The ongoing bull market is poised to celebrate its 9th anniversary in two months, and is thus the second-longest in history. In addition, as the indices keep posting new all-time highs, the valuation of most stocks has become remarkably rich. Therefore, many investors think that a bear market is just around the corner, and are thus tempted to short an ETF of the S&P, such as the Vanguard S&P 500 ETF (VOO). Nevertheless, in this article, I will analyze why investors should never short the S&P.

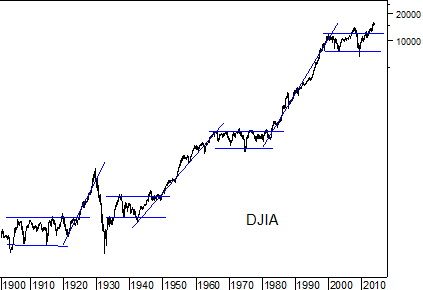

First of all, a bear market will inevitably show up at some point in the future. However, it is impossible to time it. Moreover, it is critical to realize that the ongoing bull market is a secular, not a cyclical, one. This is important because secular bull markets last much longer than cyclical ones. For instance, the last secular bull market lasted 18 years, from 1982 to 2000.

As the chart below shows, a new secular bull market is born every 2-3 decades. The S&P traded within a limited range between 1997 and 2013 and broke to new all-time highs in 2013. Even more importantly, it has remained well above its previous high of 1550 since then. This is a strong technical signal that the ongoing bull market is secular. Short-sellers should certainly be aware of this, as they run the risk of incurring excessive losses for years. Actually, this has already occurred to numerous investors, who have questioned the basis of the almost 9-year old bull market.

Investors should also keep in mind that short positions come with a significant time cost. More precisely, short-sellers have to pay for the 2% annual dividend of the S&P every year. While this amount may seem trivial on the surface, it makes a huge difference in the long run. Moreover, my experience has taught me that it is highly detrimental to have time working against the value of the portfolio. As the market spends most of the time in calm waters, such positions usually erode in value quite fast. Therefore, investors should have time working in favor of them by holding stocks of profitable companies, which reward their investors with dividends and/or capital gains thanks to their profits.

The picture becomes even worse if short-sellers realize that they also forgo the 2% annual dividend, which they would receive if they had a long position in S&P. In other words, every year that they choose to have a short position in S&P instead of a long position, they lose 4% (compared to being long). Consequently, they need a strong bear market at the right moment in order to justify a short position in S&P.

Unfortunately for them, no one can time the market on a regular basis. Even the legendary investor George Soros has held short positions in S&P for years, and has thus lost a significant amount of money. While a bear market will eventually show up at some point in the future, his losses have aggregated so much that he is very unlikely to break even, let alone achieve a decent return for all the years he has maintained these short positions. All in all, investors should realize that short-selling requires excellent timing skills, and no one has such skills because the market is completely unpredictable in the short run.

Short-sellers should also realize that they need to have excellent timing twice in order to make a profit from a short position. More precisely, as short-selling is a two-leg process, they should have the correct timing in two steps: the opening and the closing of their position. I actually remember the last time I tried to short the S&P, more than five years ago. The market had had a great run despite the political uncertainty amid the presidential elections in 2012. Therefore, while I remained fully invested in my stocks, I attempted to short the S&P in order to make a quick profit from that position and mitigate my overall exposure to the stock market.

It turned out that I had the perfect timing in opening the short position, as the market started to tumble as soon as I initiated my position. However, it was not that easy to make a profit. More specifically, the market fell 7%, but the correction ended much sooner than I expected. Without any positive sign on the horizon, the S&P suddenly began to rebound. And while I was expecting the next leg lower to close my position, the market continued to rebound steeply and thus retrieved all its losses within a short period, without any piece of news to justify the strong rebound. As a result, even though I had the perfect timing in the first leg of the trade, I ended up losing money from that position. Therefore, excellent timing is required twice in short positions, and hence, investors should stay away from this challenging endeavor.

If all the above issues are not enough to deter investors from shorting the S&P, there is one more issue. Until last year, I was very confident that the bull market would not end anytime soon because there were no signs of euphoria in the market. Such signs are usually abundant in the last phase of bull markets, so I concluded that we were not close to the last phase of the ongoing bull market. However, this has changed in the last few months, as the market keeps posting new all-time highs at a relentless rate, thus resulting in great enthusiasm in the investment community. Therefore, I believe we are now in the euphoria phase, which is the last phase of this bull market.

Nevertheless, experience has shown that the best profits of bull markets are made in their beginning and in their last phase, not in their intermediate phases. In other words, the last phase may last much longer than most rational investors expect, and the market may continue to rally for much longer than short-sellers can tolerate before they throw in the towel. Therefore, if short-sellers do not have the right timing, they are likely to be severely punished by the market in the ongoing euphoria phase.

As a side note, the fact that a cyclical bear market will inevitably show up sooner or later does not mean that the current secular bull market will end anytime soon. Cyclical bear markets can very well take place within secular bull markets, just like the collapse of the market in 1987, which took place within the secular bull market of 1982-2000. As long as the S&P remains well above the all-time high of the previous secular bull market (~1550), the current secular bull remains intact.

To sum up, a bear market will inevitably show up at some point in the future. However, investors should realize that it is impossible to time it. In addition, as short positions have time working against them, investors should not engage in this challenging strategy, which has very poor long-term returns. If they do short the market, they are likely to throw in the towel due to accumulating losses long before their thesis proves correct.