"The future is unpredictable. No one knows whether the economy will shrink or grow (or how fast), what the rate of inflation will be, and whether interest rates and share prices will rise or fall. Investors intent on avoiding loss consequently must position themselves to survey and even prosper under any circumstances. Bad luck can befall you; mistakes happen. The river may overflow its banks only once or twice in a century, but you still buy flood insurance on your house each year. Similarly we may only have one or two economic depressions or financial panics in a century, but the prudent, farsighted investor manages his or her portfolio with the knowledge that financial catastrophes can and do occur. Investors must be willing to forego some near-term return, if necessary, as an insurance premium against unexpected and unpredictable adversity."

-Seth Klarman

Early Warning Signs of Stress

You know that moment right before a storm? The point where the clouds begin to form in the distance? Sometimes it remains sunny for a bit, and sometimes the clouds close in on your location. While you don't know when, you do know the storm is coming. That is where we are today in the market.

While the S&P 500 continues to ascend, the risks in the real economy are rising with it. A new report from the Bank For International Settlements (BIS) tells us an unsettling fact: the lessons from the financial crisis have not been learnt and financial system risk continues to rise around the globe.

Additionally, the developed world seems to be drowning in debt, and the IMF says it sees challenges ahead for Emerging Europe as well. In Australia, Europe, Japan, and China, debt continues to be an increasing impediment to growth for these nations, even as central bankers attempt to stimulate growth with unprecedented monetary accommodation. This should be far more concerning to investors than it is.

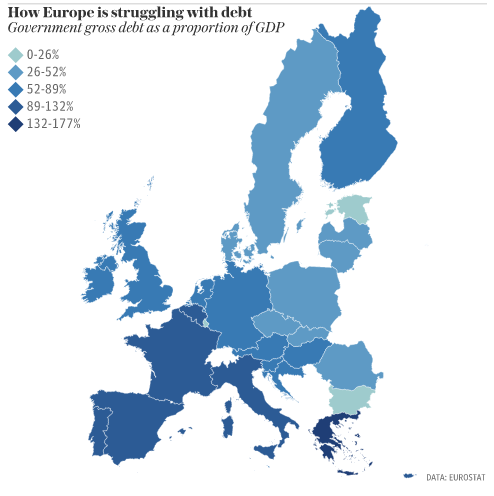

"Altogether there are five European nations whose debts are larger than their economic output, and 21 that have debts larger than the 60 per cent-of-GDP limit set out in the Maastricht Treaty. Greece’s public debt is, unsurprisingly, the highest in the EU - standing at 177 per cent of its GDP. Italy and Portugal are the next most indebted countries, with debts of 132 per cent and 129 per cent of national economic output respectively."

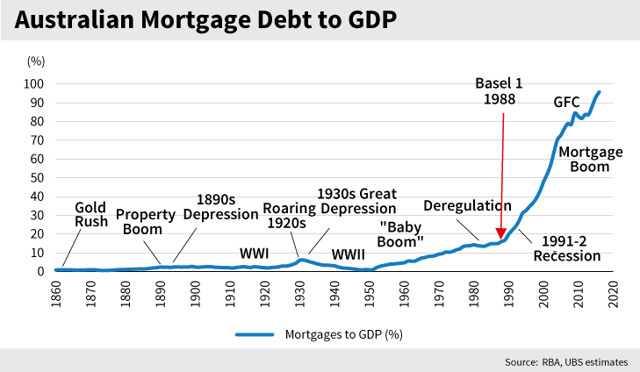

In Australia, a recent report by the Reserve Bank demonstrated that Australians are holding debt equal to 190% of their household income, a new record. This is largely due to exploding mortgage debt. Of the 3.1 million mortgaged households in Australia, an estimated 669,000 are now experiencing mortgage stress.

A report from the Bank for International Settlements warned that the surge in Australian household debt increases the instability of the Australian economy and makes the country more susceptible to another financial crisis.

