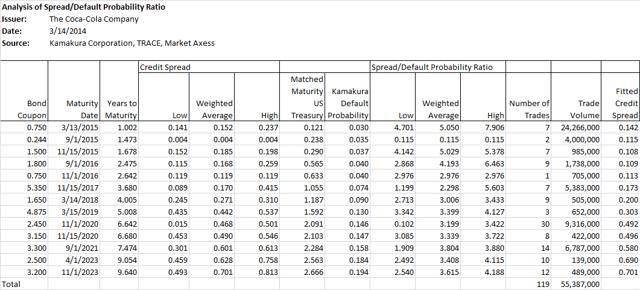

The Coca-Cola Company (NYSE:KO) ranks third on the list of the world's most valuable brand names, after Apple Inc. (AAPL) and Microsoft (MSFT), according to a recent Forbes study. Because of its iconic retail brand, the company is widely held by retail investors and gets strongly positive reviews from analysts. Today's study incorporates the Coca-Cola Company bond price data as of March 14, 2014 to get an institutional, bond market view of the company. We analyze the potential risk and return to bondholders of the Coca-Cola Company using 119 trades on 13 bond issues and a trading volume of $55.4 million in today's analysis.

Conclusion: We believe the vast majority of analysts would judge the Coca-Cola Company to be investment grade by the new Dodd-Frank definition. We have repeatedly seen in this series of notes that many iconic consumer brand companies have very low credit spreads but default probabilities that are just moderately below average. The same is true in the case of the Coca-Cola Company. Bond investors have been kind to the Coca-Cola Company, bidding up bond prices to the point where the credit spread to default probability ratio (a range between 3 and 4) is well below the 10.37 median for large trades on March 14. For investors who care only about risk and return, instead of the brand name, 278 different bond issues on March 14, 2014 offered a better reward to risk ratio than the most attractive bond issued by the Coca-Cola Company bond.

The Analysis

Institutional investors around the world are required to prove to their audit committees, senior management, and regulators that their investments are in fact "investment grade." For many investors, "investment grade" is an internal definition; for many banks and insurance companies, "investment grade" is also defined by regulators. We consider whether or not a reasonable U.S. bank investor would judge the Coca-Cola Company to be "investment grade" under the June 13, 2012 rules mandated by the Dodd-Frank Act of 2010. The default probabilities used are described in detail in the daily default probability analysis posted by Kamakura Corporation. The full text of the Dodd-Frank legislation as it concerns the definition of "investment grade" is summarized at the end of our

analysis of Citigroup (C) bonds published December 9, 2013.Assuming the recovery rate in the event of default would be the same on all bond issues of the same issuer, a sophisticated investor who has moved beyond legacy ratings seeks to maximize revenue per basis point of default risk from each incremental investment, subject to risk limits on macro-factor exposure on a fully default-adjusted basis. In this note, we also analyze the maturities where the credit spread/default probability ratio is highest for The Coca-Cola Company.

Term Structure of Default Probabilities

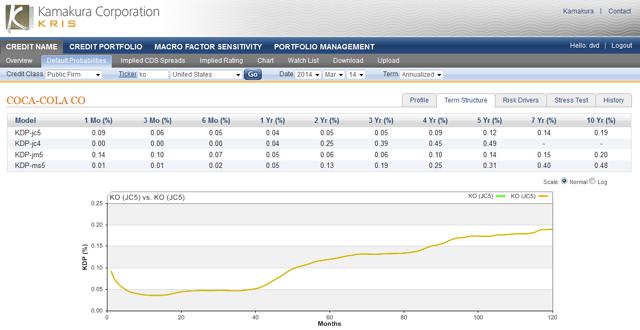

Maximizing the ratio of credit spread to matched-maturity default probabilities requires that default probabilities be available at a wide range of maturities. The graph below shows the current default probabilities for the Coca-Cola Company ranging from one month to 10 years on an annualized basis. For maturities longer than ten years, we assume that the ten year default probability is a good estimate of default risk. The current default probabilities range from 0.09% at one month to 0.04% at 1 year and 0.19% at ten years.

