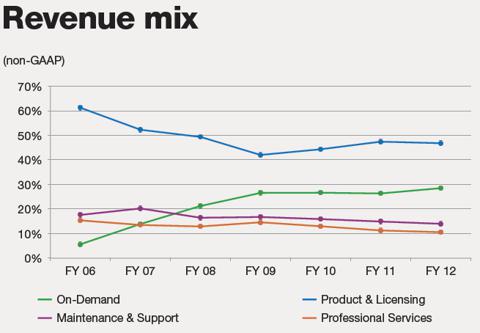

Source: Investor Day Presentation

The company's margins and earnings have improved significantly over the years. The revenue growth along with a better product mix has enabled the company to improve its performance and profitability. The company has been able to increase its revenue per head count in double digits which also contributed to the improvement in its margins. In terms of product mix, a shift towards on-demand and mobile based technology has greatly helped the company in improving its margins as these products and services are sold at high margins.

Source: Company Financial Statements

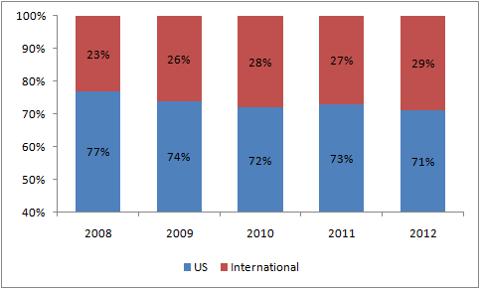

The frequent acquisitions undertaken by the company has enabled it to improve its geographic distribution of revenues. The international segment contributed approximately 29 percent of the total revenues in 2012 as compared to 23 percent in 2008. This shift significantly reduces the risk of Nuance as a wider geographic outreach makes the company less vulnerable to a single market/economy. This was also important as the increasing competition in the domestic market is making achieving further growth a bit more difficult. With an expanded geographic outreach, the company will now be able to find and exploit the growth opportunities in other markets as well.

Segment Analysis

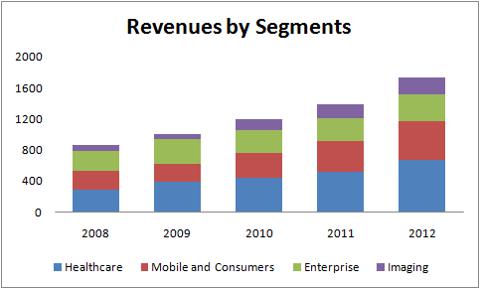

The company operates under four segments; Healthcare, Mobile and Consumers, Enterprise and Imaging. The healthcare segment is the largest for the company contributing approximately 38.5 percent of the company's total revenues. The use of speech recognition technology is increasing in this particular sector due to the new health care regulations which are focused on reducing health care costs. To comply in letter and in spirit with the new regulations, hospitals and practitioners need to adopt this technology in order to avoid penalties and be eligible for receiving compensation from the government to those who have successfully adopted the Electronic Health Record within a stated time frame.

Healthcare revenues have increased at a CAGR of 23.3 percent over the last 5 years, reaching $669.4 million in 2012. Healthcare was the most profitable segment of the company in 2012, operating at a profit margin of 47 percent. I expect this segment to continue to growing at its current pace, at least for the next two years after which the growth will slow down when the time frame given by the regulators expires.

Source: Company Financial Statements

Mobile and Consumer is the second largest segment of the company under which it provides voice recognition applications for cars, smart phones and other consumer devices. This segment has experienced a growth of more than 20 percent in its revenues primarily due to the exponential growth in the use of smart phones and other digital devices. The company currently provides software services to Apple and Samsung's customers for voice enabled functions. The company also provides services to leading car manufacturers such as Audi and BMW. Mobile and consumer segment is the second most profitable segment for the company and generated profit margin of 44.8 percent in 2012.

Under its enterprise segment, the company provides call center solutions to businesses. It saw an exponential growth in its revenues during the earlier years as businesses were adopting the voice recognition technology in an attempt to cut their costs. However, since then the growth has slowed down significantly. The segment contributes approximately 19 percent of the company's total revenues and has achieved a CAGR of 6.7 percent in its revenues over the last 5 years. Due to the rising market competition and the slowing demand, this segment currently operates at a margin of 27.3 percent, which is the lowest as compared to other segments of the company.

Imaging has been the fastest growing segment for the company. Under this segment, the company provides print management solutions. The segment's revenue grew at a CAGR of 30 percent over the last 5 years. The fastest growth was achieved in 2010 (91.2%) due to a series of successful acquisitions. This segment contributed nearly 13.1 percent to the company's total revenues in 2012, with a profit margin of 40.1 percent.

The Future Outlook

In its most recent quarter, the company has achieved a growth of 8.8 percent in its revenues as compared to the last year. However, the company was unable to translate this growth in its bottom line and thus, reported a net loss of $0.11 per share as compared to a net profit of $0.25 per share in the last year. The slower growth and declining profitability has prompted the company to cut its annual earnings outlook.

The sole reason for a decline in the company's revenues during the recent quarter was a decline in the revenues of its Mobile and Consumer segment by 16.2 percent. The reason was that some of the company's mobile customers have delayed renewing their contracts with the company as it continued to charge higher prices for its products. The management also expects the company's revenues and margins experience a decline as it transitions from its current lump sum model to a cloud based subscription model. Despite all the negative factors swirling around Nuance, I believe the company will register growth in the medium and long term on the basis of the growing demand for voice recognition.

The global voice recognition market is expected to grow at a CAGR of 8.8 percent, reaching $58.4 billion by 2015. This means that the industry will provide Nuance a great opportunity for growth in the upcoming years. Amongst the various segments, I expect Mobile and consumer segment to register the highest growth in the long run. With the low penetration of the voice recognition technology, there is ample room for the company to achieve growth in the future. However, the company is bound to face increased competition and loss of some key customers, as the big technology companies, such as Apple and Google, are working on developing their own voice recognition softwares. Despite all this, I believe that the expanding global market for voice recognition provides Nuance a substantial opportunity to grow in the foreseeable future.

Another factor that may cause a hindrance in the growth of voice recognition and related technology is the difficulty of providing integrated services and solutions to customers over multiple screens that an average individual uses in his/ her everyday life. The problem arises from the diversity of hardware and performance specifications, thus making it difficult to develop a single application that can work on all devices. However, Nuance seems to be working on addressing this problem. The company's new project, named Wintermute, will enable the company to provide cloud based personal assistance solutions across various platforms. Although this technology is in the initial stages of its development, its launch will bring a revolution in the industry and provide substantial growth to the company.

Despite the slow growth projections for the industry as a whole, I think Nuance will be able to make an exception and achieve high growth in the years to come, either through the introduction of the new technology or through its ever increasing international presence.

Conclusion

With the increasing adoption of the voice recognition technology across all platforms and various industries, Nuance will be able to register high growth in the upcoming years. Also, some problems need to be resolved, such as multi screen integration. Once these problems are clear, the industry will start experiencing exponential growth once again and Nuance, being the lead researcher in the industry, will be able to enjoy the early mover advantage. The error rate in the company's voice recognition software has decreased by 18 percent year-on-year which will enable businesses to make a seamlessly transition to this technology as a means to control their costs and improve efficiency.

To sum up, I strongly believe that Carl Icahn's active stake in the company will set a support level for the company's stock price and potentially reduce its downside risk. Based on all the aforementioned factors, I think the company provides a valuable investment opportunity and thus, I will give a buy recommendation for Nuance Communications.

Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.