Nova Measuring (NASDAQ:NVMI) makes "... metrology systems for thin film measurement in chemical mechanical polishing and chemical vapour deposition applications, optical CD and Metal Line Thickness (MLT) systems for use in post-copper chemical mechanical polishing applications and optical critical dimension systems for lithography and etch applications."

Yikes. The lazy and realistic instincts say skip it. Find something easier. But the numbers! They've grown fast and gained share on intervals short and long. The starkest thing is the profitability. Even with R&D eating 25% of revenue - a product of scale disadvantage in a frenetic industry - Nova targets 17-20% operating margin. (Obliterating its nearest peer, as we'll see.) And the company does it: the five-year range is 10-25%, with variation driven by chip cycle R&D to sales lag (R&D doubled between 2010 and 2012). In an industry that richly rewards its incumbents, why can I buy an apparent rising star for ~10 EV/EPS?

Half a dozen interesting, popular books later I had a better feel for the industry's structure and Nova's function within it. But the technology itself? I could fake it better, but not evaluate a claim like this one by an SA writer:

"With the industry transitioning to FinFET (a term coined by a University of California professor to describe a nonplanar, double-gate transistor built on a SOI substrate [silicon]) and 3D NAND, investment into optical metrology is only going to increase as the process complexity becomes multifaceted. Additionally, as the industry also increases the use for multi-patterning processes, it will also push demand for optical metrology." Translation: testing of next generation chip structures will require more intensive use of metrology tools like Nova's.

I was a few days into "digging deeper" by learning the "basics" of solid-state physics, when my brother, a meta-materials scientist, explained (less patronizingly than I deserved) to me, a finance guy, that he lacked the background to understand Nova's technology. Time to abandon this rabbit hole.

The options: a) move on; b) value it strictly by the numbers (there's some evidence you can produce a bit of alpha if you choose the right numbers and weight them correctly); or c) find a better level of analysis[1], somewhere above solid-state physics and below financial statement aggregates.

I don't think I'm alone in struggling with this problem. Since each company is different, it's rarely obvious how deep to dig or how deep your mental tools will allow. Too shallow, and you miss something important. And too deep might mean you waste time attaining fake understanding: finding and valuing something important that doesn't exist.

The rest of this report consists of basic observations that I think I weave into a convincing story, despite the absence of technological detail. This would be a harder shortcut to pull off if it weren't for the existence of a pure-play public competitor whom Nova is smashing.

Nanometrics (NANO) is Nova's closest peer: they both say they compete, their product lines overlap, they share customers, and their market caps (NANO $360m, NVMI $290m) are similar. But Nova is more profitable and growing faster. Why? Let's start with the companies' cost structures.

Nova's SG&A is ~17% of revenue, Nano's is ~31%: Nano spent ~$50m on SG&A in each of the last three years, while revenue ranged between $145m and $182m. That is SG&A/sales of 27-35%, with an average of 31%. Nova spent $17m on $120m revenue in 2014. That is 17% - a 14-point edge on Nano dropping straight to its bottom line.

Nova spends 1/5th as much on G&A: Remove selling expense - potentially an investment - and look just at G&A. Then, the comparison is $4.5m versus $24m, 4% of revenue versus 14%. Somehow, Nano spends 500% more administering just 35% more revenue.

Leanness means more left over for R&D: Nova spent $30m in 2014, 25% of revenue, compared to $34m for Nano, just 20% of revenue.

This is innovation measured by cost, but who gets more for the buck? Nova's 54-45% gross margin edge is a hint. Also consider, if Nova's product line is narrower than Nano's, which I think it might be, then the differences understate per-program investment.

Leanness also leaves more for shareholders: Nova's 2014 operating profit was $17m, or 14% of revenue, compared to Nano's $12m loss, or 7% of revenue.

Moving on, Nova outgrows Nano handily on all time frames. Below, growth is measured cumulatively from various start dates to the end of 2014.

Since 2007, which was an industry peak, Nova's sales rose a cumulative 107%, Nano's 13% - difference 94%. Since 2009, the industry bottom, it's 200% versus 115% - an 85% edge for Nova. Since 2011, the last industry peak, its 17% versus (28%) - a 45% edge for Nova. In fairness to Nano, Nova's been outgrowing the wafer fab equipment industry too, which is down 15% since 2011.

Significantly, much of Nova's outperformance is attributable to a single customer, Taiwan Semiconductor, by far the world's largest chip foundry. Between 2004 and 2013, TSMC accounted for 2/3rd's of Nova's growth - a 7-fold expansion from $7m to $49m. Non-TSMC sales grew just 65% from $32 to $53m. (But that's changing, as we'll see.)