We also explain the source and methodology for the default probabilities below.

Summary of Recent Bond Trading Activity

The National Association of Securities Dealers launched the TRACE (Trade Reporting and Compliance Engine) in July 2002 in order to increase price transparency in the U.S. corporate debt market. The system captures information on secondary market transactions in publicly traded securities (investment grade, high yield and convertible corporate debt) representing all over-the-counter market activity in these bonds. We used all of the 13 bond issues mentioned above in this analysis.

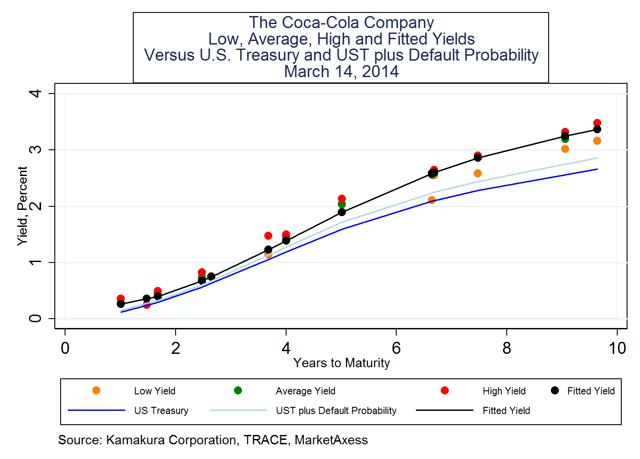

The graph below shows 6 different yield "curves" that are relevant to a risk and return analysis of the Coca-Cola Company bonds. These curves reflect the noise in the TRACE data, as some of the trades are small odd-lot trades. The lowest curve, in dark blue, is the yield to maturity on U.S. Treasury bonds (TLT) (TBT), interpolated from the Federal Reserve H15 statistical release for that day, which exactly matches the maturity of the traded bonds of the Coca-Cola Company. The next curve, in the lighter blue, shows the yields that would prevail if investors shared the default probability views outlined above, assumed that recovery in the event of default would be zero, and demanded no liquidity premium above and beyond the default-adjusted risk-free yield. The orange dots graph the lowest yields reported by TRACE on that day on the Coca-Cola Company bonds. The green dots display the trade-weighted average yield reported by TRACE on the same day. The red dots show the maximum yield in each of the Coca-Cola Company issues recorded by TRACE. The black dots and connecting black line show the yield consistent with the best fitting trade-weighted credit spread explained below.

The graph shows a narrow but generally increasing "liquidity premium" as maturity lengthens for the bonds of the Coca-Cola Company. We explore this premium in detail below.

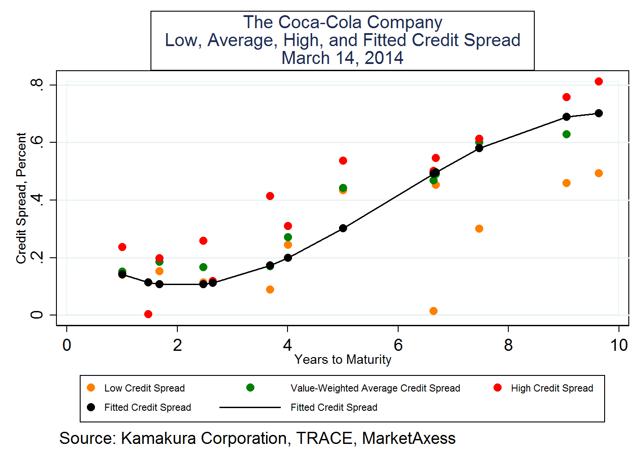

The high, low and average credit spreads at each maturity are graphed below for the Coca-Cola Company. We have done nothing to smooth the data reported by TRACE, which includes both large lot and small lot bond trades. For the reader's convenience, we fitted a cubic polynomial (in black) that explains the trade-weighted average spread as a trade-weighted function of years to maturity.

