In What Works on Wall Street James O'Shaugnessy describes more than a hundred quantitative stock strategies. He investigates their long term returns and risks. Recently I have discovered it is possible (but not easy) to implement many of these quantitative strategies. So these advanced strategies are not just an edge for hedge funds anymore but anyone can implement them at home. It can be done by screening for stocks using very flexible criteria. Then export fundamentals and price data for each stock and then rank them on multiple criteria. Finally compute the combined rank by adding the individual ranks.

One of the best strategies described in What Works on Wall Street is a mix between value and momentum called Trending Value. He ranks US stocks with positive momentum on various value factors and then proceeds with the 10% with the best rankings. These best 10% he ranks on momentum. The 25-50 stocks with the best momentum enjoy high returns (21%) despite low risks (Sharpe ratio 0.9).

I have done something similar. One of the biggest differences is that I rank on smooth momentum instead of on raw momentum. According to various stock researchers that should increase returns much. In my value ranking I include liquidity, following a suggestion of O'Shaughnessy. Other differences are I include smaller companies and ignore very recent momentum and exclude some dilutive and highly leveraged companies. I even exclude the very best momentum stocks from last week and last 4 weeks because chances are high mean reversion will correct this momentum. For more details see my overview article on deep value investing.

At the moment the US stock market is higher than just before the crisis in 1929. Not surprisingly there are hardly any value stocks in the US. My final list of US-listed value/momentum stocks contains 60 stocks. For my marketplace subscribers I do the same type of screening but then I also include international stocks. As a result I find many more stocks for ranking. When comparing international screening and ranking with US-listed stocks I should also say the latter are much more expensive. In particular it surprises me how much more flexible my screening had to be with leverage for US stocks compared to international stocks.

I will briefly discuss the best ranked stocks, based on last weeks price data. Since much has been written on 2 of these stocks I rely for a large part on what others already wrote down. The 3 value stocks with the best momentum are the following, in the order of decreasing smooth momentum:

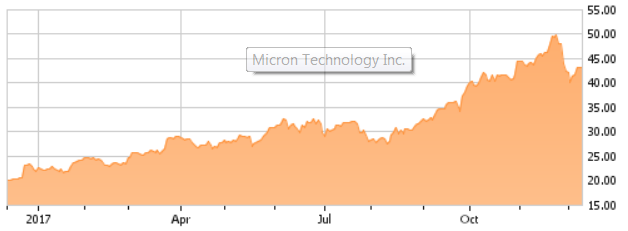

Micron Technology

Stocks with good momentum go up on fuzzy information like favorable long term trends or hidden intellectual property. This is clearly the case with large cap Micron Technology, a stock that I happen to own.

Micron Technology manufactures 2 types of computer chips: DRAM chips for fast but volatile memory and non-volatile NAND memory chips. Volatile memory gets erased when power is interrupted. There are several favorable long term trends for Micron's products:

We keep inventing new devices. Many of these devices have become "block busters". Not only desktops and laptops but also phones and tablets and, in future, self-driving cars.

This is the era of data creation and storage in the cloud. We are creating more data than ever before. Much of this is stored on our own hard disks but even more is stored in the cloud or even both on our own hard disks and in the cloud.

The end of the hard-disk: During the next 5 years most hard disks will be replaced by non-volatile NAND memory chips. They are still more expensive but quality more than makes up for the price difference.

The company owns patents for bringing processing power to memory cells. That technology has a wide range of important (scientific) applications.

The company owns patents on technology for much faster non-volatile memory that can be used as a replacement for DRAM in many applications.

There is still a good chance Micron is being acquired or buys out Intel from their joint-venture for a good price.

Micron is a cheap stock. In the value ranking 82% of the stocks are more expensive than Micron at $43.2. EV/EBIT and P/E are just below 10. It has a high Piotroski score of 8. The P/B might be high but that does not matter to me. Retained earnings have been shown to better predict future returns than a low P/B. Over the last 8 years Micron's retained earnings/Market cap was 0.238, which is excellent for a US-listed stock. A metric Micron does not score well at is liquidity. It is one of the most liquid stocks in the original list ranked on value.

But there is more: Micron is also conservatively financed. Even more so for a US-listed company. Recently Micron did a minor stock offering, which is not great. Micron may want to use the money to buy out Intel from the joint-venture. Exercising that call option might even trigger Intel to acquire Micron. The new CEO played this game before: he managed to sell Sandisk for a great price.

