Editors' Note: This article covers stocks trading at less than $1 per share and/or with less than a $100 million market cap. Please be aware of the risks associated with these stocks.

This article is part of a series that provides an ongoing analysis of the changes made to Carl Icahn's US stock portfolio on a quarterly basis. It is based on Icahn's regulatory 13F Form filed on 02/14/2014. Please visit our Tracking Carl Icahn's Portfolio series to get an idea of his investment philosophy and our previous update highlighting the fund's moves during Q3 2013.

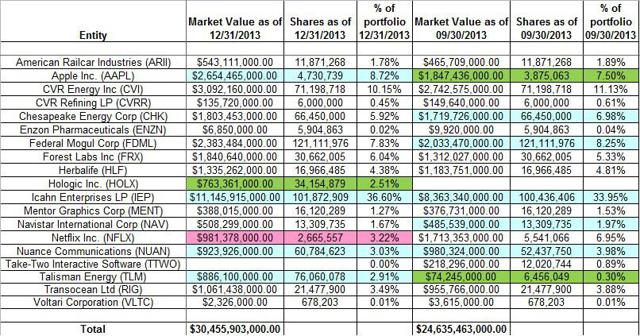

This quarter, Icahn's US long portfolio went up from $24.64B to $30.46B, an increase of 24%. The portfolio increased 14.50% last quarter as well. The number of holdings in the portfolio remained steady at 18: Take-Two Interactive Software position was eliminated and Hologic Inc. was newly added during the quarter. The largest holding is Icahn Enterprises (NASDAQ:IEP) with an allocation of 36.60% of the US long portfolio. It is followed by CVR Energy (CVI) with an allocation of 10.15%. It is a very concentrated portfolio with the largest five positions accounting for just over 69% of the entire portfolio.

Carl Icahn is best known for building sizable stakes in businesses and then pushing for changes to increase shareholder value. To learn more about his investing style and philosophy check-out "King Icahn: The Biography of a Renegade Capitalist".

Stake Disposals:

Take-Two Interactive Software (TTWO): TTWO was a very small 0.89% of the US long portfolio. It was disposed of this quarter as TTWO agreed to purchase the shares from Icahn at $16.93 per share on 11/26/2013. Icahn controlled 12.9% of the business as of last quarter - it was an activist stake that was first established in 2009 but Icahn has moved on. The stock currently trades at $19.11.

New Stakes:

Hologic Incorporated (HOLX): HOLX is a new 2.51% of the US long portfolio activist stake established this quarter at around $21 per share. Icahn currently has a 12.5% stake in the business and have nominated two representatives to the board. In early December, a new CEO (Stephen MacMillan formerly of Stryker) was appointed stemming hopes that Icahn might immediately push for the sale of the business. The stock currently trades at $21.25.

Stake Decreases:

Netflix Inc. (NFLX): NFLX is 3.22% of the US long portfolio position first purchased in Q3 2012 at prices between $53 and $85. The stake was increased by ~300% in Q4 2012 in the 50s price-range. This quarter saw an about-turn as more than half the position was disposed of at prices between $304 and $342. The stock currently trades at around $435. Icahn is harvesting large gains from the position. It was an activist stake and NFLX adopted a poison-pill provision to defend itself. Icahn backed-off as the company also started posting strong financial results.

Stake Increases:

Icahn Enterprises: IEP is a very long-term position that has seen consistent buying over the years. In the last three quarters, about ~4M shares were purchased. Last year the position size increased from ~79M shares to ~98M shares and since then the purchases have slowed. Most of that buying happened in Q1 2012 at prices between $36.50 and $42.50. The stock currently trades at $112.

Apple Inc. (AAPL): On 08/13/2013, Icahn revealed a "large position in APPLE" through a Twitter tweet. AAPL price-per-share spiked from $475 to close that day at $489.57. The original stake was increased by ~22% this quarter. Since the end of the quarter, another $1B worth of AAPL stock was purchased. The recent stake increases happened at an average cost-basis of around $500. The stock currently trades at $544. Icahn had pushed Apple to do a $50B buyback but earlier this month the call was abandoned - the campaign was partly successful as Apple is on track to buyback $32B worth of stock this year.

Talisman Energy (TLM): TLM was a new 0.30% of the US long portfolio position established last quarter. This quarter, the stake was increased by over ten-times to a 2.91% of the US long portfolio position at an average cost-basis of around $11.79. The stock currently trades below that price range at $10.61. Icahn is very bullish on Talisman Energy and has already succeeded in nominating two new board members.

