Real estate investment trusts, or REITs, are a simple way for regular investors to gain exposure to the real estate sector.

While there are many different types of REITs to choose from, healthcare in particular has strong long-term potential growth due to highly favorable demographic trends.

Let's take a look at Welltower (HCN), America's largest medical REIT, to see why this industry blue chip may be a great fit for conservative high-yield investors, especially those looking for the best high dividend stocks.

Business Overview

Founded in 1970 in Toledo, Ohio, Welltower has grown into America's largest medical REIT and is the fourth largest REIT by enterprise value (market cap + net debt).

Source: HCN Investor Presentation

The REIT owns a total of 1,384 properties across the U.S., Canada, and the U.K., but the majority of its real estate investments are in the U.S.

The company is essentially involved in every aspect of patient care, from hospitals and long-term skilled nursing facilities to senior assisted living communities and medical office buildings, or MOBs.

Welltower organizes its business into three kinds of medical properties:

- Senior assisted living (i.e. retirement homes): 69.8% of operating income

- Post-Acute Long-Term Care (i.e. skilled nursing facilities): 13.1% of operating income

- Outpatient Medical Office Buildings: 17.1% of operating income

Over the past seven years, management has been steadily reducing the company's reliance on government funding (i.e. Medicare/Medicaid), and today 93% of the company's revenue comes from private payer insurance sources.

Business Analysis

The key to any reliable high-yield investment, especially REITs, is a highly secure and consistent source of normalized funds from operations, or FFO (Welltower's equivalent to free cash flow and what funds the dividend).

In the case of Welltower, this cash flow security comes from very well staggered and diversified rental lease agreements, with an average remaining length of 9.7 years.

In addition to only having to renegotiate 1.5% to 2.5% of leases in any given year, Welltower's tenant base is similarly diversified across some of the industry's strongest names, which helps ensure that the company's portfolio of tenants can collectively continue making their rent payments in full and on time.

Though Welltower is America's largest medical REIT, it owns just 3% of the $1 trillion U.S. healthcare real estate market according to Morningstar, meaning there is still plenty of room to grow in this highly fragmented industry.

Welltower has historically been a large-scale property acquirer, buying about $13.5 billion in new properties between 2013 and 2015. And since 2010, Welltower has bought $28 billion in new properties, increasing its portfolio by about 300%.

However, management recently made a wise long-term decision to temporarily slow the pace of new property purchases in order to adapt to challenging market conditions and focus on strengthening the quality of the portfolio.

This has been done in two ways to further lower the company's fundamental risk.

First, Welltower is selling off much of its struggling skilled nursing facility properties, especially those owned by distressed SNF operator Genesis Healthcare (GEN).

In 2016 and 2017, Welltower plans to sell about $4.1 billion worth of SNF facilities, which will result in much slower growth (2017 FFO per share growth expected to be 2.9% vs 6% in 2016); however, in the long-term this is a smart move for a highly conservative blue chip REIT.

That's because the skilled nursing facility industry is currently experiencing major challenges due to a number of factors.

First, the Center for Medicare & Medicaid Services (CMS) has been instituting a number of reforms to how Medicare and Medicaid reimburse healthcare providers, including shorter-stays and 20% lower reimbursement rates.

Combined with higher regulatory compliance costs and rising labor costs in the medical industry as a whole, many SNF operators are struggling with razor thin margins and having difficulty covering their full rental costs.

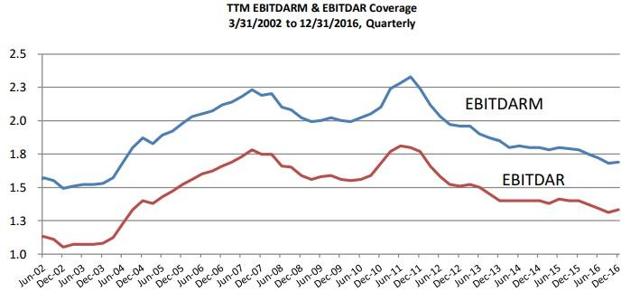

For example, the EBTIDAR coverage ratio (i.e. cash flow/rent) is a good measure of the health of the SNF industry, and in recent years it's been falling to riskier levels.

Source: Omega Healthcare Investors

Senior housing that's operated under a triple net lease model, meaning the tenant pays all maintenance, insurance, and taxes, is similarly struggling, with a total of four of Welltower's leases currently underwater.

This is why management has been so focused on selling off financially weaker properties and investing in senior housing that it operates itself. That appears to be a prudent strategy because Welltower's senior assisted living properties are actually much higher quality and better run than most of its industry rivals.

For example, Welltower's company-run senior housing facilities are not only younger than the industry average, resulting in lower maintenance costs, but they are also located in faster growing and far more affluent locations, which has helped result in higher occupancy (90% vs 82% industry average).

In fact, Welltower's overall portfolio of medical properties is very high quality, with below average property ages, above average affluence, strong occupancy, and solid same store revenue and net operating income (NOI) growth.

Welltower's increased focus on building and refurbishing its own facilities ($1 billion in planned 2017 and 2018 spending) rather than acquiring new properties is also appealing because the cash yields on these investments are higher than those it can obtain from simply acquiring new properties.

