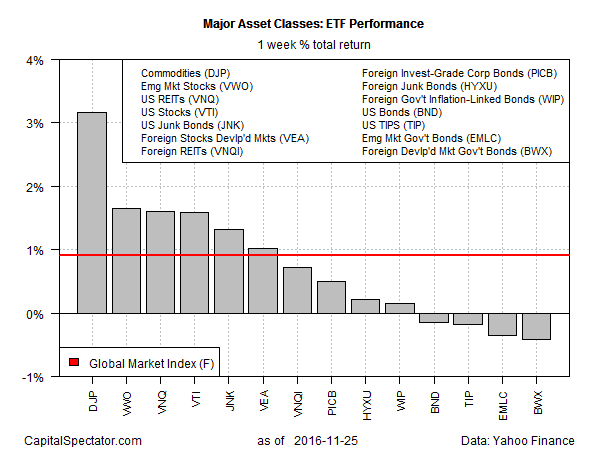

Commodities popped last week, posting the strongest weekly gain among the major asset classes, based on a set of proxy ETFs. Supported by expectations of higher inflation, broadly defined commodities led the way higher by a wide margin in the holiday shortened trading week through Friday, Nov. 25.

The iPath Bloomberg Commodity ETN (NYSEARCA:DJP) jumped 3.2% last week, marking its second advance in as many weeks. One factor in DJP’s recent rebound: expectations that US inflation will be higher in the near term. As one sign of the attitude adjustment, the yield spread between the nominal 10-year Treasury Note less its inflation-indexed counterpart (a proxy for inflation expectations) last week topped 1.90%–a 16-month high—before easing to 1.89% on Friday.

Meantime, foreign bonds took the biggest hit last week, thanks in part to a rising US dollar. The biggest loser: SPDR Bloomberg Barclays International Treasury Bond (NYSEARCA:BWX), which shed 0.4%.

The general trend, however, was firmly higher last week, based on an ETF-based version of the Global Markets Index (GMI.F). This investable, unmanaged benchmark that holds all the major asset classes in market-value weights increased 0.9% for the four trading days through last Friday.

In the one-year column, US junk bonds grabbed the top spot last week. SPDR Bloomberg Barclays High Yield Bond (NYSEARCA:JNK) posted a 9.1% total return for the 12 months through Nov. 25. The biggest loser among the major asset classes for one-year results: Vanguard FTSE Developed Markets (NYSEARCA:VEA), which is off 2.2%. By contrast, GMI.F’s one-year total return is currently in the black by 3.8%.