Mechel (MTL) stock has had a fabulous run since last June - up over 300% to date. The rally had been fueled by the surge in global hard coking coal (HCC) prices - up 270% in July-December 2015. However, coal prices have come down over 40% since early December 2016, while Mechel, with a ratchet-like resilience, is still holding on to its outstanding gains. Frankly, I would expect a much more lively reaction to the sharp correction in coal prices from a company boasting net debt/EBITDA 2016E ratio close to 7x. So, I decided to do a check-up on Mechel to see if its current equity valuation is still pricing a reasonable long-term scenario. (For those eager to know the conclusion, here is a spoiler: most probably not).

What is Mechel in a nutshell? It is a leading privately owned mining company in Russia and one of the largest producers of metallurgical coal globally, producing 15-16mtpa run-of-mine (ROM) met coal, including anthracite, and also a large producer of thermal coal (around 7mt ROM). In 2015, Mechel was the second largest coking coal producer in Russia, with an approximately 16.7% share of Russia's total coking coal production by volume.

Although the graph below is a bit dated, it correctly shows that Mechel is a close peer for Peabody (BTUUQ) in terms of met coal production volumes. And, almost like Peabody, Mechel has had a close brush with bankruptcy, even though forces more powerful than the market seem to have ultimately prevailed (more on that later). Mechel also has steel operations under its roof, producing over 4mt of crude steel p.a., most of which goes into the fabrication of long steel products. 55% of Mechel stock is owned by a Russian businessman Igor Zyuzin and his family.

Source: Company presentation

A one-time favorite of the Russian stock market, Mechel's stock had been in a tailspin from its last post-crisis peak in early 2011, going down from $70 per share to below $1 in 2014. Ambitious plans to develop a world-class Elga deposit in Yakutia, which back in 2011 was expected to nearly double Mechel's coal production to 32mt by 2018, led to a massive debt accumulation (~$10bn) just at a time when global coal prices started their relentless decline. By 2013, Mechel's EBITDA stabilized at around $700m, which was barely enough to cover interest expense of $750-800m p.a. In early 2014, Mechel, crushed by the net debt/EBITDA ratio of 13x and no relief in sight from global markets, saw no other option but to bring creditor banks to the negotiations table. The ruble devaluation in 2014 was a blessing in disguise for Mechel, both lowering production costs and, most importantly, slashing the dollar-denominated net debt burden by almost a quarter from $8.8bn at the end of 2013 to $6.8bn at the end of 2014.

Mechel was lucky in that about 70% of this amount was owed to the state banks, including VTB, Gazprombank and Sberbank. State banks were understandably reluctant to take massive hits to their equity by forcing Mechel into bankruptcy. For Gazprombank, for instance, its $1,7bn loan to Mechel represented more than 20% of its equity as of the end of 2014. Initially, though, Sberbank and VTB, whose exposure to Mechel's debt was not as dramatic, were demanding Zyuzin's head and went to court after Zyuzin flatly refused to convert $3bn worth of Mechel's debt into 75% of the company's equity. If one were to believe press reports, it was direct interference from the Kremlin that ultimately decided Mechel's fate. According to unnamed sources quoted by Reuters, the Kremlin demanded that Mechel be spared, worrying about social unrest in case massive layoffs started among Mechel's 66,000 plus staff.

With such backing, it was hardly surprising that Sberbank and VTB promptly withdrew their claims, while Gazprombank was never keen on bankrupting Mechel in the first place. By early 2016, a deal was hammered out under which Mechel was granted a grace period until 2020, whereupon principal repayment had to be completed until 2022 (VTB was the last one to sign up to the deal in December 2016). Mechel also sold 49% of its flagship project, Elga, to Gazprombank for $500m, with an option to buy it back. But the most interesting part of the story was yet to come.

Mechel and the global coal prices

Just as Mechel was hammering out a deal with the creditors in May 2016, China suddenly decided to restrict the number of working days for domestic coal producers from 330 to 276 per annum. The resulting market tightness, which was exacerbated by China's railroad disruptions and transportation bottlenecks in Australia, propelled coking coal prices through the roof, with HCC FOB Australia nearly quadrupling in 6 months. Even though Mechel's operating and financial leverage would justify even a steeper climb, the stock only replicated coal's move, going up 300%. However, despite HCC price retracing over 40% from its December 2016 peak, Mechel returned to its December highs after a brief correction and has stayed there. To answer the question if such a resilience is justified, one must first of all take a view on the future direction of coal prices, and the outlook for the coal prices largely depends on how one sees the goals that the Chinese government was pursuing in introducing production cuts.

