Bulls are having their way as summer draws to a close. Indeed, U.S. stocks and bonds seem to be the best and safest place to invest in a global economy that is at once hopeful and cautious, with lots of available cash hunting for attractive returns. But now the S&P 500 must deal with the ominous 2,000 level.

In this weekly update, I give my view of the current market environment, offer a technical analysis of the S&P 500 chart, review our weekly fundamentals-based SectorCast rankings of the ten U.S. business sectors, and then offer up some actionable trading ideas, including a sector rotation strategy using ETFs and an enhanced version using top-ranked stocks from the top-ranked sectors.

Market overview:

Bullish investors continue to ride the way of improved hiring, rising corporate earnings, and a dovish Fed (along with other central banks around the world). Looking at the ten U.S. business sectors, last week was definitely a good time to be long the economically sensitive sectors. Technology was far-and-away the leader for the week, while Telecom was the worst. Other top performers included Consumer Services/Discretionary, Financial, and Industrial. The CBOE Market Volatility Index (VIX), a.k.a. fear gauge, closed Friday at 11.47 and is trending downward.

U.S. Treasuries continue to enjoy strong demand, as well, even while the Fed continues to taper its bond buying activity. The 10-year yield fell even further last week, closing Friday at 2.40%, which is up only slightly from the prior Friday. Again, the strength in Treasuries is reflecting global investors seeking the relative safety of the U.S., given all the global uncertainties, European malaise, and violent hot spots, as well as an expectation that the Fed likely will not raise interest rates any time soon.

SPY chart review:

The SPDR S&P 500 Trust (SPY) closed last Friday at 199.19, which again is up nicely from the prior Friday as the market essentially has gone straight up after finding strong support at its 100-day simple moving average. SPY paused as it retook its 50-day SMA, and now is dealing with the psychologically daunting 200 level. With such low volume, bulls have not had to overcome any significant bearish roadblocks, but the challenge this week will be recruiting enough new bullish capital to break through 200. Additional support levels are nearby, including the 100-day SMA around 192, resistance-turned-support line at 190, and the lower line of the bullish rising channel, currently near 189, followed by the critical 200-day SMA around 187. Oscillators RSI and MACD ran further to the upside as I suggested they might last week, but they now appear to be joining Slow Stochastic in looking overbought (although not severely so). With strong psychological resistance at 200, the likelihood is for weakness (or at least consolidation) ahead of Labor Day weekend.

At the same time, the Dow Jones Industrials blue chips index is struggling to hold the 17,000 level once again. Also, the Russell 2000 small cap index closed Friday at 1160.34. It was able to quickly break through resistance at the convergence of its 100- and 200-day SMAs, but is now consolidating at its 50-day. Similar to SPY, its oscillators are looking a bit overbought, but it does not look like a setup for a bearish reversal.

Latest sector rankings:

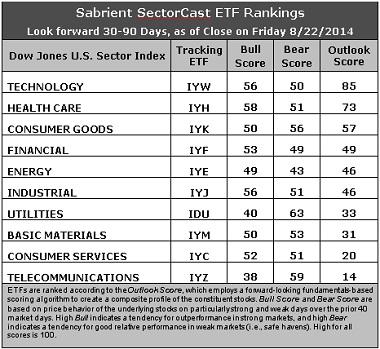

Relative sector rankings are based on our proprietary SectorCast model, which builds a composite profile of each equity ETF based on bottom-up aggregate scoring of the constituent stocks. The Outlook Score employs a forward-looking, fundamentals-based multifactor algorithm considering forward valuation, historical and projected earnings growth, the dynamics of Wall Street analysts' consensus earnings estimates and recent revisions (up or down), quality and sustainability of reported earnings (forensic accounting), and various return ratios. It helps us predict relative performance over the next 1-3 months.

In addition, SectorCast computes a Bull Score and Bear Score for each ETF based on recent price behavior of the constituent stocks on particularly strong and weak market days. High Bull score indicates that stocks within the ETF recently have tended toward relative outperformance when the market is strong, while a high Bear score indicates that stocks within the ETF have tended to hold up relatively well (i.e., safe havens) when the market is weak.

Outlook score is forward-looking while Bull and Bear are backward-looking. As a group, these three scores can be helpful for positioning a portfolio for a given set of anticipated market conditions. Of course, each ETF holds a unique portfolio of stocks and position weights, so the sectors represented will score differently depending upon which set of ETFs is used. We use the iShares that represent the ten major U.S. business sectors: Financial (IYF), Technology (IYW), Industrial (IYJ), Healthcare (IYH), Consumer Goods (IYK), Consumer Services (IYC), Energy (IYE), Basic Materials (IYM), Telecommunications (IYZ), and Utilities (IDU). Whereas the Select Sector SPDRs only contain stocks from the S&P 500, I prefer the iShares for their larger universe and broader diversity. Fidelity also offers a group of sector ETFs with an even larger number of constituents in each.