Growing Debt Continues to Strangle GDP

Fisher's equation of exchange tells us that M=the Supply of money and V=the velocity of money, and we can calculate GDP=M*V. With velocity at a low not seen since 1949, and continuing to fall, the trend for lower and lower GDP remains intact. In addition, the nation's debt burdens continue to grow at both the national and household level. Aggregate debt sits at 370% of GDP and rising.

Academic research is very clear that growing debt burdens lead to lower and lower levels of GDP growth that can be achieved. Debt acts like an albatross around the neck of a nation, choking off economic growth. What makes matters worse is that the debt is growing. More and more people are financing cars, depreciable assets, with longer and longer terms. Taking on more and more debt. Student loans are ballooning, putting the financial security of an entire generation in jeopardy. Credit card balances are growing, but wages are not.

As wages continue to stagnate, there is little confidence that those loans will be paid off. Sure enough we are seeing this in the data as delinquencies are rising beginning in the auto sector. While the current level is not worrisome, what is worrisome is the trend of rising delinquencies.

33% of American households are making payments on a depreciable asset, and Americans have racked up $1 TRILLION in car loans. American households are drowning in debt, and continue to transfer their wealth from themselves to the debt holder, instead of earning interest, they are paying interest, which has a large compounding opportunity cost for their future.

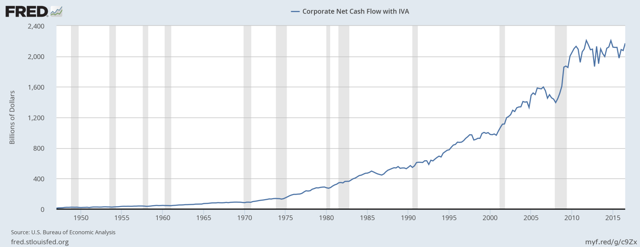

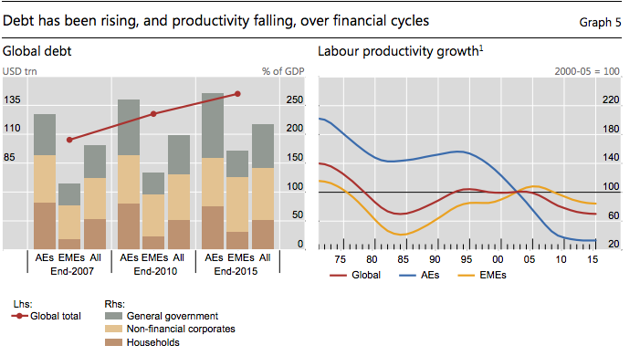

What is even worse about the debt, at the corporate level, is that it is not being used for productive ends. As global debt has risen, productivity continues to fall. This is very troublesome, as companies hoard cash and utilize low interest rate debt to juice their stock prices, through buybacks and dividends, rather than invest in the future of their business.  As bad as the debt situation is, we now find out that it may be understated by $13 trillion. BIS researchers have found that:

As bad as the debt situation is, we now find out that it may be understated by $13 trillion. BIS researchers have found that:

“Accounting conventions leave it mostly off-balance sheet, as a derivative, even though it is in effect a secured loan with principal to be repaid in full at maturity...In particular, the short maturity of most FX swaps and forwards can create big maturity mismatches and hence generate large liquidity demands, especially during times of stress.”

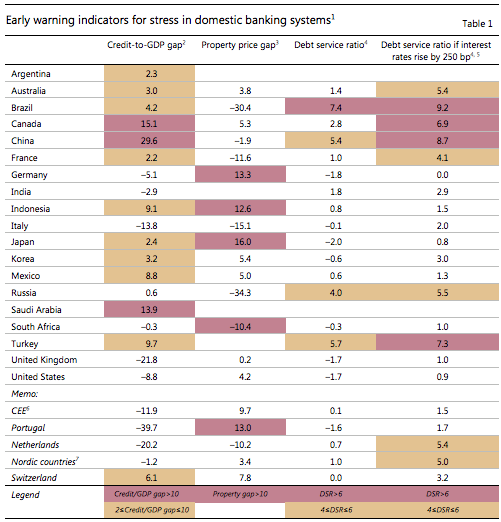

Canada & China: Red Flags Are Visible; Will This Be The Catalyst?