From the outset, few analysts and market observers believed that China's restrictions are there to stay. And they seemed to be right: by December, China's National Development and Reform Commission (NDRC) almost completely reversed its 276 day rule, effectively allowing up to 350mt of coal capacity to return to the market. However, NDRC's comments when relaxing the 276-day rule suggested that the restrictions policy was there to stay in some form or another for the foreseeable future. It appears that the government wants to kill two birds with one stone, aiming to 1) reduce obsolete and excessive capacity, and 2) maintain coal prices at a level that would allow the debt-laden domestic coal sector repay its debts without undue strain. The government wants to regulate production so that the market price for thermal coal stays around 535 Rmb/t on a 5,500kcal FOB basis, or around $80/t, which is approximately where the marginal cost of Chinese producers is located. There is no specific target for the met coal, but it is logical to assume that, with the target for thermal coal set around marginal cost, it could be the same for metallurgical coal, for which it is around Rmb 1,200/t, equivalent to $130/t FOB Australia. Anyway, the global seaborne coal prices should ultimately settle around the marginal costs as producers in the US, Australia and Africa ramp up production. As can be seen from the charts below, the marginal cost of coal production in the seaborne market is close to the marginal cost of Chinese producers.

That is why I like the $130/t price for met coal and $80/t for thermal as a long-term assumption - these prices comfortably cover the entire global coal cost curve, as can be seen from the charts below, and seem to be in line with long-term policy goals set by the Chinese government in implementing its supply-side reforms. I think, by the way, that it is not an accident that Peabody is using met coal price of $120 in its recently filed financial projections (expecting to see it as early as in 4Q17) - it is a pretty close shot at the same marginal cost.

Source: Bloomberg Intelligence

Source: Bloomberg Intelligence

Now, let's use these figures to forecast Mechel's top line, but first let's make some assumptions about the company's production and sales. My approach in valuing Mechel is as follows: I value its legacy assets, Yakutugol and Southern Kuzbass, and then separately value its flagship project - the giant Elga deposit boasting 2,2bn tons of coal reserves. My reason for separating Elga is that Mechel itself treats it as a separate entity, having sold 49% of it to Gazprombank, and it will most likely be funded using project finance, with no recourse to Mechel, so I derive its value separately, with only 51% attributable to Mechel.

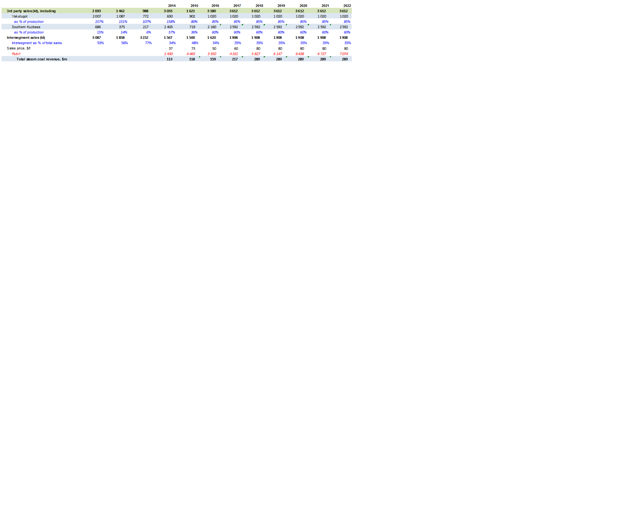

Production at Mechel's two key divisions - Yakutugol and Southern Kuzbass - has been declining in recent years, most likely due to underinvestment, as the debt-laden company was trying to save on maintenance. At Southern Kuzbass, ROM coking coal production and steam coal production dropped by 40% and 35% respectively between 2012 and 2015, while the decline at Yakutugol has been less pronounced - just over 10% from the 2012-2013 levels. I generously assume that in 2017 Mechel's ROM coking coal production at its legacy assets will be restored to the 2012-2014 average levels. For steam coal, assumed growth is slightly more aggressive (2011 peak for Yakutugol and 2014 levels for Southern Kuzbass). This, however, will require a normalization of maintenance capex (also accounted for in the model), which has apparently dropped below sustainable levels (more on that below). My production assumptions for Mechel's legacy assets are set out in the table below - note that concentrate yields at Southern Kuzbass have historically been higher than at Yakutugol. For Yakutugol, the resale of 3 rd party coal is excluded from the sales figure (this should not affect valuation in any meaningful way, as this is a low-margin business). Projections for Elga will be summarized in a separate section devoted to the project.