And it sure looks like Nova is stealing Nano's lunch at TSMC. 2013 Nova sales to TSMC rose $10m to $49m; Nano's shrank by $13m to $17m. Within TSMC, Nova caught up to and then tripled Nano within just a few years. (A caution: sales are lumpy in this industry, so the scale of the obliteration could be illusory. Nano's done a bit better recently.)

Here's what it looks like in aggregate.

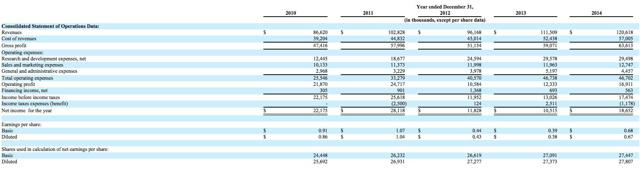

NOVA:

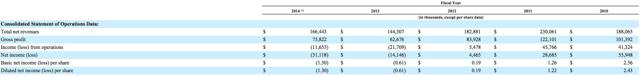

NANO:

Understand that without Nova's success with TSMC - $41m net sales growth between 2004 and 2013 - it may have failed. From its founding in 1993 through 2004, Nova's results stank. Sales (below $40m before 2004) were too low to spread its fixed costs against, which restrained R&D and marketing spend - constraining product and channel broadening - in a nasty cycle.

It was TSMC's trust that broke that cycle, not some broad-based surge, so our explanation of Nova's blossoming must fit that.

In 2006, with surging sales to TSMC, Nova began to expand its product line, and to more frequently work directly with chip fabricators, skipping big equipment intermediaries like Applied Materials (AMAT). More details from a useful interview with the company's former CEO:

Nova provides two types of measuring tools: integrated metrology tools that are placed inside the process equipment to allow measurement and process control while the process takes place, and stand alone measurement tools which are placed between process steps to allow a more sparse measurement program for less variable process steps. The latter more expensive instruments have become one of the key growth engines of the company, but they are not the only one. As Seligsohn [former CEO] explains, the transition from selling tools through OEM agreements to direct sales (and consequently, with improved gross margins), and the development and marketing of additional software products in conjunction with the instruments also set the stage for further growth.

"In fact, part of our success has been driven by our ability to expand our target markets. Take TSMC, our biggest customer. TSMC constantly looks for ways to increase the use of our products, and Nova's ability to grow in a given semiconductor [customer] has significantly increased as a result. In 2009, for example, our target market on a single [fab] basis was about $30-40 million, while this year [2013] it is about $150-200 million, meaning that our market has more than tripled itself."

What's the direction of causation here? Did Nova's decision to skip intermediaries and to broaden its product line attract TSMC?

Or did TSMC itself - looking "for ways to increase the use of" Nova's products - trigger the changes in Nova? Would we know if TSMC told Nova something like: "you've been doing a great job for us, we see lots of opportunity to work with you directly. Skip the middlemen and get your engineers cooperating direct with our engineers." Is there anything other than Nova's quality that would motivate that?

Nova became increasingly dependent on TSMC; maybe that was the point. Dependence guarantees attention, which is valuable in an industry where, every two years, tens of billions are spent building next-generation chip fabs which can't function unless hundreds of diverse cutting-edge parts come together on schedule. Co-destiny type relationships are valuable when reliable and timely supply are hard to obtain in the absence of long-run mutual dependence. Former Intel marketing chief Bill Davidow explains:

"... co-destiny describes the realization on the part of both buyers and sellers that they can achieve a satisfactory relationship only if they admit their mutual dependence and act accordingly. The semiconductor industry provides many examples. Big customers for semiconductors in recent years have been seeking reliable sources of supply to provide them with extremely high quality parts...The quality levels and failure rates of the chips are extremely important. If a company receives high-quality products from its supplier, it can dispense with incoming inspection, saving a considerable amount of direct cost and capital. As the capital equipment to inspect complex integrated circuits now costs as much as a million dollars per system, obviously companies would love to avoid the purchase of a tester. But if a customer doesn't buy that equipment and hire the trained people to run it, it loses the ability to switch to unproven suppliers. Thus the customer becomes extremely dependent on the established sources of supply."