For example, new properties can be bought for cash yields of 6% to 7% right now, but by taking its time and constructing its own assets, Welltower can obtain 7% to 9% cash yields.

This extra profitability is important because the REIT business model is unique in that the vast majority of cash flows must be paid as dividends (so that the REIT doesn't pay corporate taxes). However, this means that growth is funded mainly by external debt and equity (i.e. selling new shares).

Sources: Earnings Releases, Gurufocus, Earnings Supplements, Fast Graphs

Fortunately, due to its large size, Welltower has plenty of access to relatively low cost capital ($3 billion in currently available liquidity), which means that it can invest profitably and grow normalized FFO per share over time and with it the dividend (and share price).

Another competitive advantage Welltower has is that, because of its size (it's the No. 1 medical property operator in nearly all of its core markets), it has very good and long-lasting relations with customers.

Specifically, 95% of its outpatient medical properties are rented to major healthcare systems, including those run by states, national governments, or health maintenance organizations. This means that the REIT enjoys high switching costs that help it to enjoy stronger pricing power and generate above average margins and returns on capital.

Welltower Trailing 12-Month Profitability

Sources: Earnings Releases, Morningstar, CSImarketing

While there are certainly challenges facing different parts of the medical REIT industry, it's also important to acknowledge the immense growth opportunity in this space, courtesy of the rapid aging of the U.S., Canadian, and U.K. populations.

In fact, the population of those 85+ years of age is growing four to nine times faster than the overall population in Welltower's markets.

As a result, a substantial increase in demand for both medical resources (such as operations and treatments) is expected, but especially higher demand for assisted senior living.

Welltower is also well-positioned to provide for the fast-growing population of elderly patients suffering from Alzheimer's, which is expected to nearly triple in the next 35 years.

Global Alzheimer's Population

The bottom line is that Welltower's management has an excellent track record in steadily growing both its business and its dividend over decades, in extremely challenging and fast-changing medical environments.

Given the significant demographic trends coming over the next few years and management's moves over the past decade to improve the company's portfolio quality, Welltower appears to be positioned to take advantage of strong growth in overall medical spending.

Key Risks

While there is a lot to like above Welltower, there are nonetheless several major risk factors to be aware of.

The biggest long-term concern is arguably with the major growth that's projected in U.S. medical spending. While this creates a large opportunity for Welltower, it also serves as a double-edged sword.

Source: Hoya Capital Real Estate

That's because U.S. medical costs have been rising far faster than inflation for so long that medical spending per capita in America is by far the largest in the world.

Since the vast majority of medical spending per American occurs at the end of life, this means that governments and insurance companies alike are desperate to squeeze every last drop of savings from the current medical system before the onslaught of aging citizens fully strikes.

As a result, this naturally creates a large deal of uncertainty regarding how health care spending will be managed in the coming decades.

While it's true that 93% of Welltower's revenue is from private payer (i.e. non government) sources, that doesn't mean the company might not face margin-compressing price pressure at some point.

After all, health insurance companies are just as eager as governments to minimize costs. In addition, there is always the risk that, should the U.S. move to a single payer (i.e. government run) healthcare system, that all those private insurers currently paying Welltower could be squeezed out.

Next, consider that no company operates in a vacuum. For example, while demand for all manner of medical properties seems likely to rise in the coming decades, this is something the entire industry is aware of.

In other words, there's a risk that medical property developers could get ahead of themselves and overbuild in the short-term, resulting in too much competition, lower occupancy rates, and lower profitability across the medical REIT industry.

In the meantime, the demographic shift that is expected to raise all healthcare REIT ships is still about 5 to 10 years away, while the regulatory and financial challenges are here now.

Source: Hoya Capital Management

Fortunately, Welltower's quality management team has an excellent 47-year track record of adapting to a fast-changing medical market environment, and the company's industry-leading scale means that it will almost certainly be a survivor of any major medical REIT shakeout that may occur in the coming decades.

That being said, if too drastic of changes happen to America's medical system, than Welltower's growth could be severely impacted, resulting in far slower dividend increases and lower total returns then investors may have come to expect in recent decades.

Next, Welltower's international properties, while great from a diversification standpoint, also expose it to currency risk. Particularly, rising U.S. interest rates could cause the dollar to strengthen, which would decrease the reported growth from its Canadian and U.K. properties.

The good news is that Welltower, unlike some other REITs, doesn't appear to face much of a long-term growth threat from rising interest rates because the company is very good at matching funding costs (debt and equity raises) over time with its investment plans.

In other words, Welltower generally fixes its net cash spread (i.e. cash yield on new investments minus cost of capital), helping to ensure predictable profitability and steady FFO per share growth.

Finally, it's worth pointing out that, as a REIT, Welltower's dividend are unqualifiedand thus taxed at an investor's top marginal tax rate. In other words, it often makes more sense to own a stock like this in a tax-deferred account, such as an IRA or 401K if possible.