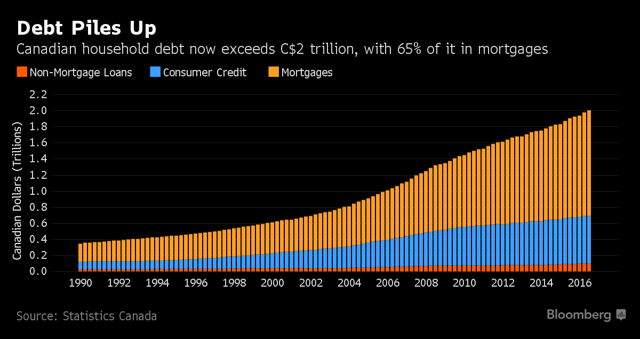

BIS data shows that Canada and China are showing red flags for their debt burden. BIS calculates a country's credit to GDP gap to get an idea of the level of debt. The measure is thought to be an early warning sign of a financial crisis. Any number above 10% indicates an elevated risk.

Canadian households are drowning in debt, nearly 65% of it is mortgage debt. As the debt rises, so does the instability of the country's financial system and the risk of a financial crisis. With the global economy so interdependent, the notion that we in the U.S. can decouple from what is going on with our neighbor to the north is simply impractical.

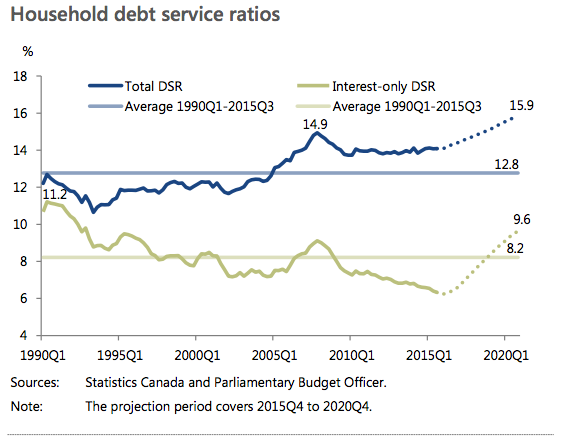

A new report from The Office of the Parliamentary Budget Officer tells Canadians they may be facing a debt crisis within the next five years as the debt service ratio continues to climb, while incomes stay stagnant. We need to pay attention to what is going on with our neighbors to the North, as Canada is the second largest trading partner with the U.S., and accounted for $544 billion in trade activity in 2016. A financial crisis in Canada will put severe pressure on the U.S. economy. In our global interdependent world, a domino falling in China or Canada will send ripples throughout the world.

A new report from The Office of the Parliamentary Budget Officer tells Canadians they may be facing a debt crisis within the next five years as the debt service ratio continues to climb, while incomes stay stagnant. We need to pay attention to what is going on with our neighbors to the North, as Canada is the second largest trading partner with the U.S., and accounted for $544 billion in trade activity in 2016. A financial crisis in Canada will put severe pressure on the U.S. economy. In our global interdependent world, a domino falling in China or Canada will send ripples throughout the world.

