In the past we have written about Yieldcos such as TerraForm Power (TERP) and NRG Yield (NYLD) and why we believe these stocks should be avoided unless their dividend yields are in the ten percent range. This high yield rate requirement has to do primarily with the declining rates of solar energy and the likely defaults resulting from depreciation of the asset base.

To summarize our view, a confluence of trends from solar, battery, and nanogrid technologies ensure that energy costs are on the path of steep secular decline. With anticipated decline of 7 to 10% in PV system costs for the foreseeable future, it is unwise to invest in 30 year instruments with flat, or worse, increasing PPA rates. These pricing structures used in the market are a recipe for defaults, stranded assets, and other unfavorable outcomes. In this context, we are skeptical about claims of companies such as SolarCity (SCTY), SunEdison (SUNE), and TerraForm Power which are promoting these solar assets as safe assets. Far from being safe, we believe a credit rating starting with a "C" would be appropriate for this class of assets.

However, the market has been myopic to these emerging risk factors and much irrational exuberance has developed in this class of assets, as evidenced by the bloated valuations of solar asset holding companies. The tulip mania of the solar assets has now crossed the line of insanity with the introduction of the TerraForm Global (Pending:GLBL) IPO.

As we go through the TerraForm Global S-1 and discuss some of the risk factors, investors should be aware that TerraForm Global is a spinoff of SunEdison. The main purpose of TerraForm Global is to provide a means for SunEdison to monetize its solar projects at a value beyond what SunEdison is able to fetch for these assets in the market. By having a captive Yieldco buyer, SunEdison expects to reduce the friction costs and financing costs of a project sale and get superior value for its projects. Conflicts of interest galore in this Yieldco/sponsor relationship and the cross relationships between TerraForm Global and SunEdison can be seen in the S-1.

In addition to all the risks we have discussed previously in the context of Yieldcos, several other risks specific to developing countries need to be considered. The more prominent of these include currency risk, counterparty risk, environmental risk, and political risk.

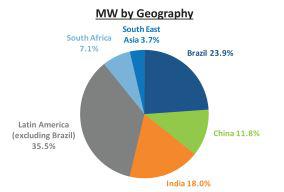

In terms of currency risk, the problems with TerraForm Global becomes evident when looking at the MW by Geography chart. As can be seen below, the top four countries as measured by the asset base are Brazil, India, China and South Africa.

In the section titled "Factors that significantly affect our results of operations and business", the S-1 states:

"Our operating results are reported in U.S. dollars. However, most of our project-level revenues and expenses are generated in currencies other than U.S. dollars (including Chinese Yuan Renminbi, Brazilian Real, Indian Rupee, Malaysian Ringgit, South African Rand, Thai Baht and other currencies). As a result, we expect our revenues and expenses will be exposed to foreign exchange fluctuations in local currencies where our clean power generation assets are located. We intend to use derivative financial instruments, such as purchasing currency options, to minimize our net exposure to currency fluctuations. Specifically, we intend to utilize these instruments to mitigate our risk exposure to currency fluctuations on a rolling three-year basis with regard to our projected CAFD. To the extent that significant debt is denominated in currencies other than local currency, we have limited our currency risk with respect to our project-level long-term debt by entering into fixed currency rate swap agreements that limit our foreign exchange exposure."

Herein lies one major problem. TerraForm Global will be entering into multi-decade contracts with short term protections. We also find it fascinating that the management and the investment bankers chose the word "fluctuations" to depict currency risk in this context.