Why, hypothetically, would TSMC choose Nova? Note that at this key turning point in ~2006, Nanometrics - probably the second-smallest player in the industry - was already too large and diverse to become truly captive to TSMC. TSMC was no more important to Nanometrics than TSMC's rivals Intel (INTC), Samsung (OTCPK:SSNLF), etc.

Let's recap. Nova stank until ~2002 - stuck at ~$20m in sales - never generating the growth necessary to both invest and profit. When the company slashed R&D spending ~50% in 2003, it looked doomed, but instead, the very next year, it caught a growth wave that would multiply its sales 4-5 times organically in a decade. A growth wave that turned Nova (modestly) profitable for the first time in 2009, and robustly profitable since 2010. A growth wave predominantly driven by tighter, broader cooperation with the world's dominant foundry.

Dormant potential awakened by a mutually beneficial co-destiny relationship with TSMC: Is this explanation of Nova's transformation roughly correct? I don't know, but it fits a lot of facts and feels satisfying.[2]

From the sellers' point of view, one typical problem with co-destiny is insufficient revenue potential. But for small sellers, the size and concentration of the chip industry solves that problem: TSMC's revenue is $20b. It's a large market in itself.

Did Nanometrics screw up by focusing its efforts too broadly? The company recently bragged of its breadth: it "...hit a new milestone in the quarter [2Q14] with five customers contributing 10% or more to our total revenues for the quarter. Intel contributed 18%; SK Hynix (HXSCF) 18%; Samsung 16%; GlobalFoundries 15%; and TSMC 11%."

Breadth costs money that small players can't afford: remember, Nova spends 1/5th as much as Nano on G&A.

On that same conference call, Nano lamented:

"... when you look at the spending patterns over the past five years going through 2014 estimate, TSMC is becoming a dominant player in capital spending demonstrating how critical it is for us to increase our penetration at TSMC."

Growth, higher gross profits, and cost savings are the obvious benefits of Nova's relationship with TSMC. Less obvious, but potentially more important in the long run, is the technological edge of hitching your wagon to the fastest horse.

Since it can cost ~$10b to build a cutting-edge, new chip fab, only a couple firms can afford to do it. TSMC is always one of those. That means Nova's engineers, hand-in-hand with TSMC's, live on the bleeding edge.

More than 85% of Nova's 2014 product revenue came from systems applied to cutting-edge chips: the 2x (20-29nm line width) and 1x (10-19nm) technology nodes. The industry moved below 30nm for the first time in 2012, 14nm in 2014, 10nm planned for 2016. Less than 15% of Nova's systems are applied to processes introduced before 2012.

This metric - fraction of revenue at cutting-edge nodes - seems a useful heuristic for how good a firm's technology is. Nanometrics doesn't publish its figure, far as I can tell.

The ferocious blow Nanometrics took between 2011 and 2013, when revenue fell 38%, was not purely permanent market share loss. The company was hurt by the timing of plant builds by a couple of its ~20% customers - a scary sight knowing Nova's even more extreme concentration. Nova was tested in this fashion in 2014, and the company adapted in a way it couldn't have a few years ago.

Nova's sales to TSMC in 2014 dropped from $49m (44% of revenue) to $43m (36%). The year was saved by non-TSMC growth from $62m to $77m, by 25%, enabling its aggregate sales to expand 8%. Non-TSMC revenue grew more in the last two years than in the prior ten. More detail on the shift from the Q4 '14 conference call:

"During the quarter, we experienced a growing order stream from our memory customers for multiple price expansion which helped us further broaden our customer base. In fact this quarter customer mix included also a memory customer that contributed more than 20% [probably Samsung] to our quarterly product revenue. During the quarter, spending of our largest customers was the slowest quarterly levels in 2014 but this quarterly softness in the foundry space was offset by increased activity in memory that including design wins with our advanced integrated metrology tools mainly for DRAM and new emerging markets which extended our overall addressable market.

We're proud in the fact that the all latest DRAM expansions were done using Nova integrated tools, as the result of all of this memory revenue during the quarter increased significantly and accounted for 27% of our product sales versus 19% in Q3 clearly demonstrating the inroad we're making into the memory space. In the fourth quarter, we posted revenue of 25.8 million in line with our guidance."

What it looks like is that Nova has graduated from co-destiny; or, as its former CEO puts it, the company has broken through its "glass-ceiling". TSMC nurtured it to scale and profitability, enabling years of positive cash flow, dramatically greater research and marketing investment, reputation, and product line expansion. Nova's now got what's required to efficiently target growth in a broader set of customers.