"The projected increase in the total DSR to 15.9 per cent would be 3.1 percentage points above the long-term historical average of 12.8 per cent (from 1990Q1 to 2015Q3). It would also be almost one full percentage point above its highest level over the past 25 years, 14.9 per cent, which was reached in 2007Q4. Analysis conducted at the Bank of Canada (see Djoudad (2012)) indicates that an increase in the DSR “would imply that households are more vulnerable to negative shocks to income or to interest rates, making household balance sheets more precarious and having a negative impact on financial institutions"

U.S. GDP Remains Weak

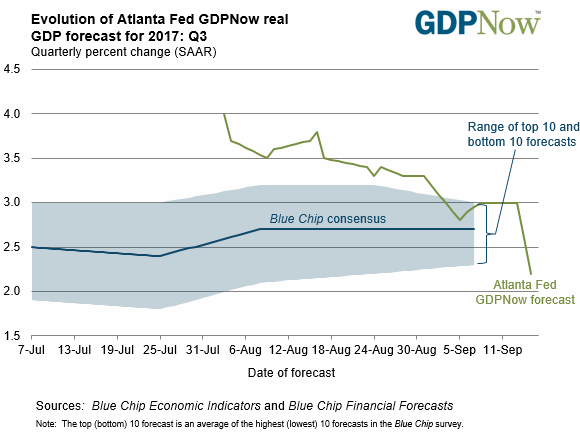

Furthermore, everyone was excited about the near 3% print for 2Q GDP. Yet most ignore the challenges with calculating 1Q GDP that pushes activity into the 2Q calculation. A better analysis tool is to take the two together, and average them out. when we do this, we see that we are running at around 2.1%, and more bad news is on the way. The Atlanta Federal Reserve published their GDP NOW forecast and it is not good. Currently, they are projecting just 2.2% and falling for GDP in Q3.

What Can Go Wrong?

Investors seem to relish the idea of remaining unaware of the fundamentals as they bathe in the euphoria of a market that continues to go up nearly every single day. The new tag line at parties seems to be "how many FANG stocks do you own"? An answer of "none" and you will be banished to the table in the corner. Instead, people should be asking how many Treasuries do you own? Unfortunately, the answer to this, more often than not, is zero. The vilified asset is up 12.67% this year, besting the S&P 500's return of 11.74% and destroying the S&P 600 small cap index, which has phoned in a rather pathetic 1.08% return year to date.

While most investors are enjoying watching their balances go higher and higher, with their smattering of FANG leading the pack, I am growing increasingly worried at what lies ahead. It is what I do - more than manage assets, I manage risk. I am consumed with the constant question of: what can go wrong? Any good investor should be consumed with that question, because it is the risks you don't see that result in the demise of your capital.

That is why despite my bearish stance, I continue to hold 35% equities in our portfolios, just in case I am wrong, and markets keep running a bit longer. But I am still consumed with the reality that financial engineering and central bank stimulus can only keep global stock markets rising for so long, before the real economy needs to be there to support the prices of risk assets.

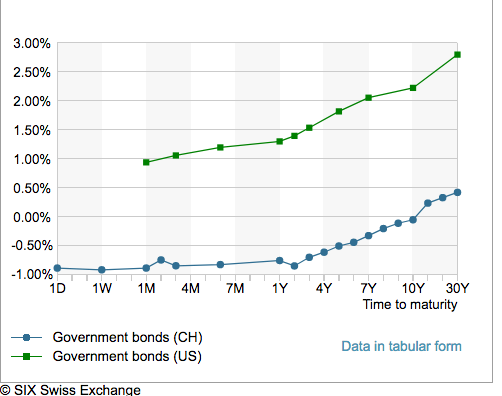

As risks continue to rise, so does my desire to buy as many long-term zero coupon U.S. Treasury bonds as I can get my hands on. The 10-year Treasury at 2.36% is a steal, when Swiss 10 years are paying -0.056%. The opportunity in U.S. Treasuries is stark compared to its European counterparts.

