Expected earnings reports and the whisper number impact for February 8th, 2012, after market close.

Knowing how likely a stock's price will move following an earnings report will help you make better trades. Many investors believe that beating or missing the whisper number has the greatest impact on stock movement. If the number is exceeded, the stock is rewarded and prices move higher. If the number is missed, the stock is punished and prices move lower. Unlike the analysts estimate, the "whisper number" from WhisperNumber.com has actually been proven to have a greater impact on stock movement.

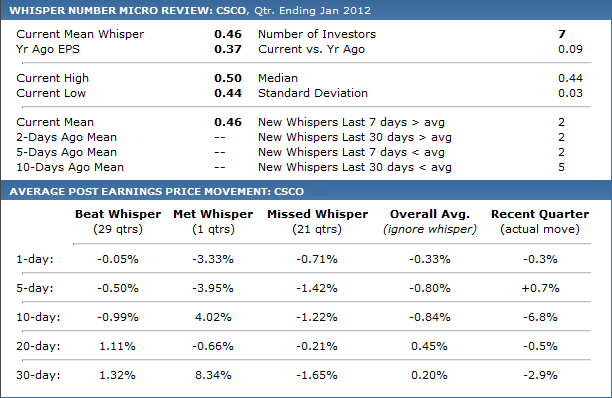

Cisco (CSCO) reports earnings Feb. 8th, after market close. The whisper number is $0.46, four cents ahead of the analysts estimate. Cisco has a 57% positive surprise history (having topped the whisper in 29 of the 51 earnings reports for which we have data). The average price movement (starting at next market open) within ten trading days of these fifty-one earnings reports is -0.8%. The strongest price movement of +1.3% comes within thirty trading days when the company reports earnings that beat the whisper number, and -4.0% within five trading days when the company reports earnings that miss the whisper number. Last quarter the company reported earnings three cents ahead of the whisper number. Following that report the stock realized a 6.8% loss in ten trading days.

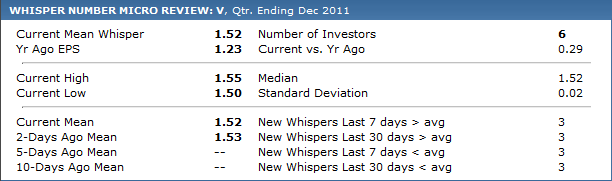

Visa (V) reports earnings Feb. 8th, after market close. The whisper number is $1.52, seven cents ahead of the analysts estimate. Visa has a 60% positive surprise history (having topped the whisper in 6 of the 10 earnings reports for which we have data).

Whole Foods Market (WFM) reports earnings Feb. 8th, after market close. The whisper number is $0.63, three cents ahead of the analysts estimate. Whole Foods has a 42% positive surprise history (having topped the whisper in 10 of the 24 earnings reports for which we have data). The average price movement (starting at next market open) within ten trading days of these twenty-four earnings reports is -0.1%. The strongest price movement of +7.9% comes within thirty trading days when the company reports earnings that beat the whisper number, and -4.0% within thirty trading days when the company reports earnings that miss the whisper number.

Computer Sciences Corp. (CSC) reports earnings Feb. 8th, after market close. The whisper number is $0.58, in-line with the analysts estimate. CSC has a 70% positive surprise history (having topped the whisper in 19 of the 27 earnings reports for which we have data). The average price movement (starting at next market open) within ten trading days of these twenty-seven earnings reports is +0.6%. The strongest price movement of +1.9% comes within twenty trading days when the company reports earnings that beat the whisper number, and +3.8% within thirty trading days when the company reports earnings that miss the whisper number. Last quarter the company reported earnings of $0.94.

Also reporting after market close: Akamai Technologies (AKAM); whisper number is $0.36, five cents ahead of analysts.

When analyzing the data collected by WhisperNumber.com, the most important aspects are how a company reacts to beating or missing the whisper number, the average post earnings price movement, and in what timeframe (see link in profile to receive alerts). Keep in mind that trading on whispers is a technical play on market psychology, rather than a bet on a company's fundamental strengths.

A company's reaction to the whisper number expectation is the key - on average companies that exceed the whisper are rewarded, while companies that miss are punished following an earnings report.

According to The Wall Street Journal:

The percentage of companies that have beaten expectations often is cited as a barometer of corporate profitability, an indicator of how well the economy as a whole is doing or a predictor of where the stock market is going. What goes unsaid, however, is that these positive surprises are becoming so common they are nearly universal. They are predetermined in a cynical tango-clinch between companies and the analysts who cover them. And there is no reliable evidence that the stock market as a whole will earn higher returns after periods with more positive surprises.

In short, there isn't anything surprising about earnings surprises. They aren't the exception; they are the rule. "All the numbers are gamed at this point," says James A. Bianco, president of Bianco Research.

Whisper numbers provide the unbiased earnings expectation proven more significant than the analysts estimates.

Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

Disclaimer: All trading involves risk, and the information presented is not intended to be a recommendation of any kind.