Will that dilute its special sauce relative to Nanometrics, or has the company's relationship with TSMC provided it with the insights and scale necessary to fill the needs of a broader set of customers?

And what else makes Nova unique? After all, its recent diversification successes have not sacrificed its efficiency. G&A declined y/y in 2014.

What about culture? Take a look at reviews left by the companies' respective employees at Glassdoor.com. Nova's employees generally like the place: they describe it as close-knit, hard-working, and start-up like. Unbureaucratic, with all the good and little bit of bad that implies. Partly, that's because Nova hasn't been financially safe long enough to accumulate fat. But there might be more to it than that. Nova's former CEO says:

"It was an enormous privilege for me to lead a company like Nova, and it gives me great pride," he says. "I am an eighth-generation Israeli. To me Nova represents a serious Zionist achievement. I leave with a great feeling, as though I was part of a relay race in which I did my absolute best in my portion of the race."

Nations have long taken pride in the strength of their chip sectors, for reasons symbolic and strategic. Those impulses must be amplified in a firm with 90% of its people and assets in Israel.

In contrast, here's a not atypical Nanometrics employee review:

"Company has been around for a long time. It is definitely a case study for "What is wrong with the company's culture?" Everything. People who work there either have been there for a long time (10+years) or joined recently. Well qualified people wouldn't stay long because those "long time veteran" don't know what they are doing and make it worse everyday. Anything you do to try to improve makes you the enemy. Some of the previous reviews are totally correct. People work under the threat of being fired. Career growth? what is that? Do yourself a favor and stay away from this company. If there is someone you hate, help them a job at this place."

Let's wrap up. Prior to a recent acquisition, NVMI was earning ~$0.70/share on ~15% operating margins. The company held $122m cash, or $4.20 per share. The stock traded at ~$11, so its EV was ~$7, or 10x the EPS run rate. It would look even cheaper if you normalized its profit margins to the 17-20% the company expects, and has achieved, on average.

The $47m acquisition reduces cash to $75m, or $2.80 per share, so EV is now ~$8. It adds $25-30m, or ~20%, to its sales, and is expected to be accretive within the year. Let's say EPS bumps up to $0.75, so NVMI's EV/EPS bumps up to 11. (I'll say more about the acquisition once we learn more about it.)

Now, this is mind-boggling, but Nanometrics is valued identically to Nova from a P/S and P/B perspective: ~2.25, and 2.1. The company is expected to return to modest profitability in 2015, with 5% operating profit margins versus 15-20% for Nova.

Nano trades at an EV/EPS of 25, 2.5 times Nova's - its reward for what?

Does the median guy who owns Nano but not Nova possess technical insights I lack? Or is he unaware of the more basic stuff detailed above? I'd guess the latter.

There is an inefficiency here: you can either short one, go long the other, or both. But at least one of these companies is atrociously mispriced.

I'd target $17 for Nova - a 20 P/E multiple plus the cash - implying upside of 55%. And I wouldn't pay more than book value, $8, for Nano, since 2015 should be the company's fourth straight year of failing to earn a 10% ROE. I've got more confidence in the long than in the short.

[1] An interesting anecdote on this "level of description" concept from Ray Kurzweil's "How to Create a Mind":

"American scientist Herbert A. Simon (1916-2001), who is credited with cofounding the field of artificial intelligence, wrote eloquently about the issue of understanding complex systems at the right level of abstraction. In describing an AI program he had devised called EPAM (elementary perceiver and memorizer), he wrote in 1973, "Suppose you decided that you wanted to understand the mysterious EPAM program that I have. I could provide you with two versions of it. One would be... the form in which it was actually written-with its whole structure of routines and subroutines... Alternatively, I could provide you with a machine-language version of EPAM after the whole translation had been carried out-after it had been flattened so to speak... I don't think I need argue at length which of these two versions would provide the most parsimonious, the most meaningful, the most lawful description... I will not even propose to you the third... of providing you with neither program, but instead with the electromagnetic equations and boundary conditions that the computer, viewed as a physical system, would have to obey while behaving as EPAM. That would be the acme of reduction and incomprehensibility."

[2] TSMC has grown enormously in the last decade; it's now roughly 4 times larger than the second-largest dedicated foundry. Rapid growth makes change less costly. Say that Y is better than X, but you've been using X, and it costs money to make the switch. You'll be more willing to absorb the fixed costs of making the switch if you know that in the next 2-3 years, your capacity is going to double, so that Y's benefits are layered across a large base. Does TSMC's growth and aggression help explain the company's historical willingness to bet on an unproven player?