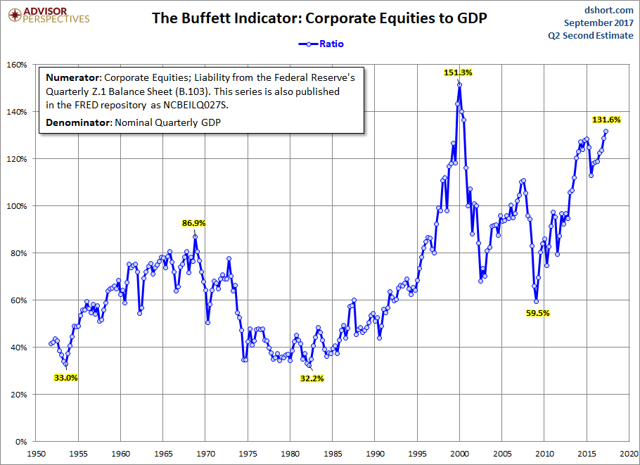

Market Valuations Continue To Rise Past The Obscene

The argument used by the bulls continues to be that stocks look cheap relative to interest rates. In fact, they argue, stocks should be much higher, especially if we have low rates for a longer period of time. I politely demur at the notion that investors should be overweighting a market that is at its second highest level, behind the tech bubble. Many contend that valuations don't matter and prognosticators are wrong.

Indeed they are correct - the research shows prognosticators have a poor history of being correct. But the index crowd forgets that a stock is a claim on a business, and that business produces cash flows from operations. In buying that stock, I am making an investment that the stock is undervalued relative to its growth rate, or that the stock will produce a higher level of earnings going forward.

As Warren Buffett says, I would rather buy a wonderful company at a fair price, than a fair company at a wonderful price. The reason he has that preference is because he expects the wonderful company to produce superior cash flows over the years, and he can make plenty of money in the process of owning that stock. But today, notions of valuation continue to be irrelevant to many market participants. I am again reminded of the words of Warren Buffett, who tells us that we do not have to swing at every pitch that comes our way.

There are times when cash and cash equivalents such as U.S. Treasury Bonds, become the investment of choice, and I think we have reached a period like this today. I say this not because I think the market is going to go down imminently, I say this because as an investor, I am seeing very little to invest in. I am instead seeing a great deal of individuals speculating in stocks, and I am seeing corporate America engage in a low debt fueled financial engineering campaign to prop up asset prices, all funded by the Federal Reserve and their experiment into extraordinary monetary policy.

Instead of using low cost liquidity to invest in the future, build new factories, invest in equipment, and engage in productive activities, corporations are simply becoming hedge funds that take in investor dollars and generate returns based on leverage from low interest rate debt. I remain very cautious today, not to simply be contrarian, but because I look around the world and see risks like I have never seen in my lifetime or in my studies of market history. This is because central banks around the world have been engaged in stimulus programs we have never seen before.

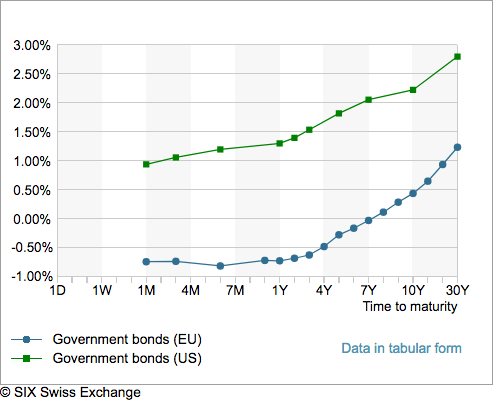

The ECB has lowered their rate to a negative number - why does this not concern more market participants?

The rate in Europe is negative 0.04%. The yield curve throughout Europe is showing debt out to 30 years in some countries at a negative yield.  Warnings on Valuation Continue to Be Ignored Even as Earnings Fall

Warnings on Valuation Continue to Be Ignored Even as Earnings Fall

Market participants continue to dismiss warnings in the real economy, without considering that bears, such as Dr. John Hussman, may be right even if he has seemingly been proven wrong by a steadily advancing market. People forget that paper wealth is not real wealth. Until you sell, you have made nothing.