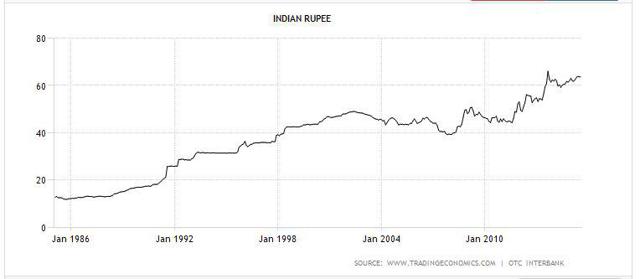

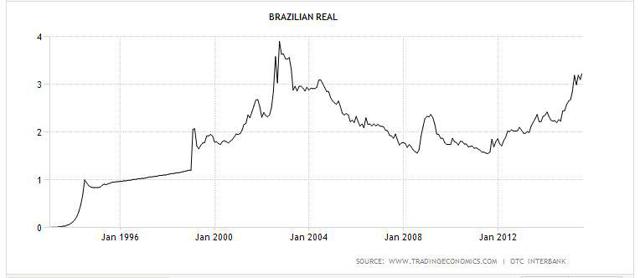

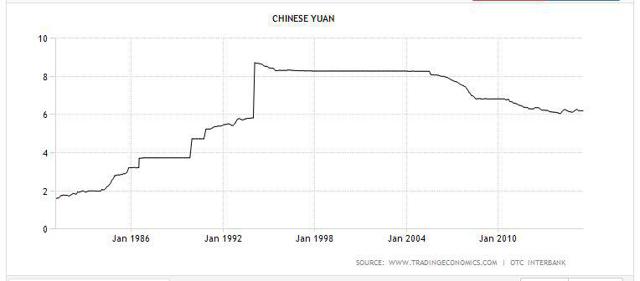

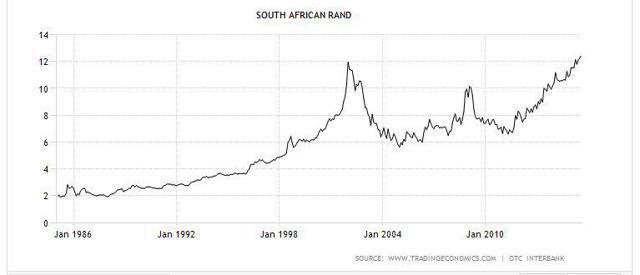

Readers can review the 20 to 30 year currency exchange rate charts (consistent with the duration of typical PPAs) and decide if "fluctuations" is the right word for the currency risk from these assets (source: tradingeconomics.com ).

The Indian Rupee depreciated from approximately 15 rupees per dollar to about 64 rupees per dollar in a three decade period.

The story with the Brazilian Real is worse even if one were to exclude the hyperinflation in the 80s and 90s.

Chinese Yuan has performed almost as poorly as the Rupee over three decades. Although the Yuan fared much better during the last two decades due to China's burgeoning manufacturing might. A compelling case can be made that the Yuan will likely be relatively stable against the dollar going forward.

The South African Rand has also fared very poorly against the dollar.

Would any reasonable investor call these currency trends fluctuations? Anyone? We have a bridge to sell.

The harsh reality is that vast majority of the countries targeted by TerraForm Global have secular currency declines vis-à-vis dollar. These kinds of secular currency trends cannot be easily, if at all, mitigated with derivatives except at an exorbitant cost. The prospectus states various way that TerrraForm Global is attempting to manage this risk but we have little faith that this systematic risk can be meaningfully mitigated over a span of 2 to 3 decades. Calling the Company and its markets "Global" is a nice euphemism but there is a reason these countries are referred to as "third world countries" or "developing countries".

To be sure, some of the currency risk is likely to be mitigated by rate increases. However, the efficacy of these rate increases will vary between contracts and are likely subject to some very favorable outcomes.

When it comes to counterparty risk, the risk profile in developing countries is very different from that of Western countries. The S-1 states: "Counterparties to our PPAs may not fulfill their obligations, which could result in a material adverse impact on our business, financial condition, results of operations and cash flows."

This is risk even for US assets. Even in the western context, as sensationalized by Barclay's report, the once stable utilities are suspect in the emerging energy environment. In developing countries, where infrastructure is nearly non-existent, the power companies are weak and much less stable. Private parties in the energy generation business typically have no credit record to speak of.

Non-performing loans are also endemic problems in developing counties. For example, according to The World Bank data, India's rate of non-performing loans stands at 4.2%. Mind you, these are not 20/30 years contracts like the PPAs but loans for much shorter time periods. Interestingly, China's default rate is a mere 1.1%, but China's loan system runs by government fiat and the definition of non-performing loan is nebulous at best.

To say that the offtaking counter parties in these countries are a credit risk would be an understatement. The concept of "creditworthy counter party" in the developing country in a 20 to 30 year context is, more likely than not, an oxymoron. What is the value of a PPA from a financially weak or bankrupt customer a few years down the road?