Welltower's Dividend Safety

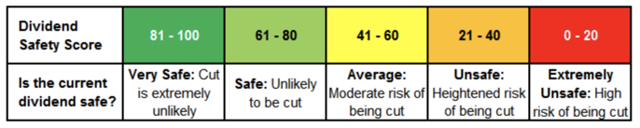

We analyze 25+ years of dividend data and 10+ years of fundamental data to understand the safety and growth prospects of a dividend.

Our Dividend Safety Score answers the question, "Is the current dividend payment safe?" We look at some of the most important financial factors such as current and historical EPS and FCF payout ratios, debt levels, free cash flow generation, industry cyclicality, ROIC trends, and more.

Dividend Safety Scores range from 0 to 100, and conservative dividend investors should stick with firms that score at least 60. Since tracking the data, companies cutting their dividends had an average Dividend Safety Score below 20 at the time of their dividend reduction announcements.

We wrote a detailed analysis reviewing how Dividend Safety Scores are calculated, what their real-time track record has been, and how to use them for your portfolio here.

Welltower has a Dividend Safety Score of 83, indicating a very safe payout and one of the most secure dividends in the real estate sector.

Welltower's impressive track record of steadily growing its payout in all manner of economic, interest rate, and industry conditions (uninterrupted dividends since the early 1970s) is driven by three main factors.

First, as a medical REIT, Welltower's business is highly resistant to economic downturns since demand for medical care is pretty consistent, even during severe recessions. In fact, Welltower's revenue grew each year during the financial crisis.

And because its leases are so long-term in nature, Welltower's cash flow is highly predictable and recurring, allowing for very secure and consistently growing payouts.

Next is management's highly disciplined approach to maintaining a safe FFO payout ratio. While the company's cash flow can fluctuate at times (if industry conditions are tough and management is reshuffling the portfolio as it is now doing), Welltower's dividend is always reasonably covered by FFO per share.

Source: Earnings Releases

Now it should be noted that Welltower does have one of the medical industry's higher payout ratios. However, its payout ratio has been steadily declining over time as management focuses on increasing its financial strength and security.

For example, because of the increasing challenges of the medical industry, management has made strengthening Welltower's balance sheet a key priority, specifically lowering its leverage ratios and raising its interest coverage and fixed-charge coverage ratios.

That has helped Welltower generate one of the most secure balance sheets in its industry and obtain a strong investment-grade credit rating from all three major rating agencies.

In fact, today Welltower is tied with rival Ventas (VTR) for the best credit rating of any medical REIT.

Source: Brad Thomas

That in turn ensures the REIT has access to plenty of low cost capital to keep growing in the coming years, including steady growth in its highly secure dividend.

Overall, Welltower's dividend is very safe because of the company's reasonable payout ratios, recession-resistant business, conservative management style, and proven commitment to the dividend.

Welltower's Dividend Growth

Our Dividend Growth Score answers the question, "How fast is the dividend likely to grow?" It considers many of the same fundamental factors as the Safety Score but places more weight on growth-centric metrics like sales and earnings growth and payout ratios. Scores of 50 are average, 75 or higher is very good, and 25 or lower is considered weak.

Welltower has a Dividend Growth Score of 28, meaning that investors can expect below average payout growth in the coming years.

That's not surprising given that blue chip REITs such as Welltower are usually not known for a fast dividend growth rate but rather are famous for high security and consistency.

While Welltower's dividend has only grown by 3% to 4% annually over the last two decades, the company has paid uninterrupted dividends since 1971 while increasing its payout for more than 10 consecutive years, making it a Dividend Achiever.

Over the next decade, thanks to strong demographic growth catalysts, Welltower should be capable of continuing to increase its FFO per share, and thus its dividend, at about 3.5% to 4.5% a year, in line with its recent historical norm.

Welltower's dividend has been paid for more than 180 consecutive quarters, and dividend investors are likely to continue being rewarded by the company.

Valuation

Over the past year, Welltower shares have underperformed the S&P 500 by about 20%. However, that doesn't necessarily mean it's a bargain today.

For example, the price/FFO ratio (the REIT equivalent of P/E ratio) is currently 15.9, which is lower than the the industry median of 18.0 but still higher than its historical norm of 13.2.

Meanwhile, HCN's dividend yield of 5.1%, though much greater than the S&P 500's 1.9%, is slightly below the industry median yield of 5.3% and not far from the stock's five-year average yield.

In other words, Welltower appears to be trading at just about fair value, and its long-term annual total return potential of 9.1% (5.1% dividend yield plus 4% annual FFO per share growth) is solid but not overly exciting.

However, it should be noted that over the past five years, Welltower's very low volatility (78% less than the S&P 500's) has meant that it's been a great choice for low risk, high-yield income investors.

Conclusion

While there will always be a large amount of regulatory uncertainty in the medical REIT industry, Welltower, as the biggest and one of the best-managed players in this industry, appears to represent a solid high-yield way for investors to benefit from one of the largest demographic trends expected in the years ahead.

Better yet, thanks to its low volatility, generous and secure dividend, recession-resistant business model, conservative management, and decent growth prospects, Welltower seems to be a sensible candidate for investors living off dividends in retirement.