Introduction

Previously, I published an article warning about the perils of subprime credit lending at Ally Financial (NYSE:ALLY). I continue to maintain a bearish outlook for the consumer lending industry, specifically, the subprime lending industry. In this article, I will make a close analysis of Capital One Financial, Inc. (NYSE:NYSE:COF), another company whose business operations fit the criteria I have been investigating. I intend to warn investors of Capital One's rosy business operating results and present a thesis arguing that COF appears to be significantly overvalued. The financial and numerical data I present throughout this article is available in the company's most recent 10-K and 10-Q filings. I will heavily reference notes found in the company's filings, all other relevant articles have been cited for the reader. In recent trading sessions, COF shares have started to decline dramatically in response to some of the material I cover in this article.

Business Overview

Capital One Financial Corporation is a bank holding company that provides various financial products and services in the United States, the United Kingdom, and Canada. The company operates in three business spaces: credit cards, consumer banking, and commercial banking. The company offers non-interest-bearing and interest-bearing deposit accounts. The company also provides credit card, auto, home, and retail banking loans; and commercial and multifamily real estate, commercial and industrial, and small-ticket commercial real estate loans. In addition, the company offers credit and debit card products and online banking services, treasury management, and depository services. Capital One has branch locations primarily in New York, New Jersey, Texas, Louisiana, Maryland, Virginia, and the District of Columbia. Capital One Financial Corporation was founded in 1988 by current Chairman and Chief Executive Officer, Richard D. Fairbank.

Key Executives | ||||

Name | Title | Pay | Exercised | Age |

Mr. Richard D. Fairbank | Founder, Exec. Chairman, Chief Exec. Officer and Pres | 2.82M | N/A | 66 |

Mr. John G. Finneran Jr. | Gen. Counsel and Corp. Sec. | 1.19M | 5.95M | 67 |

Mr. Stephen S. Crawford | Head of Fin. and Corp. Devel. | 1.82M | N/A | 52 |

Mr. Sanjiv Yajnik | Pres of Financial Services | 1.15M | N/A | 60 |

Mr. Richard Scott Blackley | Chief Financial Officer, Principal Accounting Officer, Sr. VP and Controller | N/A | N/A | 49 |

Thesis

Over the past year, Capital One's stock performed quite well, reaching a record $93 per share in February 2017 from $63 per share in July 2016. The increase came after disappointing performance over the last two years. What strikes me most is how (as many publicly-traded companies have) Capital One's stock price benefited mostly from the post-election "Trump Rally" rather than actual fundamental reason. An article published by Bloomberg highlights the optimism-induced speculation that has strategists at Goldman Sachs voicing their concern. In a separate article published by Danielle DiMartino Booth on Bloomberg View, Ms. Booth presents some evidence of a similar kind optimism driving consumer borrowing, despite counter-intuitive macro data.

My thesis for shorting shares of Capital One is similar to the one I presented in my article covering Ally Financial. I believe COF is standing with a risk model that has for some time now shown signs of stress. As I will later show, COF's allowance for loan losses and charge-off rates indicate the company is indeed in worse shape than before. Also later in the article, I talk about how the Federal Reserve recently raised their target on the Fed Funds Rate. Following the rate increase in March, the Fed's most recent "dot plot" continues to expect three rate increases this year. This compares to the Fed's previous pace of only hiking once per year in December. These rate increases are increasingly important to the performance of loan portfolios of lenders like Capital One. Further, the current administration in Washington continues to face conflict conducting public policy. This uncertainty may start to erode what is otherwise a positive climate of consumer and business confidence.

A drawback of consumer lending businesses is the dependence on conditions in the business cycle. Like most financial companies, Capital One's valuation historically follows the credit cycle. As credit markets dried up ahead of the financial crisis, Capital One's valuation closely followed downhill. Preceding the U.S. Presidential Election shares of Capital One declined considerably from a peak of $91 in July of 2015. After what appeared like a sudden rally without material evidence to justify, shares of Capital One returned to 2015 peak levels.

