PZ Cussons Plc. (OTC:PZCUF) (OTCPK:PZCUY) is a British soap company that trades on the London Stock Exchange and is a constituent member of the FTSE 250, an index of the largest companies by market capitalization on the London Stock Exchange from 101st to 350th. However, it is not a company that is familiar to many stateside, and hence receives little attention in the U.S. In this article, I want to examine the company as a prospective investment.

Company Overview

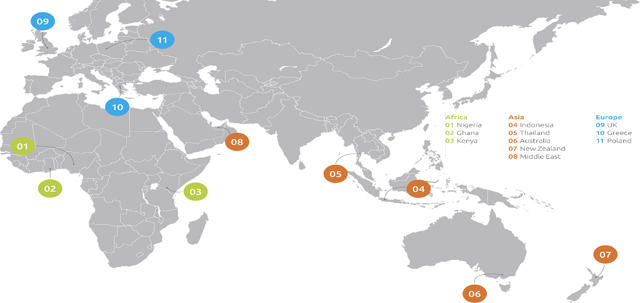

Founded in 1879 and incorporated in 1884, PZ Cussons Plc. is a British-based provider of personal healthcare products and consumer goods with a market capitalization of $1.11 billion, with operations in Africa, Asia and Europe. It operates in four sectors: electricals; food nutrition; home care; and personal care & beauty. The closest American counterpart that PZ Cussons would have is the much larger Proctor & Gamble (NYSE:PG).

Spearheading its product line-up is its Imperial Leather soap brand, though it produces many other soaps too (Carex, Duck Laundry, Joy, Luksja, Pearl, Premier). In addition to its soaps, the company also offers hair care products, liquid hand-wash, shower gels and skincare products. The picture below provides an overview of PZ Cussons' product portfolio:

Competitive Advantage

PZ Cussons sells soap and its products have strong brand awareness in their markets. Though Americans may not be familiar with what they offer, everyone in the UK has heard of Imperial Leather, which is well-known in the company's key European markets, Poland and Greece, and in the African and Asian markets within which the company operate.

Soap is not something that is subject to technological obsolescence - so long as the brand is well-promoted, it will be sold and used repeatedly, and it is a low-cost product to make. In addition, the company is very focused in terms of where it markets its products - they choose key areas where they have local knowledge and build their brands within those areas. One instance of how successful this strategy is can be seen in the case of Nigeria: PZ Cussons has been a presence in Nigeria since 1899, which is their biggest single market today.

This combination of a necessary product and a customer base across both mature and growth markets that has been built and maintained over time is what provides PZ Cussons with its competitive advantage.

Current valuation

PZ Cussons market their products very well, and their longevity reflects their success, as does their consistent dividend payouts.

The company is a dividend aristocrat which has paid dividends for 42 years in a row, and for 27 of those years the dividend has consecutively gone up.

The dividend yield is currently 3.08%, and the 5 year average dividend growth rate is 6.28%. The dividend payout ratio is 62.4%, which is perfectly acceptable. It is currently trading at a P/E ratio of 20.3, and seems fairly valued at this time.

Conclusion

PZ Cussons is an excellent, long-established company with a diverse portfolio of well-marketed products that is currently trading at a fair price and has an impressive dividend history that looks set to continue. Dividend growth investors should give serious consideration towards adding it to their portfolio.

DISCLAIMER: I am not a financial professional and accept no responsibility for any investment decisions a reader makes. This article is for informational purposes only.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.