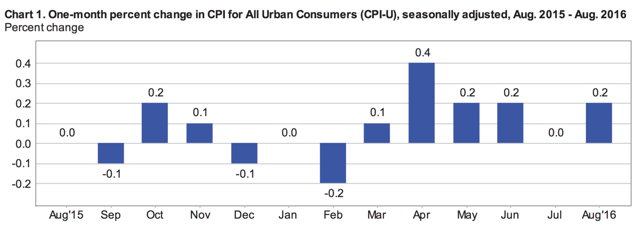

The Consumer Price Index for All Urban Consumers (CPI-U) increased 0.2% in August on a seasonally adjusted basis, the U.S. Bureau of Labor Statistics reported today. Over the last 12 months, 'headline' inflation rose 1.1% before seasonal adjustment.

This was a particularly interesting month, because the overall energy and food indexes played no role in the inflation number - both were up 0.0% in August. Gasoline prices were down 0.9% in the month, however, and are still down 17.3% over the last 12 months.

Of note in the inflation report: Medical care commodities were up 1.1% in August and medical care services were up 0.9%. Both of those are strong numbers. Apparel was up a moderate 0.2% and shelter up 0.3%.

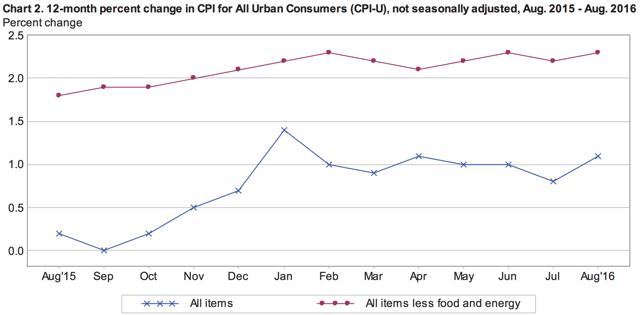

Core inflation - which strips out food and energy - was up 0.3% in August and has increased 2.3% over the last year. Even though overall inflation remains muted, core inflation has been rising, and at this point, has surpassed the Federal Reserve's target of 2.0% annual inflation. Could this lead to higher interest rates later this year? The Fed would have to admit that this 12-month chart seems to depict 'moderate' inflation, and certainly not deflation:

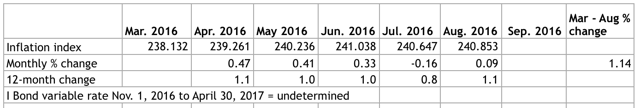

What the August number means for I Bonds and TIPS. Holders of Treasury Inflation-Protected Securities and I Bonds are also interested in non-seasonally adjusted inflation, which is used to adjust principal balances on TIPS and set future interest rates on I Bonds.

In August, the CPI-U index was set at 240.853, an increase of 0.09% over July's 240.647. The August number will be used to increase the principal balance of TIPS 0.09% in October. For example, the index ratio on a 10-year TIPS maturing in July 2018 will increase from 1.11597 on October 1 to 1.11689 on October 31. See all the October index ratios here.

I Bonds have a variable interest rate that will re-adjust on November 1 based on inflation from March to September 2016. We are now five months through that cycle, with inflation up 1.14% in the period. If the Treasury were setting a new I Bond variable rate today, it would be 2.28%, far better than today's 0.16%.

September's inflation number will be released on October 18 at 8:30 a.m., and at that point, investors will know that the new variable rate (which lasts six months) will be on November 1. But investors still won't know if the current fixed rate of 0.1% will hold. It is possible that it could drop to 0.0%. And that sets up an interesting investing decision for people waiting to buy their I Bond allocation for 2016. I'll be looking at this issue in future articles.

Here is the overall trend in non-seasonally adjusted inflation over the last 12 months: