After a disastrously negative hedging impact ruined Chesapeake Energy Corporation's (NASDAQ:CHK) Q4 2016 results, the firm has a chance to redeem itself when it reports Q1 results before the market opens on May 4. Here's what investors should keep in mind.

Hedging situation

Chesapeake Energy's hedging strategy left it with a large bruise as it exited 2016, with the firm posting $395 million in unrealized hedging losses in Q4. Management didn't direct that much attention to the issue, instead pivoting to Chesapeake's hedges going forward.

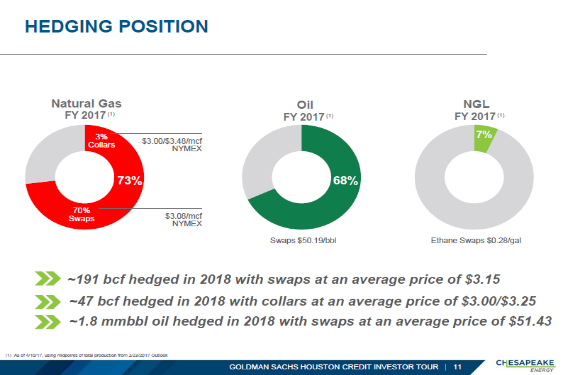

Below is a look at Chesapeake's 2017 hedges as of April 10. Compared to its Q4 hedges, Chesapeake should receive just under a 10% bump up in its hedged dry gas and oil realizations. Its NGLs output should also fetch stronger prices as well.

Source: Chesapeake Energy Corporation

Materially better realized prices will help shrink Chesapeake's losses and bolster its operating cash flow streams. Lower operating expenses across the board, particularly on the GP&T front (midstream), will further compliment those gains. Not enough for Chesapeake to post positive net income but hopefully enough to paint a reasonable road to profitability at just slightly higher prices.

Investors should keep in mind that even though the firm has done a great job restructuring itself (less obligations, more liquidity, simpler corporate structure with removal of VPPs) Chesapeake is still posting losses and is most likely outspending its operating cash flow streams with its revamped capex budget.

Chesapeake aims to spend between $1.7-2.5 billion on capital expenditures and $200 million on capitalized interest this year, equal to $575 million a quarter. It would be impressive just to see Chesapeake generate over $400 million in operating cash flow. Investors should see what part of that large capex range the firm is angling towards and what kind of cash flow streams Chesapeake is generating now that its hedge position has improved.

Implications of drilling program

Chesapeake is running 18 drilling rigs and 11 frac crews across its six core areas of operation, at the upper end of its annual meeting guidance. That implies the firm is most likely spending at the upper end of its capex budget as well. There are a couple reasons to believe why Chesapeake is stepping up activity in light of its financial situation.

Part of it is due to the need to offset sharp production declines, retain acreage, and meet minimum volume requirements or else pay massive fees on top of a smaller production base. Chesapeake has a lot of long term commitments to meet and ramping up spending is the only way to meet those goals.

That is part of the story, but another factor ties into management banking on two key things. The first is a recovering energy price environment combined with rising production levels post-2017 (guidance calls for Chesapeake's output to be basically flat this year) leading to profitability in 2018. Newer more productive wells with lower DD&A per BOE expenses would in theory put Chesapeake in the black by next year if prices move a bit higher.

However, that strategy is entirely dependent on a recovering oil & domestic natural gas pricing environment. Chesapeake knows it can't rely on hopes and dreams of a better world with sky high energy prices to fix all of its financial problems. This is where the second part of its drilling ramp up strategy comes into play, Chesapeake is boosting its activity in order to speed up the monetization process of its assets.

Asset sale update

If you have been following Chesapeake Energy you have heard this before, asset sales drive a large part of the bull thesis. Cash raised from the divestments cover Chesapeake's ongoing outspend and allow it to pay down debt and midstream obligations, freeing up cash flow in the process by improving its balance sheet enormously. This is what enabled Chesapeake to turn its massive 2016-2018 debt wall into practically nothing in the sense those maturities have all been paid off or pushed back.

Now to keep the momentum going after two recent Haynesville sales, which raised a little over $900 million gross, Chesapeake's divestment focus is turning back to the Mid-Continent region in Oklahoma. This is where the firm raised $470 million selling off its 42,000 net acre Meramec position about a year ago, and where the firm plans to sell off "multiple divestment packages" in the near future.

When Chesapeake holds its conference call look out for commentary from management concerning its Mid-Continent asset sale strategy. The firm has two rigs appraising other parts of the Meramec and another two developing the emerging Oswego play, which is also liquids-rich and very prolific.

Chesapeake may be using its two Meramec rigs to speed up the delineation and appraisal process for a potential suitor. When looking at south central Canadian County, Chesapeake brought a few Meramec wells online on acreage far removed from its core operational footprint. That could be seen as an attempt to prove that acreage, especially as Chesapeake aims to sell off packages to the "south and east of [the] focus area".

Investors should also look out for the reasoning behind Chesapeake Energy buying up an additional 26,000 net acres in Major County, which borders Blaine County. This appears to be the new focus area for the firm, and considering its large acreage presence, may be Chesapeake's way of drilling itself back into the Meramec play.

Chesapeake also has two rigs developing the Oswego in eastern Kingfisher County, which could be part of management's divestment scheme. It is to the east of Chesapeake's focus area and has been heavily touted as a great oil-weighted play. While Chesapeake wants a more liquids-oriented production base it needs cash more, and its Oswego and/or second tier Meramec acreage would be two prime ways to raise a meaningful amount.

Any update on this front could yield material upside. Aggressive drilling activity speeds up the appraisal and optimization process, allowing Chesapeake to market better well results or acreage previously thought not to be prospective for viable portions of the Meramec play to potential suitors. We'll see.

Final thoughts

Chesapeake Energy Corporation isn't in dire financial straights anymore but if it wants to prove that profitability isn't a pipe dream it needs to showcase real results from its transformation process. Cuts in midstream, operating, and corporate levels costs on top of an improved hedging program, cheaper completed well costs, and improved well productivity need to at least illuminate a pathway to a profitable 2018.

Asset sales are a great way to keep the lights on when you have over 6 million net acres across six core areas of operation, especially when that cash is being used to right the ship, but an investment needs to be more than that. Chesapeake Energy Corporation has fought its way to here, now the market needs to see what the firm is capable of post-survival mode.

Before then, check out what Chesapeake Energy Corporation has been cooking up in Wyoming's Powder River Basin as management starts claiming the PRB oil plays are economical in the current environment.