As interest in achieving exposure to commodities has increased in recent years, various issuers have introduced exchange-traded products designed to access this potentially attractive asset class. While assets have flowed into exchange-traded products that offer exposure to natural resources prices through futures contracts and physical commodities, ETFs that invest in stocks of the companies engaged in the extraction and production of commodities have also become popular tools.

Commodity-intensive equities often exhibit a positive correlation to the spot price of the underlying resource or resources, since the profitability of these firms depends on the prevailing market price for their goods. Because the underlying assets are stocks, this strategy may diminish some of the diversification benefits found when investing directly in commodities or futures contracts. But there are some potential advantages as well. Investing in commodity-related equities avoids the thorny issue of contango, and results in the underlying assets having an identifiable stream of cash flows - something that can’t be said for a bar of gold or herd of cattle.

There are now nearly 30 ETFs in the Commodity Producers Equities ETFdb Category, including funds focusing on timber, agribusiness, steel and various mining activities. By far the most popular choice in the category is the Market Vectors Gold Miners ETF (GDX), which offers exposure to stocks of companies engaged in the discovery and extraction of precious metals. GDX is offered by Van Eck, an issuer known for expertise in the hard assets space. Last month saw Global X, another leading provider of commodity intensive equity ETFs, introduce a competing product: the Pure Gold Miners ETF (GGGG). While these two exchange-traded products may seem to be similar in terms of exposure, a closer look reveals that there are some significant differences both in the underlying holdings and the factors that will drive returns.

“Pure” Exposure

The recently-launched GGGG seeks to replicate the Solactive Global Pure Gold Miners Index, a benchmark that consists of companies that generate the vast majority of their business from gold mining. According to the fund’s prospectus, in 2010 over 95% of the revenues from the companies in the underlying index were derived from gold mining.

The index to which GDX is linked has slightly different inclusion requirements. Companies must be “involved primarily in gold mining.” That distinction may seem insignificant, but it has a big impact on which companies are included in the two gold miner ETFs. Many gold miners also generate revenues from the extraction of silver, copper and other precious and industrial metals. Those that generate more than 5% or so of their revenues from metals besides gold won’t be included in GGGG, but may be found in GDX.

The overlap between the two funds is considerably less than one might imagine given the seemingly similar focus. Only four of the 10 largest holdings in GDX are found anywhere in GGGG:

| Largest Holdings | ||

|---|---|---|

| Company | GDX Weight | GGGG Weight |

| Barrick Gold Corp. (ABX) | 14.8% | n/a |

| Goldcorp (GG) | 11.5% | n/a |

| Newmont Mining Corp (NEM) | 7.8% | n/a |

| AngloGold Ashanti (AU) | 5.4% | 4.9% |

| Silver Wheaton Corp (SLW) | 5.1% | n/a |

| Kinross Gold Corp (KGC) | 5.1% | 4.7% |

| IAMGOLD Corp (IAG) | 4.6% | n/a |

| Gold Fields Ltd. (GFI) | 4.4% | 4.8% |

| Yamana Gold (AUY) | 4.4% | n/a |

| Eldorado Gold (EGO) | 4.3% | 4.6% |

Some companies included in GDX generate significant revenues from silver. SLW, for example, sold close to 19 million ounces of silver in 2010, compared to close to 26,000 ounces of gold. Silver sales for Silver Wheaton accounted for close to $400 million in revenue last year, while gold accounted for a little more than $30 million. So GDX may be more appropriately described as a precious metals mining ETF, as the underlying components generate revenue through extraction of both gold and silver.

Gold vs. Silver

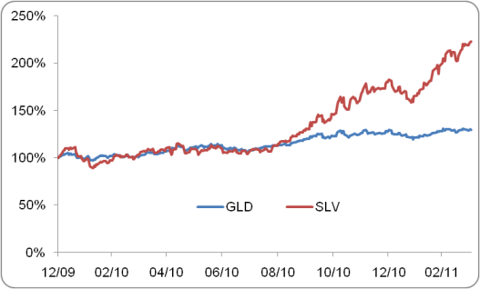

Gold and silver are both precious metals, and as such share some price drivers and can exhibit strong correlations in certain environments. But the commodities are certainly not substitutes. Silver is used more widely in industrial applications, and as such can be more directly impacted by the health of the global economy. The performance of the Gold SPDR (GLD) and Silver Trust (SLV) during 2010 illustrate the potential for gold and silver to either move in unison or deviate from one another. During the first half of the year, the two precious metals tracked one another closely, but silver began to outpace gold by a significant margin later in the year:

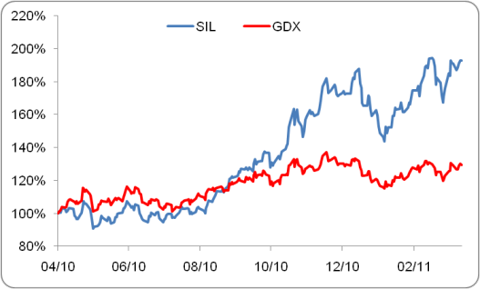

To understand how the mix of gold to silver may impact the performance of mining stocks, it is perhaps helpful to compare the historical performance of GDX and the Global X Silver Miners ETF (SIL), which seeks to replicate an index comprised of companies that derive the majority of their revenue from silver mining. Since its launch in April of last year, SIL has gained more than 90%; GDX is up a more modest 30% over the same period:

So clearly there is a difference between gold miners and silver miners in terms of risk and return. While the components of both SIL and GDX maintain exposure to both metals, SIL is impacted more directly by silver while GDX will take its cues primarily from gold. When there are big differences between the performance of gold and silver, there will likely be big differences between the performance of gold miners and silver miners. It’s worth noting that the ratio of gold prices to silver prices has shown considerable volatility historically. As recently as mid-2008 the gold/silver multiple was above 80; it’s since plummeted to about 37.

That means that we can expect companies that focus exclusively on gold mining to perform differently than those that focus primarily on gold mining but derive, say, 25% of revenues from silver and copper mining.

Verdict

GGGG and GDX are similar products, but far from identical. The “pure” gold miners ETF obviously has a limited operating history, so we can’t draw much in the way of conclusions by examining the relative performance of these products. But given how the underlying metals and various mining ETFs have performed, it seems reasonable to expect GGGG to perform better when gold prices outperform silver, and vice versa. If GGGG had been around last year, it likely would have lagged behind both SIL and GDX from a performance perspective.

Of course, there is no conclusion that one product is universally superior to the other; they simply have different risk profiles that may make one more appealing for certain objectives. Those seeking pure play exposure to gold gold through stocks of mining companies would be better served with GGGG, while those seeking more broad-based exposure that includes silver and other metals would be better off with GDX.

Disclosure: No positions at time of writing.

Disclaimer: ETF Database is not an investment advisor, and any content published by ETF Database does not constitute individual investment advice. The opinions offered herein are not personalized recommendations to buy, sell or hold securities. From time to time, issuers of exchange-traded products mentioned herein may place paid advertisements with ETF Database. All content on ETF Database is produced independently of any advertising relationships.