In our fifth edition of Taking Stock with Tech, we cover tech equity themes that’s inclusive of large/mid-cap news, and industry data points. Though we can easily acknowledge that we cannot cover every equity theme, we believe that these insights will prove useful.

Micron Inc. may have found support following Earnings Announcement

Micron (NASDAQ:MU) took a beating in the past couple of sessions following what has been unanimously perceived as a good quarterly report.

The stock bounced off the 50-Day Moving Average, and traded upwards on positive SIA (Semiconductor Industry Association) data, for the month of May. The SIA data (which we will discuss in more detail) implies positive read-through for NAND and DRAM specifically, which grew 48% and 60% y/y, respectively.

Given the positive industry data points, and the stock trading at a depressed forward P/E multiple of 4.8x, one may wonder if now is an opportune time to pick up Micron shares.

While we acknowledge that Micron’s multiple probably isn’t justified, and is undervalued. Investors must concede that the stock exhibits a lot of volatility precisely because it trades at a low-multiple, exhibited rapid sales/earnings growth following a cyclical trough. It’s the negative perception of cyclical stocks that drive valuation ranges, and it’s why we’re not surprised by the pull-back following its 240% rally from its 52-week low.

We think investors should buy up shares opportunistically. We will reveal exclusive research on Micron to our premium research subscribers this week.

Snap Inc. unveils new chat features

Snap Inc. (NYSE:SNAP) continues to add more features to Snapchat, as we move beyond the simplistic design interface that has made the app popular among millennials.

Snapchat introduced “Paper Clips,” which allows users to share outbound links from the app. Of course, it’s worth noting that Snapchat introduced a preview function, so users don’t click on malicious links from spam accounts.

The new feature may prompt speculation over affiliate links, and how it may impact Snap’s digital advertising model going forward. Furthermore, we expect that digital advertisers will spend more on “follower campaigns” given the residual value of sharing outbound links to followers on Snapchat.

Snap also introduced backdrops and voice filters, which allows users to modify Snap Stories/Messages with new backdrops that are designed via the scissor functionality paired with voice mods that can be selected from a range of voices by clicking on the speaker icon.

The new voice modification feature is the easiest to use out of the three, whereas Paper Clips (link sharing) may take a while to really take off. The new backdrop filter was incremental in nature, and is really targeted at hardcore Snap users.

Overall, the recent update was more incremental, though it’s worth noting the amount of effort Snap Inc. puts into developing new functionality.

We continue to reiterate our Top Pick Internet Pick designation on Snap Inc.

SIA data read through

May was a strong month for Semiconductors, as SIA updated its model to reflect 24% y/y growth on aggregate. The industry logged eleven consecutive months of y/y growth, but with growth rates accelerating into 2H’17 where seasonality contributes to better q/q compares. This suggests that the cyclical trough may be coming to an end, as growth was broadly distributed, as growth was inclusive of analog, logic and discrete growth as well.

RBC Capital Markets provided a monthly data summary for the entire industry.

The category that added most to May was memory and logic chips, which grew 54% and 16% y/y respectively.

AMD (AMD) +8.56%, Micron +4.7%, STMicroelectronics (STM) +2.59%, Intel (INTC) +2.63%, ON Semiconductor (ON) +1.81%, and Cypress Semiconductors (CY) +1.65%.

The data suggested that Intel and AMD may exhibit better industry tailwinds going into the second half of 2017. Therefore, industry expansion helps to offset the perceived weakness from declining MPU volumes, because of competition in the case of Intel.

Future of advertising and television

In a Credit Suisse report released Wednesday morning, it was noted that TV networks are transitioning towards more advanced targeting methods for linear programming. Though, we find these efforts promising, it’s still nascent according to the report.

Here was the key highlight:

Our speakers argued that the TV industry is in the early stages of transitioning to using data to target viewers more efficiently. Open AP is a welcome early step, and is likely to gain traction with networks and advertisers, but is far from being the only driver of this transition. Comcast's advanced advertising products were also praised, and Simulmedia showcased its impressive buy-side platform (see charts below), a SaaS version of which is now available to advertisers, agencies, networks and MVPDs. Our speakers highlighted that we are in a "land grab" phase, with various platforms seeking to establish standards which will determine how the market develops long term.

We find these developments to be more promising, though we acknowledge that they’re nascent and may not transition quite as successfully as industry insiders are anticipating. Replicating the digital ad-targeting model is difficult for standard broadcast television, with companies like Facebook (FB) and Twitter (TWTR) likely to absorb more exclusive content and rebroadcast via their respective platforms.

Comcast (CMCSA) could be more resilient in the face of cord-cutting, especially if new ad-tech offers useful insights that can help mitigate the declining subscriber pool over time.

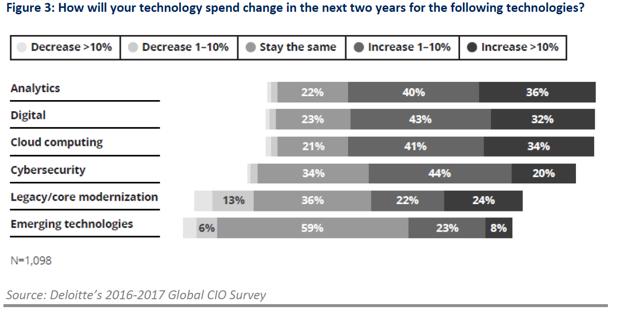

Global CIO survey provides insights on IT spending priority

A new IT survey was released by Deloitte, and the key takeaway suggests that there are further legs to cloud migration and modernization of IT infrastructure at various companies.

Key highlights (summary from Wedbush Securities): 1) end-users are still under-investing, with current IT spend leaning towards modernization of legacy/core on-premise data centers. 2) investment priorities to shift away from legacy platforms (Oracle (ORCL) and IBM (IBM) are big losers in this scenario). 3) Investment more concentrated in emerging tech like MLA, IoT, and process/robotic automation tied to the datacenter.

The key focus areas for IT spending over the next two years: 1) Analytics, 2) digital, 3) cloud computing, and 4) cyber security.

Winners: Microsoft (MSFT), Accenture (ACN), Amazon (AMZN) and BlackBerry (BBRY).

Losers (legacy providers): Oracle, IBM, HP Enterprise (HPE).

Tech valuations under a microscope again…

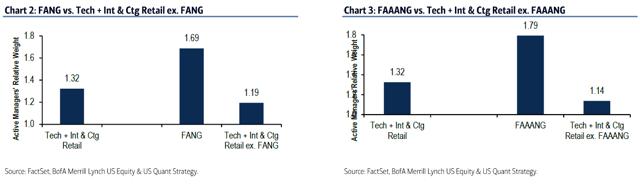

FANG (Facebook, Amazon, Netflix (NFLX) and Google (GOOG) (GOOGL)) overweight relative to other tech stocks. It’s been noted that stocks that are overweight soon underperform relative to comparable indexes.

Whereas FAANG inclusive of Adobe (ADBE), and Avago (AVGO) show an even higher weighting among investment managers.

The stocks likely to exhibit the most beta are FANG stocks, though it was noted by Mark Mahaney on CNBC recently that there’s very little fundamental news that could diminish business fundamentals for 2H’17.

Overall, we maintain our stance that the market is long overdue for a correction.

Cho's Investment Research is SA's premier research package that gives investors and traders an additional edge when investing into companies. It's a trade publication, research service and an idea generator. This service comes at a low annual subscription cost of $40/month.

For more information click here.

Source: BofAML

Source: BofAML