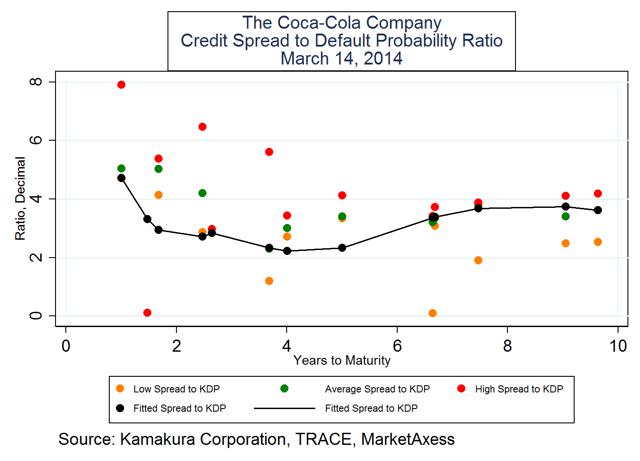

Using default probabilities in addition to credit spreads, we can analyze the number of basis points of credit spread per basis point of default risk at each maturity. For the Coca-Cola Company, the credit spread to default probability ratio generally ranges from about 2 times to 5 times for maturities of 4 years and under. For the longer maturities, the credit spread to default probability ratio falls in a range from 3 to 4 times.

The credit spread to default probability ratios are shown in graphic form below for the Coca-Cola Company.

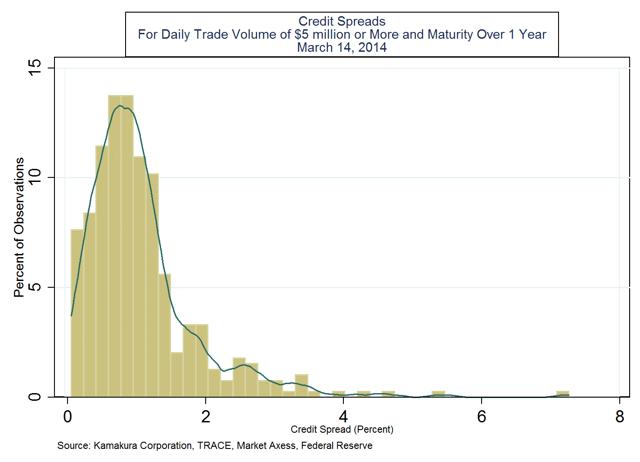

Are these reward to risk ratios "normal"? Are they above or below average? The best way to answer that question is to compare them to the credit spread to default probability ratios for all fixed rate non-call senior debt issues with trading volume of more than $5 million and a maturity of at least one year on March 14. The distribution of the credit spreads on the 393 traded bonds that met these criteria on March 14 is first plotted in this histogram (only spreads of less than 8.00% are graphed):

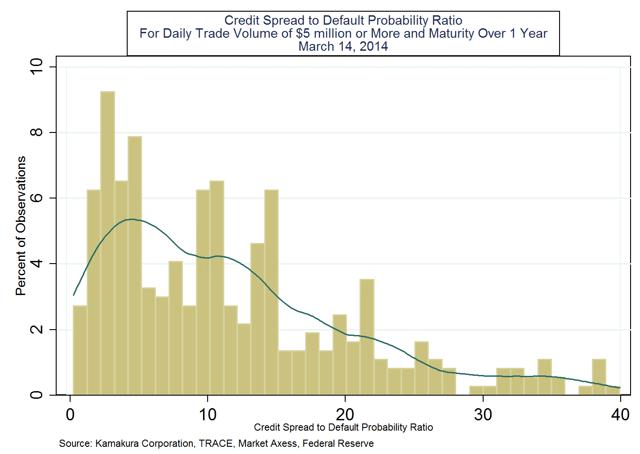

The median credit spread for all 393 trades was 0.89%. The average credit spread was 1.07%. The next graph shows the wide dispersion of the credit spread to default probability ratios on those 393 March 14 trades (only ratios of 40 or less are graphed):