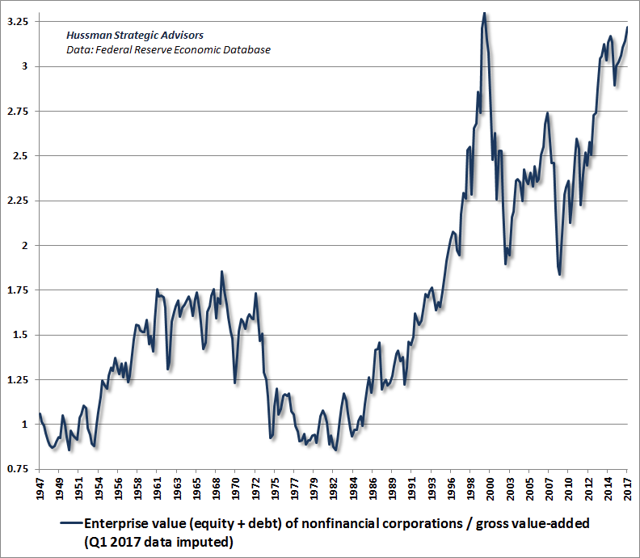

"investors should remember that the 2000-2002 market collapse wiped out the entire total return of the S&P 500, in excess of risk-free Treasury bill returns, all the way back to May 1996. Likewise, the 2007-2009 market collapse wiped out the entire total return of the S&P 500, in excess of risk-free Treasury bill returns, all the way to June 1995. By the time that a market cycle is completed, a value-conscious, full-cycle investment discipline tends to be enormously forgiving of early exit, particularly when one exits at historically rich valuations. At present, the debt burdens of non-financial companies have never been higher relative to their gross value-added. Meanwhile, the market value of non-financial stocks is also near the 2000 extreme relative to their gross value-added. The sum of equity and debt is known as “enterprise value.” The chart below presents enterprise value as a fraction of corporate gross value-added...which illustrates the extreme value of financial claims on corporations, relative to the revenues needed to serve them. Present levels are within a breath of the 2000 extreme." Dr. John Hussman

Investors continue to dance in a burning room, and so far, they have been unscathed. One day the music will stop, and investors will be overwhelmed by the stampede for the exits. One of the great lessons of investing is not to let fear or greed overtake you. Staying balanced and focusing on opportunities and risks, keeps one from making poor investment decisions.

I continue to remain cautious even as my peers are pouring into FANG and holding 100% equity portfolios. I am more comfortable being a contrarian, following the economic fundamentals, and the fundamentals of a market that continues to trade on optimism, stimulus, or hope - anything but fundamentals, anything but true organic earnings.

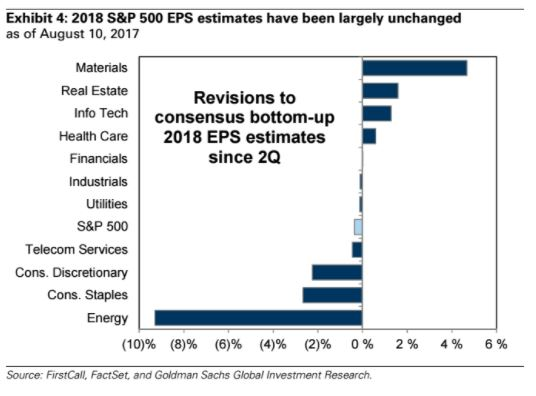

In the second quarter of 2017, we saw nearly half of all earnings growth coming from just one sector, beaten-down energy. Investors are forgetting Larry Kudlow's tagline - earnings are the mother's milk of stocks, and earnings are falling.

"...results in the first half of the year “have not been strong enough to warrant positive S&P 500 [earnings per share] revisions,” Goldman Sachs wrote in a note to clients. Of the S&P 500’s 11 primary sectors, it noted, forecasts for 2018’s profits have come down for six of them...Forecasts have come down even more for the remainder of the current year. For 2017, analysts see earnings of $130.46 a share for the S&P 500. That’s down 3.5% from the $135.25 that was forecast at the end of April. "

So let me get this straight: Companies are earning less money, and we should pay premium prices for assets that are estimated to produce less cash flow? This is why I penned the piece Now This is Getting Ridiculous. The market is not operating as a mechanism of price and value; it is operating on a binge of central bank liquidity and the absurd notion that There Is No Alternative (TINA) to equities.

