The Federal Reserve's QE3 is targeted to end in October. Many wonder how the end of the program will impact U.S. stocks. We argue it will have little impact. Of course, we expect greater volatility during that period but it should be short-term. In addition, many investors argue a four trillion dollar balance sheet is excessive. We argue that the quantitative easing policy may have large negative repercussions in the next several years but not in the short-term.

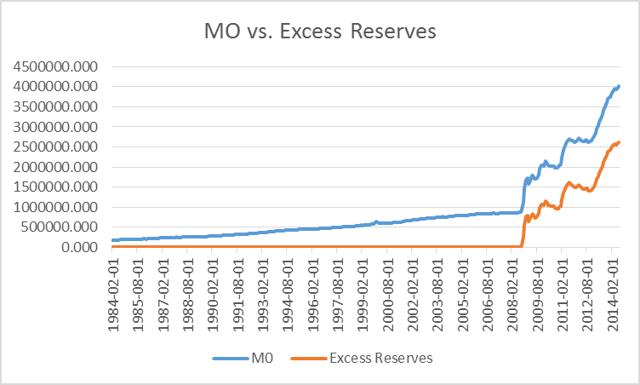

Let us begin by taking a look at some data from the Fed's website. The first figure is a time series of the monetary base and excess reserves banks held at the Fed from 1984 to 2014.

It can be seen from the figure as the monetary base started to grow substantially in 2008 the amount of excess reserves banks held at the Fed grew at the same rate. Prior to 2008 excess reserves stayed flat at almost zero. The correlation between excess reserves and the monetary base from 2008 to today is 0.996.

What does this mean? It means the Fed is creating currency and buying assets, but the currency is ending up back at the Fed not in the hands of the public. In other words, the money is not going anywhere. It goes out of the Fed and then comes right back in.

In addition, prior to 2008 the monetary base was close to 900 billion dollars. If one subtracts the current non-seasonally adjusted monetary base, 4 trillion, from the non-seasonally adjusted excess reserves, 2.6 trillion, you get 1.4 trillion dollars. The difference between 1,400 and 900 billion is 500 billion. Therefore, in reality the monetary base has only increased by 500 billion dollars in the last six years.

Moreover, we calculated the growth in money stock, M2, over a six year period. The growth in M2 from 2008 to 2014 is 38%. The growth in M2 from 1996 to 2002 was 45%. The growth rate in M2 from 1971 to 1977 was 75% the maximum six year growth rate using data starting from 1960. The growth in money supply has not grown at an unprecedented rate as many argue it has.

Therefore, people who criticize the Fed for expanding its balance sheet to over four trillion dollars should restate their critique. Yes, the balance sheet has expanded but money growth has not. Why does the Fed create money just to be stored at the Fed? We are not sure. One guess is the Fed wants to do everything in its power to stave off deflation. They do not want to repeat the Great Depression. Therefore, telling global markets that they are expanding their balance sheet at an unprecedented rate signals to the market they will fight deflation at all costs. Therefore, the market believes it and there is no deflation. But in reality the Fed is growing money supply at normal rates as shown above.

We are not saying the Fed policy does not deserve critique. Keeping interest rates so low for so long can have a distortionary impact on prices across all asset classes. The question is when does Fed policy have an adverse impact on the U.S. stock market?

We argue not in the short-term as many are expecting. First, as argued above, monetary growth has not expanded outrageously. Second, the Fed is ending QE3. However, in not so transparent words they will still expand the balance sheet by reinvesting bond proceeds back into assets. The bonds pay back interest and principal when it matures. When bond mature the assets on the balance sheet naturally decline. By reinvesting any principal payments the Fed is maintaining the size of the balance sheet at its current level. In addition, typically interest payments are used to pay off expenses and the bulk is returned to the Treasury. The Fed has stated it will reinvest the interest, thereby adding to its balance sheet. In other words, the Fed is creating a QE4 but not publicly via the media.

To summarize we believe the end of QE3 will not create a 30% market correction because, one the reinvestment of interest and principal by the Fed and two, because QE is not linked to growth in money stock.

We do believe that the Fed's policy may create problems for the U.S. stock market down the road. The reason is that there is 2.6 trillion dollars of excess reserves. As soon as interest rates rise banks will want to lend those excess reserves out instead of holding them at the Fed. The Fed does know this so they will just increase the interest rate they pay on excess reserves to stay above the federal funds rate. Therefore, they have tools at their disposal to manage the excess reserve situation. However, it is hard to tell how this strategy will play out. We are not optimistic it will play out well because history suggests it never plays out well for the Federal Reserve as Milton Friedman always argued. They are playing a game we are not sure they can win.

In conclusion, we suggest to stay invested in the US stock market using ETFs such as the SPDR S&P 500 Trust ETF (SPY), the iShares Russell 2000 ETF (IWM), and the SPDR Dow Jones Industrial Average ETF (DIA). As long as interest rates remain low we see more upside. Therefore, one should ignore the timing of the ending of the quantitative easing policy. However, we suggest to start taking money off the table if there is any sign interest rates are increasing quickly and excess reserves are falling quickly. By that time we may write another article.