Recent Headlines

Another article published on March 10th by Bloomberg news highlighted more recent worries from the subprime auto lending industry which continues to provide key insight into the current credit cycle. I have been interested in this credit cycle since the spring of 2015, but only until recently, has my thesis started to gain some traction.

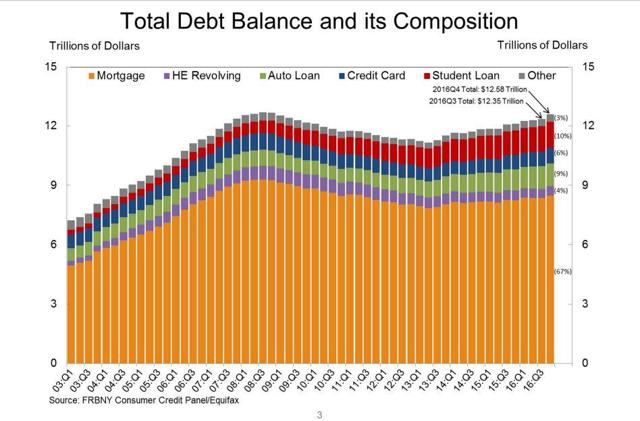

In December, I referenced research from the New York Federal Reserve in my article covering Ally Financial. This month, the New York Fed published their "Quarterly Report on Household Debt and Credit" conditions for the fourth quarter of 2016. The report reveals that:

Total household debt increased by 1.8% in the fourth quarter of 2016, rising $226 billion to reach $12.58 trillion, only 99 billion shy of its 2008 third quarter peak..." and

Balances increased across all debt products, with a 1.6% increase in mortgage balances, a 1.9% increase in auto loan balances, a 4.3% increase in credit card balances, and a 2.4% increase in student loan balances this quarter."

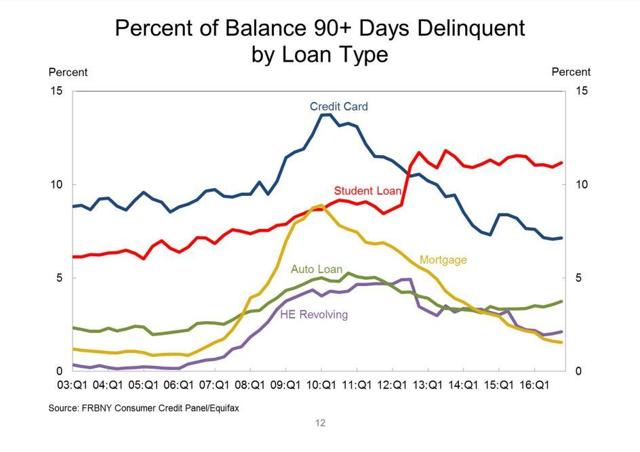

This information leads to the main point in my thesis that the current credit cycle has reached a peak and that credit tightening or a downturn in credit conditions is likely imminent.

Naturally, in 2008, residential mortgages were the largest component of household debt. Under the current composition, household debt has seen growth in student loans, consumer credit cards, and auto loans which have been financed during the current credit cycle. Due to increased financial oversight and regulation, a system-wide financial crisis such as the one that occurred in 2008 is unlikely. However, I do expect for credit markets to tighten soon and for lenders such as Ally Financial and Capital One to continue to face headwinds well into next year.

As I mentioned earlier, the Federal Reserve recently raised their target on federal funds rate and indicated more frequent rate increases throughout the year. As I argued in a prior article, this is likely to have an adverse effect on loan portfolios concentrated in mid-tier and lower-tier subprime consumer credit, and loans with adjustable or variable interest. Additionally, the most recent Fed "Beige Book" contained mixed reports across the Fed districts regarding auto and commercial lending. Some districts reported seeing declines in auto lending and mostly flat commercial and home mortgage lending. Additional supporting evidence can be found in the company's filings.