As money moves into the equity markets at a greater and greater rate, most of which has flowed in through index funds, the risks continue to grow in the equity market. Index proponents continue to stay committed to invest at any valuation mantra, ignoring the facts of a market that stands at the greatest level of valuation in history, outside of the tech bubble and the valuations precipitating the 1929 crash. This reminds me of the book "Extraordinary Popular Delusions and the Madness of Crowds." Investors continue to invest, the facts be damned.

“An enthusiastic philosopher, of whose name we are not informed, had constructed a very satisfactory theory on some subject or other, and was not a little proud of it. "But the facts, my dear fellow," said his friend, "the facts do not agree with your theory."—"Don't they?" replied the philosopher, shrugging his shoulders, "then, tant pis pour les faits;"—so much the worse for the facts!” ― Charles Mackay, Extraordinary Popular Delusions and the Madness of Crowds

I believe investors are taking greater and greater risk playing this game of musical chairs, and I am not the only one. Lloyd Blankfein, CEO of Goldman Sachs, stated "Things have been going up too long." Jeffrey Gundlach, Ray Dalio, Seth Klarman, Howard Marks, and many others have given warnings that markets are overextended.

“When share prices are low, as they were in the fall of 2008 into early 2009, actual risk is usually quite muted while perception of risk is very high. By contrast, when securities prices are high, as they are today, the perception of risk is muted, but the risks to investors are quite elevated.” -Seth Klarman

Conclusion

The book "Extraordinary Popular Delusions and the Madness of Crowds" is an absolute classic because while the date on the calendar changes, and the world seems to change around us, the behavior of humans does not. As Charles Mackay states in the text:

“Men, it has been well said, think in herds; it will be seen that they go mad in herds, while they only recover their senses slowly, one by one.”

And so it will be again this time, for all the warnings in the world will not stop market participants from buying assets at prices they will later shudder to think they would ever think of paying, let alone actually did.

Cash & cash equivalents (U.S. Treasuries) remain the investment of choice for wealthy investors who care to invest, rather than speculate on how high the already overvalued stock market can go. Discerning investors got that way by paying attention to the price they paid for things, and the value they received.

As Warren Buffett says "Long ago, Ben Graham taught me that 'Price is what you pay; value is what you get.' Whether we're talking about socks or stocks, I like buying quality merchandise when it is marked down."

Wealthy investors continue to carry more cash than they have before and yet the average investor continues to pile into stocks. The greatest investors in the world are telling you to be cautious, the greatest finance executives in the world are keeping more cash in corporate America than ever before, and the wealthiest Americans are stock piling cash. So I ask you: maybe it is time for the average investor to question why they continue to pile into stock market index funds that are insanely overvalued?

Why they keep putting their hard-earned capital at risk of losing 30-50% to make 5-10%? These investors, finance executives, and wealthy Americans believe that they will be able to buy assets cheaper at some time in the future, or they believe that stormy seas may lie ahead and want to be prepared. This is deflationary.

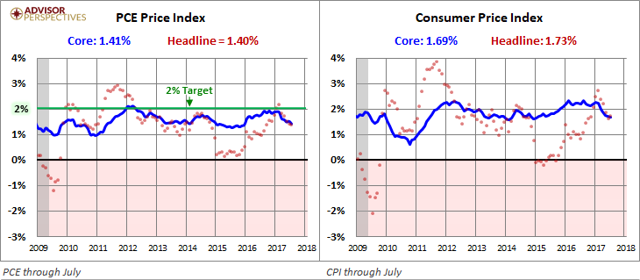

"Commodities prices, broadly, despite the persistent hope for both an acceleration in domestic, and global, economic growth, are down about 13 percent, year-over-year. Crude oil sits at its lowest level of 2017, amid a glut of both oil and gasoline, even in the middle of the summer driving season....used car prices are falling, another sign of weak pricing and some slowing in domestic demand. Overall, the latest batch of economic numbers have been punk, not nearly strong enough to warrant further tightening by the Federal Reserve, despite promises to do so. There is a risk of financial deflation rearing its ugly head again, if price deflation in commodities continues and forces resource companies to retrench again. So, then, how will inflation reach the Fed's stated 2 percent target anytime soon? Very simple … it won't."