Mechel's coking and steam coal production

Source: Mechel 20-f, my projections

In terms of pricing, we should remember that Mechel produces HCC only at two of its assets - lower quality low-volatile HCC at Yakutugol (Neryungri) and higher quality high-volatile HCC at Elga. Since HCC of both types is little used in Russian domestic blast furnaces, it is mostly sold for export: the share of exports at Yakutugol is over 80% and coking coal from Elga is nearly 100% exported. As for Southern Kuzbass, it produces semi-soft/semi-hard coking coal (SSCC/SHCC), which is mostly consumed domestically, with about 50% used to satisfy the needs of Mechel's own steel segment and with exports accounting for about 30%.

I assume that altogether Mechel will be exporting around 70% of its coking coal output going forward. The bulk of exports will continue to be represented by high-quality HCC from Elga (I assume that 100% of its output will go to exports) and somewhat lower quality HCC from Yakutugol (85% of its total sales). The share of exported output of Southern Kuzbass (SKCC) will continue to be less significant. Even though the popularity of SHCC/SSCC as a blast furnace feed has been growing in recent years in Asia (primarily China and Japan) due to its relative cheapness, there is a limit as to how much SHCC you can mix into a furnace charge without jeopardizing steel quality (estimated at around 30% of total furnace charge). Besides, the trend for consolidation of steel plants in China should increase the share of large furnaces (over 2mtpy) in total production going forward, and large furnaces demand more HCC to run at optimum efficiency. Therefore, I assume that the share of exports in Southern Kuzbass' output will stay the same at around 30%.

For exports, I apply a modest 5% discount to Australia FOB benchmark to the price of HCC from Yakutugol and a 20% discount to Yakutugol's coal for Southern Kuzbass' SSCC/SHCC, in line with the long-term relationship between SSCC and HCC in the seaborne market. For domestic sales, I apply a 10% discount to Australian benchmark for the Yakutugol coal and the same 20% discount to Yakutugol coal is applied to Southern Kuzbass' SSCC/SHCC. For the sake of simplicity, I have assumed exported steam coal price equal to the domestic price at $80.

Mechel's coking coal revenue projections

Mechel's steam coal revenue projections

Source: Mechel 20-f, my projections

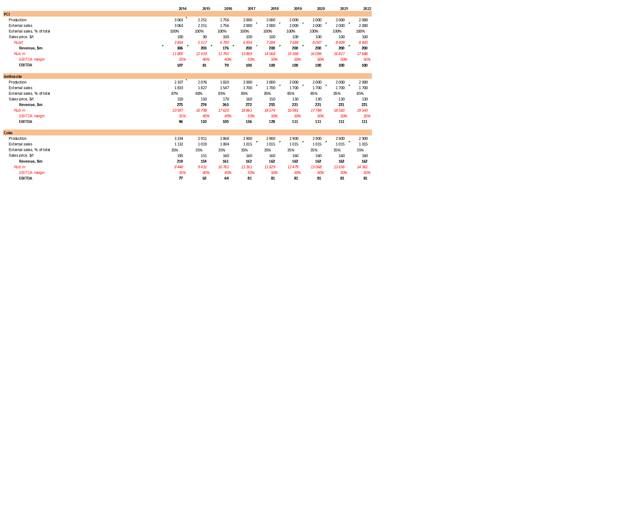

Now let's turn to the costs and profitability of coking and steam coal concentrate production. Mechel's coal concentrate costs are among the lowest globally thanks both to nature's generosity that has placed at the company's disposal huge seams of quality coal accessible for open pit mining (90% of the company's total production is from open pit), and to the ruble's devaluation. In 3Q16, it cost a mere $13 to mine a ton of coal at Yakutugol and $30 at Southern Kuzbass. The mining cost advantage is tempered by the relatively high cost of transportation due to large distance from ports, but even that has been mitigated by the ruble's devaluation, coming down from $40-45 to $20-25 (FOB Far East). G&A represents about 8% of the mining segment revenue. The summary of cash costs and EBITDA is set out in the table below - as one can see, it produces a respectable 50-65% EBITDA margin going forward.