Notes from Capital One's 10-K filings:

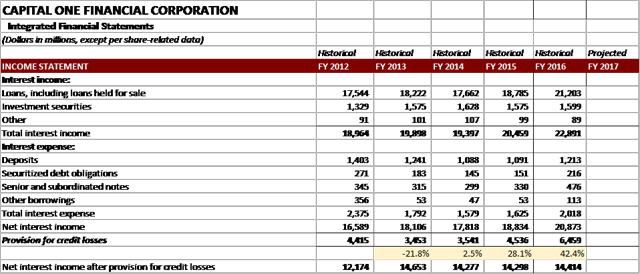

In order to prove that COF's financial performance contradicts the company's current market valuation, I need to highlight the company's financial results over the last five years. I also want to highlight the trend underlying the company's allowance for loan losses, outstanding loan delinquencies, and net charge-offs.

Typically, in this industry, managers reference change in business strategy to maximize profitability. The strategy involves updated risk models and an increase in lending to riskier consumers, reaching for higher yield. The question is, does this business model work? To answer this question, I must look at the income statement line by line.

Capital One's provision for loan losses has continued to trend upward to such extent that the amount of revenue allocated to the provision has started to hurt bottom-line earnings.

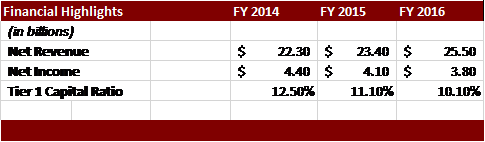

Looking at the income snapshot from above, a continuous growth in revenue year on year as well as growth in total net revenue after interest-related expenses is apparent. However, the impact revenue growth has on earnings is offset by higher non-interest expenses and a higher portion allocated to the provision for credit losses. Again, I'd like to mention Capital One's bullish stock price movement as investors mostly ignored the year-on-year declines in operating and net income since FY 2014. The profit gap continued to widen further in FY 2016 while the amount set aside as a provision for credit losses rose by 42 percent. The allowance for loan losses ballooned by 28 percent over FY 2015. Still, Capital One's management continued to move ahead with a $2.5 billion share buyback program set to end in the second quarter of FY 2017.

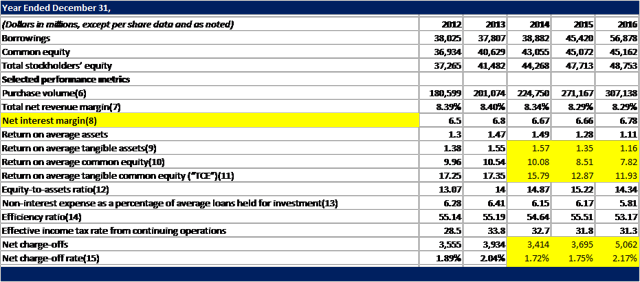

For additional signs of worsening financial performance, I want to point to the company's most recent return on assets and return on equity ratios.

Using all metrics: average assets, tangible assets, average common equity, and tangible common equity, Capital One appears to be underperforming. The underlying trend of these financial ratios is part of the reason why I am skeptical of a Goldman Sachs recent rating upgrade from 'Neutral' to 'Buy.' The bank followed this upgrade with an increase to their price target from $106 to $110. Goldman Analyst Ryan M. Nash cites a "market underestimation of EPS leverage, growth math, as well as flattening net charge offs (NCOs)." I think the evidence I provide in this article contradicts this optimistic view.

Despite worsening credit conditions, the market is already pricing COF shares at a premium to tangible book value and on par with book value. The lengthy section of risk factors in COF's 10-K filings confirms the business is inherently dependent on risk models and middle-to-below-average credit consumers for growth. This business model does not permit the allowance for credit and loan losses to shrink as lending expands. Adding to this, there is the notion that COF lacks the sophisticated deposit balances of larger well-capitalized banks such as JPMorgan (NYSE:JPM). I believe investors should be adequately discounting Capital One's shares and should assume less optimistic "growth math."