Here are some of my observations on this week's scores:

1. Technology still holds the top spot with an Outlook score of 85. The sector displays solid scores across most factors in the model, including solid Wall Street analyst sentiment (net upward revisions to earnings estimates), a good forward long-term growth rate, and strong return ratios. The forward P/E is below average (Financial and Energy sport the lowest), but insider sentiment (open market buying) is perking up again. Healthcare remains in the second spot this week with a score of 73 as the sector continues to display the strongest sell-side analyst sentiment (upward revisions), a good forward long-term growth rate, and reasonable return ratios. Consumer Goods/Staples has risen to the third spot, largely due to sell-side analyst upward revisions. Financial and Energy round out the top five. Overall, the same five sectors from last week compose the top five.

2. Telecom stays in the cellar this week with an Outlook score of 14, as the sector has low scores on most factors in the model. Consumer Services/Discretionary stays in the bottom two with a score of 20, despite a strong forward long-term growth rate.

3. Looking at the Bull scores, Healthcare again displays the strongest score of 58, although Technology and Industrial perked up, given their strong performances last week. Telecom is now the laggard with a score of 38, followed closely by Utilities. The top-bottom spread is 20 points, reflecting low sector correlations on particularly strong market days. It is generally desirable in a healthy market to see low correlations and a top-bottom spread of at least 20 points, which indicates that investors have clear preferences in the stocks they want to hold, rather than the all-boats-lifted-in-a-rising-tide mentality that dominated 2013.

4. Looking at the Bear scores, Utilities is the clear leader again with a score of 63, which means that stocks within this sector have been the preferred safe havens on weak market days. Telecom also has shown good relative strength during market weakness. Energy continues to display the lowest score of 43. The top-bottom spread is 20 points, reflecting low sector correlations on particularly weak market days. Again, it is generally desirable in a healthy market to see low correlations and a top-bottom spread of at least 20 points.

5. Technology displays the best all-weather combination of Outlook/Bull/Bear scores, while Telecom is clearly the worst. Looking at just the Bull/Bear combination, Healthcare is the leader, followed by Industrial, indicating superior relative performance (on average) in extreme market conditions (whether bullish or bearish). Energy, which at times has displayed the best Bull/Bear combo score, still shows the worst, indicating general investor avoidance during extreme conditions.

6. Overall, this week's fundamentals-based Outlook rankings continue to look neutral. Although Utilities remains lower in the rankings, Consumer Goods/Staples has risen, and only three sectors are scoring above 50. Still, for the most part, defensive and economically-sensitive sectors are mixed about in the rankings with no clear direction emerging.

These Outlook scores represent the view that the Technology and Healthcare sectors remain relatively undervalued, while Telecom and Consumer Services/Discretionary may be relatively overvalued based on our 1-3 month forward look.

Stock and ETF Ideas:

Our Sector Rotation model, which appropriately weights Outlook, Bull, and Bear scores in accordance with the overall market's prevailing trend (bullish, neutral, or bearish), suggests holding Technology, Healthcare, and Industrial (in that order) in the prevailing bullish climate. (Note: In this model, we consider the bias to be bullish from a rules-based standpoint when SPY is above its 50-day simple moving average and its 200-day SMA.)

Other highly-ranked ETFs from the Technology, Healthcare, and Industrial sectors include PowerShares Dynamic Semiconductors Portfolio (PSI), Market Vectors Biotech ETF (BBH), and SPDR S&P Transportation ETF Trust (XTN).

For an enhanced sector portfolio that enlists top-ranked stocks (instead of ETFs) from within Technology, Healthcare, and Industrial, some long ideas include Facebook (FB), QUALCOMM (QCOM), Incyte Corp (INCY), Gilead Sciences (GILD), Con-Way Inc (CNW), and Southwest Airlines (LUV). All are highly ranked in the Sabrient Ratings Algorithm and also score within the top two quintiles (lowest accounting-related risk) of our Earnings Quality Rank (a.k.a., EQR), a pure accounting-based risk assessment signal based on the forensic accounting expertise of our subsidiary Gradient Analytics. We have found EQR quite valuable for helping to avoid performance-offsetting meltdowns in our model portfolios.

However, if you think the market has come too far and you prefer to maintain a neutral bias, the Sector Rotation model suggests holding Technology, Healthcare, and Consumer Goods/Staples (in that order). But if you have a bearish outlook on the market, the model suggests holding Utilities, Consumer Goods/Staples, and Technology (in that order).