Nuance Communications (NUAN): NUAN is 3.03% of the US long portfolio stake established in Q1 2013 at prices between $18 and $25. The position was increased by roughly two-thirds last quarter at prices between $18.31 and $20. The stock currently trades below the low end of those ranges at $14.81. Icahn's ownership is currently at over 17% of the company (~60M shares). Nuance adopted a poison-pill provision that allowed shareholders to purchase additional shares, if any one shareholder acquired more than 20% of the outstanding shares. On October 8, 2013 Nuance yielded somewhat by appointing two new Icahn recommended directors, thus avoiding a proxy fight, at least for the time being. For investors attempting to follow Icahn, Nuance is a very good option to consider.

The rest of the positions were kept steady:

CVR Energy Inc.: CVI is a huge 10.15% of the US long portfolio position first purchased in Q4 2011. The bulk of the current position (71.2M shares: 80% of the whole business) was purchased through a $35 per share tender offer. The stock currently trades at $37.66: it has been a roller-coaster ride with the stock reaching as high as $72.32 in May but has since been in an extended downtrend. Two MLPs were carved out since the tender: CVR Refining (CVRR) the refining portion and CVR Partners (UAN) the nitrogen fertilizer unit. CVR Energy owns 71% of CVR Refining and 53% of CVR Partners.

Chesapeake Energy (CHK): CHK was first purchased in 2010 but was quickly sold. The bulk of the current stake was purchased in Q2 2012 at prices between $14.50 and $23. The stock currently trades at $25.14. Icahn successfully engaged in a proxy fight alongside Southeastern Asset Management that led to the eventual departure of the CEO. Icahn increased the position by another ~10% last quarter, indicating a clear bullish bias. He currently owns around 10% of Chesapeake (66.5M shares).

Federal-Mogul (FDML): FDML is a very long-term stake first purchased in 2000. It went through an asbestos-claim related bankruptcy and emerged in 2007 with Icahn owning over 75% of the outstanding shares, as debt he owned got converted into equity. The position was increased marginally in the last two quarters of 2011 at prices between $13 and $23. Last quarter, his share count increased by ~58% (over 44M shares) - the new shares were purchased by exercising FDML's rights offering (In May, Federal-Mogul launched a $500 million rights offering whereby shareholders could purchase an additional share for each one they currently held) at $9.78 per share - Icahn got 44M of the 51M shares purchased in the offering. The move paid off almost immediately as the stock currently trades at around $16.91. Icahn now controls just over 80% of the business. It is Icahn's fourth-largest position at 7.83% of the US long portfolio.

Navistar International (NAV): NAV is a relatively small 1.97% of the US long portfolio position that was increased by ~12% last quarter at prices between $27.50 and $40. The stock currently trades at $35.74. Icahn controls around 16% of the business.

Forest Labs (FRX): FRX is 6.04% of the US long portfolio activist stake first purchased in Q2 2011 at prices between $32.50 and $40. The stock currently trades well outside that range at $71.39. Over the years, the position has been increased by around 10%. Icahn engaged in two proxy battles in the interim and prepared for a third one last year. A deal with the company in June 2013 avoided that and an Icahn representative was appointed to the company's board as the eleventh member. The activism is finally starting to yield results: the CEO was replaced in October and in December the company announced an accelerated repurchase program to be funded with a $1B debt offering and also announced plans to cut $500M in costs by 2016. Icahn holds 11.5% of the outstanding shares of FRX. The stock has already returned ~19% YTD and that is following a stellar 72% return last year.

CVR Refining LP : CVRR is a small 0.45% of the US long portfolio position established in Q1 2013 as a result of the spin-off (carve-out) of CVR Refining from CVR Energy. The position was increased by 50% in Q2 2013 at prices between $28 and $35. The stock currently trades well below that range at $20.97.

Herbalife (HLF): HLF is 4.38% of the US long portfolio stake first purchased in Q1 2013 in the high-30s price range. The position was marginally increased in Q2 2013 to almost 17M shares. The stock currently trades at $66.39. Bill Ackman is on the other side of this trade - short 20M shares since Q4 2012.

Transocean Ltd. (RIG): RIG is a small ~3.49% of the US long portfolio stake first purchased in Q4 2012 at prices between $44.20 and $49.50. The position was increased by ~250% in Q1 2013 at prices between $44 and $60. The stock currently trades below those ranges at around $43.13.

Voltari Corporation (VLTC), American Railcar Inds. (ARII), Enzon Pharmaceuticals (OTC:ENZN), and Mentor Graphics (MENT): These are relatively small (less than 2% of the US long portfolio) positions that were held steady this quarter. Although the stakes are small on a relative basis, the percentages owned of the businesses concerned are very significant. Icahn owns 14%, 55.60%, 13.7%, 14.2%, and 12.9% of VLTC, ARII, ENZN, and MENT respectively.

The spreadsheet below highlights changes to Icahn's US stock holdings in Q4 2013:

Disclosure: I am long NUAN. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.