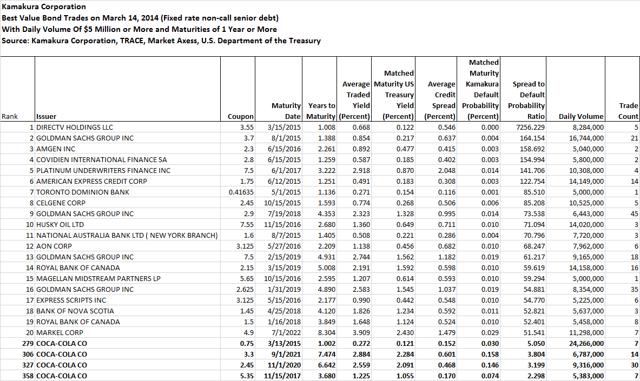

The median credit spread to default probability ratio on those 393 trades was 10.37. A total of 278 out of 393 large trades on March 14 had better credit spread to default probability ratios than the best ratio for any of the Coca-Cola Company bonds which traded at least $5 million in volume. Here are the 20 "best trades" done March 14, 2014 that had the highest ratios of credit spread to default probability. We have also reproduced the credit spread to default probability ratios for bond trades over $5 million in volume for the Coca-Cola Company. The Coca-Cola Company bonds ranked 279th through 378th of the 393 large trades on March 14.

Credit Default Swap Analysis

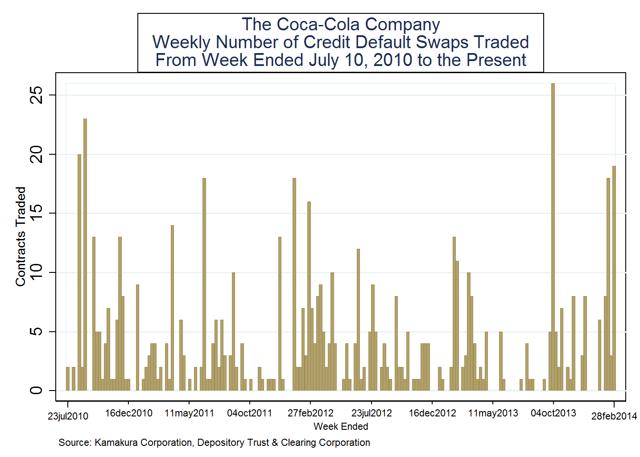

For the week ended March 7, 2014 (the most recent week for which data is available), the Depository Trust & Clearing Corporation reported there were no trades involving the Coca-Cola Company. The weekly number of credit default swap trades on the Coca-Cola Company since the DTCC began publicizing weekly trade volume is shown here:

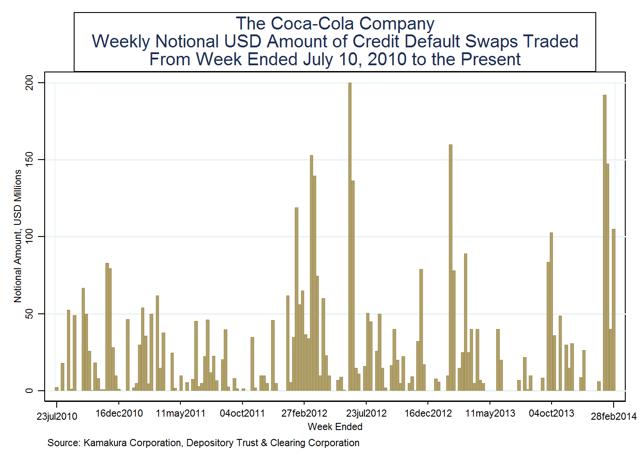

The notional principal of credit default swap trading on the Coca-Cola Company over the same period is shown in this graph:

Additional Analysis

On a cumulative basis, the default probabilities for the Coca-Cola Company range from 0.04% at 1 year to 1.89% at 10 years. We give the relative rankings of the company's default probabilities below.

Over the last decade, the 1 year and 5 year annualized default probabilities for the Coca-Cola Company have been consistently below 0.10%, even through the credit crisis. The exception is in recent months, because the Coca-Cola Company's 5 year annualized default probabilities have been moving up steadily to near 0.15%. The one year default probability has risen from effectively zero to 0.02%.