In terms of environmental risks, developing countries have some risks that a western investor may not appreciate. For example, the S-1 states: "Land title in India can be uncertain and there is no assurance of clean title." Anyone who follows India's development knows that land grabbing is a common occurrence in India. A local thug, a land mafia, or a politician (sometimes one and the same) can usurp land and wreak havoc. India's legal system is notoriously inert, corrupt, prone to be exploited, and offers little relief for the injured party.

Corruption is also endemic in many of the developing countries and can rear its ugly head at any point in time. A corrupt bureaucrat or politician may seek money just to keep the energy plant operating or may decide that an optimal route for a future public road runs right through the solar farm that does not bribe him.

In terms of political risk, the surprises can be even nastier. Adverse mandates including punitive laws, retroactive price reductions, retro active taxes and tariff changes, nationalization, curtailment, and resettlements are commonplace. Sometimes these nations can even take measures to restrict repatriation of cash flows back to the US. Consider the recent capital market turmoil in China when the government decided to interfere with capital markets and arbitrarily imposed trading curbs. An astonishing ten plus percentage of Chinese companies may not even trade on a given day. How does one measure investment or political risk in these markets?

Does this sound like an ideal environment to site multimillion dollar solar or wind projects? We are amazed that SunEdison management has the chutzpah to hold long term assets in these jurisdictions. A far better model for SunEdison here would have been to build and sell projects and let some local investors carry all the risk and deal with local politics and corruption. But, then again, from SunEdison's perspective, why not do it if TerraForm Global shareholders bear all the risk and SunEdison shareholders get all the benefits.

This brings us to the part about what rewards TerraForm Global shareholders get for taking these risks. According to the S-1: "Our initial quarterly dividend will be set at $0.2750 per share of Class A common stock, or $1.1000 per share on an annualized basis."

Given this dividend, the S-1 suggests an initial public offering price of $19-21 per share or a dividend ratio of approximately 5%. The question is if the offering is priced fairly, and the dividend level is appropriate, given the Company's prospects.

A fair price for a portfolio of any assets should provide a return consummate with the risks of the asset base. For this class of assets, we start with a baseline of about 7% to 10% yield to address declining PV system values. On top of that let's layer on currency risk, counter party risk, environmental risk, political risk, and then tag on a reasonable return for the stockholder.

Given the combination of various risk factors above, our opinion is that a blended yield of 20% may be the minimal acceptable return for TerraForm Global assets.

However, yield is not the only benefit of a typical YieldCo. As the YieldCo's assets grow, the YieldCo stock holders can benefit from an ongoing growth in the dividend streams. In the case of TerraForm Global, assuming the dividend grows at the same breakneck pace as TerraForm Power, a dividend growth of 100% is possible in the first year. From a valuation perspective, the growth component of TerraForm Global needs to be factored in addition to the initial yield component. Based on the dividend yield and growth expectations, we see the fair value for the IPO to be about $10 if we factor in about a years of growth.

Investors should note that this value of $10 is about half the TerraForm Global IPO Estimated Maximum Offering Price per Share of $21. While the offering price is subject to change, we value this IPO about half the current expected maximum offering price.

Final Thoughts:

If the purpose of Yieldco is to create safe long term returns for yield chasing, retirement oriented investors, is third world the place to look for it? Why should a western investor even consider investing into 20 or 30 year investments in these countries where currency keeps declining, corruption is rampant, politics are muddy, regulatory landscape can change on a dime, institutions are weak, laws are made to broken, and justice can be bought?

If an investor is insane enough to do this, what would be an acceptable return?

For the insane investors who are still interested in such an IPOs, our view is that there at least should be a decent return around 20%. Investors also need to estimate what part of the return they are willing to get from future dividend growth.

Another way to look at this problem would be ask: What are the risks with the international markets targeted by TerraForm Global and what is the valuation discount that would be appropriate for these international assets compared to a US Utility centric YieldCo?

On a relative basis, we are of the opinion that investors need to demand a about 10 percentage points in additional yield for these long term international solar assets compared to equivalent US assets.

Our Sentiment: Avoid (at the stated IPO price)