I have been highly critical of Farmland Partners Inc. (NYSE:FPI) since I started writing at Seeking Alpha. One of the main focuses of my criticism has been their continuous purchases of Illinois cropland at extremely low cap rates. It is their high exposure to cash crops and the predictably declining rents associated with them that I believe has been the main cause of their declining share price.

Most recently, I focused on their new preferred shares, and in that article I stated:

As you can see, the only investment strategy that leads to an increase in cash flow is putting it all in the West Coast. Even then, the increased cash flow is only $6 million and actual contribution to FFO would be lower after property level expenses are removed.

Is FPI going to completely overhaul their investment strategy and stop investing in money-losing grain farms? I doubt it.

Maybe my doubt was misplaced.

This morning the news broke that FPI has made a very large purchase in California. My initial reaction is that this purchase is very positive for FPI and is their best hope to squeeze maximum value out of the proceeds from the preferred offering.

The Deal

FPI is purchasing 5,100 acres of California farmland that produces almonds, pistachios, and walnuts. The deal is structured as a sale-leaseback with a 25-year NNN lease with Olam International Ltd. (OLMIF).

Olam is a Singapore based global player in agriculture. They operate in 70 countries, have tens of thousands of employees and are projected to have over $15 billion in annual revenue for 2017. In short, Olam is a very solid tenant with plenty of experience and the diversification to maintain rent payments even if this particular farm is not profitable.

The press release emphasizes that the lease involves a revenue-sharing component. No details have been released in terms of cap rate or how much revenue sharing might be involved other than Pittman being quoted in the press release:

On an unlevered NOI basis, we expect these leases in 2018 to be accretive to our portfolio relative to the cost of our recently issued preferred security.

Readers of my prior articles know I do not consider Mr. Pittman to be very credible. In this case, I believe that going with a California investment is FPI's best chance. If the lease is heavily weighted towards revenue-sharing, it could provide the potential for upside. While we need to wait for more details to be released, I find it plausible that this lease could be accretive.

Nut Prices

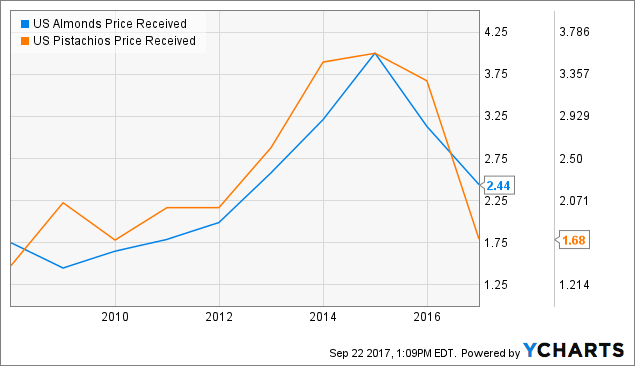

US Almonds Price Received data by YCharts

US Almonds Price Received data by YCharts

Like many crops, nut prices have been trending down in 2016 and 2017. However, unlike corn producers, the crop is still producing profits.

Estimates from the Almond Board of California suggest that the break-even price for almonds is around $1.35/pound (excluding land cost). This provides a healthy safety margin.

Additionally, orchard crops are characterized by significant upfront costs that are spent before the trees even start to mature. Once the trees are mature, the ongoing costs are relatively low. The effect is that a particular orchard is not profitable for several years, but once producing it remains profitable for well over a decade with relatively little additional cost.

This is in stark contrast from corn or soybean farms where the farmer makes a decision each year whether or not and how much to plant. This is also why Olam is willing to make a 25-year commitment. They have already invested significant amounts of money in the current orchards and want to ensure they will reap the benefits.

Conclusion

FPI is facing a lot of difficulties, and I continue to believe that the falling rents in their Mid-Western farms are more severe than management has been willing to discuss.

California appears to be the only area FPI can invest in to get cap rates high enough to justify the cost of the preferred shares. On the surface, this purchase appears to be exactly what they need, with an experienced and diversified tenant.

This purchase is not enough to change my bearish views on the company in general, but I do believe it is a step in the right direction. FPI should be announcing more acquisitions in the near future as they spend the remaining proceeds from the preferred shares, more acquisitions like this one would be a positive sign.

Will FPI successfully change direction? Or are they taking one step forward to go two steps back later?