As explained earlier in this note, the firm's default probabilities are estimated based on a rich combination of financial ratios, equity market inputs, and macro-economic factors. Over a long period of time, macro-economic factors drive the financial ratios and equity market inputs as well. If we link macro factors to the fitted default probabilities over time, we can derive the net impact of macro factors on the firm, including both their direct impact through the default probability formula and their indirect impact via changes in financial ratios and equity market inputs. The net impact of macro-economic factors driving the historical movements in the default probabilities of the Coca-Cola Company have been derived using historical data beginning in January 1990. A key assumption of such analysis, like any econometric time series study, is that the business risks of the firm being studied are relatively unchanged during this period. With that caveat, the historical analysis shows that the Coca-Cola Company default risk responds to changes in 5 risk factors among the 28 world-wide macro factors used by the Federal Reserve in its 2014 Comprehensive Capital Assessment and Review stress testing program. These macro factors explain 53.2% of the variation in the default probability of the Coca-Cola Company. The remaining variation is the estimated idiosyncratic credit risk of the firm.

The Coca-Cola Company can be compared with its peers in the same industry sector, as defined by Morgan Stanley and reported by Compustat. For the U.S. "food, beverage and tobacco" sector, the Coca-Cola Company has the following percentile ranking for its default probabilities among its 125 peers at these maturities:

1 month 73rd percentile

1 year 54th percentile

3 years 38th percentile

5 years 28th percentile

10 years 27th percentile

For the longer time horizons, the Coca-Cola Company default probabilities are in the safer half of the peer group. Note that the default risk of the firm is strictly statistical. The brand name of the firm and the love consumers may have for the product has nothing to do with the default probability except for the impact of the brand name on profitability and cash flow.

Comparison with Legacy Ratings

Taking still another view, the actual and statistically predicted credit ratings for the Coca-Cola Company both show a rating in the "investment grade" territory. The statistically predicted rating is 4 notches below the legacy rating, those of Moody's and Standard & Poor's. The legacy credit ratings of the Coca-Cola Company have changed only once in the last decade.

Conclusions

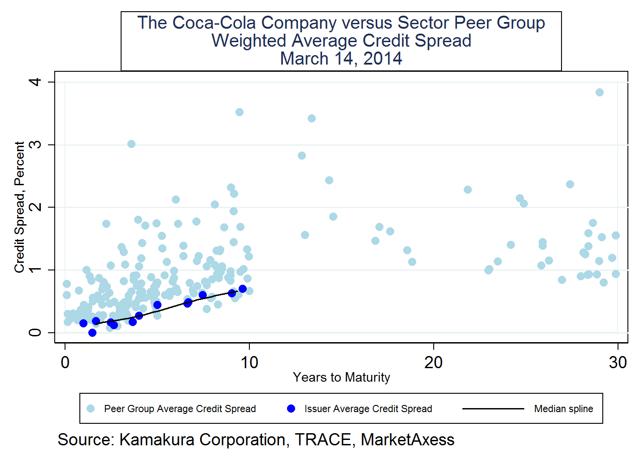

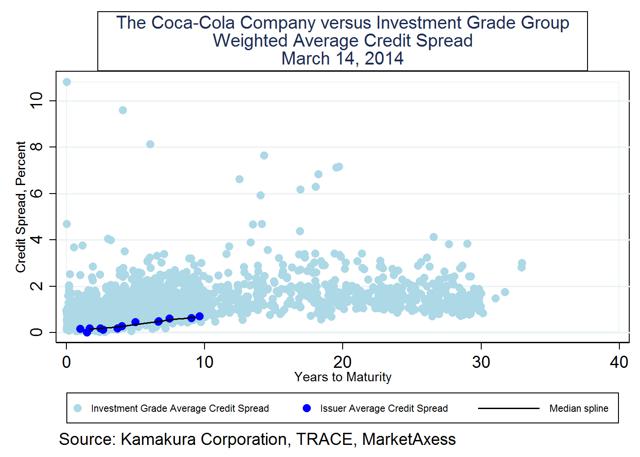

Before reaching a final conclusion about the "investment grade" status of the Coca-Cola Company, we look at more market data. First, we look at the Coca-Cola Company credit spreads versus credit spreads on every bond in the "consumer products" sector that traded on March 14:

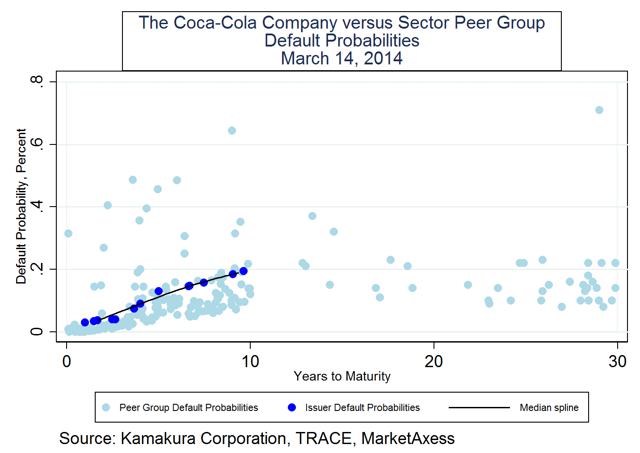

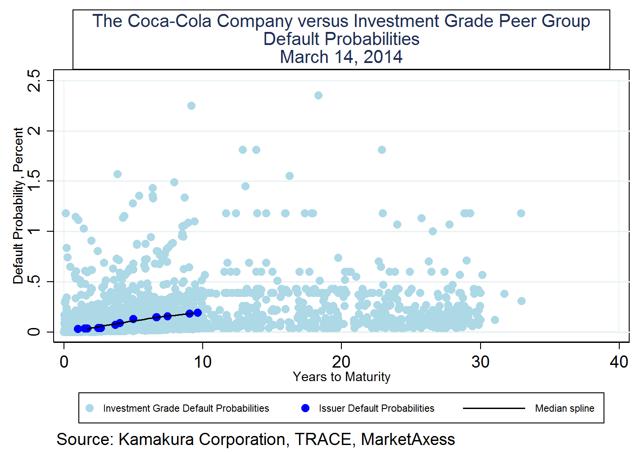

The Coca-Cola Company credit spreads were near the lower end of the range for the peer group. We now look at the matched maturity default probabilities on those traded bonds for both the Coca-Cola Company and the peer group:

Consistent with the percentile rankings above, the default probabilities for the Coca-Cola Company are above the average of the industry peer group. We note that the bonds trading heavily are generally a much better group of credits than the industry in aggregate. We now turn to the legacy "investment grade" peers. First we compare traded credit spreads on March 14, 2014:

Again, the Coca-Cola Company credit spreads are near the bottom of the investment grade peer group range. Investment grade default probabilities on a matched maturity basis for the bonds traded on March 14 are shown in this graph:

Again the default probabilities for the Coca-Cola Company rank at or slightly below the median for the investment grade peer group.

We believe the vast majority of analysts would judge the Coca-Cola Company to be investment grade by the new Dodd-Frank definition. We have repeatedly seen in this series of notes that many iconic consumer brand companies have very low credit spreads but default probabilities that are just moderately below average. The same is true in the case of the Coca-Cola Company. Bond investors have been kind to the Coca-Cola Company, bidding up bond prices to the point where the credit spread to default probability ratio (a range between 3 and 4) is well below the 10.37 median for large trades on March 14. For investors who care only about risk and return, instead of the brand name, 278 different bond issues on March 14, 2014 offered a better reward to risk ratio than the most attractive bond issued by the Coca-Cola Company bond.

Author's Note

Regular readers of these notes are aware that we generally do not list the major news headlines relevant to the firm in question. We believe that other authors on Seeking Alpha, Yahoo, at The New York Times, The Financial Times, and the Wall Street Journal do a fine job of this. Our omission of those headlines is intentional. Similarly, to argue that a specific news event is more important than all other news events in the outlook for the firm is something we again believe is inappropriate for this author. Our focus is on current bond prices, credit spreads, and default probabilities, key statistics that we feel are critical for both fixed income and equity investors.

Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: The Kamakura Corporation has business relationships with a number of organizations mentioned in the article.