Mechel's EBITDA: coking and steam coal

Source: Mechel 20-f, my projections

For the remaining mining segments (anthracite, PCI, coke), for which the company does not report cash costs, I assume a 50% EBITDA margin going forward, which is hardly conservative.

Mechel's EBITDA: other mining products

Source: Mechel 20-f, my projections

As for the iron ore, in 2016 Mechel de facto stopped selling it to the 3 rd parties (before, external sales constituted around 20%), with the entire ~2,8mt volume going to the steel business, therefore I don't forecast the iron ore segment separately, as it will be implicitly present in my projections for the steel business.

Mechel is the second-largest long steel producer in Russia, but its steel segment has had very low margins historically, with EBITDA margin hardly exceeding high single digits after the 2008 crisis. Margins started to improve in 2016 with the launch of Universal steel mill, which is capable of producing high-margin products, including high-speed rails (total capacity is 1,1mt). The mill is expected to achieve full ramp-up in 2017. Therefore, going forward I generously assume Mechel's steel margin at 15% thanks to the mill's launch.

Mechel steel segment projections

Source: Mechel 20-f, my projections

Before completing the valuation of Mechel's legacy assets, a few words on capex, to which the company's valuation is pretty sensitive. I believe that the current level of maintenance capex at $100m p.a. is not sustainable - back in 2012, the company was estimating maintenance at $250m. An argument could be made that this figure might have fallen after the ruble's massive devaluation in 2014, but Mechel's maintenance capex was cut to $150m already in 2013, long before the devaluation and just when the debt problem was reaching its climax - so we can assume that underinvestment started 4 years ago. Besides, given that most capex articles are most likely USD-denominated (e.g., mining equipment), at least $150-200m should be penciled in for maintenance capex. Another reality check is the ratio of capex to sales presented on the graph below - as can be seen, it plummeted from 14% in 2011 to a meager 2% in 2016. A reasonable and even conservative assumption of maintenance capex at 5% yields capex estimate of $250m. Therefore my $200m capex projection looks pretty generous; if we increase it to $250m, the downside for Mechel increases from -40% to -63%.

Mechel's capex evolution ($m and as % of sales)

Elga: great expectations

To complete Mechel's valuation, we need to value the company's 51% stake in its flagship project, which is also its only source of future growth - the giant Elga deposit in Yakutia boasting 2.2bn tons of coal reserves. At the moment, Elga is producing 4mt of ROM coal per annum, about three quarters of which is coking and the rest is thermal. The existing washing plant has capacity of 2.7mt. Back in 2011, Mechel was setting sights on a 30mtpa operation, but now even building the second stage, which includes expansion of output by 9mtpa and the same increase in washing capacity, looks like a tall order.

Last year, Mechel estimated the cost of the 2nd stage at RUB70-80bn, which at the current exchange rate comes to roughly $1.2-1.3bn. Expected construction time is 2-3 years. I've built a simplified model of Elga based on these parameters, assuming that construction will start in 2018 (as 2017 will most likely be spent arranging non-recourse project finance, which is the only likely way of financing for Elga, considering Mechel's debt burden) and will last for three years. I'm using a discount rate of 12%. Long-term coal price assumptions are the same as above. Production cash costs are assumed to be the same as at Yakutugol/Neryungri (they were higher at $45/t in 2015 - see chart below - and should decrease to Yakutugol's level as Elga ramps up).

As can be seen from the table below, the resulting NPV is a modest $587m, with an IRR of 11%. The project adds $1,4 value per share.

Elga model: a modest outcome

The resulting Mechel valuation (DCF of legacy assets plus 51% of Elga) gives a 40% downside to the current price (see table below). On a positive note, the model shows that by 2022, when the debt repayment should be completed, Mechel should be able to accumulate about $6.7bn in cumulative free cash flow, covering about 90% of its debt repayment requirement.

Mechel's summary financial model

Supporting Documents