We are currently in a world of disinflation, with deflationary forces gaining steam, debt burdens beginning to overheat, restrained GDP growth a reality, and central banks that are in unchartered territory, experimenting with negative rates, and in the process showing their desperation to create some level of inflation, and stave off what they really fear... deflation.

The risk of another deflationary depression is beginning to come into focus, only time will tell if central bankers can defeat it. I hope they can. What everyone really fears is that 10-year Treasury at 2.23%. Investors need to realize the intense risks during this period of time and the value of cash, which gives you the ability to buy everything cheaper in the future. As Seth Klarman said, "when securities prices are high, as they are today, the perception of risk is muted, but the risks to investors are quite elevated.”

Despite the recent backup in rates, I continue to stand firm in my thesis that the 30-year Treasury will fall to 2% and the 10-year to 1% before the end of the cycle. While bond bears continue to call for rising interest rates, and growing inflation, the bond market continues to tell investors the truth, the question now is whether investors will listen or continue, in the words of Charles Mackay, to disregard the facts and speculate in stocks based on their theory that there is no alternative to equities.

The bond market continues to tell investors in words that cannot be misunderstood; don't take risks.

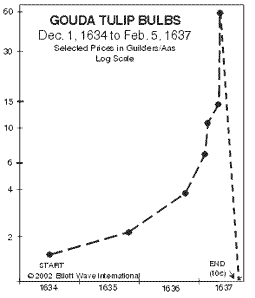

I leave you with a passage from Charles Mackay's classic tome concerning the tulip craze in 1630s Holland. It is particularly instructive in the behavior of crowds, and in its revelation that the motivations of market participants do not change. This time is not different. The psychological factors that propelled the tulip bubble to extremes in Holland in the 1630s are at work in our present day, propelling a handful of stocks higher and higher, and taking market averages with them.

Mackay's brilliant analysis of human behavior in 1841 is alive and well in 2017. Greed, stupidity, herd mentality, the reckless belief that the rules of economics have somehow been suspended in this instance, and that this time was different are all driving dangerous speculation in risk assets. The time has come to reassess the risks in your portfolio, and prepare for the possibility that history will repeat itself and the storm is coming.

"People who had been absent from Holland, and whose chance it was to return when this folly was at its maximum, were sometimes led into awkward dilemmas by their ignorance... By 1636, special markets for trading in tulip bulbs were established on the floor of the Stock Exchanges in Amsterdam and other towns. Many people grew suddenly rich, and others, not wishing to be left out, began speculating madly themselves.

At last, however, the more prudent began to see that this folly could not last for ever... It was seen that somebody must lose fearfully in the end. As this conviction spread, prices fell, and never rose again. Confidence was destroyed, and a universal panic seized upon the dealers. A had agreed to purchase ten Sempers Augustines from B, at four thousand florins each, at six weeks after the signing of the contract. B was ready with the flowers at the appointed time; but the price had fallen to three or four hundred florins, and A refused either to pay the difference or receive the tulips.

Defaulters were announced day after day in all the towns of Holland. Hundreds who, a few months previously, had begun to doubt that there was such a thing as poverty in the land, suddenly found themselves the possessors of a few bulbs, which nobody would buy, even though they offered them at one quarter of the sums they had paid for them. Many who, for a brief season, had emerged from the humbler walks of life, were cast back into their original obscurity. Substantial merchants were reduced almost to beggary, and many a representative of a noble line saw the fortunes of his house ruined beyond redemption."