Additional Notes From Capital "Financial Highlights" section:

My Take: From the table above, did you notice any trend? COF's management defends their increased risk profile as being "in line" with their business strategy focused on improving risk-adjusted returns. It is evident from the figures that risk-adjusted returns have not aligned with earnings for at least the past three fiscal years. Adding to this, last year, COF hammered out $6.5 billion to set aside for their provision for loan losses. The operating results appear to indicate the start of a downward trend in COF's business strategy. This performance emanates from a business which was founded on the advent of data analytics in the early '90s. The problem may not be poor data as much as it is excessive risk-taking on loans backed by poor credit and deteriorating subprime credit conditions. My idea is that the U.S. economy is in a late business cycle. Granted an extended period of monetary easing, low interest rates and looser lending standards, the business cycle is well-correlated to business and consumer credit. When credit conditions deteriorate as they did in 2008, credit markets start to dry up. More recently, oil markets have contracted once again and global economic growth appears to continue to face headwinds. Adding to this, we still have major uncertainty surrounding (or lack of) specific plans for conducting public policy in Washington. The main idea is that when the phase of optimism fueling businesses and consumers starts to wane, risky lenders like Ally Financial, Santander Consumer USA (NYSE:SC), and Capital One Financial are likely to be the first to take a hit on earnings.

In brief, as the total household debt increased by 1.8% in the fourth quarter of 2016, the share of subprime or lower-tier credit as well as delinquencies ticked down a bit. In contrast, looking at Capital One's lending mix, loan-delinquencies, and net charge-offs for the same period, it becomes apparent that the company may have bit into the rotten part of the apple.

On this final note, I want to move my discussion on to the appropriate valuation for Capital One's equity.

Valuation

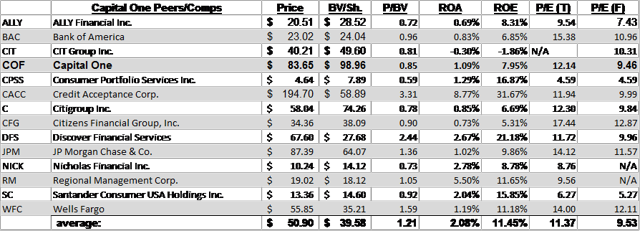

When assessing Capital One's equity valuation, I use the book value multiple approach. To do this, I had to look back at my short-list of comparable companies, which I have recently updated since I last looked at Ally Financial. The short list of comps is presented below.

I started investigating further into Capital One in January of this year, just after the company reported FY 2016 earnings. In the table above where I highlight the comps, you can compare across various valuation metrics. These companies were selected due to their exposure to subprime credit lending. In addition, the comps represent exposure to auto, mortgage, consumer and commercial lending spaces. Averaging out each of these metrics helps to better estimate the company's intrinsic value. On a final note, Capital One is not exactly the most lucrative lender. Given the information I presented in this article, expect my estimated valuation to be lower than that of top-tier lenders.

COF's current market valuation in my opinion contradicts the company's actual operating performance. When I referenced the stock chart at the beginning of this article, I noted that like most U.S. publicly traded companies, Capital One's shares benefited from the wave of consumer optimism after the election.

Given that Capital One has demonstrated a deterioration in financial performance and added a material amount to their allowance for loan losses for several quarters now, the company's common shares should realistically be valued closer to the comps around .70x book value. This valuation prices the company closer to the pre-election trading range below $70 per share, and equates to a market capitalization of roughly $33.6 billion. If my estimated valuation is correct, a short position today would benefit from a share price decline of roughly $13, making the downside potential at least 18%. On price to earnings basis, Capital One still trades pretty high relative to comps. Applying the average P/E ratio indicated in the table above, COF shares should also be valued below $70 per share.

Conclusion

On March 21st, shares of Capital One closed at $83.65 per share after what seemed like a late reaction to Capital One's dismal loan portfolio. The company's shares have been in free fall since March 1st.

Capital One's fundamentals long ago diverged from growth potential and the company's valuation continued to drift higher. As investors weighed in the reality of Capital One's lending standards, the company's stock has finally started to retreat. Now considering the slow growth in commercial lending, risks associated with consumer lending with household debt near a peak, deteriorating subprime credit conditions and looming interest rate increases; there appears to be more room for alpha on the downside of Capital One's shares.

This article is part of Seeking Alpha PRO. PRO members receive exclusive access to Seeking Alpha's best ideas and professional tools to fully leverage the platform.