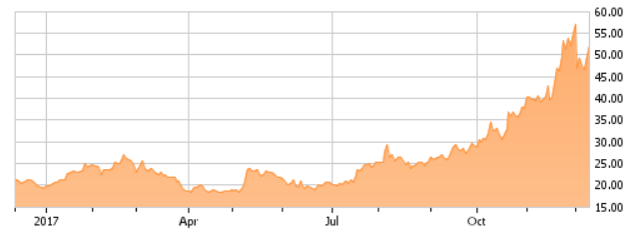

Daqo New Energy Corp

Daqo New Energy Corp is a Chinese manufacturer of polysilicon for solar cells. Its market cap is about $550 million. The company experiences a big tailwind: high demand and low competition inside China. Because of import tariffs imposed by the Chinese government it can sell its product for a high price. The situation is explained in more detail here. The author of that article thinks the company will do fine even if the polysilicon price collapses, because the company is a low cost producer.

Another article mentions other trends: continued stimulus for solar power in China and the rest of the world and rising oil prices. That author acknowledges there are new technologies for cheaper production of polysilicon. However he thinks it will take another 3-4 years before this new production technology will decrease Daqo's competitiveness.

Overall Daqo New Energy Corp ranks slightly better on the combination of value metrics than Micron. In the value ranking 82.67% of the stocks are more expensive than Daqo New Energy Corp at $49.4. It does not score well on 8-year retained earnings/Market cap and Enterprise Value/Gross Profit. It compensates for this with better rankings for liquidity, and low EV/EBIT and P/E.

Daqo's balance sheet shows low leverage. The company has significant debts however. But if the company keeps earning what it is earning now that won't be a problem. That its Piotroski score is 8 is also reassuring.

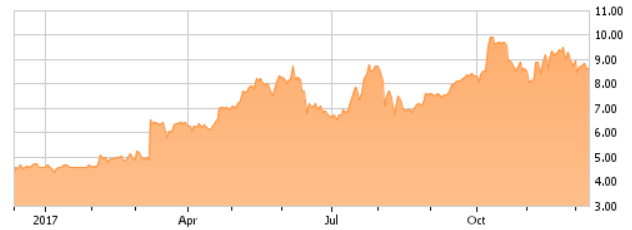

inTest Corporation

inTest Corporation is a small cap with a market cap of $89 million at a share price of $8.6. What is most interesting about this company is that few people have noticed the good momentum combined with the relatively good fundamentals. At least, on Seeking Alpha there are no recent focus articles on this stock.

The company designs and manufactures thermal management products and semiconductor automatic testing equipment interface solutions. Both types of products are used for automatic testing of IC's, wafers and other electronics.

On May 24, 2017 the company completed an acquisition of an even smaller loss making company for $22.6 million plus $4.1 million in contingencies. The acquired company manufactures precision induction heating systems for industrial manufacturing applications. Management says this acquisition complements the company's existing thermal solutions and allows the company to enter many other markets than automatic testing.

Over 2017 and 2018 the company expects the acquired business to earn at least $48 million in EBITDA. Since the company has few liabilities you might think this will translate to a big cash pile. However 45% of the purchase price is goodwill so earning this kind of EBITDA might require large upfront capex payments. On the other hand goodwill may have been paid for speculative growth. Indeed management says the new business is growing fast. There are also yet unexplored growth opportunities for this business in Asia. If you are stuck with a home bias this could become your hot stock!

I think the momentum in shares of inTest Corporation is mostly related to favorable trends in the semiconductor sector. See my description of Micron above.

Based on just the value rank the company is cheaper than Micron and Daqo. 85% of the stocks in the value rank are more expensive than inTest Corporation. In particular the values for EV/Gross Profit, EV/EBIT, P/E and retained earnings/Market cap are good. Like Micron trading volume is high, which is a negative.

Large owners: the family Holt seems to own 20.8% but is selling with a Rule 10b5-1 plan. They need to divide the inheritance of former executive chairman Alyn R. Holt. See also here. Outsider Nokomis Capital owns 11.1% and outsider Thomas A. Satterfield owns 13.1%. I don't think there are special measures preventing this company from being acquired.

Editor's Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.