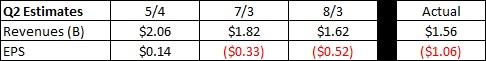

For investors in Tesla Motors (NASDAQ:NASDAQ:TSLA), you probably didn't want to see the company's second quarter results. Despite analyst estimates coming down significantly, seen in the table below, Tesla still managed to miss, and miss tremendously on the bottom line. Also, some parts of 2016 guidance were updated, and not in the direction investors want to see. It's amazing that shares have held up so well, given another quarter of poor results.

(Source: Yahoo Finance analyst estimates and Tesla update letter)

Tesla managed to lose more than twice the amount per share analysts were looking for. Don't forget, this non-GAAP EPS number was actually helped by the company's secondary offering during Q2, which added more than 7.3 million shares to the count (thus spreading out the loss over more shares). Analysts were expecting a $0.35 per share profit this year going into the report, but that seems nearly impossible now after a $1.64 loss in the first half of the year. Don't forget, Tesla management guided to non-GAAP profitability this year after missing last year's mark by almost $3 a share.

When Tesla discussed its guidance, it said that it expects GAAP and non-GAAP automotive gross margins (excluding ZEV credits) to rise by 2-3 percentage points through Q3 and Q4. However, in the Q1 investor letter, management was calling for a 25% margin on the Model X and almost 30% on the Model S by the end of 2016. Given the Model S will represent more than half of the year's deliveries, that should put Tesla around 28%, right?

Well, considering that GAAP automotive gross margins were 23.1% and non-GAAP were 21.9%, this seems like a guidance take down. In fact, as Marketwatch pointed out, Elon Musk flip flopped on the conference call, sticking to his original guidance despite the numbers not seeming to add up. He said the company was a quarter or two off on its goals, but that they could be hit by the end of this year. While we're on the subject of gross margins, let's take a look at the following statements from the quarterly investor letters as well as the conference call:

Q1: After excluding $57 million of ZEV credit revenue, Q1 Automotive gross margin was 20.0% on a non-GAAP basis.

Q2: On a non-GAAP basis, gross margin excluding ZEV credits increased over 200 basis points from Q1 to 21.9%.

Conference Call, CFO Wheeler: Automotive gross margin excluding ZEV credits grew from 20.1% in Q1 to 21.2% in Q2.

Conference Call, CFO Wheeler (later in call): In Q1 automotive gross margin, excluding ZEV credits was 20.1% and we expanded that to 21.9% in Q2.

OK, am I missing something? Not only did things not increase by over 200 basis points, but now on the conference call we get this 21.2% number that is nowhere in the investor letter but then later we get the 21.9%. Tesla management seriously needs to get its story straight, and perhaps having several different gross margin metrics is the problem. One thing is certain, and that is that there was no improvement of more than 200 basis points.

Two other guidance points were adjusted in a big way. 2016 operating expenses, which originally were supposed to rise by "about 20," and then "20%-25%," are now expected to rise by 30%. Again, that brings into question how Tesla will be able to hit non-GAAP profitability this year. Additionally, the company maintained its roughly $2.25 billion capex plan for the year, despite only spending about $512 million through the first half of the year. That leads to a lot of spending in Q3 and Q4 if you believe them, so don't be surprised if you see a large cash burn. For a related opinion, see Montana Skeptic's great article here.

Management on the conference call also decided to stick with 373,000 reservations for the Model 3, a number given to us back in the middle of May. If the number was higher, wouldn't management want to boast that? We heard on the call about how the 60 kWh version of the Model S is "reaching down into Model 3 reservation holder territory." Does that mean M3 reservations are declining? Plus, when thinking about Tesla in the back half of this year, we got these extra gems on the conference call related to vehicle production and profitability:

CFO Wheeler - We've got a couple more holiday weeks in Q4. You might want to think about that when you're doing your modeling.

CEO Musk - Well, if you exclude Model 3 CapEx ramp, then - well in fact, really for Q3 and for Q4, Tesla would be profitable excluding the Model 3 CapEx ramp.

So is Tesla already trying to hedge its bet against production and deliveries for the second half of the year given the holidays? A few years ago, customer vacations were blamed for a Q4 delivery miss. The company didn't even give Q3 guidance for deliveries, and anyone who took accounting knows capex and profitability are two vastly different things. Management also threw aside its goals for stationary storage that was thought to provide $500 million in revenues this year.

I'm extremely amazed that Tesla shares finished the after hours session down less than one percent. In the end, it was more hype and worse performance from Tesla, even with significantly reduced estimates. Many guidance points continue to weaken for 2016 and management can't even get its numbers straight. At this point, any hopes for non-GAAP profitability seem like a pipe dream. With another awful quarter on the books, Tesla proved Wednesday that it should not have a $30 billion plus market cap.